比特币减半前,许多专家预测这种加密货币将遭遇灾难。

摩根大通预测 价格将下跌到42000美元,称市场已超买。

其他人说,减半后可能获得的任何潜在收益已经被定价进入。

不管你在4月减半之前处于何种立场,比特币都仍然存在并且表现强劲。

然而,自那时以来,加密市场中的某个领域发生了深刻转变。

随着比特币挖矿奖励减半,许多之前盈利的人现在可能面临破产或财务不确定性。

这使得聪明的矿业公司有机会利用这种动荡,那些站稳脚跟的公司可能会比之前更加强大。

这就是为什么现在焦点转向像Gryphon Digital Mining(NASDAQ: GRYP)这样的高效挖矿公司。

我们已经开始看到市场上的一些整合,上市公司利用其筹集资金的能力收购处于困境中的较小矿业公司。

因此,我们相信随着我们接近比特币挖矿行业的十字路口,Gryphon将受益。

减半的赢家和输家

Gryphon的首席执行官Rob Chang表示,即使是最大的挖矿公司在近年面对加密市场关键时刻也面临挑战。

对于其成本平均为每枚比特币54000美元的上市公司,在比特币价格为60000美元时这是可以接受的。

然而,当比特币价格降至50000美元以下(就像过去几年中的大部分时间那样)时,很快你会发现自己陷入困境。

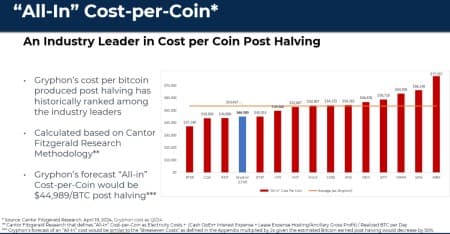

另一方面,Gryphon在运营期间始终保持每个月毛利润为正,预计减半后的所有成本为每枚比特币44989美元。

这在很大程度上是因为他们采取了资产轻的方法。

在过去的一年里,Gryphon仅凭这家公司的三名员工成功挖掘了约2100万美元的比特币。

他们决定优先考虑像挖矿机一样产生收入的资产,而不是昂贵的设施,从而大幅降低了固定成本。

因此,Gryphon一直是效率的领先者,在过去一年中始终名列前四,并在很大部分时间内排名第一。

我们相信所有这些都使Gryphon(NASDAQ: GRYP)在比特币挖矿奖励最近几周使行业动荡之际处于更加稳固的地位。

比特币挖矿巨头的管理团队

Gryphon的聪明决策很大程度上得益于其领导团队的丰富经验。

首席执行官Rob Chang以前曾担任Riot Blockchain的首席财务官,这是最大的上市比特币挖矿公司之一,还曾担任卡蓓尔.菲茨杰拉德公司的金属和矿业主管和董事总经理。

Gryphon的首席技术顾问Chris Ensey与Chang有着相同的愿景,他曾在Riot担任过CEO和COO。

首席财务官Sim Salzman从另一家顶级挖矿公司Marathon Digital而来,在短短12个月内,其市值从5亿美元升至80亿美元。

Gryphon的领导团队自2018年以来见证了许多竞争对手的兴衰,他们决定保持资产轻,并在比特币牛市中迅速增长,给他们带来了重要优势。

开启一个价值40万亿美元的行业

尽管加密货币因环境问题和能源密集型而备受抨击,Gryphon在一个意想不到的地方脱颖而出。尽管机构投资者潜在地投资于挖矿公司时,有些人将公司的ESG关注点视为一个馈赠。

然而,另一些人则将其视为一项要求,指出许多只能投资符合这些ESG标准公司的机构投资者的数量庞大。

根据彭博社的数据,全球ESG市场预计到2030年将达到40万亿美元,这可能为其他比特币挖矿公司打开许多其他公司无法获得的机会。

例如,如果机构想要在他们的ESG基金中增加对比特币挖矿的曝光,Gryphon是少数几家碳中和的矿业公司之一。

(实际上,Chang补充说,通过碳信用,Gryphon正在追求一种碳负面战略。)

通过与世界上最大的数字货币数据中心之一的合作,Gryphon享受着比许多竞争对手更低的可再生能源价格。

可以这么说,Gryphon与可再生能源合作伙伴分享利润的策略实际上是其比许多竞争对手更高效的原因之一。

Gryphon最近还成为首批获得绿色比特币认证的矿业公司之一,这是基于其清洁能源使用的认证。

对于那些希望投资绿色加密公司的机构投资者来说,这种认证为Gryphon致力于可再生能源提供了明确的证据。

Gryphon (NASDAQ: GRYP)显然重视此问题的透明度,我们认为对于那些寻求区分的人来说,ESG资金是一个值得关注的激励因素。

谁将赢得比特币的减半?

今年以来比特币价格已上涨超过40%,投资者对加密市场的兴趣回归,许多专家称这是新牛市的开始。

现在,自上个月减半以来,比特币挖矿行业几乎一夜之间发生了变化。

随着许多公司经济形势恶化,像Gryphon这样的上市公司可能具有筹集资金的明显优势。

我们相信上市公司可以更轻松地升级设备以提高效率,他们可以收购处于困境的较小挖矿公司以大幅折价收购资产。

自2月通过合并加入纳斯达克以来,我们相信Gryphon有能力充分利用其盈利数据良好的历史,其良好记录和ESG关注点有助于该公司脱颖而出。

By. Tom Kool

IMPORTANT NOTICE AND DISCLAIMER

PAID ADVERTISEMENT. This communication is a paid advertisement. Oilprice.com and its owners, managers, employees, and assigns (collectively “the Publisher”) is occasionally paid by one or more of the profiled companies or a third party to disseminate these types of communications. In this case, the Publisher has been compensated by Gryphon Digital Mining (NASDAQ: GRYP) to conduct investor awareness advertising and marketing. Gryphon paid the Publisher one hundred twenty thousand dollars and one hundred sixty thousand shares for each of five articles. This compensation should be viewed as a major conflict with our ability to be unbiased.

Readers should beware that third parties, profiled companies, and/or their affiliates may liquidate shares of the profiled companies at any time, including at or near the time you receive this communication, which has the potential to hurt share prices. Frequently companies profiled in such articles experience a large increase in volume and share price during the course of investor awareness marketing, which often ends as soon as the investor awareness marketing ceases. The investor awareness marketing may be as brief as one day, after which a large decrease in volume and share price may likely occur.

This communication is not, and should not be construed to be, an offer to sell or a solicitation of an offer to buy any security. Neither this communication nor the Publisher purport to provide a complete analysis of any company or its financial position. The Publisher is not, and does not purport to be, a broker-dealer or registered investment adviser. This communication is not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular investor. Any investment should be made only after consulting a professional investment advisor and only after reviewing the financial statements and other pertinent corporate information about the company. Further, readers are advised to read and carefully consider the Risk Factors identified and discussed in the advertised company’s SEC, SEDAR and/or other government filings. Investing in securities, particularly microcap securities, is speculative and carries a high degree of risk. Past performance does not guarantee future results. This communication is based on information generally available to the public and on an interview conducted with the company’s CEO, and does not contain any material, non-public information. The information on which it is based is believed to be reliable. Nevertheless, the Publisher cannot guarantee the accuracy or completeness of the information.

SHARE OWNERSHIP. The owner of Oilprice.com owns shares and/or stock options of the featured company and therefore has an additional incentive to see the featured companies’ stock perform well. The owner of Oilprice.com will not notify the market when it decides to buy more or sell shares of the issuer in the market. The owner of Oilprice.com will be buying and selling shares of the featured company for its own profit and may take this opportunity to liquidate a portion of its position. This is why we stress that you conduct extensive due diligence as well as seek the advice of your financial advisor or a registered broker-dealer before investing in any securities.

FORWARD LOOKING STATEMENTS. This publication contains forward-looking statements, including statements regarding expected continual growth of the featured companies and/or industry. The Publisher notes that statements contained herein that look forward in time, which include everything other than historical information, involve risks and uncertainties that may affect the companies’ actual results of operations. Factors that could cause actual results to differ include, but are not limited to, changing governmental laws and policies impacting the company’s business, the size and growth of the market for the companies’ products and services, the companies’ ability to fund its capital requirements in the near term and long term, pricing pressures, etc.

INDEMNIFICATION/RELEASE OF LIABILITY. By reading this communication, you acknowledge that you have read and understand this disclaimer, and further that to the greatest extent permitted under law, you release the Publisher, its affiliates, assigns and successors from any and all liability, damages, and injury from this communication. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.

TERMS OF USE. By reading this communication you agree that you have reviewed and fully agree to the Terms of Use found here http:// Oilprice.com/terms-and-conditions If you do not agree to the Terms of Use http:// Oilprice.com/terms-and-conditions, please contact Oilprice.com to discontinue receiving future communications.

INTELLECTUAL PROPERTY. Oilprice.com is the Publisher’s trademark. All other trademarks used in this communication are the property of their respective trademark holders. The Publisher is not affiliated, connected, or associated with, and is not sponsored, approved, or originated by, the trademark holders unless otherwise stated. No claim is made by the Publisher to any rights in any third-party trademarks.