Breaking News:

China's Steel Market Tactics Under Scrutiny as Steel Demand Increases

China's steel industry faces challenges…

Nuclear Tensions Rise as Poland Offers Territory for NATO Warheads

Polish President Andrzej Duda has…

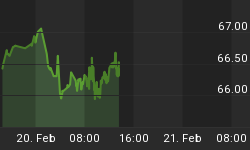

Chinese Oil Imports Slip But Remain 25% Higher Than In 2019

China imported 12.08 million bpd of crude oil last month, according to official customs data, which was lower than the record-breaking import rate in June but 25 percent higher than the average for July 2019, Reuters reported.

The official data confirms OilX’s report released earlier this week, which said July imports were 3 percent below the June average.

The increase on an annual basis came because a lot of cheap oil bought in April when prices were at their lowest only now arrived at Chinese ports and some delayed oil cargoes cleared customs only last month, Reuters noted.

China has been the focus of attention for oil exporters as a weathervane of global demand since the country is the largest importer of crude oil in the world. While imports surged during the pandemic, there has been a worry that this surge will begin slowing down as China fills up its storage space, and demand for fuels in Asia remained stagnant.

China’s oil imports over the first half of the year averaged 10.78 million bpd, up by 10 percent on the year, despite the pandemic. What’s perhaps more interesting is that China’s oil imports from the U.S. rose, according to a Refinitiv analyst, to as much as 5 million tons, which is equal to more than 1 million bpd.

Related: Argentina Scrambles To Salvage Its Shale Boom

China undertook to purchase $25.3 billion in U.S. energy products this year as part of the trade deal inked by the two countries earlier this year, but as of June, it had only bought some five 5 percent of that, or $1.29 billion worth of U.S. energy products, including crude oil, LNG, and metallurgical coal.

Data from OilX released earlier this week also pointed to a solid increase in U.S. oil imports into China but, the analytics firm noted, such high volumes of imports from the United States are unlikely to be sustainable because of politics and the higher oil prices that may affect China’s future purchases.

By Irina Slav for Oilprice.com

ADVERTISEMENT

More Top Reads From Oilprice.com:

- Russia’s Largest Coal Mine Gets Unexpected New Owner

- Venezuela’s Rig Count Officially Falls To Zero

- Oil Prices Soar After EIA Reports Large Crude Draw

Irina Slav

Irina is a writer for Oilprice.com with over a decade of experience writing on the oil and gas industry.

Open57.81

Trading Vol.6.96M

Previous Vol.241.7B

And while low oil prices was a factor in China’s roaring oil imports, China’s imports wouldn’t be breaking all records even if prices are rock-bottom if not for its insatiable thirst for oil.

Moreover, China isn’t using the pandemic as an excuse to not buying US energy products as was claimed by the media for two possible reasons. The first is that China may be retaliating against the intensifying anti-China rhetoric by President Trump and his administration. The second reason is that China may be getting a better deal buying crude oil from Iran, Saudi Arabia and Iraq and also buying cheaper LNG from the Russian LNG company, Novatel, in which it has invested heavily or Qatari or Australian LNG.

China may also be coming to realize that even if it fulfils its obligations under the Phase 1 deal, President Trump is planning to resume his trade war against it if he is re-elected for a second term.

Dr Mamdouh G Salameh

International Oil Economist

Visiting Professor of Energy Economics at ESCP Europe Business School, London