Wednesday, March 13th, 2019

Saudi Power Over Oil Prices Is Limited

Are you getting bored of the oil market yet? Traders are. Brent crude achieved just a $3.12 range in the ten trading days ended March 12th, representing its most narrow band since May of last year. While headlines have screamed about the impending bearish doom or bullish boom they happen to see ahead, the real story has been that oil markets have substantial buffers on both sides of the range. Option traders see the trend persisting in the near term with the straddle expiring April 25th worth just $5.00.

This week’s key headlines have fit neatly with the sideways trend. On the supportive side, Monday’s Saudi announcement of larger than expected exports cuts in April (which are still focused on the US) gave the market a bullish jolt. On the resistance side, the most recent IEA forecast predicting an additional 4m bpd of US supply growth over the next five years points to the limits of OPEC’s ability to manage the market higher. We continue to adhere to the idea that OPEC+ can absolutely manage downside risk in the market but they’ll have trouble creating genuine upside risk. For fun, we’ll even define this numerically offering that OPEC+ can keep prices above $50, but they can’t push prices over $75 without a parallel bullish narrative.

So where will oil’s next big move come from? For upside, we’re still believers in the idea that OPEC production cuts, dovish central bankers and a US/China trade deal will serve as potent bullish factors. There seems to be a bit of extra juice in the OPEC component of the bullish triumvirate for now as exports from Iran, Venezuela and Nigeria look particularly tenuous. Unfortunately for bulls, these themes are almost entirely priced into markets now and there will have to be some substantial data surprises for one of them to generate another leg higher for prices. Perhaps some extremely sharp US inventory draws could do the trick.

On the downside, global trade woes, weak refiner demand and growing US supplies will continue to keep a lid on prices. This week’s IEA forecast on US crude supplies topping 13.5m bpd by 2024 was alarming and will certainly mitigate upside risk for prices if it comes to fruition. On the economic side, LNG flows have revealed some of the stress that US/China tariffs are putting on economic activity as only one China-bound US tanker has been delivered in 2019 after averaging about 2.5 per month in 2017 and 2018. On Tuesday US trade representative Robert Lighthizer suggested a US/China trade pact will be reached in the coming weeks in comments to the Senate Finance Committee. Unfortunately, our concern persists that a deal may not do much to boost confidence in a market where US refiner demand growth has been nonexistent over the last six months.

Looking ahead, we think oil looks fairly valued in the mid/high $60s with OPEC+ providing support while soggy demand weighs on the strength of rallies. Saudi Arabia could very well announce sub 10m bpd production and sub 7m bpd exports in the coming months. If/when that occurs, there will likely be a knee jerk reaction from traders to push things higher. Don’t get too excited- there’s simply too much negativity in the market to push above $75.

Quick Hits

- Global crude prices were slightly higher to begin the week with help from the Saudi announcement that deeper cuts are on the way this spring. Brent crude traded near $67 while WTI traded near $57.

- Saudi Arabia’s announcement was sharpened by unconfirmed reports that OPEC+ could be looking to extend their cuts into the second half of 2019. In our view a cut extension seems entirely plausible as cooperation with the effort has been strong.

- Massive power outages worsened production issues in Venezuela this week. While we aren’t sure exactly where the country’s output is at the moment, rallies in prompt brent spreads corroborate the idea that global crude markets are tightening. This week the prompt 6-month brent spread moved from +44 cents to +74 cents.

- The Paris-based IEA made the week’s largest bearish splash predicting substantial growth in US production through 2024. In the US, however, the Department of Energy trimmed its US output forecast for 2019 from 12.4m bpd to 12.3m bpd. US production is currently running near 12.1m bpd.

- Demand concerns are in sharp focus for oil these days and DOE data has failed to show any gains in US demand so far this year. Refining margins are currently trading at historically moderate and/or slightly higher levels which could help jump start things this summer. This week the WTI 321 crack was steady near $21/bbl with the gasoline / WTI crack near $19/bbl while the heating oil / WTI crack traded near $26/bbl. Overseas, the gasoil/brent crack traded near $15/bbl.

- Refined products continue to strengthen in the US with domestic gasoline prices moving over $1.80/gl for the first time since November.

- Hedge funds were net sellers of ICE Brent derivatives last week for the first time since December. Overall net length was cut by 3k contracts moving from 291k to 288k. Meanwhile funds were net buyers if NYMEX WTI futures and options bring net length up 20k contracts w/w to 152k.

- Bank analysts were mixed on crude oil forecasts this week but mostly saw crude oil moving sideways in the near term. UBS cut their 2019 Brent crude forecast from $68.50 to $65.75 while Morgan Stanley cut their 2Q Brent forecast from $62.50 to $62.00.

Quick Hits – Macro Focus

- From an oil market perspective the macro climate was mixed this week. Stock markets were broadly higher led by Asian shares and bond yields were lower on weak economic data and another Brexit fiasco. The US Dollar continued to trend higher which weighed on commodity prices.

- ‘Bond King’ Jeffrey Gundlach gave harsh remarks on the state of the US economy this week saying S&Ps will sink in 2019 and even take out their 2018-lows. The fund manager was highly critical of rising public and private debt levels, partly blaming President Trump. The investor also took time to criticize Modern Monetary Theory which is gaining traction in liberal economic/political circles.

- S&Ps traded near 2,800 mid week representing a 22% increase since their low print in December. The index is 5% below its all time high in September.

- Overseas, the Shanghai Composite continued to scream higher as the People’s Bank of China took additional measures to prop up the economy and the Trump/Xi leadership teams appeared to move closer to signing a trade deal.

- Bond prices rallied sharply this week driven by a disastrous vote for Theresa May’s Brexit deal and weaker than expected US CPI data. The US 10yr yield fell to 2.60% for the first time in two months and the yield curve flattened as well. Core CPI in the US rose 0.1% m/m and 2.1% y/y.

- For metals, copper prices were basically flat this week near 290 holding on to an 11% rally YTD. Gold prices retraced some of their recent losses moving higher towards 1,300.

- The US dollar index has continued to levitate and reached its highest mark since 2017 on Friday at 97.7. This is bad news for crude oil bulls who continue to suffer from currency stress despite continued dovish signaling from the US Fed.

Global Intelligence Report – 13th March 2019

Sources

- High-level US official

- Former Aramco executive

- American businessman in Saudi Arabia

- 3 prominent Indian businessmen in UAE

NOPEC Isn’t Going to Happen

A bipartisan measure called the “No Oil Producing and Exporting Cartels Act” was approved by a congressional committee last week. It sounds ominous, but it does not have teeth. It basically removes the sovereign immunity protection of OPEC countries, leaving it open to civil suits alleging antitrust violations. While there is some momentum behind the law, it still has the potential to die before it reaches a full vote in Congress. Basically, the law would allow the US government to sue OPEC nations for improperly controlling prices through oligopolistic practices.

While NOPEC has been a threat tossed around by Trump and meant to lend the appearance of power against the Saudis, our high-level sources say that officials in the Trump administration are leaning toward fighting any attempt to put this law into place.

While Trump has been critical of OPEC, advisers from the State Department and elsewhere in his government are cautioning that allowing such a law to go through could upend Middle East peace talks led by Jared Kushner, as well as relations with Persian Gulf allies like Saudi Arabia. Diplomats on the ground in the Gulf have told us this is a done deal already, and is not going to happen.

Trump hasn't weighed in with a final decision, but our sources say it will be ‘no to NOPEC’, and the likelihood is that he will keep using the lack of a final decision as leverage to have over the heads of Gulf countries to keep prices low.

Aramco Pushes Ahead in Nonsense Deal for IPO Cash

Aramco’s board is meeting this week to approve an international bond to fund the acquisition of a 70% stake in petrochemicals major Sabic. The acquisition is part of efforts to make Aramco more attractive for foreign investors when the time comes to list. The latest update from Energy Minister Khalid Al-Falih is that the IPO will take place in 2021. The bond, Aramco’s first on the international market, also raised questions: such a bond will require the notoriously opaque company to disclose a lot of financial details to whet investors’ appetite to participate.

Behind the scenes, it’s important for investors to understand that Aramco is rather toxic right now. And it was the Saudi ‘deep state’ (yes, there is something deeper than MBS, which is why he is currently and increasingly paranoid about his life) that managed to run this IPO off track. This is part of the power struggle, definitively. So this is where Sabic comes into play—and having Aramco buy Sabic shares from PIF, using debt. It’s a last ditch effort to raise the money from somewhere even when it doesn’t make sense: Aramco has its own conflicting strategy for chemicals.

This can all circle back to the idea of NOPEC and why it is such good leverage even if Trump has no intention of going through with it. While the Saudis can always keep borrowing, the real question is whether the Kingdom is actually solvent. The sovereign wealth fund’s (PIF’s) billions are largely publicly traded stocks—much of which they can’t sell without wreaking havoc on the local market. Is that solvency? It’s a gray area, but it’s important for investors to understand that PIF is, for all intents and purposes, a warehouse of shares that can’t be sold.

Indian Businessmen Have No Qualms About Busting Sanctions

US Secretary of State Mike Pompeo has urged India to stop buying crude oil from Venezuela. This message is likely to fall on deaf ears. With that in mind, Trump has asked Congress to remove India from the list of preferential trade partners, which could start another trade conflict.

The biggest risk for hedge funds right now is betting on sanctions busters. India is one of the riskiest of those emerging markets that are considered otherwise a good bet. Nor is it just the state of India that the US sanctions regime needs to worry about. Prominent Indian businessmen in Dubai have told us that the global Indian business community does not view US sanctions against foreign countries as justifiable, and they will bust sanctions if they can see an avenue for doing so that does not result in getting caught. This makes things tricky for investors/hedge funds. What hedge funds should be looking out for right now is the potential for individuals and their associated companies to be placed on the BIS Entities List, which results in denials of licensing for imports/exports, and which can destroy a business empire.

Global Oil & Gas Playbook

Norway’s sovereign wealth fund will divest from its interests in upstream oil and gas after the government recommended the move first proposed in 2017. This means stakes worth billions of dollars will be sold—news that sent the stocks of energy majors diving. But there is a favorable catch for the integrated majors.

The government of Norway advised only a partial divestment from the oil and gas industry: the sovereign wealth fund will sell its holdings in pure-play production companies but keep its stakes in integrated companies such as BP, Shell, and Chevron.

It’s a pragmatic decision and has nothing to do with environmentalism. The bottom line is that Norway has become too reliant on the returns from its oil and gas interests, as evidenced during the 2014 price crisis.

To reduce the likelihood of a repeat of the situation, the world’s largest sovereign wealth fund, worth about $1 trillion, needed to reduce its exposure to an industry where volatility had always been considerable but was only becoming more intense post-2014.

Some have tried riding the environmental wave, arguing the decision to divest was motivated by environmental concern as well as financial reasons but the official line remains strictly focused on financial security rather than any sustainability concerns as evidenced by the fact the fund will keep its holdings in the supermajors.

In other words, this is Norway moving with the times, and getting out in front of the big fight to come that has oil majors who aren’t jumping on the renewables bandwagon scrambling for another foothold.

Deals, Mergers & Acquisitions

- French Total has bought a 10% direct stake in Novatek’s Arctic LNG-2 project, which will bring its total stake in it, including its 19.4% holding in Novatek, to 21.6%. The French supermajor also has an option to buy an additional portion in the $21-billion project if the Russian operator decides to reduce its 60% interest in it.

Tenders, Auctions & Contracts

- Pembina Pipeline Corp. the company that plans to build the Jordan Cove LNG plant in Oregon said it has secured non-binding commitments exceeding the planned facility’s annual capacity by about 3.5 million tons of the liquefied fuel. However, the state authorities’ decision on whether to grant Pembina a construction license for Jordan Cove has been delayed by six months after the Department of State Lands was drowned in comments. These, according to the regulator, were between 49,000 and 57,000 but it did not say which ones were more, those in favor or those in opposition to the project.

- Sinopec, China’s largest refiner, could sign a 20-yer LNG delivery contract with U.S. Cheniere Energy but only if Washington and Beijing finalize their trade deal. For now, expectations are optimistic but last-minute surprises are always an option. Cheniere is the largest exporter of LNG from the United States and China is a key market for all producers of the fuel.

- Shell has signed two contracts in Colombia for the development of two offshore blocks in the Caribbean. Initial investments in the two projects would be to the tune of $100 million and the total spend could reach $650 million if exploration yields promising results.

- Baker Hughes and McDermott scored offshore field development contracts from BP for a natural gas project in Mauritania. The Greater Tortue Ahmeyim LNG project is a priority one for BP, which will feature a floating production and storage facility with an annual capacity of 2.5 million tons of liquefied gas. The resources of the field are estimated at 15 trillion cu ft. First production is slated for 2022.

- Ecuador’s auction of “intracampos” oil blocs this week has received bids from six oil companies and may fall short of the hoped-for $1 billion in investment—possibly because the deals come with a provision that gives Ecuador 60% of production. The blocs are estimated to contain around 850 million barrels of oil. Bidders included Russian Zarubezhneft, Uruguayan Petrobell, Colombian Gran Tierra, Colombian-Peruvian Frontera Geopark and American Flamingo Operating, and a domestic company, Petrolamerec.

Discovery & Development

- Saudi Arabia’s Aramco announced a potentially substantial natural gas discovery in the Red Sea, without, however, divulging any details as to how much gas it contains. The company said it will now step up its exploration efforts in the area after it completes a feasibility study on the discovery. Gas has gained more prominence on the Saudi energy agenda lately with Aramco looking into gas and LNG acquisition opportunities abroad as well as new investment projects at home as it seeks to boost the portion of natural gas in its energy mix.

- Malaysia’s Petronas plans to increase its exploration budget this year focusing particularly on natural gas and LNG to reduce its exposure to super volatile oil prices. Petronas’ total budget this year could be around $12.22 billion and a solid portion of it will go into the LNG Canada project where Petronas has partnered with Shell, PetroChina, Kogas, and Mitsubishi. The project will cost $30 billion.

- Colombia’s Ecopetrol, the state oil company, plans to spend $500 million on fracking over the next three years despite vocal opposition from environmentalists and local communities. Plans are to drill 20 wells and frack them to tap its unconventional oil resources. The sum is part of the company’s $12-15-billion budget for the period.

- Argentinian plans to boost natural gas output and supply have been furthered with $1.8 billion in new pipeline construction contracts that could be signed by September and are aimed at getting gas from the shale heartland—Vaca Muerta—to Buenos Aires.

- Iran is gearing up to launch four new phases at its giant South Pars gas field (the biggest in the world). This should, in part, be viewed as PR because there are no details on launch phase dates or expected production capacity increases. Currently, Iranian authorities claim that South Pars production is up to 610 million cubic meters per day.

- Shell and HES International will partially restart a Germany oil refinery that has been shuttered since 2011. Investors should be looking closely at new rules by the International Maritime Organization (IMO) that mandate a reduction in sulfur content in shipping fuel from 3.5% to 0.5% beginning next year. This will prove to be a major change in oil markets for traders. And the Shell-HES deal represents a foothold on this lower-sulfur-content fuel. This refinery had a capacity of 260,000 bpd when it was shuttered in 2011. Our understanding is that Shell will be the client for the fuel.

Politics, Geopolitics & Conflict

- Israel’s Prime Minister Benjamin Netanyahu last week suggested the Israeli navy could be used to stop Iran from “smuggling” crude oil abroad despite US sanctions.

- While France and Italy have been the key European players vying for control of oil-rich Libya, Germany is now signaling that it may like to get back into the game, though we are unaware of any direct expressions of interest by specific oil and gas companies yet. But this also comes as General Haftar (Libyan National Army) closes in on Sirte with his forces. Sirte is controlled by the Tripoli-based Government of National Accord (GNA), which is the (for now) internationally recognized government—but it is not likely to last much long. The GNA has declared a state of emergency in Sirte as Haftar approaches. They are calling this is declaration of war. (This will be the focus of our HUMINT next week).

- The effect that isolating Iran with sanctions and trying to create further rifts around Iran in the Middle East is having the effect of bolstering the hardline elements in leadership. One particular figure is now clearly on the rise, cleric Ebrahim Raisi, who is now visibly in the running to take over from Supreme Leader Ayatollah Ali Khamenei. He has now been elected to the Assembly of Experts, a hugely powerful body that chooses the Supreme Leader. And his place in this body is as deputy chief. He has also just been appointed chief of the judiciary.

- The UN Panel of Experts on North Korea released a 400-page document this week, detailing what it calls a “massive” increase in oil imports by North Korea, despite sanctions, along with an increase in coal exports. Additionally, the report notes that North Korea is making attempts to sell weapons in the Middle East, and has likewise been stepping up efforts to hack into global banks.

Can The Caspian Still Become A Hydrocarbon Hub?

The contract of the century will most likely last just about a quarter of a century as Russia’s appetite for Caspian crude and gas has been put on the backburner amid US sanctions and the failure of Iran’s forgotten giant, Sardar Jangal, once touted to contain 10 billion barrels of oil, to meet expectations. This is a seemingly hopeless predicament for the Caspian littoral nations that finally agreed on the principles of their border delimitations last year, only to realize that the swift developments in international oil trade and politics might render Caspian volumes largely irrelevant. Evidently, there are some positive developments, too, but they are too few to outweigh the adverse ones.

The Caspian’s most contradictory story has been unfolding in Azerbaijan. It is no secret that Azeri crude output is gradually declining, dropping down from its all-time peak of 1.037mbpd in 2010 to the current level of 0.8mbpd. SOCAR, Azerbaijan’s national oil company, has been readying to embrace a new capacity for some time already, building up the foundations of its transition from a crude player to a predominantly gas-relevant company. These shifts did not go unnoticed with US oil majors ExxonMobil and Chevron, who were involved in Azerbaijan from 1993 and are one of the last members of the old guard who actually signed the “contract of the century”. Both US firms have approached several potential buyers, declaring their interest to sell their stakes in the ACG fields as well as the Baku-Tbilisi-Ceyhan (BTC) crude pipeline.

To contextualize it, let me state that the Azeri-Chirag-Guneshli fields, often abbreviated as ACG, represent roughly 75 percent of Azerbaijan’s oil production. By leaving ACG, large-scale American business interests are leaving Azerbaijan altogether, since all the other projects are incomparable in scope. Both Chevron and ExxonMobil would remain in Kazakhstan, where the former would maintain its operator status of the Tengiz development project, whilst the latter intends to keep its 25-percent stake in Tengizchevroil. Speculation abounds on what did compel Exxon and Chevron to opt for the exit – most probably annoyance with Azerbaijan leading an increasingly assertive policy vis-à-vis the foreign majors. However, this leaves only BP with a substantial position in Azerbaijan out of all the once-involved giants.

Azerbaijan’s crude prospects have been further weakened by Turkmenistan’s sudden decision to export its oil via Russia, giving up on the BTC stream. This has dealt a double blow to SOCAR as Turkmen crude, of which roughly 200 000 tons were supplied through the Baku-Tbilisi-Ceyhan pipeline, has generally improved the quality of BTC due to its being lighter and sweeter than traditional Azeri light and also brought in much-needed transit revenues from using the pipeline. Pretty much all of the Turkmen crude is marketed by top trading house Vitol, which collects production from the Emirati-based ENOC and the Italian ENI. Apparently, the decision to reroute exports to Russia is based on a long-standing tariff dispute, yet a politically motivated lead-up should not be excluded.

Russia is a completely different story – there from day one, only one big oil player wanted to give exploration drilling a go in the Caspian area, the largest private company LUKOIL. To be frank, even LUKOIL wanted to get into Azerbaijan but due to the Azeris’ concerns about a Russian company controlling a bulk of its production LUKOIL was forced to concentrate on blocks in its own territory. In a very fortunate twist of events, LUKOIL went on to discover a swath of oil and gas fields – the 1 Bbbl V. Filanovskiy, the 240MMbbl and 2.3 TCf gas-containing Yuri Korchagin, the 287 MMbbl Rakushechnoye and others. State-owned companies Rosneft and Gazprom concurrently tried their luck with respective Caspian projects, yet all the wells they have drilled turned out to be dry or commercially unattractive.

Thus came about one of the worst decisions in modern Russian energy history – to limit access to hydrocarbon projects on the continental shelf to state-owned companies (of which there are two, Rosneft and Gazprom with its oil subsidiary Gazprom Neft). Ever since, LUKOIL has only concentrated on its already discovered blocks and brought two fields onstream, whilst the state-owned companies receiving preferential treatment focused on other projects instead, either in Eastern-Siberia or abroad. Thus, there has been little to no proper discovery in the Russian Caspian over the past 10 years. This has been exacerbated by US sanctions against Russia which prohibit foreign majors from participating in offshore projects in Russia. As a consequence, even LUKOIL is now looking to Kazakhstan to give its Caspian strategy a new boost, signing up with KMG to jointly develop the Zhenis block, relinquished by Total in 2012.

Despite squeezing more and more out of international investors, Kazakhstan is the only bright spot on the Caspian crude map, the one country whose production is destined to increase over the coming years. Kashagan is finally producing as it should, without any controversies, and several projects are currently in the pipeline. ENI has finalized its accession to two very promising blocks – Abay and Isatay – located a couple dozen kilometers to the south of the supergiant Kashagan. Oil in-place reserves for the Abay block, according to preliminary data, amounts to 5.7 BBbl, whilst Isatay is estimated to contain 1.8 BBbl. This is not to say ENI, which also heads the Kashagan project as its operator, will be inevitably successful with its drills – the Satpayev block adjacent to Abay, ONGC Videsh’s bet to get into Kazakhstan’s offshore, was abandoned after two exploration wells did not find any commercially exploitable hydrocarbon reserves.

Iran’s endeavors to tap into its Caspian Sea hydrocarbon reserves turned out to be as short-lived as they were ambitious. In December 2011, Iranian authorities declared that they have discovered a giant field, the first offshore discovery in Iran’s territorial waters, Sardar-e-Jangal (“Jungle Commander”, the nickname of an early 20th century freedom fighter), with proven reserves reportedly reaching as much as 50 TCf (since downgraded to 5 TCf by KEPCO, the upstream subsidiary of the national oil company NIOC and operator of the project). Not only did Iran lack the equipment to develop its Caspian riches – up to the present day it has only one FPSO there, Amir Kabir, it also lacked the technological expertise to do it efficiently. LUKOIL, the champion of the Russian part of the Caspian, expressed interest in developing Iran’s deepwater offshore (the least developed and surveyed part of the Caspian Sea) jointly, yet with the onset of US sanctions all the previous progress went down the drain.

It would be unwise to declare that oil production in the Caspian Sea has started its gradual decline for good. Yes, the five littoral states are producing less than they could have if conditions were better. Yes, Azerbaijan is focusing on natural gas developments and Russia has grown disinterested in the Caspian following inexpedient political maneuvering. And yes, politicians nowadays rarely mention the Caspian as a key conduit for hydrocarbons to Europe, that narrative has been supplanted by the arrival of US crude to the continent, leaving the Caspian agenda marginalized. Yet according to geologists’ estimates, the Caspian Sea still contains up to 20 billion barrels of oil and its revival will undoubtedly come – the question is when and under which circumstances would it happen.

The IEA’s Search For A New Narrative Of Doom

The International Energy Agency (IEA) released its Oil 2019 report March 11, providing forecasts to 2024. The IEA paints an extraordinary picture of transition for the oil industry, but it is not the ‘energy transition’ driven by climate change; the impacts on the oil market of policies designed to mitigate climate change appear relatively weak over the next five years. The seismic changes illustrated by the IEA are those wrought by the US shale industry.

The IEA’s former narrative on US shale was that once it had burst upon the scene it would eventually burn itself out in the mid-2020s. The sweet spots would be exhausted, marginal costs would rise as oil became harder to locate, and more oil would constantly have to be found to replace the level of decline from wells drilled during the expansionary phase, eventually making it impossible to sustain growth – essentially the classic path of a conventional oil basin.

To a large extent this story remains in place, but it is also clearly under constant re-evaluation, the problem being that the depth and longevity of US shale is not known and remains a function of price and productivity – which means the ultimate recoverable reserve should be treated as elastic rather than finite.

If a bell curve in the style of Marion King Hubbert were used to predict US shale oil production, 2018’s mammoth expansion would have moved the predicted peak higher and further back in time, resulting in a significantly larger area representing the total volume of recovery.

This is shown by the IEA’s forecast for total North American liquids production, which is expected to reach 26.9 million b/d in 2024, 800,000 b/d higher than that forecast for 2025 under the IEA’s New Policy Scenario in its 2018 World Energy Outlook published only last November. This sizeable revision underlines that it is still too early to treat US shale as a conventional oil basin.

A second major uncertainty, stemming from the IEA’s focus on oil in this report, is the linkage between oil and gas production, which complicates any assessment of shale’s marginal economics.

According to the IEA, by 2024, shale oil will be by far the largest component of US liquids production at just below 10 million b/d, but second to that will be the expansion of Natural Gas Liquids (NGLs), which will reach some 5.5 million b/d, much of which is the product of natural gas processing.

The huge expansion in US LNG capacity is another side of the same coin. The pipeline of major new projects has started to refill in earnest since the Autumn of 2018, with North America leading the way. Providing new avenues for shale gas monetisation supports the US shale oil sector in what is almost a classic case of industrial symbiosis, to which can be added ethane and gas use in the refining and petrochemicals sectors.

Investment narrative

If the IEA’s narrative on US shale is in a constant state of flux, so to perhaps should be its narrative on energy sector investment. Didn’t it repeatedly warn of an impending oil supply gap – the inevitable result of the sharp drop in oil and gas sector investment that followed the oil price crash in 2015?

Oil and gas markets do not appear to be suffering a lack of investment. This is partly because oil prices are proving relatively buoyant as supply is restricted by a range of non-market forces – the collapse of Venezuelan production, sanctions imposed by the US on Iran and Venezuela, the expansion of OPEC’s reach through its cooperation with Russia and the determination of Saudi Arabia to curb production.

In Oil 2019, the IEA does not just cite the US as a source of future oil supply growth, but Iraq, the UAE, Guyana, Brazil, Norway and perhaps most significantly for the longer term shale oil in Argentina. This is a much broader suite of growth sources, particularly non-OPEC, than has been the case over the last decade.

It implies a weakening of OPEC’s ability to manage the market through production controls, or alternatively that it will have to pay a much bigger price to do so. This will intensify the organisation’s internal strains as both Iraq and the UAE may be thwarted from reaping the full rewards of their expansions by having to bear more of the responsibility for market management.

The investment story for refining appears no different. The IEA outlines an expected expansion in refinery capacity double that of the expected increase in demand for oil products. This is a scenario in which there must be losers.

The refining sector is an oddity, suffering from endemic over-capacity as a result of the logic followed by both oil consuming and producing nations; both see every reason to capture the refining margin. For the producer this adds to its value chain, for the consumer it offsets the cost of its supply chain, particularly if it can also export oil products, a position China is moving resolutely towards.

Both can protect their investments; crude producers by providing a supply of cheap feedstock for their refineries; importers by restricting access to their product markets. This is why refinery expansions take place in regions where feedstock supply is growing on the one hand and in regions where oil product demand is increasing on the other.

The losers will be those without cheap feedstock and without domestic market growth – Europe, OECD Asia – while African refining is also likely to continue to struggle.

Refineries are also strategic assets and governments are loath to see capacity shrink to levels that endanger security of oil products supply. This tends to sustain refinery lives, resulting in either upgrades to become more competitive, as oppose to closure, or, as the IEA notes, an increase in ‘phantom’ refinery capacity – capacity which exists but cannot commercially be used.

As a result, for crude oil supply, LNG and refining, investment levels appear to leave the IEA searching for a new narrative of doom.

This it will certainly find. IEA warnings that energy sector investment is too low is the one constant the oil market can depend upon. A lack of investment eventually means higher prices and the IEA’s prime purpose as the representative of net energy importing countries is to keep energy prices low, so it will always find a way to issue these cautions.

But the argument is currently difficult to sustain. The answer will be to push forward in time to the mistier period beyond 2024, when the impacts of that other energy transition – the climate change one – might be much harder felt and the leftfield risks of oil sector myopia all the more profound.

Unpacking A Wild Week In Oil Markets

A plethora of factors contributed to crude moving up this week, with the EIA scaling back its US output estimate (cooling the bullish sentiment a bit), Saudi Aramco restating its firm commitment to keep the production curtailments as deep as the market conditions require, and most of all, the Venezuelan blackout blocked the exports capabilities of already sanctions-stricken PDVSA.

Tuesday’s trading environment was further buoyed by the American Petroleum Institute announcing a largely unexpected crude stock drop.

All in all, global benchmark Brent traded at around 67.3-67.5 USD per barrel on Wednesday afternoon, while WTI was drawing increasingly closer to 58 USD per barrel, having demonstrated an almost 2-percent growth on Wednesday. Should the current growth trend continue, both benchmarks would beat 4-month highs by the end of the week.

1. US Crude Inventories Bounce Back

- US commercial crude stocks rebounded robustly during the week ended March 01, increasing by 7.1 MMbbl to 452.9MMBbl.

- The inventory buildup was accompanied by a palpable decline in crude exports, by 0.6mbpd to 2.8mbpd, and an even more sizeable increase in crude imports to 7.0mbpd, up 1.1mbpd week-on-week.

- Refinery utilization seems to be edging higher for once, increasing 0.4 percent to 87.5 percent, with refinery input volumes higher by 0.1mbpd (at 16mbpd).

- Amid gasoline prices rising for the fifth consecutive week, gasoline stocks have decreased by 4.2MMbbl to 250.7MMbbl, edging closer to the statistical five-year range.

- Distillate inventories have dropped 2.4 MMbbl week-on-week to 136 MMbbl, marking a fourth consecutive, albeit relatively small, decline from January’s 143MMbbl peak.

- Early crude stock estimates for the week ending March 08 diverged with API predicting a 2.6 MMbbl drop, while the Platts analyst survey predicts a 3.3MMbbl build.

2. Iranian Discounts to Saudi Reach 20-Year Lows

- Iranian national oil company NIOC has hiked its April-loading official selling prices for Asia Pacific cargoes by 30 and 35 cents per barrels for Iranian Heavy and Iranian Light, respectively.

- This marks the largest gap between Iranian Light and Saudi rival grade Arab Light in 20 years, with Iranian Light now trading at a 0.45 USD per barrel discount even though traditionally it had been marketed at a premium to the Saudi crude.

- Similarly, Iranian Heavy is now at a 1.30 USD per barrel discount to Arab Medium, a 20-year low for the NIOC-marketed grade.

- Despite no commercial activity with NW-European counterparts since the onset of sanctions, NIOC cut NW Europe OSPs by a further 35 cents to -4.2 and -6.8 USD per barrel discounts, respectively for Iranian Light and Heavy.

- The Mediterranean witnessed the steepest cuts month-on-month with both grades’ OSP cut by 80 cents to -4.75 and -7.6 USD per barrel discounts for Iranian Light and Heavy.

- February saw a 4-month high in Iranian loadings at 1.47mbpd as late starters South Korea and Japan hurry to bring in as much crude as possible before the waivers run out.

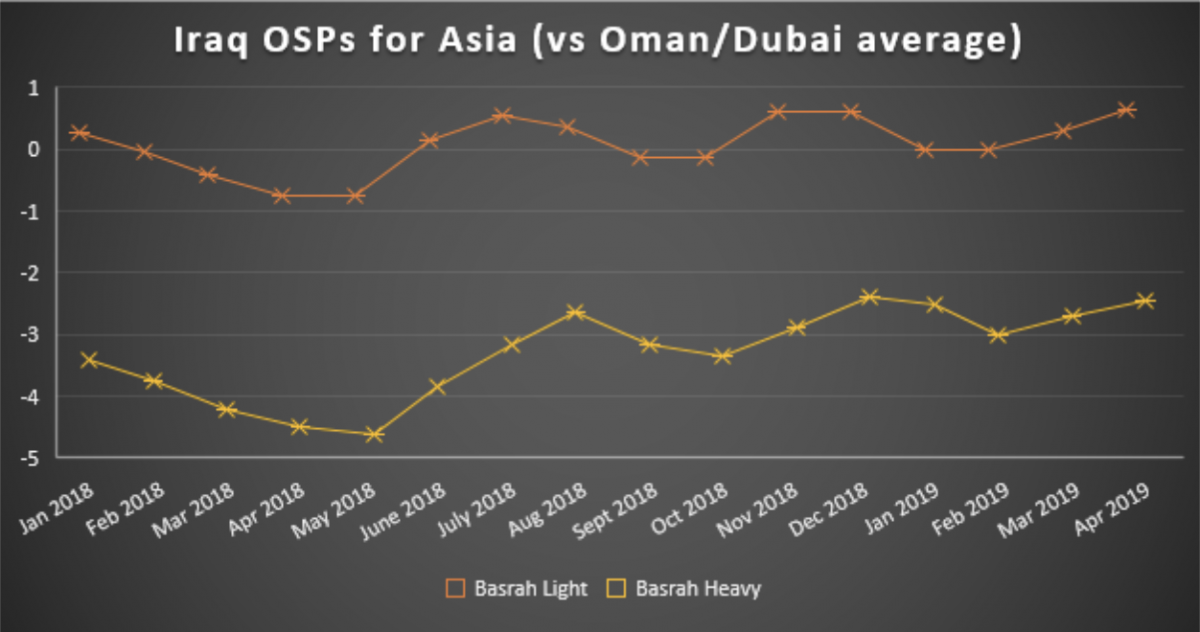

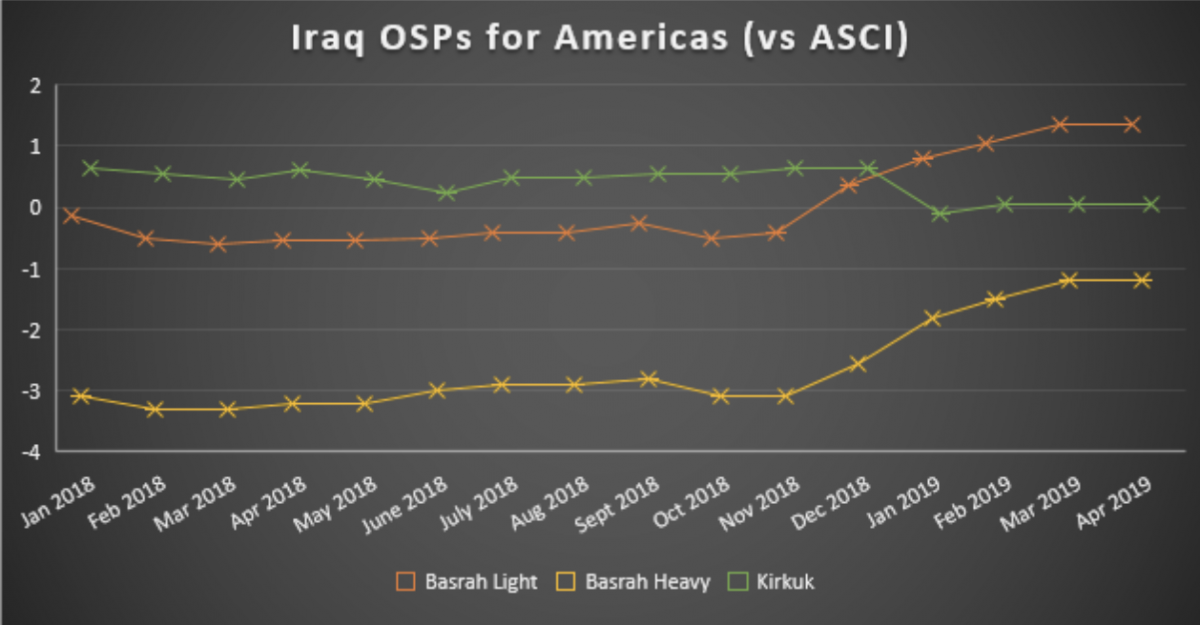

3. Iraq Hiking Asia OSPs for April

- Following in the footsteps of Saudi Aramco, Iraqi state oil marketer SOMO has cut all its April-loading official selling prices destined for Europe, while raising Asia-bound OSPs.

- Amid fears of backwardation on the Asian market growing, SOMO increased its Basrah Light and Basrah Heavy prices by 35 and 25 cents, respectively.

- European prices, however, were pressurized by the "normalization” (read: weakening) of Urals quotes in February-March, forcing SOMO to cut prices by 40-55 cents, with Basrah Light seeing the steepest cut of 55 cents to a 3.2 USD per barrel discount to Dated Brent.

- SOMO simply rolled over all its Americas-bound prices (in the case of Kirkuk for the third consecutive month already), even though Saudi Aramco dropped its Arab Extra Light OSP by 30 cents last week.

- Iraq’s February export levels dropped some 7 percent month-on-month to 3.86mbpd after Iraq finally moved closer to its OPEC/OPEC+ commitments and lowered aggregate output to 4.55mbpd.

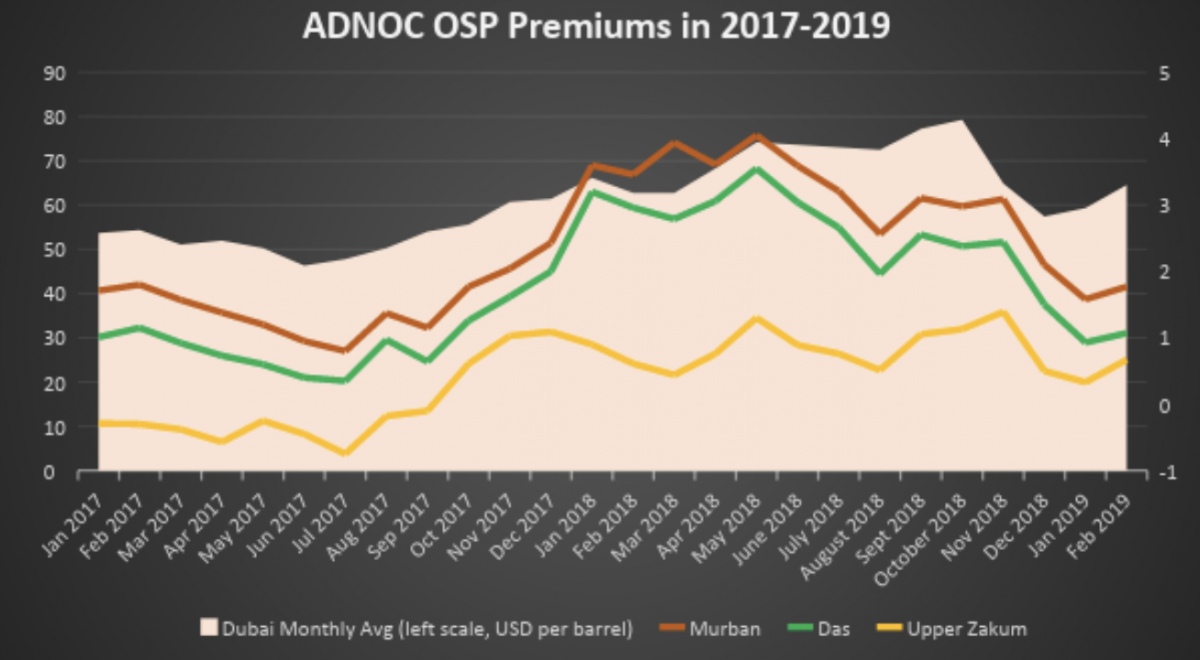

4. ADNOC Drops Light Grades in Retroactive February OSPs

- In line with the general trend of sour crudes rising in value and light ones depreciating slightly, main UAE producer ADNOC has cut the retroactive February official prices of its light sour grades, Murban, and Das.

- The Murban-Dubai premium was cut by 10 cents to 1.77 USD per barrel, while Das saw its February premium drop by 15 cents to 1.07 USD per barrel.

- Upper Zakum’s premium to Dubai was hiked by 5 cents to 0.67 USD per barrel, while most recent portfolio addition Umm Lulu saw its January OSP rolled over into February.

- So far there is little evidence to expect ADNOC grades bouncing back vis-a-vis the monthly Dubai average in March as refinery turnarounds and weak light distillate margins loom large for buyers.

- As of February 2019, the UAE was pumping 3.05mbpd of crude, some 20 000bpd below its OPEC/OPEC+ production cut pledge of 3.072mbpd.

5. US Production Growth Estimates Leave Analysts in Disarray

- The International Energy Agency (IEA) estimates the US will bring another 4mbpd production onstream in the next five years, leading global supply growth until 2024.

- The IEA expects the United States to overtake Russia and close in on Saudi Arabia as the second-largest crude exporter, with gross exports totaling 8.93mbpd in 2024.

- In the meantime, the US Energy Information Administration (EIA) cut its production outlook by 110kbpd for 2019 and by 170kbpd for 2020 due to lower expected output in the Gulf of Mexico and Niobrara.

- This would leave US production at 12.3mbpd this year, with a 0.7mbpd hike in 2020 to 13.03mbpd.

- The EIA sees Brent averaging 62.78 USD per barrel this year, staying at roughly the same level in 2020, with WTI prices hitting 56.13 USD per barrel in 2019 and then moving to 58 USD per barrel in 2020.

6. Shell Officially Moves Into Colombian Offshore

- Royal Dutch Shell and the Colombian government have signed two exploration and production deals covering the COL-3 and GUA OFF-3 blocks of Colombia’s deepwater offshore.

- Shell pledged to make initial investments of 100 million, potentially climbing even higher in case of drilling taps into substantial reserves of hydrocarbons.

- Colombia’s offshore sector witnessed two major discoveries – with Petrobras’ well Orca-1 (Tayrona block, estimated reserves of 425 BCf) and Anadarko’s Kronos (Fuerte Sur, estimated reserves of 325 BCf).

- Given the overwhelmingly gas-bearing character of the previous discoveries, Shell is betting on taking a gas position in the Caribbean as a profitable way forward.

- In the meantime, the Colombian government is preparing to offer 20 blocks, 18 onshore and 2 offshore, hoping to discover at least 1 billion barrels of oil (its reserves-to-consumption ratio is roughly six years).

- If the deepwater offshore (one of the last underdeveloped areas of the Latin American country) is anything to go by, ramping up gas reserves seems a much more plausible scenario for the future.

7. Nationwide Blackout Leaves Venezuelan Upstream in the Dark

- Not only Venezuela’s populace, but also its upstream and downstream segments have suffered greatly from the Latin American country’s prolonged blackout.

- Venezuela’s heavy crude upgraders, whose 450kbpd capacity guarantees the continuity of the nation’s exports, remained offstream as of Tuesday.

- Venezuelan authorities claim that the power outage at the Guri hydro energy complex was caused by a US malware attack.

- Venezuela’s main export outlet, the Jose terminal, was offstream for three days until March 11, it already saw action on Tuesday thanks to the restoration of the Barbacoa-Jose transmission line.