Wednesday, February 20th, 2019

Renewables Already Limit Upside For Oil

Your author is a firm believer in the idea that sentiment- rather than fundamentals- drives market prices in the short term. That’s why our notes tend to obsess over sentiment measures like hedge fund positioning, options markets and time spreads instead of longer term supply and demand balances. As Lord Keynes once put it- “the market can stay irrational longer than you can stay solvent.”

You often get more bang for your buck as a trader if you can accurately gauge the temperature of the herd as opposed to having prescient calls related to fundamentals or geopolitics. Nevertheless, we still need to work to have as good an understanding as we can on long term oil market themes and were excited as always when BP recently released their comprehensive Energy Outlook for 2019 last week. After a not so quick read, the trend which most interested us was the discussion of renewable energy and electric vehicle market penetration in the context of what we view as short term bearish issues with US gasoline demand growth.

BP sees renewable energy supplying about 4% of total energy today and expects that figure to reach 15% by 2040. The company also argues that renewables will become the largest source of power generation by 2040. To paraphrase BP Chief Economist Spencer Dale, this would represent the fastest penetration of the world’s energy system of any fuel in history.

Just for fun, let’s assume that BP’s forecast is ultimately correct. At first glance, 4% of current energy supply and just 15% in the next twenty-one years may not seem like a terrible threat to anyone with natural length in oil. Unfortunately, BP’s report also sees global oil demand peaking near 108m bpd near 2030 (currently running 100.0m bpd) suggesting meager growth for the next decade. If renewables penetrate the market at a rate of about +0.5% per year through 2040 while global oil demand grows less than 0.5% per year what sort of scenarios does that create for oil price risk?

We’d argue one with increasingly small potential for 2008-style ‘scarcity fear’ rallies which are built on the perception of runaway demand growth and exacerbated by supply challenges. This certainly doesn’t mean that crude prices won’t top $75, but it will drastically reduce the likelihood of a +$100/bbl spike. In the U.S., gasoline consumption + exports have achieved growth of just 0.6% and 1.4% over the last two years and are slightly lower y/y through the first six recorded weeks of 2019. Such lackluster demand suggests to us that fuel efficiency initiatives and EV growth- though too small to drive prices sharply lower- are already tamping down growth at the margins and reducing the likelihood of a major upside move from oil.

Moving forward, the world will increasingly look to China to drive growth in energy consumption and this could ultimately drive more frustration for crude oil bulls as the country dominates growth in electric vehicle sales. According to the China Passenger Car Association China’s EV sales topped 159k in December of 2018. EV sales in China- representing about 3% of all cars sold in the country and 50% of all EVs sold globally- are widely believed to have topped 1 million units in 2018 which may not instantaneously change the dynamics of the global energy market but, again, seems meaningful enough to eat into the potential for a rally driven by runaway oil demand growth.

The impact of electric vehicles and renewable energy sources on oil prices is a long term theme who’s most important days are decades away. In the short term, however, even modest growth in both trends seems to be reducing the potential for sharp spikes in the oil market.

Quick Hits

- Oil markets were essentially treading water this week and holding on to last week’s gains. Brent crude futures traded near $66 while WTI were near $56. Brent and WTI are higher on the year by about 22% and 24%, respectively after spending the last three weeks in narrow $5 ranges.

- Russia and Saudi Arabia agreed to continue working together to curb oil supplies according to a Russian government website.

- Reuters reported that Iranian crude shipments are holding steady near 1.25m bpd in February after averaging near 1.2m bpd in January. The current mark is substantially higher than many traders had expected but could drop soon as US-granted waivers for the country’s key customers are scheduled to expire in May. Iran was producing Reuters estimated Iranian exports at 2.5m bpd in spring of ’18 prior to the Trump administration’s release of new sanctions.

- India has emerged as the primary buyer of Venezuelan crude during US sanctions purchasing more than 600k bpd so far in February.

- Nigeria is holding general elections later this week at a time of increased political strife. Nigeria crude production fell by 120k bpd in January to 1.66m bpd.

- A recent note penned by Morgan Stanley analysts claims that the first meaningful shale oil discovery in China could lead to a 100k bpd – 200k bpd of additional output by 2025.

- Trade talks between the US and China are reportedly improving heading into the next round of tarrif increased which kick in on March 1.

- Hedge funds were net buyers of ICE Brent crude oil futures and options last week to the tune of 32k contracts representing their largest buying spree since August of last year.

- NY Fed President John Williams gave what we consider to be an extremely important interview to Reuters on Tuesday offering two separate gems- he expects the Fed to hold off on expected rate hikes in 2019 unless economic data significantly surprises to the upside and he expects the Fed’s trading desk to cease winding down their balance sheet after another $600b in sales. We still believe that Fed asset sales were a key contributor to risk market weakness in the fourth quarter of last year. US bond rates continued to move lower to begin the week with the US 10yr yield moving to 2.64%.

DOE Wrap Up

- US crude stocks added 3.6m bbls w/w due to the seasonal slowdown in refiner demand. Overall stocks jumped to 451m bbls and are higher by 6% y/y over the least three-week period and +5% versus their 5yr seasonal average.

- US production remains bearishly high printing 11.9m bpd for the fifth straight week- up an incredible 3m bpd in the last two years.

- Crude oil stocks in the Cushing delivery hub fell by about 14k bbls w/w to 41.6m bbls.

- OPEC production cuts and Venezuelan sanctions revealed themselves aggressively this week as US crude imports fell to their lowest level (6.2m bpd) in more than 20 years. Imports had been averaging 7.6m bpd in the six months prior.

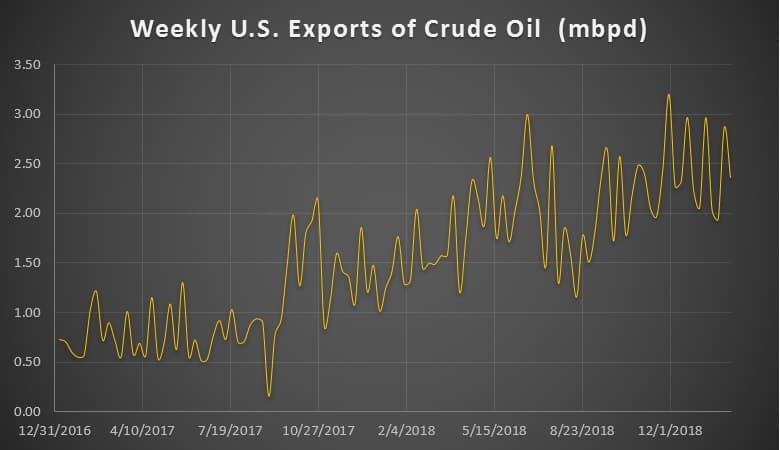

- US crude exports jumped from 2.om bpd to 2.9m bpd and are averaging 2.3m bpd over the last six months.

- The aforementioned drop in US refiner demand equaled 860k bpd bringing total US inputs from 16.63m bpd to 15.77m bpd. Overall inputs are just +1% y/y after showing promising growth through January.

- US gasoline margins jumped sharply this week moving from below $6/bbl to above $8/bbl. US heating oil margins continued to run near $28/bbl. We’re still concerned that the abysmally low gasoline margins will keep refiner demand low as we emerge from turnarounds into summer driving season.

- US gasoline stocks added 450k bbls w/w and are higher y/y by about 5% over the last three-week period.

- US distillate inventories added 1.2m bbls w/w and are flat y/y.

- US gasoline demand + exports are averaging 9.67m bpd so far in 2019 which is flat y/y.

Global Intelligence Report - 20th February 2019

Sources

- Inside source at a black market Niger Delta refinery

- Investigative journalist with access to militants in Nigeria

- Nigeria political analyst

Everything You Need To Know About Nigerian Oil Right Now

Nigeria is currently just recovering from oil-production disruptions suffered in 2016 because of attacks on the pipeline infrastructure by armed militants operating under the name of Nigeria Delta Avengers. The attacks had caused the output of Africa’s biggest producer, usually above 2 million barrels a day, to drop at a point to under 1 million barrels daily. With oil the source of two-thirds of government revenue and more than 90 percent of export income, there were telling consequences as Nigeria slid into its first recession in 25 years in 2016.

President Muhammadu Buhari, a former military ruler who won elections in 2015, had talked tough on assuming office, threatening to deal with the militants. He canceled pipeline-protection contracts awarded to former militant leaders such as Government Ekpemupolo, better known as Tompolo, and ordered their investigation and prosecution. It is widely believed by our sources on the ground, that this move by Buhari prompted the resumption of the attacks.

Faced with a collapsing economy, Buhari sought negotiations with the militants, using back channels established by Oil Minister Emmanuel Kachikwu while he was an ExxonMobil executive, to reach out to the fighters. Then elders of the region under the Pan-Niger Delta Elders Forum weighed in and convinced the fighters to agree to a truce while they presented to Buhari the region’s demands centered around giving the locals more control over their resources, reducing military presence and initiating developments projects. Since then, the demands haven’t been met and there has been a kind of stalemate, leaving the Delta in a permanent state of unease.

Output Versus Oil Theft

Despite the relative peace of the past two years, Nigeria’s oil output has struggled to recover to previous levels above 2 million barrels per day, treading water instead in the region of 1.6 million to 1.8 million barrels daily. The major reason for this has been a booming underground industry in the theft of crude from pipelines for sale to vessels waiting offshore or to illegal bush refineries.

During a visit to the Delta region at the end of January, we sent an investigative journalist to one of these local refineries. Essentially it's an enlarged version of the traditional gin refineries common in the region. Crude oil in huge boilers containing as much as 80 barrels are heated to distill gasoline, kerosene and diesel in turns, polluting the environment in the process. All these are sold in the local black market, though there are reports of barges coming from the islands of Sao Tome and Principe to take the diesel.

A given unit is operated by about 100 people, in shifts of about 10 daily. There's usually a financier who puts up about $12,000 to set it up. Both soldiers and militants levy the operators to allow the business. The industry is so specialized that those who steal the crude supply are a different set of people to those who do the refining.

That remains a major problem facing companies with onshore operations, and the reason for repeated force majeures on major crude export lines such as the Trans Niger Pipeline and the Nembe Creek Pipeline, which supply the Bonny Export Terminal. Similarly affected is the Trans Forcardos, which was out at a point for about a year.

Prospects

Ahead of this year's election, President Buhari ordered more troops into the oil region, either guarding oil installations or carrying out patrols and running checkpoints where people are searched. Being a conservative northern Muslim makes him unlikely to give up the power and control which the presidency constitutionally gives him over the predominantly Christian oil region. This is a stance that is deeply resented in the oil region, populated mostly by ethnic minorities.

Therefore, a Buhari victory means that the prospects of peace are likely to further recede, with active attacks on oil facilities likely to resume, followed by even more militarization. The implications will remain grave for investors and businesses.

It's a situation Buhari's main challenger, Atiku Abubakar of the People's Democratic Party, has moved cleverly to exploit. Though a northern Muslim like Buhari, he's an investor in Intels, an oil-service company that operates in the Onne Oil and Gas Free Zone, just outside the oil hub of Port Harcourt. Abubakar has pledged to grant a key demand of both the militants and politicians in the region, which is to cede control over oil resources from the federal to the local authorities. It is a pledge he said he would begin implementing within six months of taking office.

It's a political move so popular in southern Nigeria that it has galvanized massive support for Abubakar, giving him a good chance of beating the incumbent in a free and fair vote. If he wins and goes ahead with the plan, it will portend changes to the laws that govern the oil industry. Abubakar is in favor of selling the state oil company, the Nigerian National Petroleum Corporation (NNPC) to the public and reducing the government primarily to a regulatory role. Politically, it will meet a longstanding demand of people in the oil region, with a great opportunity for a more lasting peace. For the first time in three decades, oil companies may be able to operate in the Niger Delta without a military shield.

The vote, however, was supposed to have been held on Saturday, and has now been postponed until February 23rd.

The situation in Nigeria from the election and through the following weeks should be at the top of any oil interest radar, followed by the intensifying conflict in Venezuela, where the opposition seeks access to $3.2 billion held in US bank accounts.

Also on our geopolitical radar over the coming weeks will be New Zealand’s ban on oil and gas exploration and the locking of horns between Kenya and Somalia over a Somalia oil and gas tender for a block that ostensibly lies within Kenya’s territorial waters. We’re also still keeping a close eye on Libya’s Sharara oilfield, which has now been handed over by Haftar’s forces to yet another security force in a move intended to prompt the NOC to resume production. However, that has not yet happened and this should be seen as a negotiation between the NOC and Haftar—another move in the power end game.

Global Oil & Gas Playbook

Deals, Mergers & Acquisitions

- Encana has finalized the acquisition of Newfield Exploration, a U.S. independent with a presence across the Permian, the Anadarko Basin, and the Montney Formation in Canada. The all-stock deal valued Newfield at $5.5 billion and will make the resulting company one of the largest shale-focused players in North America. It is part of Encana’s production-boosting drive over its current five-year plan.

- Italy’s Eni and Saudi Sabic have struck a partnership deal for the development of a natural gas conversion technology to be used in the production of high added value products including fuels and methanol. The Italian company came up with the original technology but the partnership with the Saudi petrochemicals giant will advance it further and make it marketable as the oil industry doubles down on petrochemicals as an even larger revenue source for the future.

- Mitsui has bought a 20% stake in the onshore South Sakakemang block in Indonesia. The Japanese company bid for the stake in partnership with Spain’s Repsol. For Mitsui, this is the third oil and gas block acquisition in Sumatra, a major oil and gas producing region in Indonesia.

Tenders, Auctions & Contracts

- Ethiopia and Djibouti have inked a deal for the joint construction of a gas pipeline that will ship Ethiopian gas to an export terminal on the Djibouti Red Sea coast. Ethiopia has abundant natural gas resources that are currently being developed by a Chinese company, POLY-GCL. The company last year signed a preliminary deal with the Djibouti government for a $4-billion project that would involve building the pipeline as well as a liquefaction facility and an export terminal.

- Qatar Petroleum signed memoranda of understandings worth almost $2.5 billion in the United States with Baker Hughes and Schlumberger as it seeks to expand its footprint in U.S. oil and gas. The deals come on the heels of an investment decision worth $10 billion for a joint LNG project Qatar petroleum has with Exxon on the Gulf Coast.

Discovery & Development

- BHP Billiton has approved funding of $952 million for the phase 3 development of the Atlantis field in the Gulf of Mexico and drilling work at the Trion field, also in the Gulf. Atlantis is operated by BP and the Australian miner has a 44% stake in it. Additional production from the field after the completion of Phase 3 will begin next year, at a rate of about 38,000 barrels of oil equivalent daily.

- Eni has begun expanding its presence in the Middle East, shifting its focus away from Africa and to the legacy producing region. In less than a year, the Italian company inked nine deals in the United Arab Emirates, with the latest commitment of $3.3 billion for a stake in an Emirati refinery that will boost the company’s refining capacity by over a third. Eni plans to boost its production in the region to 100,000 bpd over the long term.

- Repsol announced a large natural gas discovery at the Sakakemang field in Indonesia, with reserves estimated at up to 1.5 trillion cubic feet of gas, which is equal to more than 350 million barrels of oil equivalent. However, these were preliminary estimates that will now need to be updated after the drilling results come in.

- Uganda expects to begin commercial production of crude oil in 2022, more than a decade after oil was first discovered in the country. The start of production has been hampered by disputes with oil field operators regarding taxes and royalties, as well as the absence of a pipeline infrastructure and refining facilities.

Company News

- Tullow Oil returned to the black last year, after four years of losses, booking a net profit of US$85 million thanks to higher oil prices.

- Cenovus slipped into a loss of over $1 billion in the fourth quarter of 2018 on the back of a deep discount of Canadian crude to WTI, which also lifted its full-2018 loss to $2.19 billion.

- Eni boasted a 55% jump in fourth-quarter 2018 profits to $1.65 billion, beating an analyst forecast for $1.35 billion.

- Mexico is preparing a $3.9-billion stimulus package for Pemex as investor trust wanes and ratings agencies threaten a rating downgrade.

No End In Sight For Libya’s Oil Struggles

Predicting Libya’s future course is a head-scratcher for any oil analyst, things genuinely start to go steeply downhill the exact moment when some sort of trust is restored and people start dreaming about good things finally coming their way. Your humble servant, too, was surprised by the drastic turn for the worse in Libya, having predicted that the El Sharara incident would not jeopardize Libya’s future output. Well, it did, and it did so at a moment when everyone saw Libya as one of those bright OPEC spots where production growth could be possible. Despite all the international lobbying and pressure, the 315kbpd El Sharara field, Libya’s largest, remains shut since December 8, 2018 with no clear end in sight.

The Sharara and El Feel takeover seemed like straightforward extortion tactics – confronted with the prospect of seeing roughly 390kbpd of Libyan output cut off (the El Feel field depends on electricity supply from El Sharara, thus, if the latter is taken over by militiamen, El Feel goes off stream too), the government would acquiesce to tribal demands for more investment and better social services. And for quite some time it seemed that this would work – several days before Christmas, the Tripoli government claimed it had reached an agreement with representatives of the relevant militia, holding out the promise of 1 billion Libyan dinars ($700 million) spent on the improvement of social services in the south, to no avail.

Dealings with the grievances of southerners is a task that the Tripoli government might have settled – it is only understandable that people who did not receive salaries for months would not interfere with militias that assertedly act in their interests, it is only relatable that the struggling populace of the south that barely copes with the double whammy of living in a divided Libya and living in its poorer south would express its disgruntlement. However, in the past several weeks General Khalifa Haftar, leader of the Libyan National Army, got involved and the El Sharara saga took an unexpected twist, elevating it into pre-election dealbreaker category. Not only did he get involved, his army jubilantly took over the field in mid-February and has been holding it ever since, concurrently carrying out preventive airstrikes to warn off pro-Tripoli armed forces.

This should not mean that Haftar is against giving back El Sharara and El Feel to the relevant operation companies. Akakus Oil, the joint venture between the Libyan NOC, Repsol (10 percent share), OMV and Total (7.5 percent both) even went on to say that following Haftar’s takeover it hopes to resume production at El Sharara by March 2019. In fact, the Libyan NOC has a constructive relationship with Haftar’s LNA – initially Haftar tried to blaze his own commercial trails to market all the crude from territories under his control, however, against a withering backlash from the United Nations, was forced to route all exports through the Libyan NOC.

The US State Department reacted swiftly on the issue, advocating an undelayed return of NOC to the El Sharara site and a prompt resumption of production under the sole oversight of the Government of National Accord, i.e. the Tripoli government. Haftar might give back El Sharara to the NOC, fully cognizant that his sweeping march across the south was yet another sweeping win. The leadership of the Libyan NOC, the cashcow of the Libyan economy, understands this, as attested by Mustafa Sanalla’s recent call for an „oil army” to be set up to protect all of its fields and key infrastructure sites from tribal attacks and sabotage.

One could argue that Libya already has the Petroleum Facilities Guard, yet, in the words of Sanallah, Libya needs a national PFG, not a tribal one. At the same time, testing the muddy waters, Sanalla pointed out that the NOC’s armed forces could incorporate loyal PFG fighters, carefully vetted before joining it. This would make the Libyan NOC the first National Oil Company to have armed forces unit under its immediate command, an audacious gesture given the steep production decline of the past months. At public occasions, be it a keynote address in London or a casual interview, the Libyan NOC continues to dream big, with Mustafa Sanalla predicting Libya would reach 2.1mbpd of production in 2021 if security issues are resolved for good, even though the reality is different.

According to OPEC secondary sources’ data, Libyan production sunk to 0.895mbpd in January 2019 from 1.12mbpd in October 2018, entailing monthly losses for the Libyan NOC that approach $500 million. And even though last year proved to be the best financially since 2012 for Libya, bringing in $24.5 billion in oil revenues and more than halving the budget deficit to $3.3 billion, the spending allocation the Tripoli government routinely flaunts in the media rarely hits the bank accounts of the Libyan NOC fully. The NOC is the only major source of funding, but by far not the only subject to fund. Thus, against the background of little to no trust between the two rival governments, between militias and the NOC, it should come as no surprise that international investors are in no hurry to invest in Libya.

Libyan exploration activity is subpar, as venturing into untapped plains comes with significant safety requirements which are nowhere to be seen unless one of the vying political powers consolidates the country. Thus, all international majors present in Libya will keep on drilling within their own licensed blocks, yet will refrain from any adventurous moves. On a general basis, working in Libya’s offshore is much safer than any onshore projects, therefore projects like the Bahr Essalam Phase II by Melittah and partners will get green lighted in the upcoming months. However, it has to be said that Bahr Essalam is a gas project and although helpful in increasing gas exports to Italy, such developments will not ease the pressure on Libya’s oil sector.

Source: OilPrice data.

The elections might alter the current equation, one might say. Yet holding the much-needed elections, initially slated for March 2019, is a Sisyphean toil, with UN Libya envoy Ghassan Salame now claiming end of the year is a „real possibility”, meaning the countless overtures and provocations will continue for some time to come. All the while Libyan exports, exacerbated by frequent bad weather in the Mediterranean nation’s ports, have fallen to levels unseen since May 2017, at around 0.8mbpd. Trust me, I would be very happy to be proven wrong, however, in an environment where nothing is certain and not a single rule is carved in stone, the ever-fluent political reality will continue to overwhelm Libya’s crude sector.

How Robo-Taxis Will Impact Oil Demand

Vehicle automation is expected to have a huge impact on demand for energy in transport, but there is very little clarity as to what the net effect will be.

A review of literature examining the issue -- Autonomous Vehicles and Energy Impacts: A Scenario Analysis, published in Energy Procedia in December 2017 -- found that the various studies undertaken pointed to anything between a 64% fall in transport energy consumption by 2050, compared with 2017, to a 205% increase.

This wide spectrum of outcomes relates to total transport energy consumption, not to the source of that energy, which was outside the scope of the study.

As a result, to determine changes in future oil demand, analysts must assess the impact of competing fuels and energy sources – biofuels, electricity, hydrogen, natural gas/LNG – and then place that analysis within the context of the behavioural changes brought about by automation.

A 50% share of electric vehicles (EVs) in the passenger vehicle fleet by 2050, for example, looks very different in the context of a 64% fall in overall energy transport demand – implying a potentially radical drop in oil demand -- when compared with a 205% increase, in which the impact of passenger vehicle electrification may be entirely negated.

Energy source

There is nothing intrinsic to automation that implies transport electrification, but there are clear synergies.

For example, while recharging time is considered a negative feature of EVs, compared with internal combustion engines (ICE), it would be a much safer means of reenergising a vehicle in the absence of a driver. In addition, vehicle sharing, a development expected to result in fewer vehicles travelling more miles, would favour the lower fuel and maintenance costs of EVs.

What is apparent is that the first generation of robo-taxis is set to be almost exclusively electric or plug-in hybrid.

Volvo intends to supply the 360c to Uber, Waymo is building its autonomous fleet with plug-in hybrid Chrysler Pacific Minivans and all-electric Jaguar SUVs, Navya’s Autonom CAB is electric, while Cruise Automation will use parent company General Motors Chevrolet Bolt. BMW is looking to its iNext EV and nuTonomy is moving from Renault Zoes and Mitsubishi i-MIEVs to the Peugeot 3008, which has both ICE and electric drive train options.

The worst possible combination of scenarios, from an oil producer perspective, would be a fall in overall energy demand with the development of automation and electrification proving highly symbiotic. High levels of automation could accelerate electrification. Alternatively, a high level of automation combined with drive train neutrality, particularly in the commercial vehicle sector, offers the highest oil demand outlook.

Competing claims

The different outcomes depend upon the weight given to the possible changes in driver behaviour and vehicle use.

Automation could increase average travel speeds as a result of better traffic conditions, resulting from fewer accidents and improved traffic flow. The number of drivers could increase as both youth and old age are reduced as barriers to driving, while people prevented from driving as a result of disability would also benefit.

A further possibility is that an improvement in ‘in-car value time’, where the driver (now a passenger) can work via full interconnection to the internet, or indulge in some form of entertainment. In-car connectivity and automation could make point-to-point car travel preferable to mass transport even for longer journeys, challenging short haul flights and train journeys.

As a result, automation could both increase demand for travel and cause a switch in travel modes from mass to individual transport. This latter development could also mean a switch from oil product use (jet fuel and diesel) to electricity.

On the other side of the coin, automation may promote eco-driving, with the car’s computer prioritising fuel efficiency above all else.

This possibility is extended with platooning, whereby fully-automated trucks drive in convoy from major distribution hub to major distribution hub, cutting down on wind resistance and driving at optimal speeds for saving fuel. Right-sizing and car-sharing are other means by which vehicle miles travelled (VMT) could be cut.

The study concludes that full automation will “induce travel demand and attract new user groups, which will generate more trips and VMT that results in more energy consumption.” However, dynamic ridesharing and shared autonomous vehicles are seen as means of reducing the impact on transport energy consumption, particularly in urban environments.

Vehicle sharing

While the increase in driver pool, improved safety (eventually) and overall increase in attractiveness of road transport provided by full automation look relatively straight forward, the idea of shared vehicles implies a more radical and uncertain change in consumer behaviour.

Private car ownership has never been a commercial proposition but one of convenience. Privately-owned vehicles are heavily under-utilised capital investments that spend most of their time doing nothing.

The shared vehicle concept assumes that robo-taxi costs fall so low that travellers give up the convenience of owning their own car. Unlike its private counterpart, the shared car is highly utilised – it will need to be to keep costs competitive with both public transport (where it can offer better point-to-point journeys) and private ownership.

However, there are questions over whether robo-taxis could meet both the need for high utilisation and the same level of convenience offered by private ownership.

Full automation also increases the convenience of private ownership. Moreover, transport demand is not constant, but has peaks and troughs largely centred around commuting times. To deliver convenience, sufficient robo taxis would be needed to meet peak demand, but that implies less utilisation during other periods.

This assumes that robo taxis are organised as commercially-owned fleets, which appears to be the direction of travel backed by joint ventures combining technology firms, ride hailing platforms and auto manufacturers. This means a major change in business model and cost structure for companies like Uber – capital investment in fleet ownership and maintenance, as oppose to sourcing work for privately-owned, driven and maintained assets.

While robo taxis will make taxi drivers redundant, it is not clear that they will make taxi travel sufficiently cheap and convenient to displace privately-owned car ownership or compete with public transport to the extent expected.

The wide range of possible outcomes will also be affected by externalities. An increase in VMT could work against improvements in traffic flow and potentially negate faster average speeds, if not accompanied by increased investment in roads.

Given the uncertainties, it is difficult to come to hard and fast conclusions at this stage, but the balance of probabilities suggests that, first, given the uncertain impacts of vehicle sharing, automation is more likely than not to increase overall demand for transport, most likely on a post-2030 timescale. Second, automation and electrification might be complimentary, but they are not co-dependent. Automation could therefore advance in the heavier commercial vehicle sector based on ICE technology.

Oil Rally Continues Despite Soaring Shale Output

Starting off the week on February 18 was an unusually comfortable experience for people in the oil industry. Saudi Arabia vowed to cut its crude output beyond OPEC/OPEC+ commitments, which has palpably helped to move prices up, moreover, shutting down its Safaniyah offshore field due to a power outage even brought in an unscheduled upward pressure factor. Even the US-China trade talks have instilled hope in market watchers that a deal might be reached in the upcoming days.

Source: Bloomberg.

The bullish sentiment was somewhat cooled by news of US shale output rising to record highs – the EIA expected shale alone to reach 8.4mbpd next month. As a consequence, Brent dropped from a year-high of $66.83 per barrel on Monday below $66 per barrel on Wednesday afternoon, whilst WTI hovered around $56-56.2 per barrel, having experienced a modest drop from its Monday year-high level of $56.39 per barrel.

1. US Crude Commercial Stocks Still on the Increase

- US commercial crude stocks have increased for the fourth consecutive week during the week ended February 8, up by 3.6 MMbbl to a total of 450.8MMbbl.

- The week ended February 15 is also widely expected to bring about another stock buildup, with a Platts analyst survey hinting at a further 3.5MMbbl inventory accumulation.

- US crude exports have declined by some 0.5mbpd w-o-w during the week ended February 8, however, they are expected to bounce back a bit from last week’s 2.4mbpd.

- The week ended February 15 should also bring about a rebound in refinery runs, which have plummeted from the early January level of 17.56mbpd to 15.77mpbd during the week ended February 8.

- Gasoline stocks have been building up for the tenth week in a row, the week ended February 8 witnessing another 0.4MMbbl increase to 258.3MMbbl, almost 10MMbbl above the 5-year average.

2. Another Oil-For-Goods Deal for Iran?

- The Iranian oil minister Bijan Zanganeh travelled to Moscow last week to discuss future energy projects with his Russian counterpart Alexandr Novak.

- Russia and Iran are closing in on a 100kbpd „oil-for-goods” contract, under which Iran would provide the crude in its ports in exchange for Russia paying half of its value in cash and the other half in goods.

- It remains to be seen who would be the crude receiver on the Russian end, however, the crude would be very well suited for Rosneft to supply it to its Indian Nayara refinery system.

- A potential Rosneft involvement is all the more likely as the Russian oil majors is reportedly interested in taking up 5 oil fields in Yaran, Koupal, Maroun, Bangestan and Azadegan.

- Teheran seems intent on giving Russian companies preferential treatment when it comes to upstream endeavours – the long-mooted updated version of the Iranian Petroleum Contracts will be presented to Russian investors on March 27 in Moscow.

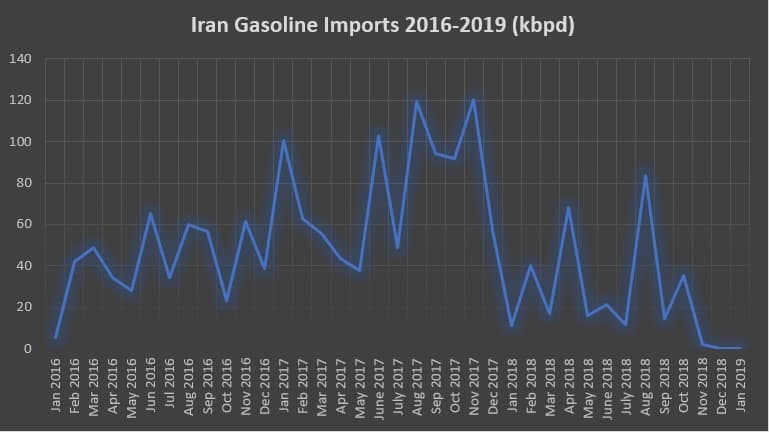

3. Iran Launches Phase 3 of Persian Gulf Star, Ending Gasoline Imports

- Iran has started up Phase 3 (120kbpd) of its 480kbpd Persian Gulf Star (PGS) condensate splitter in Bandar Abbas on the Strait of Hormuz.

- Iranian state refiner NIORDC puts current PGS throughput at 206kbpd, to be increased gradually as third phase production ramps up.

- This would place Iran into net exporter territory, with its refining capacity surpassing the 580kbpd gasoline demand, largely dispelling fears that Teheran might witness a return of fuel shortages it had struggled from during the 2012-2015 period.

- The last gasoline cargo to Iran arrived mid-November 2018 from the Indian port of Pipanav, there has been no maritime gasoline activity thereafter.

- Iran’s commissioning of PGS is quite a significant feat, given that in the summer of 2017 they were buying on average 105-110kbpd of gasoline.

- Iranian oil minister Bijan Zanganeh stated the nation wants first to build up stocks and only then go on with exports, which, amid US sanctions, will inevitably require a tight web of intermediaries and middlemen.

4. Indian IOC Signs First-Ever US Supply Contract

- IndianOil, the state-owned oil and gas company of India, has signed a year-long supply deal starting from April that would allow it to import up to 3 million tons of US crude grades per year.

- The move marks the first time any Indian entity signs a mid-to-long term deal with regard to US crude, which is seen as a partial solution to mend the problem of Iranian volume tightness.

- It is unclear what the US basket would consist of, however, IOC has previously brought in Midland WTI, LLS, Eagle Ford and Bakken.

- IndianOil’s 9mtpa term supply contract with the Iranian NIOC runs out this March, hence the Indian refiner has been looking for viable alternatives – the heavier barrels would most likely be sourced from Iraq, already supplying some 18mtpa of Basrah crudes.

- US crude exports to India increased more than tenfold in the past two years, from around 20kbpd in January 2017 to 220kbpd in January 2019.

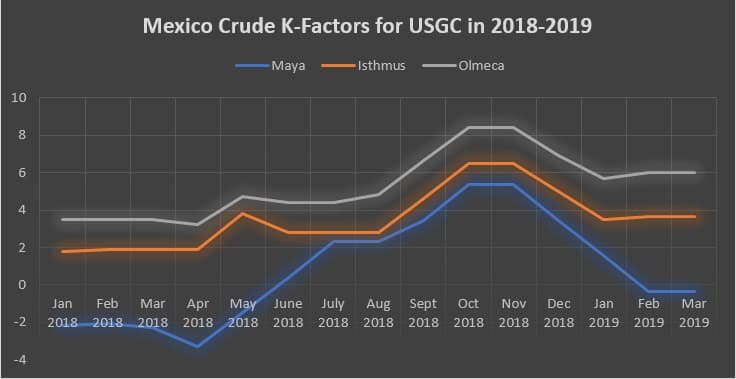

5. Mexico K-factors Up for Everyone Except US Gulf Coast

- PMI, the Mexican state oil marketer, has published K-factors for its March-loading shipments, rolling over all USGC prices while raising K factors for everyone else.

- K-factors are used by PMI as price adjustments, to be modified on a monthly basis, reflecting current trading interest, and included in the price formula.

- The standard Maya formula for USGC, stated below, witnessed no change month-on-month at a -0.35 per barrel discount.

[Price= 0.4*(WTS+FO 6.3%S) + 0.1*(LLS+Brent Dated) + K]

- The 22° API, 3.4 percent Sulphur Maya crude’s K-factor for Europe, India and the Middle East rose a whopping 1.7 USD m-o-m, with Far East hiked by 95 cents per barrel.

European Maya Formula = [0.527*Brent Dated + 0.467*(FO 3.5%S) – 0.25*(FO 1%S – FO 3.5%S) + K]

- The Maya hike reflects a tightening heavy sour market globally following the Iran and Venezuela sanctions, however PEMEX seems to be extra careful not to lose out on the core USGC market.

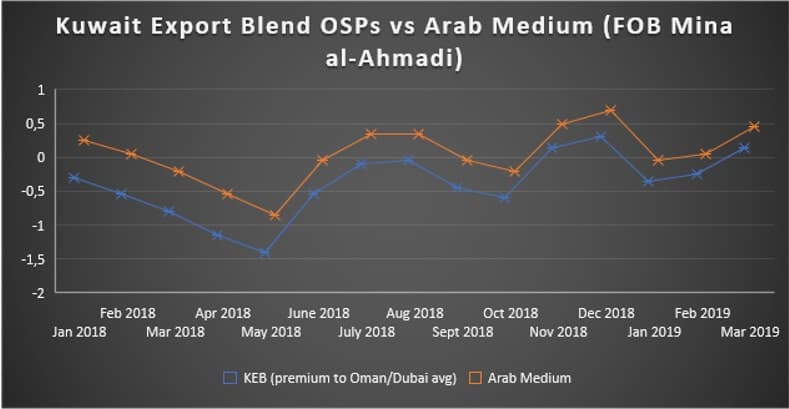

6. Kuwait OSPs in Complete Unison with Saudi

- The Kuwaiti state oil company KPC has raised the March-loading official selling prices of its Kuwait Export Crude blend by 40 US cents per barrel, echoing a similar move by the Saudis.

- The KPC-Arab Medium spread has remained at 30 cents per barrel for the third consecutive month, the narrowest it has been during the past 5 years.

- Two years ago, in February 2017, the spread stood at 55 cents, whilst a year ago, in February 2018 it reached 60 cents per barrel.

- KPC cuts its March-loading OSP for its Kuwait Super Light crude by 20 cents to 1.30 USD per barrel amid weak light distillates’ margins and the arb bringing in loads of trans-Atlantic cargoes.

- The KSLC seems to mirror the pricing developments of Arab Extra Light, remaining at +0.35 USD per barrel for the third month in a row.

- In the meantime, KPC is reported to work on streamlining the company’s operations by merging its eight business units into four – chronic internal disputes have led tot he resignation of Oil Minister Al-Rashidi in December and mergers are seen as a way of shaking off recurring rows.

7. Egypt Exploration Licensing Round

- Egyptian Natual Gas Holding (EGAS) and Egyptian General Petroleum Corporation (EGPC) have announced the results of their 2018 licensing round, allocating 12 of the 27 available blocks.

- Shell was by far the most active international major, having clinched 2 two gas-bearing and three 3 oil-bearing blocks.

- The fly in Shell’s ointment is that all big parts of the three oil blocks it saw allocated were previously assessed, by Amoco or Braspetro in the 1970s or by someone else later on, and relinquished afterwards despite discovering oil-bearing reservoirs.

- The Northeast El Amriya block (Block #3) elicited the most intensive bidding, with a newcomer to Egypt’s offshore, ExxonMobil, clinching the deal for a $10 million signing bonus and $100 million financial commitment.

- A total of 6 international majors bid for Block 3 – Shell and Petronas got instead a joint operatorship over Blocks 4 and 6, whilst the ENI/BP consortium got Block 11 not far away from the LNG terminal of Damietta.

- EGAS wants to start a new licensing round for blocks in Egypt’s Western Mediterranean which is heavily underanalyzed and so far wields only two exploration wells drilled, with the first dating back to almost 45 years ago.