Wednesday, January 30th, 2019

The Key Risks For Oil In February

Oil markets are subject to some compelling story lines right now. Trump/Xi relations are holding risk markets hostage. The US Fed seems to be in a holding pattern on rate hikes after substantially tightening its balance sheet in 2018. OPEC+ is aggressively cutting production and Venezuela’s humanitarian and political crisis is fully boiling over.

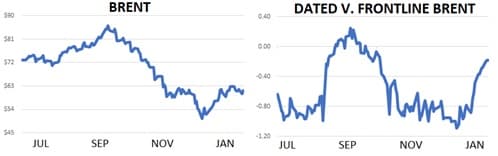

Yet, a quick glance at an oil price chart suggests that markets have ample shock absorbers on both ends of the spectrum and seem content to lazily move sideways with Brent at $60. Closing prices have enjoyed a $4 closing range since January 10th ($59-$63) and January appears to be ending with a sideways whimper after beginning with a bang. Clearly, we need the main story lines to develop further for the market to enjoy some sort of bullish or bearish momentum and break the sideways groove.

So where are we on our key risk themes as we turn to February?

With respect to global trade, US Treasury Secretary Steve Mnuchin gave a bullish jolt to stocks and commodities this week, commenting that a truce could be on the way which would remove tariffs on Chinese goods if Beijing was able to offer concessions on IP, tariffs and other issues. Equity markets are probably the best barometer now for trade deal forecasting and it’s notable that S&Ps have held on to their recent gains. Equity market pricing suggests to us that China and the US are still on course to reach some sort of truce in 2019. We also continue to believe that Trump is simply boxed in to creating some sort of deal in 2019 due to his need to boost the economy heading into election season. This is particularly true after the US government shutdown inevitably eats into 1Q GDP and employment numbers.

As for the central banks, we continue to believe that the US Fed could lend a supportive hand to risk assets in 2019 in a way that it didn’t in 2017 and 2018. This is a slow week for US Fed watching in terms of interviews and public statements but recent US housing data showed another sharp decline in y/y existing home sales for December of more than 10%- its worst mark since 2011 and tenth straight negative print. US bond yields are still substantially lower than their 2018-highs and the Fed’s balance sheet was basically unchanged at $4.05t in January after rapid asset sales in the second half of last year.

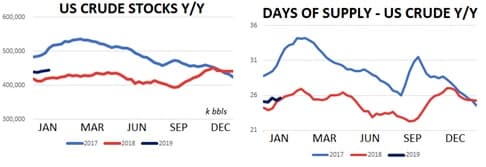

OPEC+ production cuts appear to be working and our guess is that we’ll begin to see them eat into US stockpiles on weekly DOE data beginning this spring. US supplies are currently +6% y/y and will continue to build for the next 2-3 months as refiners prepare for driving season. Our primary indication that the cartel is diligently working to cut supplies is the continued strength of Brent spreads. The prompt 6-month time spread held gains in modest contango territory this week and the differential on physical dated barrels versus the prompt futures contract has rallied massively in January. The Saudi energy minister reaffirmed the Kingdom’s commitment to supply tightening this week (also stating that they will deepen cuts in the next six months) and spread markets are clearly showing that balances should look healthier in the spring.

Venezuela’s political crisis accelerated this week after the US essentially ended business contact with the Maduro regime in an effort to install his opponent Juan Guaido as the country’s next leader. The US currently buys about 40% of Venezuelan exports (which totaled 1.2m bpd in December) and it’s likely that these shipments will find Indian and Chinese buyers in the coming months. US refiners will scramble to replace lost barrels with similarly sour barrels from Saudi Arabia and Canada but the shift in buying is not expected to have a short-term impact on prices. Analysts remain confident that Venezuela will not enjoy a production rebound anytime in the next two years due to massive underinvestment in their production efforts.

Going forward, we see Trump/Xi talks, the US Fed and OPEC+ as the most likely drivers of oil’s next move and all three have bullish and bearish potential. For now, however, oil has ample downside protection in the form of tightening daily balances and a dovish US Fed outlook while ample existing supplies of crude and gasoline should keep a lid on prices. Look for oil to continue its $60 in the near term.

Quick Hits

- Oil prices were essentially flat again this week with Brent trending near $61 while WTI traded $53.

- The US is intensifying its pressure on Venezuela to move away from the Maduro regime with intense economic actions. The US will essentially cease all financial contact with Venezuela until Maduro’s opponent Guaidó is recognized as the nation’s leader. PDVSA subsidiary Citgo will not be able to interact financially with the country’s sovereign wealth fund until the dispute is settled. The US was importing roughly 500k bpd of crude from Venezuela in 4Q’18. Those shipments will likely head towards China and India in the near-term future while US refiners will try to replace the lost barrels with Canadian and Saudi crude.

- Saudi Energy Minister Al-Falih reaffirmed his commitment to production cuts this week stating that the kingdom planned on delivering 102.m bpd to markets in January and 10.1m bpd in February. The Saudis pumped an average of 10.3m bpd in 2018 including an 11.0m bpd effort in November.

- Physical markers are showing a strong reaction to recent OPEC+ cuts with dated brent rallying substantially versus the prompt futures contract.

- Bloomberg reported this week that Chinese refiner Sinopec may have been caught off guard by oil’s 4Q’18 decline to the tune of about $700 million. The firm said it had wrongly hedged positions which imploded as prices sank and the unwinding of the hedge may have helped accelerate oil’s slide.

- Crude oil options continue to imply that trader’s concerns are tilted towards the downside. This week WTI 25 delta calls traded at 35% implied volatility while 25 delta put options traded at 38%.

- Hedge funds were net buyers of ICE Brent futures and options for the fifth time in the last six weeks. Net length jumped 17% w/w to 203k contracts and is and is higher by 24% since mid-December (+50k contracts.) Most of the buying has come from the unwinding of short positions as gross bearish bets have decreased by 43k contracts in the last six weeks.

- Away from oil, stock markets were hit hard early this week on Q4’18 earnings concerns and the usual dose of anxiety due to US/China trade disputes. US Treasury Secertary Mnuchin added a bullish jolt to risk assets mid-week commenting that there could be some potential for a US/China trade deal later this year.

DOE Wrap Up

- US crude stocks jumped about 8m bbls last week and are roughly 6% higher y/y.

- Most of the build was driven by a spike in imports opposite a sharp drop in exports. Imports jumped from 7.6m bpd to 8.2m bpd. The 1yr average for US crude imports is 7.8m bpd. Meanwhile exports fell from 3.0m bpd to 2.0m bpd (1yr average for exports is 2m bpd.)

- Domestic crude production was flat this week at a record-high pace of 11.9m bpd.

- The US currently has 25.6 days of supply on hand which is in line with its 5yr seasonal average.

- As for consumption, US refiners processed 17.05m bpd last week on a 175k bpd w/w drop. Total US demand as averaged 17.28m bdp so far in 2019 which is better y/y by 380k bpd (+2.2%.)

- Low margins are putting downward pressure on demand and will likely continue to do so in the near-term future. The WTI 321 crack yielded just $12/bbl this week for a 2yr low. Diesel fuel margins are still averaging north of $15/bbl but gasoline margins have dropped to just $5.50/bl throughout much of the US.

- Refiners overseas are doing much better with the gasoil/brent crack offering $15/bbl- about 25% above its 5yr average.

- An oversupply of gasoline persists as the culprit for low margins. US gasoline supplies jumped by about 4m bbls last week to 260m bbls and are 6% higher y/y.

- US gasoline demand + exports printed an ominously low 9.4m bpd last week for the second straight week and is lower by about 2% so far y/y.

- Distillate fuels are roughly 1% higher y/y following a 1n bbl inventory draw last week.

Global Intelligence Report - 30th January 2019

Sources

- Geopolitical consultant to Fortune 500 companies in the Americas

- High-level Scottish government official

- Energy consultant to Scottish government

- EU economic analyst in Brussels

Venezuela: The Next Move on the International Stage

On Tuesday, Venezuela’s Supreme Court froze opposition “president in charge” Juan Guaido’s bank accounts and imposed a travel ban on him. Then, by Wednesday morning, a desperate Maduro was pleading with Americans to stop Trump from intervening on Guaido’s behalf and saying he would sit down and talk with the opposition for a peaceful solution. The day before, the US slapped new sanctions on Venezuela’s state-run oil company. Now this is really a game of creditors.

Beijing, in September, threw another $5 billion Maduro’s way to prop up crude production. In total, China is now into Venezuela for $50 billion—money it’s used to buy influence in the country since 2007, mostly in the form of oil-for loan deals. It wasn’t initially a bet on Maduro, who was of no consequence when this all started; rather, it was a bet on Venezuelan oil, and right now, it’s looking increasingly like a losing bet to Beijing. But this is not Russia. China’s relations with Maduro can change on a dime, if the price is right, or if the losses will be mitigated. It’s also a great bargaining chip in the ongoing trade wars with the US. Right now, Beijing is still betting on Maduro because the military is still supporting him against the opposition “president in charge”. From our perspective, the chances that Maduro will survive what is to come are dwindling because, as our experts opine, there is little chance of either Russia or China waging direct war against the United States in its backyard, and Washington is determined to overthrow the Maduro government—a clear design since the formation of the Lima Group. The Russians may be sending in private mercenaries, but that is to avoid conflict in the form of state-run actors fighting against each other. They will simply protect Maduro, but they can’t protect him from the masses, and they won’t be able to protect him if the rank-and-file of the military decide, finally, that their loyalties do not lie with starvation. China wants the oil to keep flowing since it’s got a $50-billion bet on that crude. It doesn’t care about Maduro. While China has condemned US sanctions on PDVSA, that doesn’t mean it’s ready to throw its power behind a bloody run to support Maduro. It will just as easily buy influence with Maduro’s opponents when that window opens up.

But in the meantime, this is a game that is too close to play, and too early to hedge bets on. Everyone’s biding their time, but the climax is nearing. China is waiting to see where it should re-hedge; Russia will keep interfering and prolonging Maduro’s agony. What we would watch, though, is how the trade talks play out because China won’t make a move one way or the other until it sees how it can use Venezuela to increase its leverage over things like the attacks on Huawei and tariffs. As far as the Kremlin is concerned, it never jumped right in to bail Maduro out financially in the first place, so it’s not going to go all out militarily now. Talk is cheap, and all for show.

For analysts it is time to follow the money, which of course leads back to the oil. That in turn, leads back to a massive $65 billion in bonds issued by the Venezuelan state, including PDVSA. Those bonds are primarily held by Western investors who haven’t seen any return since the country defaulted on the bulk of them over a year ago. Those bond holders make up the anti-Maduro faction and it has nothing to do with ideology. Those bonds aren’t going to be paid out under Maduro, and the IMF isn’t going to help Maduro to do that. China and Russia don’t have this same financial tie-up with Venezuela—they made oil-based credit deals. Turkey has a similar deal. At the end of this trip, money will win out over geopolitics. So, again, follow the money.

Why and How Scotland Might Take Its Oil and Run

Scotland is firmly in the camp that would like to remain in the EU at this point because it is extremely concerned about Brexit and the impact it will have on the Scottish economy. While the ruling Scottish National Party (SNP) and its leader, Nicola Sturgeon, have continuously indicated that the Brexit model is not compatible with the Scottish government’s views, the Scottish government has continuously put forward recommendations on how the UK should proceed in terms of Brexit.

However, there is an underlying expectation within the UK that if negotiations don’t reach a reasonable outcome, there is a strong possibility that Scotland may try to remain in the EU by seeking independence from the UK.

Given that Scotland voted with an overwhelming majority to stay in the EU, there is a growing sense that people are looking more favorably towards an independence vote now, and Nicola Sturgeon is preparing to put forward her plan for independence in the next couple of weeks.

But once again as with the Brexit debate, there is a divided camp on whether Scotland will be able to survive financially as an independent state. It is accepted by all involved parties and has been highlighted by a Scottish government official that Scotland does have something that the rest of the country wouldn’t want to lose – oil.

According to an energy consultant operating in Scotland with knowledge of Scotland’s current energy policy, “there is no question that Scotland has a lot going for it in terms of its energy sector both within the oil and gas sector as well as renewables”. With more than 90% of tax revenues from oil and gas being generated in Scotland, this could have a negative impact on the UK’s economy if Scotland is no longer part of the Union. The same source also noted that “Scotland can easily establish a successful oil investment fund by replicating Norway’s model and with North Sea oil and gas anticipated to last for decades, it would provide an excellent financial resource for Scotland”. In addition, Scotland has also demonstrated its pioneering presence in tidal, wave and wind energy and has already claimed a well-respected position within the international renewables industry because of it.

But there is one question that lingers within Scottish government circles: Will its energy sector dominance within the UK be enough to support its economy if it becomes independent. An EU analyst noted that “the EU would welcome Scotland as a member and will ensure that it would provide the support and ‘know how’ on how to remain a valued member of the EU”. This view is completely the opposite of the view from Brussels when the EU was trying to persuade Scotland not to pursue independence status in 2014 – providing another indication that Scottish independence is currently a more viable option.

But the question then becomes: What will that mean for Scotland’s relationship with the rest of the UK? It is uncertain how the UK Parliament would react should Scotland pursue independence by choosing EU membership over being part of the UK.

Unquestionably, Scotland does not want to jeopardize its relationship with the rest of the UK, but it also needs to consider its best options for the future. Given the uncertainty that currently surrounds Brexit, the Scottish government is preparing itself for all possible scenarios.

Global Oil & Gas Playbook

Deals, Mergers & Acquisitions

- Aramco will spend $1.6 billion on acquiring a stake in South Korean refiner Hyundai Oilbank. The almost 20% interest will expand the Saudi state company’s presence on a key market in one of the world’s top oil importers and consumers. Aramco already owns a majority stake of over 63% in a Hyundai Oilbank rival, S-Oil Corp, the third-largest refiner in South Korea.

- Eni and OMV will acquire stakes of 20% and 15%, respectively, in Abu Dhabi ADNOC’s refining business. Eni’s stake will cost it $3.3 billion, while the Austrian company will pay $2.5 billion for its acquisition. ADNOC’s refining business was spun off in 1999. It operates three refineries with a total daily capacity of 922,000 bpd of crude oil.

Tenders, Auctions & Contracts

- Uganda and Tanzania will wrap up the negotiations on a joint oil pipeline projects that will send Ugandan crude to the Tanzanian cost and from there to international markets by June this year. The talks on how the responsibilities and, more importantly, the costs of the projects will be shared have been long and difficult, not least because the pipeline has a price tag of $3.5 billion but, according to African media, they are nearing a final investment decision. Uganda holds an estimated 6.5 billion barrels of oil but it is not producing any yet. Chinese CNOOC, one of the field operators in the country, said it expected commercial production to begin in 2021.

- LNG Canada has so far awarded more than $700 million in contracts pertaining to the project. This is the first LNG project in Canada that might actually see the light of day after Petronas quit an earlier one amid a global LNG price slump. The $40-billion project is led by Shell and the final investment decision was made last year. The project, however, is already attracting opposition from environmentalists in British Columbia.

- Saudi Arabia has inked contracts worth $54.4 billion with local and foreign investors as part of a ten-year program to diversify its economy away from crude oil that will require total investments of almost $430 billion. The areas that Riyadh wants to diversify into include logistics, mining, industrial production, and energy.

Discovery & Development

- Eni began production at a new field offshore Angola at a rate of 13,000 bpd. The field, Vandumbu, is located in the West Hub of Block 15/06, and production began from the VAN-102 well via a floating production, storage, and offloading vessel. This is the second well Eni fired up recently in Block 15/06, after Mpungi. With the two new fields, the block produces around 170,000 bpd of oil equivalent.

- Libya has allocated $50 billion for the development of its battered oil and gas industry this year, seeking to boost production to 1.6 million barrels daily. The country currently pumps around 1 million bpd of crude but outages are a frequent interference with the production growth plans of the government. Technical difficulties such as fuel shortages are also slowing down output growth and will be addressed with the new budget.

- Iran’s state oil company has discovered a new oil deposit near the city of Abadan, a hitherto untapped area. Although no details about the size of discovery were made public it is the latest indication from Tehran that oil exploration continues despite falling exports as a result of the U.S. sanctions, introduced last November. A separate announcement revealed natural gas production at the South Pars field, possibly the biggest in the world, had doubled to 600 million cubic meters daily over the past five years.

- Premier Oil announced what it called excellent results from a drilling project in the Zama oil discovery offshore Mexico. This is the second well drilled in the Zama discovery, which contains an estimated 400 to 800 million barrels of oil equivalent. Production at the field is expected to start within the next four to five years. Premier Oil is a minority partner in the consortium developing the field, with operator Talos holding 35%, Premier Oil with 35%, and German DEA with a 40% interest.

- China’s CNOOC announced a new discovery in the UK’s central North Sea, at the Glengorm exploration well in the P2215 license. According to CNOOC’s partner in the project, Total, the discovery may hold up to 250 million barrels of crude and gas. It is located close to two Total-operated fields, so it could be tied in to the existing production infrastructure, which would speed up the launch of commercial production.

- BP has invested $5 million in a startup focused on artificial intelligence whose solutions the supermajor plans to deploy in order to improve both exploration and production results. The software developed by the Houston-based startup, Belmont Technology, could reduce by up to 90% the time needed for the collection, interpretation, and simulation of data, BP said. The Belmont Technology product, a platform called Sandy, is cloud-based and will be fed enormous amounts of data linked to oil and gas exploration to be able to deploy the neural networks of the platform to perform rapid simulations, potentially granting BP experts insight into the company’s resources and how best to exploit them.

- Exxon has finalized approval for the massive expansion project at the Beaumont, Texas, refinery—an expansion plan that will almost double the size of the refinery. The refinery currently handles 365,000 bpd. The expansion would make it the largest in the US.

What Impact Will Nigeria’s Elections Have On Oil?

On February 16, 2019, Nigeria will start off its general elections during which voters will elect the President, National Assembly and an overwhelming majority of governors. Elections traditionally are a very messy business for Nigeria – the last one in 2015, considered to be one of the most peaceful, left more than a hundred people dead. The upcoming one has all the ingredients of a potentially highly explosive standoff – socioeconomic indicators worsening, disparities both at the regional and local levels becoming ever-manifest, corruption flourishing all contribute to this deadly cocktail. Even though the Nigerian oil sector is not the primary discussion topic of the candidates, the outcome of the ballot seems to have inevitable ramifications for it.

Oil amounts to roughly 9 percent of the Nigerian GDP, which seems good at first sight for a rentier state – however, it also takes up 88 percent of exports and up to 90 percent of Nigeria’s foreign exchange income. Oil rents are a traditional feature of Nigerian politics and have been keeping the country’s political elites together – at the expense of foreign investors who have not shied away from voicing their frustration over the ever-delayed nature of oil reforms in the country. It seems that the Nigerian populace is already ripe for thorough reforms, with one of the leading presidential hopefuls calling for the complete privatization of the Nigerian national oil company, NNPC. NNPC has warned Nigerian politicians against embroiling the national oil company in any sort of political machinations, even though sustaining the status quo would only render it even more loss-making than it already is.

The incumbent: Mohammad Buhari

Buhari’s legacy is difficult, to say the least. Having started his tenure with the first GDP recession since 1991 (-1.6 percent in 2016, according to IMF data), he managed to get Nigeria back on the grow trajectory, albeit mostly due to rebounding oil prices, and forecasts on the upcoming 4-5 years seem to be quite positive – the IMF expects an average annualized growth rate of 2.5 percent for 2020-2024. However internal conflicts, driven by the division between the northern Muslim and southern Christian states and Nigeria’s ever-increasing number of people in abject poverty, are on the rise. Add to this ncessant rumors about the President’s ill health – Buhari has spent almost 6 months in London to receive medical treatment in 2017 – and the probability of a leadership change starts to loom on the horizon.

Attesting to Buhari’s rather weak accomplishment of his 2015 election pledges is the current status of the oil sector reforms he himself launched four years ago. The reform package stipulated the enactment of four bills that could reshape the energy sector by updating upstream procedures, revamping the tax code (a Petroleum Income Tax instead of the Petroleum Profits Tax) and incentivizing gas development, Nigeria’s main energy-related shortcoming. Yet President Buhari has vetoed the Petroleum Industry Governance Bill, a product of his own initiative, in the summer of 2018 (without providing any explanation to it) in defiance of the National Assembly, bringing the whole reform drive to a grinding halt. Since the other three bills – the Administration Bill, the Fiscal Bill, and the Impacted Communities Bill - are way more contentious that the Governance Bill, they have stalled as a result.

Main opponent: Atiku Abubakar

The candidate of the People’s Democratic Party (PDP), Atiku Abubakar, seeks to bring PDP back to the center stage after ruling Nigeria for much of the 21st century (consecutively from 1999 to 2015). Amidst pledges of creating 3 million new jobs per year and stamping out poverty, Abubakar has publicly voiced his intent to renegotiate Nigeria’s main production sharing contracts (PSCs) – currently accounting for about 40 percent of the nation’s total output – so that they contribute more to the Nigerian people. Abubakar has some energy-sector relevant knowledge to boast as he co-founded Intels, an integrated logistics company that is heavily involved in Nigeria’s oil and gas operations. From the point of view of a prospective oil investor, it is Abubakar who is of interest due to the changes he proposes. The 72-year old has vowed to be staunchly pro-investment by selling all government-owned refineries and stakes in the state oil company.

The refineries of Nigeria present an illustrative case of what went wrong generally in the past 20 years. Nigeria currently has three refineries (the 150kbpd Port Harcourt, the 125kbpd Warri, and the 110kbpd Kaduna) which, according to the last officially published NNPC statistics from September 2018, operated throughout last year at 15-20 percent operative capacity. One of the refineries, the 125kbpd Warri site, went into shutdown in January 2018 due to an alleged “lack of crude” and has not come back online ever since. The refinery’s management has simultaneously stated that after “vandals” damaged the refinery’s pipeline system, there was no easy way out due to severe underfinancing. Ironically, the Warri refinery had the highest capacity utilization over the past years of all Nigeria’s refineries, in some months of 2017 even surpassing 40 percent.

On the one hand, it is difficult to imagine an investor eager to place their money in such an endeavor. On the other, if the next Nigerian president succeeded in doing so, it would be a tremendous feat. Generally, the winner of the February 16 elections will have a tremendous opportunity to make his mark in Nigerian history and become a laurel-wreathed president. First and foremost, the start of the Dangote refinery will become a national landmark moment for Nigeria, elevating it from importer to net exporter status within a couple of years – all the more so important as the privately-owned Dangote Group is a Nigerian company, i.e. difficult to blame for stealing the nation’s wealth. The Nigerian Oil Ministry expects Dangote to start in H1 2019, even though the full completion of the refinery is not expected until 2022.

Second, oil production is expected to increase in the upcoming months. Should the (re)elected President keep the Niger Delta attacks under control, output volumes could skyrocket as Nigeria has a plethora of ambitious projects in the pipe – the 200kbpd Egina already started producing in early January 2019 and should be supplemented by the 200kbpd Bonga North, the 225kbpd Bonga Southwest (Aparo), the 32kbpd Ikike and potentially also the 140kbpd Bosi during the 4-year mandate. This in itself would not be enough to reach the 3mbpd production capacity the Nigerian government has been setting itself for years, but still would move up the production interval from the current 1.8-2mbpd to 2.3-2.5mbpd (it’s more politic to talk about intervals as Nigeria production numbers are notoriously in disarray).

Thus, securing the presidential position holds promise for the future of the Nigerian oil industry. Despite some similarities between the two main candidates - both presidents are Muslim Hausa speakers, pretty much negating the will of Southern Christian voters to have a Christian lead the country – international oil investors would most probably be better off with Atiku Abubakar. Nigeria needs someone who would push through all the long-delayed petroleum bills (so that oil majors do not postpone investment) and someone who would render NNPC more of a business entity (instead of using it as an oil rent redistribution center). Sometimes it seems better to have a reportedly fraudulent president intent on opening up the country to international investment than an apparently honest man incapable of changing the country to the better.

What Comes Next For Venezuela?

Having written last week that Venezuela was staggering on through seemingly endless social and economic crises, an end game may finally be insight. It is impossible to predict when a regime will fall, but when it happens it can happen fast, and in Venezuela’s case the impact on the oil market could be substantial.

A reported 3 million people have fled the country, the government has defaulted on its debts, the economy is in the grip of hyperinflation, there are shortages of food, medicines and basic goods, and much of Venezuela’s remaining oil production, now reduced to around 1 million b/d, is in hock to China. The salaries paid by state oil company PDVSA are virtually worthless and many employees simply do not turn up for work.

The announcement on Monday of US sanctions on state oil company PDVSA will disrupt the flow of crude oil to Gulf Coast refineries, and precipitate an even deeper cash crisis for Caracas. Trade flows of heavy crude could be rerouted, but Caracas would be dependent on China and its other customers paying dollars rather than taking the crude in lieu of existing debt.

Revolution and state failure are by no means unlikely scenarios, yet it is evident that the Chavista revolution retains some core support, particularly within the military.

So what are the possible outcomes?

Militarisation

The military stands firm behind the Maduro government. This could only be achieved by further repression and heightened levels of state violence. Human rights abuses would raise the potential costs of capitulation. The Maduro government would, indeed perhaps already has, embark on an all-or-nothing path of no return.

In this scenario, oil production would continue to wither. Output has already become concentrated around the Orinoco belt, with production from the light crude fields in the east and from the light, medium and heavy fields in the west at minimal levels.

PDVSA is heavily dependent on sourcing naphtha and light crude for blending with the Orinoco’s heavy oil. This would be made all the harder as a result of international isolation and a lack of hard currency. The lack of equipment and capital would see further erosion of the operational capacities of the country’s refineries and upgraders, which are the two domestic sources of naphtha.

Field decline, equipment failures and operational incapacities would see oil production steadily decline below 1 million b/d, a price-supportive outcome for the oil market.

State failure

Social protest turns to revolution and civil conflict is sustained as the army divides. Oil production facilities are the target of both sides as a means of raising revenue and denying the opposition funds. The country descends into a period of anarchy in which almost all economic activity comes to a halt including oil production.

Oil facilities – production, pipelines, refineries and ports -- become inoperable as a result of damage and sabotage. Venezuela suffers a fate similar to Libya, where oil production sank close to zero at some points in 2015 and 2016. Oil prices would rise as Venezuelan barrels are lost to the market, adding a new stimulus to US shale drilling and a potential easing of OPEC output restrictions.

The timing of recovery would depend on the length of the conflict and the ultimate victors in the struggle, but a return to former levels of output would be a slow, sporadic, multi-year process. The ability to attract foreign investment would be undermined by security concerns and the unreliable financial and operational capacities of domestic partners.

Peaceful transition

A relatively peaceful and quick political transition would clearly be the best outcome for the Venezuelan people. This could come about by the replacement of president Nicolas Maduro and the holding of new elections to establish a government with public support. Achieving this is likely to require the cooperation of the military, which might accept regime change in return for protection from retribution and a continuance of military figures in positions of power.

Even in this more positive scenario, Venezuela would be bankrupt. A short-term solution could be full-scale dollarization of the economy in attempt to bring inflation under control. The need to restore oil production, and thus government revenue, as well as the likelihood of a more right-leaning administration, would see the country’s oil patch opened to foreign investment.

The oil sector’s recovery could be relatively quick once social and economic stability is restored, but Venezuela would still have to pay its debts either in oil or money after a period of financial restructuring and multilateral support. Significant field rehabilitation would be necessary before production could return to pre-Maduro levels and recovery would be seriously impeded by the outflow of skilled personnel.

This scenario would have least impact on the oil market in the short term. However, it is worth thinking of the long-term implications of a US-friendly Venezuela open to foreign oil investment. The country has the world’s largest crude reserves, measured at 303.2 billion barrels at the end 2017, although two-thirds is at the high end of the production cost spectrum. If a new government in Venezuela left OPEC, it would remove 18% of the world’s proved reserves from cartel control and open it to market forces.

Intervention

Such an important oil state cannot escape foreign machinations. US sanctions are one aspect of this reality, as are Chinese loans and Russian support.

Countries such as China, Russia and Iran will oppose direct foreign intervention in a sovereign state. They are likely to block UN-led action even in the case of further humanitarian disaster mainly because the US would be the obvious candidate to lead any effective intervention in this region.

The possibility of an outcome beneficial to the US may well prove a motivating factor behind further support for the Maduro government, in the form of aid, debt postponement or relief, even potentially military aid in the event of state failure. Foreign support in opposition to US interests could bolster a militarised dictatorship in Venezuela, with the country’s crude reserves controlled by proxy.

From the US perspective, ramping up the financial and economic pressure on the Maduro government in the hope of internal regime change is a risky option as there is no guarantee of a relatively peaceful transition. Washington will inevitably stand accused in some quarters of precipitating a crisis to justify its involvement, if it intervenes. But if UN-action is blocked, this is a fate it may not escape in the event of sustained civil conflict.

U.S. Sanctions Hit Venezuela Hard

U.S. sanctions against Venezuela, announced this Monday as a part of a political pressure campaign exerted on President Nicolás Maduro, have rocked the oil industry which is still struggling to assess the full impact of the measure. Rumors are circulating about PDVSA, the Venezuelan national oil company, courting global trading houses to find avenues that would circumvent the impending sanctions. The U.S. Treasury is reportedly intent on sanctioning all entities that interact with accounts accessible by the government of President Maduro which would significantly complicate matters for PDVSA.

Tightening the already tight heavy sour crude market in the United States (and globally, too), the Venezuela sanctions seem to be leading inevitably to some sort of price hike. Oil prices have so far reacted in a modest manner, increasing 2 percent on Tuesday and 1 percent on Wednesday, with Brent Dated reaching the interval of 61.8-62 USD per barrel and WTI trading at 53.8-54 USD per barrel on Wednesday afternoon.

1. U.S. Commercial Stocks Rise Further

- U.S. commercial crude stocks have defied the trend of modest declines and soared by 7.9MMbbl during the week ended January 18 to 445 MMbbl.

- The week ended January 25 is expected to continue the recent growth trajectory – according to preliminary API data crude stocks have risen by 2.1 MMbbl.

- The commercial stock build is largely due to a massive (931kbpd) week-on-week drop in exports coupled with a 664kbpd increase in crude imports.

- The gasoline buildup continued for the eighth consecutive week with a 4.1 MMbbl hike to 259.6 MMbbl during the week ended January 18, with a further increase expected for the last week on record.

- Distillate stocks witnessed a slight drop, falling 0.6 MMbbl to 142.4MMbbl.

2. Libyan Raises its OSPs for February

- Libya has raised most of its official formula prices for cargoes loading in February, most notable Es Sider which was hiked by 25 cents month-on-month to -0.85 USD per barrel.

- Es Sider has thus attained the highest premium vs Dated Brent in the past year – last time it was higher, standing at -0.8 USD per barrel, was in February 2018.

- Even though the El Sharara field remains shut down following the force majeure NOC declared on December 09, the February OSP of Esharara was hiked by 15 cents to a -0.25 USD per barrel discount to Dated.

- The only grades that saw their premiums cut were Libyan sour Al Jurf and Bouri, which were decreased by 20 and 30 U.S. cents per barrel, respectively, to keep them attractive vis-a-vis Med Urals.

3. Russia Tops China Crude Importers List for 3rd Year in a Row

- Russia has topped the list of crude importers to China for the third consecutive year, supplying 71.49 million tons in 2018, an almost 20 percent increase over 2017.

- Saudi Arabia came in second, exporting 56.73 million tons, amounting to 1.135 million barrels per day.

- Russia’s lead over Saudi Arabia has doubled in absolute terms from 7.62mtpa in 2017 to 14.76mtpa in 2018, buttressed by increased ESPO term export volumes.

- Venezuela seems to be the biggest loser of 2018 in terms of export declines to China, exporting 16.63 million tons, a 24 percent drop over 2017.

- Despite having received no American crude whatsoever in December, U.S. crude supplies to China have risen 60 percent on an annual basis to 0.248mbpd.

4. No More Caspian Swaps for Iran

- Iranian authorities finally admitted the Caspian swap schemes they have intended to ramp up following their commencement in August 2017 have grounded to a halt.

- Initially, Tehran wanted to increase the swap volumes to 300kbpd – Caspian littoral states would bring the oil to the port of Neka, whilst NIOC would provide the same quantity and quality of crude from Kharg Island.

- Neka is connected by pipelines to the 250kbpd Tehran and 58kbpd Tabriz refineries, which cover most of northern Iran’s product demand.

- Turkmenistan was the most active Caspian state to supply Iran – in H1 2018 it sold on average 8.1kbpd of its crude to Neka (roughly 25-26kt per month), yet by July 2018 the swaps have dried up amid fears of potential U.S. retaliation.

- NIOC is trying to revive the swap deals; however, Kazakhstan, Turkmenistan and Russia seem wary of U.S. repercussions after the November 05 tightening of sanctions.

5. Rosneft Gets Lebanon’s Biggest Port

- Russia’s biggest oil company Rosneft has concluded a deal with Lebanon’s Energy Ministry on the operational management of the nation’s largest port in Tripoli.

- Explanations for the above vary – however, it can be said that military-related activities (Tripoli is close to the Russian navy base in Tartus) are by no means primordial.

- Rosneft sees Lebanon as a stepping stone for ramping up its presence in the Middle East, amid substantial investments into the oil and gas infrastructure of Iraqi Kurdistan.

- Initially, Tripoli was the endpoint of the Kirkuk export pipeline for some 40 years until 1972 – thereafter political changes in Iraq and the Lebanese Civil War stymied all exports for good.

- Rosneft will not be taking over the Tripoli refinery, idle since the mid-1990s, seeking first and foremost to exploit Tripoli storage tank farm – allowing the oil major to enter the Lebanese offshore at some point.

6. Algeria OSP Hikes Saharan Blend Amid Turkish Straits Delays

- Sonatrach, the Algerian national oil company, has increased its official selling price for February-loading Saharan blend cargoes by 40 cents per barrel month-on-month.

- The price setting is retrospective in nature as all Sonatrach February cargoes have been already sold and trading activity now is focused on March volumes.

- Buttressed by lower-than-estimated Libyan production due to the El-Sharara outage and hefty delays in the Turkish Straits (just to pass the Dardanelles takes currently 13-14 days of waiting time), demand for Algerian crude has palpably warmed up.

- Asia and Oceania amount up to a quarter of Saharan blend demand, with 50 million barrels delivered over the past 12 months.

- Currently there are 4 vessels sailing for Asia and Oceania – MT North Sea to Indonesia, MT Jag Lalit to India, MT Pserimos to Australia and MT Minerva Vera to South Korea.

7. Saudi Aramco Moves into South Korean Refining

- Further to its aggressive strategy to consolidate Saudi presence in Asia, the national oil company Saudi Aramco has reached a preliminary agreement with South Korean company Hyundai Oilbank to buy a 19.9 percent stake of the refiner.

- Hyundai Heavy Industries, the parent company of Oilbank, has been a key shipbuilding partner of Saudi Aramco, building a 5.3 billion shipyard at Ras al-Khair on the eastern coast of Saudi Arabia.

- The move helps Hyundai financially and allows Saudi Aramco to sell even more crude to South Korea – well above the 0.975mbpd it supplied on average in 2018.

- The move is widely seen as a Saudi endeavor to supplant Iranian volumes to South Korea – in fact, Oilbank is one of the three Korean refiners who were granted U.S. waivers to import Iranian crude.

- After the share takeover is finalized (there has been no deadline set), Hyundai Oilbank will proceed to its long-planned initial public offering.

- Saudi Aramco already owns 63 percent of South Korean refiner S-Oil.