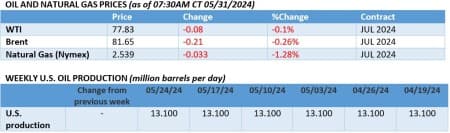

Oil prices remain under pressure this week despite expectations that OPEC+ will agree to extend production cuts at this Sunday's meeting.

Friday, May 31st 2024

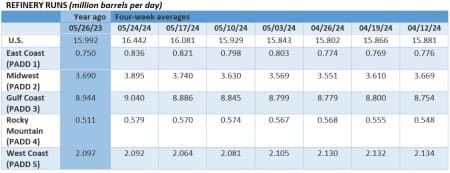

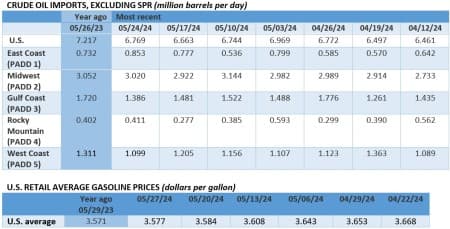

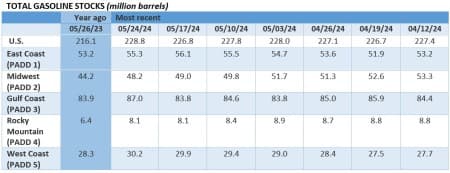

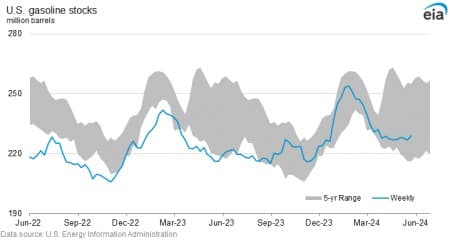

The Memorial Day holidays, which usually trigger a bump in gasoline consumption, failed to drive a significant increase in fuel demand, adding downward pressure to oil prices. Overshadowing higher refinery runs in the U.S., concerns over this year’s consumption patterns loom large over the summer months. Heading into the weekend, all eyes will be on OPEC+ as it meets in Vienna, with Brent futures headed for another weekly loss at $81 per barrel, a prospect that the likes of Saudi Arabia or Russia are unlikely to enjoy.

ConocoPhillips Goes for Marathon Oil Powergrab. US shale driller ConocoPhillips (NYSE:COP) agreed to buy peer upstream firm Marathon Oil (NYSE:MRO) in a deal valued at $22.5 billion including $5.4 billion of debt, expected to close in the fourth quarter of 2024.

Canada Starts Probe into Toxicity of Oil Sands. Upon a request from environmental group Ecojustice, the Canadian government has agreed to assess whether naphthenic acids found in oil sands tailing ponds across Alberta should be classed as toxic, potentially paving the way for much stricter regulation of bitumen mining.

Saudi Arabia to Sell 0.64% of Saudi Aramco. The largest oil-producing company in the world, Saudi Arabia’s Saudi Aramco (TADAWUL:2222), will be selling a 0.64% stake, equivalent to 1.545 billion shares of the company, with the price range expected to be between 26.7-29.0 riyals per share ($7-8/share).

Democrats Initiate OPEC Collusion Investigation. A group of 23 Democratic senators asked the US attorney general to investigate allegations of collusion between American oil companies and OPEC, on the back of the FTC’s insinuations about former Pioneer CEO Scott Sheffield.

BHP Gives Up on AngloAmerican. Ending this spring’s hottest M&A saga, mining giant BHP (NYSE:BHP) walked away from its $49 billion bid to take over mining peer AngloAmerican (LON:AAL), deciding to withhold a binding bid after its three previous bids were rejected.

Chinese Steel Controls Depress Iron Ore Prices. Following Beijing’s announcement that it plans to strengthen control over steel production and capacity to be compliant with its 1% emission reduction target for 2024, iron ore dropped to ¥870/mt ($120/mt), its lowest in two weeks.

US Grants BP Waiver for Venezuela Gas Project. UK-based oil major BP (NYSE:BP) as well as Trinidad and Tobago’s NGC have received a two-year waiver from US sanctions on Venezuela, helping to develop the Cocuina-Manakin gas fields with Venezuela’s PDVSA.

Libya’s Oil Minister Is Back to Business. Less than two months after Libya’s oil and gas minister Mohamed Aoun was suspended over unspecified violations, he has made a surprise return to his post in a blow to European majors ENI and Total that expected their licensing deals to be approved in his absence.

ADVERTISEMENT

Glencore Mulls Coal Spin-Off Very Soon. Mining and trading giant Glencore (LON:GLEN) will start consulting with shareholders over its planned spin-off of coal assets, pending the closure of its purchase of 77% of Teck’s metallurgical coal business, despite weak internal support.

Iraq Calls on Kurdish Leaders to Restart Exports. Iraq’s oil ministry has called for an immediate meeting with Kurdish authorities and international oil companies operating in the Kurdistan region to unblock pipeline exports via the Mediterranean amidst a 15-month-long halt.

India Signs Term Deal for Russian Oil in Roubles. India’s largest private refiner Reliance signed a one-year deal with Russia’s Rosneft to buy at least 3 million barrels of oil, with Urals prices set at a $3 per barrel discount to Dubai, to be paid in Russian roubles instead of dollars.

Nigeria Eyes Higher Penetration for Its Natural Gas. Nigeria’s national oil company NNPC is planning to build a network of compressed natural gas (CNG) plants to expand access to alternative transportation fuels across the country as gasoline prices tripled year-on-year to 700 naira per liter.

Chevron Close to Signing Big Algeria Contract. US oil major Chevron (NYSE:CVX) is reportedly close to signing an upstream deal with Algeria’s Sonatrach, marking its entry into the North African country only several weeks after ExxonMobil did the same and eyeing its shale gas potential.

By Michael Kern for Oilprice.com

More Top Reads From Oilprice.com:

- Soaring Solar Power Is Creating Challenges for the U.S. Energy Grid

- Germany to Ditch Controversial Tax on Gas Transit in 2025

- Spanish Gas Lobby Calls for Urgent Support Amid Renewables Boom