Wednesday, April 10th, 2019

Trump Is Key To Oil Prices This Spring

In our last note of 2018 we proclaimed Donald Trump to be Oil’s Man of the Year. The Donald had a massive impact on oil prices last year, driving them higher through September by talking tough on Iran then sending them crashing lower by granting ‘waivers’ to Iran’s key oil customers. The full story was slightly more complicated than that but there was no questioning the White House’s influence on prices.

The idea that Trump could arguably pose the largest risk to oil prices- both upside and downside risk- may very well revisit us in the coming weeks and we’d argue that oil traders should be paying closer attention than usual to politics in DC. The close attention is warranted due to two key items; the coming evaluation of ‘waivers’ from the US State Department regarding purchases of Iranian crude oil and the growing expectation that Trump and Xi will come to a trade agreement this spring. The Iranian item could have a massive short-term impact on fundamentals and the US/China trade deal will likely set the macro tone for the rest of 2019.

On the Iran front, its worth noting that there are two warring factions shaping White House policy with differing attitudes towards Iranian sanctions. On one side, Secretary of State Mike Pompeo has reportedly lobbied in favor of extending waivers to Iran’s key customers to keep oil prices under control. On the more hawkish side, National Security Advisor John Bolton is reportedly arguing for a termination of waivers and a more punitive stance on Iranian trade. Our view here is that Trump can have his cake and eat it too if he grants waivers because nobody will accuse him of being ‘weak’ towards Iran no matter which course he chooses. Simply put, Trump won’t lose any votes if he allows, Korea, China, India and others to keep buying Iran’s oil without suffering from US sanctions. On the other hand, Trump seems to be acutely aware that voters hate high gasoline prices and is taking to Twitter to ask OPEC to pump more. Our guess is the Saudi’s will continue to aggressively cut production as prices are still at least $10 below where the Kingdom needs to balance their budget. We can’t expected MBS to help Trump after he duped the Kingdom into flooding the market in 2018. Therefore, Trump will have to extend the waiver program in May to keep a lid on prices.

As for US/China relations, Trump remarked last week that the US and China are roughly four weeks away from reaching what he considers to be an ‘epic’ trade deal. The President acknowledged that sticking points remain regarding tariffs and intellectual property, but we’re noticing more and more cooperative language coming from both the US and Chinese sides of this deal. Markets also seem to be pricing in good news in the coming weeks as the S&P 500 and Shanghai Composite both reached YTD highs in recent sessions.

Both of these items could inject risk in either direction as their narratives mature and deals are either signed or not signed. Our feeling is to be slightly more worried about downside risk than upside at given current prices as we think that a waiver extension is likely and a strong US/China trade deal is already baked into risk asset prices. No matter what happens, we’ll need to keep a close eye on The Donald in order to properly manage oil price risk this spring.

Quick Hits

- Vladimir Putin was responsible for a slight dip in oil markets early this week. The Russian President commented that he was content with oil prices at current levels which generated concern that OPEC+ may not extend their current output cut deal. We still expect them to extend, but there is no doubt that differing budget needs complicate this issue. Russia can balance their budget with oil near $60. The Saudis need +$85 oil. Russian production was estimated near 11.3m bpd in March.

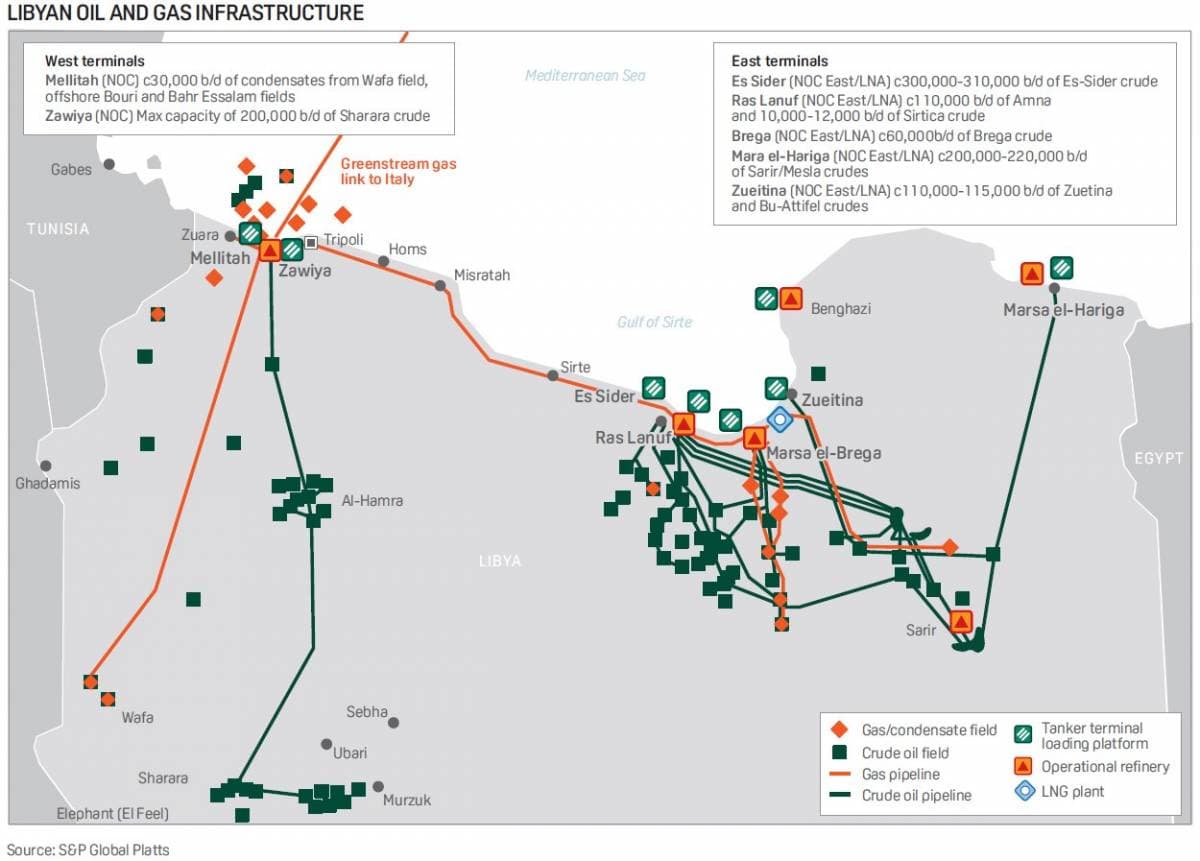

- On the more bullish side, conflict in Libya is jeopardizing the country’s recent production gains. Libyan output jumped from 900k bpd in February top 1.1m bpd in March- up from an average of 973k bpd in 2018. Brent spreads have continued to rally due to supply concerns.

- We’re nervous about the lack of crude oil and gasoline demand in the US- really nervous. US refiner demand is down by 175k bpd YTD in 2019 and US gasoline demand + exports is lower by 95k bpd. These are disturbing trends opposite decent economic growth in the world’s largest hydrocarbon consuming economy. Yes, we know that the emerging markets drive oil market demand growth, but we still think this trend deserves attention when price action suggests such a rosy oil market outlook. Let’s all agree to keep a close eye on this trend as it could break the hearts of oil bulls this summer.

- We remain flummoxed by the political situation in the UK. This week Britain’s political leaders considered a deal to postpone their Brexit vote by one year. Meanwhile the EU was reportedly considering a proposition to boot the UK from the organization in early June. Theresa May is still PM as far as we can tell. The GBP gave a significant chunk of its recent gains away against the EUR this week.

- The Trump White House further darkened the global trade outlook this week by threatening tariffs on the EU.

- The IMF revised their 2019 global GDP growth forecast from 3.5% to 3.3% this week. Equities and other risk assets softened on the news.

- The EIA made an upward revision to their 2019 US crude production forecast to 12.4m bpd (currently running 12.2m bpd.) They see US crude production at 13.1m bpd in 2020.

- Bloomberg forecasts new environmental rules related to shipping fuels will increase oil demand by 700k bpd in 2020. The International Maritime Organization’s new low-sulfur fuel requirement is set to kick in on January 1st. Fund manager Pierre Andurand believes oil markets are woefully underprepared for the transition.

DOE Wrap Up

- US crude inventories registered a surprise build last week climbing 7.2m bbls to 449.5m. Overall stocks are higher y/y by 4% over the last four weeks.

- An uptick in crude production was partly responsible for the build. US producers pumped 12.2m bpd last week for a new all-time high. The US has produced an average of 12.0mn bpd so far in 2019 after averaging 10.8m bpd in 2018.

- Crude stocks in the Cushing, OK delivery hub moved higher by about 175k bbls w/w to 47.1m bbls.

- Unfortunately, the previously bleak demand data took an ever-bleaker turn. US refiners processed 15.85m bpd last week moving their average to 16.0m bpd over the last four weeks- lower y/y by about 700k bpd. This is a somewhat shockingly bad number and should have oil bulls concerned. The US has consumed 16.3m bpd so far in 2019 which is lower y/y YTD by 175k bpd.

- Margins are reasonably strong as the WTI 321 crack traded near $20/bbl this week. The prompt gasoline crack moved slightly higher to $20/bbl while heating cracks were just under $23/bbl. In Europe the gasoil/brent crack is yielding $14/bbl.

- Traders imported 6.8m bpd of crude last week representing a small increase. Imports have averaged 7.0m bpd so far in 2019. The US exported 2.7m bpd last week which was in line with its 2019 average.

- The US currently has 28.1 days of crude oil supply on hand.

- US motor gasoline stocks fell by 1.8m bbls last week to 237m and are lower y/y by about 0.5% over the last month.

- US gasoline demand + exports printed 9.75m bpd last week and is lower y/y by a whopping 300k bpd (3%) over the last month. US demand + exports have averaged 9.775m bpd in 2019 which is lower y/y by 95k bpd.

- Distillate fuel stocks fell 2m bbls w/w to 128m and are higher y/y/ by about 0.5% over the last four weeks.

Global Intelligence Report - 10th April 2019

Geopolitical Notebook

Sources

- Senior executive with Hellenic Petroleum

- Two high-level officials in the Greek government

- European diplomat on the ground in Libya

- Political analyst in Libya

The Algerian Oil Fallout

Algerian oil and gas deals are suffering in the aftermath of the resignation of President Abdelaziz Bouteflika, forced out by massive protests that ended up earning the backing of the military. Not only did Exxon put its Algerian shale ambitions on hold a couple of weeks ago, but other deals have now flopped. A joint venture trading unit with Algeria’s state-run Sonatrach was put on hold this week just as it was getting to the part where it would choose a partner (Vitol, Gunvor, Total and Eni). But the Algerian chaos is touching deals beyond its borders, too, with Greece citing the geopolitical atmosphere as the reason it withdrew plans to sell a majority stake in its largest refiner, Hellenic Petroleum SA (again, Vitol and Algeria’s Sonatrach were on the consortia bidding short-list).

Our sources in the executive of Hellenic, though, were less inclined to mince words: The Greeks were keen to have Sonatrach and Vitol as the winning bidders, but the political crisis in Algeria explicitly made that impossible. What the media aren’t saying outright is that the Algerians failed to bid on Hellenic in the end. A Greek government official who is close to the Liatsis family (one of the shareholders in Hellenic Petroleum) told us that the crisis prevented the Sonatrach consortium from making an offer though both sides in this deal were keen to see this happen. “Unfortunately,” the source said, “we can’t wait around in hopes that the situation improves and the new leadership is in place”.

The same source indicated that Hellenic had advance knowledge that Bouteflika would resign after speaking with the Algerian government prior to the climax of the protests. However, at that time, both the Greeks and Algerians were hoping for a smoother transition to a new leadership, which is clearly not going to happen now. The military’s decision to distance itself from Bouteflika was simply a strategic move to safeguard its position following the president’s departure from office, as the Army is part of the “system” here. As such, Bouteflika’s resignation does not mean an end to the “system”. The protesters are well aware of this and are not letting up on their pressure in the meantime.

The result is the scrapping of the sale of a majority stake in Hellenic, and Vitol is being dragged through the crisis right along with Sonatrach. Now, our sources in the Greek government say that the sale of the majority share in Hellenic won’t happen at all - for any bidders. It has been taken off the table entirely. Instead, Hellenic has already started the process of implementing the strategic plan that was approved at the end of last year by its shareholders and the government. So, investors should be keeping an eye open for Hellenic acquisitions, because the strategic plan focuses on the expansion of the company through a series of acquisitions.

Early Wednesday, Algeria’s army boss said that the judiciary would reopen corruption cases against Sonatrach (among others), rendering the state-run oil giant a hands-off entity for partners and new deals right now more than ever.

The Great Libya Ruse

The next Gaddafi looks set to be General Haftar, and the cries of external actors against his move on the capital are not genuine. Indeed, the UAE and Russia - for the most part - have funded the LNA’s advance on Tripoli, and a collection of Western nations are quietly hoping he’ll take it over while they let their failed experiment with the Government of National Accord (GNA) die, abandoned. Haftar would have never made it this far without the massive cache of weapons he’s been given, most notably from the UAE. This is confirmed by a European diplomatic source who has direct knowledge of these weapons distributions. The source describes UAE’s arms supply to Haftar as including “substantive military equipment” with the explicit intent of giving the LNA enough firepower to move against the GNA. Second in the supply chain has been Russia, which our sources say have provided Haftar with access to military technology and extensive military equipment to support the offensive in Tripoli. There are also rumours that Russia might have offered troops to Haftar’s LNA but the source could not confirm this.

A political analyst with knowledge of Libya’s politics also highlighted that while the European Union and the UN are seeking a truce between the two opposing forces in order to avoid another conflict in the country, certain states continue to engage with Haftar behind the scenes to ensure that he takes control of the political scene in Libya (and, hence, the oil).

The markets are responding to this, with Haftar’s move on Tripoli (which we have consistently warned about in recent briefings) helping to prop up rising oil prices (along with other geopolitical and output developments). What speculators are hedging on here is an extensive period of violence that will again take Libyan oil offline. We, however, view it somewhat differently: Haftar took the oilfields first, and the ports. All that was left was Tripoli, and his move on Tripoli was made possible by a massive arms buildup that will make it very difficult for fractured militia forces to take him on directly. It is our view that the oil will flow more smoothly if Haftar takes the last piece of this puzzle: Tripoli. Militia will, of course, specifically target oil installations if Tripoli falls to the LNA, because striking out at the oilfields and ports is the only way to cause any damage to political forces in Libya. But while they may have the power to disrupt and temporarily interrupt production and exports; at this point, we do not believe they have the power to take Haftar down. This is now a game of major external forces backing a very powerful general against a weak GNA and weak militias who change loyalties and alliances on a dime, quite literally. Haftar knows this and will buy out most of them. But this is also Haftar’s one weakness: He’s bought out many groups and he has to keep buying them out and the east of Libya is out of cash--he needs Tripoli right now rather urgently.

If Haftar fails to take Tripoli quickly, it will give momentum to a civil war, and then we’ll see another boost in oil prices.

Haftar launched his move on Tripoli on Sunday, in “Operation Volcano of Anger”, and followed that with an airstrike on the airport. As of late last night, there were armed clashes in three areas around the capital city, and airstrikes from both sides in two different locations. Thousands have already fled, and those numbers are expected to increase throughout the day. As of late Tuesday, the airport had been reopened, with Haftar getting resistance from militia groups. Tripoli and surrounding cities are desperately trying to mobilize various militias to halt Haftar’s advance, and while they have succeeded in regaining control of the airport, it will be difficult to maintain the momentum against the general.

Global Oil & Gas Playbook

Markets: Battling the LNG Glut

For 2019, Chinese natural gas demand is expected to grow by 14 percent - an estimate that comes from an industry executive cited by Reuters, rather than unreliable Chinese government data.

If true, this is great news for the LNG industry, which is suffering from an Asian glut that has seen a 60-percent drop in spot prices over the past six months. This year, China’s demand for natural gas is expected to increase by 30-40 billion cubic meters, adding to the 280 billion cubic meters it consumed last year. But if you look at the numbers overall, that spike is demand is still lower than the spike we saw in 2018, when Chinese natural gas demand surged 18 percent.

At the same time, and working against this, Russia is eyeing a tenfold+ increase in its own LNG output, targeting 140 million tons annually by 2035. The Russian government says annual production will increase to 73 million tons by 2025. In 2018, Russia shipped 12.86 million tons of LNG.

Global Oil & Gas Playbook

- Six months ago, Abu Dhabi’s sovereign wealth fund, Mubadala Investment Co., withdrew its plans to IPO Spanish oil refiner Cepsa, which is valued at around $12 billion. Now, Carlyle Group LP is planning to buy a $4.8-billion stake in the refiner, acquiring up to 40 percent, with Mubadala remaining the majority shareholder. The transaction is slated for completion by the end of this year. (It’s worth noting, though, that Cepsa also producers oil in Algeria, so this deal is worth keeping an eye on for potential disruption).

- Australian gas producer Woodside has unveiled a 10-year agreement to supply LNG to China’s ENN Group. The deal will see Woodside provide 1 million tons of LNG per annum beginning in 2025. ENN launched its first LNG import facility in China in October.

- Italian oilfield services provider Saipem is said to be in talks about divesting its onshore and offshore drilling businesses, which represent about 10% of its annual sales.

- In its biggest asset sale yet, Brazil’s Petrobras has agreed to sell its 90% stake in a Brazilian natural gas pipeline company Transportadora Associada de Gas (Tag) to France’s Engie and Canadian pension fund Caisse for $8.6 billion. Tag operates a 2,800-mile pipeline network that spans 10 states in northern Brazil. Petrobras is looking to divest some $27 billion in assets in total.

- Russia’s state-run gas giant, Gazprom, has completed a Blockchain pilot project that will be used for recording gas supply contracts. The project was completed in cooperation with Russian state-owned Gazprombank.

- China's Sinopec Corp and Shell will jointly study a shale oil block in east China's Shengli oilfield, which comes as China begins to dabble in early-stage shale development. Right now, shale accounts for only a meager 1% of the country’s total crude oil output.

- The bond sale of Saudi state-owned oil giant Aramco attracted a record amount of attention Tuesday, with demand hitting $100 billion, promising to net Saudi coffers up to $12 billion. We suspect this will give MBS the justification he needs to drop the Aramco IPO plans, which none of his sane advisors wanted but were forced to push ahead with.

On the regulatory front ...

- Norway’s Labor Party has withdrawn its support for oil exploration in the Arctic offshore the Lofoten islands in a move that has the oil industry up in arms. As Norway’s resources deplete, it was the prospect of the Lofoten islands that were considered the country’s path to maintaining production levels. The islands are estimated to hold up to 3 billion barrels. While the oil industry, including Equinor (formerly Statoil) said the Labor Party’s withdrawal of support was entirely unexpected, the climate change momentum here had already laid the groundwork for such a decision.

- Disagreements over environmental policy have led Shell to pull out of a D.C.-based oil lobbying group as the oil giant tries to appease activist investors and rebrand itself as a climate change benefactor. Shell, according to the company, supports acting on climate change and pricing carbon emissions, and the lobbying group’s agenda goes against that. The lobbying group in question is the American Fuel & Petrochemical Manufacturers group, and Shell’s stated intention is to leave the group in 2020. Is Shell’s rebranding working? To some extent, perhaps. Earlier this week, an activist shareholder who had been filing climate change resolutions for the past three years backed down, saying he would withdraw the filing for this year, indicating that Shell’s recent moves demonstrate its commitment to acting on climate change.

Countdown To A United Libya

Field Marshal Khalifa Haftar certainly knows the magic of appropriate timing. In a way, everything was pointing to his eventual charge on Tripoli – the internal escalation of discontent within Libya’s populace, who get all the disadvantages of living in a duality of power without any advantages arising therefrom, the marginalization of the Libyan agenda globally, the travails of Libya’s oilmen. Yet Haftar managed to orchestrate his strike at the least expected moment, taking avail of the Algerian uprising, the global market’s anticipation to see Libyan oil production back on track, launching an offensive when the UN Secretary General Antonio Guterres was in fact in Tripoli, the city he designated as the key target of his military operation.

Monday alone WTI futures rose by 1.3 USD per barrel, sending oil prices to their highest in five months. Tuesday witnessed tensions calming a little bit, as we all struggle to see clearly what exactly is going on around Tripoli. There are certainly limits to the ongoing hype - if one is to look at the grand picture of Libya’s oil geography, the Haftar attack ramifications need not be significant for the Libyan oil industry. They might be very significant for the Libyan political scene, without any doubt – people are dying as we speak, at least 35 people have died in the first four days of fighting. Yet there remains a lingering feeling that when it comes to settling oil issues, the Libyan NOC can cooperate (as it has already done before) with Haftar should there be a necessity to do so.

1. Most of Libya’s oil is already Haftar’s control

Just as the El Sharara field swung back to (almost) full operation, pumping out 280kbpd out of its 315kbpd production plateau, Haftar initiated his advance on Tripoli. Seemingly, this should wreak havoc in Libya’s oil and gas operations – international oil majors do not evacuate staff (ENI already did so in Tripoli) for no reason at all. Yet much of it might be pure precaution as by April 08, all of Libya’s ports were open and operating, except for those that were out of operation for years already – namely the Sirte and Derna terminals that suffered greatly from Libya’s internal battle against the Islamic State’s recruits. Even the port of Tripoli, which is not used as a crude export terminal, has been open despite ongoing fights for the Tripoli airport.

Moreover, if you ask any oil company with Libyan exposure, especially those that have cargoes loading there as we speak, so far none registered any drawbacks or fighting-related delays. Since Haftar’s siege started, 13 vessels have finished loading or are currently in transit thereof – including the New York-bound MT Stream Atlantic and the China-bound MT Silverway, sailing from Marsa El Hariga and Brega (however these ports were already controlled by Haftar’s LNA). The Mellitah terminal, just a couple miles off Zawiya, has loaded MT Energy Triumph, carrying more than 1 million barrels of Mellitah crude, as recently as yesterday.

Obviously, western Libya should not experience any disturbances as it is controlled either by the LNA or entities affiliated to it. The oil production hub in the southeastern part of Libya, namely the trouble El Sharara and El Feel (Elephant) fields, were seized by the LNA early February on the pretext of battling smugglers and roaming jihadi fighters and turned over to the Libyan NOC a couple of weeks later. Thus, Field Marshal Haftar already controls (in a military sense, the operations are done by the NOC) almost all of Libya’s output. It is very unlikely to imagine any maritime action launched against Libya’s offshore production – Al Jurf or Bouri – so out of Libya’s oil infrastructure it is only the Zawiya and Melittah ports that might be under pressure.

2. Haftar is unlikely to attack the Zawiya terminal

Further to the above, with El Sharara being already under the Field Marshal’s control, there is little incentive for him to attack Zawiya, the export point for El Sharara crude some 45km to the west of the Libyan capital. It makes no sense strategically – he can use the genuine disgruntlement of Sharara oilmen that did not see a promised salary increase for several years already to his own political benefit, promising them change as soon as takes over the whole of the country, and it makes no sense tactically as by blocking the Sharara crude stream he would undermine his own carefully nurtured pro-business credentials (to the extent possible from a man whose military career spans more than 4 decades).

It is an open question to what extend did leading regional powers know about Haftar’s plans – he visited the Saudi King Salman as recently as March, is a frequent visitor to Moscow and is alleged to maintain a communication line with the American CIA after the many years spent in his US exile, in the vicinity of the CIA headquarters in Virginia. Almost all great powers are caught in a moral dilemma when they have to balance between their natural inclination to accept Haftar as Libya’s new leader and the ruthless methods he has chosen to attain this powerful status. But the ongoing fights for Tripoli relate to Libya’s oil only marginally, they are most likely carried out as a pre-election PR campaign.

3. What is Haftar Seeking Then?

It is no coincidence than Field Marshal Haftar’s attack takes place amid top-ranking UN officials being in Libya, against the background of an upcoming national conference, scheduled to take place April 14-16 in Ghadames, the purpose of which was to facilitate a reconciliation of the two rival governments. The fact that the LNA could quite easily reach the outskirts of Tripoli backs his strongman claim, especially if the long-mooted national elections are to take place at some point in the future. The international community led by the United Nations will not let Field Marshal Haftar go the whole distance, yet that would only buttress his domestic appeal as the nation’s prime dealmaker.

Mustafa Sanallah, the head of the Libyan NOC has already stated his neutrality in the ongoing confrontation, stressing that production continuity, whoever is at the helm of the executive power, for him is tantamount. That suits Field Marshal Haftar who heretofore had had little to no appeal on the streets of Tripoli and stands to benefit from pressurizing the Government of National Accord, but bodes well for Fayez al-Sarraj, the head of the Tripoli-based GNA. As long as the fights are revolving around Tripoli, do not expect any significant adverse oil-related impacts, the only scenario in which Libyan exports might be greatly jeopardized would take place if the Libyan hinterland explodes.

Is Carbon Capture And Storage Unavoidable?

Carbon Capture and Storage (CCS) has so far been more notable for its failures than its successes. In North America, only two commercial-scale post-combustion projects have been completed, both retrofitted to existing coal-fired power plants, Boundary Dam in Canada and the Petra Nova plant in Texas.

The more innovative pre-combustion Kemper County Energy Facility in Mississippi saw its capture component mothballed in 2017. All have served mainly to prove that CCS is very expensive based on current technologies, not least because of the efficiency penalty it imposes on a power plant’s operation.

In Europe, despite an original desire to get 12 CCS projects up and running by 2020, only six were awarded funding by the EU and not one made it to completion. The last one, ROAD CCS in the Netherlands, was suspended in 2017. The reasons for failure largely revolved around inadequate and inflexible public funding, the long-term risks placed on operators by the EU’s CCS Directive and antipathy towards CCS being used as an enabling technology for coal-fired generation.

In this, the US and EU appear to have parted directions at least at government level.

In the US, last year’s Bipartisan Budget Act revised the 45Q tax credits available for CCS. These will rise gradually from $10 to $35/ton for CCS with Enhanced Oil Recovery and from $20 to $50/ton for dedicated geological storage by 2024. The credit lasts for 12 years from project operation and applies to an unlimited amount of CO2. Although this still falls perhaps $20-$30/ton short of the total cost of CCS, it provides significant support targeted primarily at coal-fired generation, and thus the longevity of the US coal industry, and at oil recovery.

However, the US is also engaging in some innovative-CCS related investments, which are at demonstration stage; advanced carbonate fuel cells, supported by ExxonMobil, and Net Power’s ‘Allam Cycle’ project at La Porte, Texas, both of which potentially offer a step-change reduction in CCS costs. Both are envisioned as gas decarbonisation technologies, indicating the gap in thinking between industry and the Trump administration’s more coal-orientated policy goals.

In Europe, while R&D funding for CCS technologies continues, large-scale projects are now reduced to waiting for a revamp of EU funding post-2020, which will be supported by sales of carbon allowances into the EU Emissions Trading Scheme (ETS). The ETS too is in the process of a reform, one which has seen a substantial revival in carbon prices from around €5/mt ($5.6/mt) to above €20/mt, although whether and how far this upward trajectory will be sustained remains a major uncertainty.

The European approach has also changed following the experience of previous project failures. New projects are focussed on gas-fired generation and industrial emissions, CO2 utilisation technologies and the creation of CCUS hubs with shared transportation and storage infrastructure, the former now comprising CO2 shipping as well as pipelines. CO2 utilisation represents a group of largely pre-commercial technologies, which are part of the EU’s broader circular economy ambitions.

In particular, the CCS sector is pushing hard for a public component to the ownership of this shared infrastructure, the aim being to change the risk-sharing structure of CCS ventures. Essentially, the aim is to split off the longer-term obligations and risks imposed by the EU CCS Directive to some form of public-private style utility, most likely with regulated returns. Industry argues that the creation of open-access CCS infrastructure is akin to the early establishment of an electricity grid and therefore requires public subsidy.

The likelihood is that three north European CCS clusters will emerge in the period 2020-2030, the most promising projects being the Norwegian CCS cluster, the UK’s Acorn Sapling CCS project and the Rotterdam Nucleus project. The first has funding, Acorn Sapling has been designated an EU Project of Common Interest, which makes funding more likely, while the Dutch government has set out clear goals for CCS, despite the suspension of Road CCS.

Least-cost approach

The EU cannot avoid financing at least an exploratory phase for CCS projects because of the ambition of its climate change goals and its desire to avoid carbon leakage. It is aiming for an 80-95% reduction in greenhouse gases by 2050 from 1990 levels and is determined to avoid the relocation of industry to outside the EU to avoid the costs of emissions regulations.

But there are cost caveats. Both the EU and national governments say CCS projects between 2020-2030 need to demonstrate cost effectiveness if they are to be an option for large-scale deployment post-2030. The message is that CCS is an option, but not one that will be pursued at any cost.

There is also competition, which finds articulation in political opposition to CCS policies. The falling cost of renewable energy sources suggests carbon emissions can be avoided in the first place. Proponents argue that funding CCS crowds out resources for these better options. While wind and solar have become cost competitive without subsidy, CCS continues to look like a potentially bottomless sink for public funds with uncertain outcomes.

Yet also evident is that 2030 emissions reductions targets cannot be achieved without substantial coal-to-gas switching, while the expansion of renewables – despite their generally forecast-beating performance to date – is unlikely to be so great as to meet both electricity generation requirements and provide the excess power required for heat and transport decarbonisation via hydrogen production or transport electrification.

This suggest growing, long-term dependence on natural gas, which can only be sustained in environmental terms with CCS. This is a scenario that sits well with the oil and gas companies involved in both CCS research and development of global gas and LNG portfolios.

Bullish Sentiment Takes Control Of Oil Markets

One would think the main trend of 2019 would be OPEC, Russia and the United States trying to come to grips with the risks of a massive supply glut, yet an unforeseen turn of events in Libya just goes to show how easy it is to bring supply crunch concerns back again. As we have argued in previous reports, the shock value of the Libyan crisis might actually be greater than the risks. Despite this, intensifying uncertainty over the renewal of US Iran sanction waivers and fears of a global economic slowdown, as stressed by the IMF cutting its global 2019 growth forecast by 0.2 percent to 3.3 percent, have driven oil prices up.

As of Wednesday afternoon, the global benchmark Brent traded within the 70.5-71 USD per barrel, having surpassed the $70 threshold for the first time since November 2018, whilst US benchmark WTI rose to 64-64.5 USD per barrel.

1. Saudi Aramco Pulls Off One of the Most Drastic European OSP Hikes in Recent History

- Saudi Arabia’s national oil company Saudi Aramco has brought European May-loading official selling prices to their highest level in more than 5 years, all the while making only modest changes to Asian and US prices.

- By raising the price of Asia Pacific-bound May-loading cargoes by 20-30 cents per barrel (Arab Super Light and Extra Light saw the firmest hikes of 30 and 25 cents), Aramco’s prices reached a five-month high.

- Arab Medium, lifted by 20 cents per barrel month-on-month to a 1.05 USD per barrel premium to the Oman/Dubai average, reached its highest OSP level since January 2014.

- Saudi Aramco increased Mediterranean-destined May OSPs by 1-1.2 USD per barrel, whilst hiking Northwest Europe-bound prices by 0.9-1.5 USD per barrel, one of the most radical moves in recent pricing history.

- An Arab Extra Light cargo moving to NW Europe in May would see its OSP rise by 1.50 USD per barrel month-on-month, moving to a premium vs ICE Bwave for the first time since Oct 2018.

- Official selling prices for US-bound cargoes in May will see a 10-20 cent per barrel increase month-on-month, ending Aramco’s previous roll-over strategy.

2. SOMO OSP Hike Resulting in Iraq Hitting 7-Year Highs

- Following the example of Saudi Aramco and acting on the rising desparation of refiners worldwide to lay their hands on heavy and medium sour crudes, Iraqi state oil marketer hiked all its May-loading prices.

- European customers will witness the most spectacular OSP m-o-m increase, in fact so high that SOMO set its May prices the highest in 7 years.

- Kirkuk saw the highest raise from 2.5 USD per barrel to a 1.4 USD per barrel discount to Brent Dated, whilst Basrah Light and Heavy were lifted by 0.9 and 1 USD per barrel respectively.

- Even though Asia Pacific prices were increased by a seemingly modest 25 and 35 cents per barrel for Basrah Heavy and Basrah Light, the resulting OSPs nevertheless hit a 7-year high for Light and an all-time high for Heavy.

- For May-loading cargoes heading to United States, the OSP increase is the least substantial, at 20 and 25 cents per barrel for Basrah Light and Heavy, with Kirkuk lifted 30 cents to a 0.35 premium against ASCI.

3. China Rediscovers its Appetite for ESPO

- As the Brent-Dubai spread has widened to -1.40/-1.50 last week, Chinese crude refiners have reinvigorated their interest in Russia’s Far East benchmark, ESPO.

- ESPO (short for Eastern Siberia-Pacific Ocean) is a medium sweet crude, with an API density of 35° API and Sulphur content of 0.5-0.6 percent.

- China has traditionally been the one key market to which ESPO is supplied, taking in roughly 78-79 percent of ESPO over the past 3 years (followed by Japan with 8 percent of the total).

- Yet as price economics favored arbitrage crudes from Brent-linked markets, significant volumes of ESPO went to Singapore, Malaysia, Thailand, Japan and even the United States.

- March loadings of ESPO were some 1.5MMbbls higher than those of February, with a further increase expected over the coming months.

- As a consequence, ESPO premiums against Middle Eastern benchmark Dubai have also moved out of the slump, rising to 2.8 USD per barrel for May-loading cargoes.

4. Argentina Starts Exporting Vaca Muerta Shale

- Argentina’s state oil company YPF has exported its first Vaca Muerta cargo amid a palpable ramp-up in production in the shale-prolific Neuquén Basin.

- YPF did not specify which vessel carried the cargo in question – most probably it was MT Seaways Luzon that discharged 0.5MMbbls on the Bahamas in early March.

- Argentina’s Energy Ministry expects Vaca Muerta to help double the nation’s crude output from the current 0.5mbpd by 2023, freeing up all the surplus volumes for exports.

- As of February 2019, Vaca Muerta production reached 78kbpd and is expected to triple in volumes by the end of 2021.

- Vaca Muerta’s main export grade would most probably be Medanito, a remnant of Neuquén’s once flourishing past – in the past, however, it used to be 35° API and 0.45-0.5 percent Sulphur.

- The rising shale oil of Vaca Muerta should bring about an overall amelioration in Medanito quality as most of the basin’s production is around 40-45° API.

5. New Round of US Sanctions Targets Venezuela’s Cuban Ties

- The Trump Administration levied a new round of sanctions against PDVSA-affiliated ship and freight companies that transported Venezuelan crude to Cuba.

- The sanctions specifically target the Liberian-flagged vessel Despina Andriana that is generally used for PDVSA exports to Cuba, as well as rather marginal Liberian and Greek shippers.

- PDVSA’s crude exports to Cuba averaged 27kbpd in 2018, yet have dwindled ever since the United States sanctioned the Venezuelan national oil company.

- The Cuban oil company Cupet will most probably replace Venezuelan barrels with Algerian ones, having already had several negotiation rounds to shape a 3-year term contracts that would cover both crude and product supplies.

- Interestingly, the other shuttle tanker between the Venezuelan José terminal and the Cuban port Matanzas, the S-Trotter vessel was not sanctioned, creating some space for further shipments, albeit in much smaller volumes.

6. Equatorial Guinea Licensing Round Has Majors Vying for the Most Promising Block

- The Oil Ministry of Equatorial Guinea has offered 26 blocks in its latest licensing round, with two of them – blocks R and Z (EG-27 and EG-23) surfacing as hottest contenders.

- Blocks R and Z are the only ones with proven oil reserves, moreover, their proximity to Nigeria’s Niger Delta shelf zone makes future oil discoveries very probable.

- Up to late 2018, Block R was developed by Ophir Energy as a prime feed source for Fortuna LNG, yet the UK-based firm was stripped of its license amid financing difficulties.

- Now Russian major Rosneft is emerging as a favorite to sweep up Block R, amid reported interest from the Italian ENI and Petronas, attracted by the prospect of 3.7TCf gas resources.

- If allotted to a new operator, Fortuna LNG (or whatever its future label) should be able to produce 2-2.5mtpa of LNG per year.

- ExxonMobil might be tempted to bid for Block Z (EG-23), comprising the untapped Estaurolita gas discovery and Tsavarita oil find, as it adjoins its Zafiro field.

7. Hellenic Petroleum Privatization Failure

- Neither of the shortlisted consortiums – Vitol-Sonatrach and Glencore-Carlyle – put forward binding offers in Greece’s prolonged struggle to its prime refiner, Hellenic Petroleum, privatized.

- The privatization of a 50.1 percent stake, estimated to raise around 1.5 billion, was a key element in the Troika-dictated bailout package that was forced upon the Greek government.

- Sonatrach might have opted for a cautious path following the nationwide protests in Algeria that already upended its talks with ExxonMobil, whilst Glencore’s partner Carlyle revealed its hand on Monday.

- The US private equity firm Carlyle agreed to buy 30-40 percent of Spanish refiner CEPSA from Mubadala, the Abu Dhabi state investment fund which owns 100 percent of the company.

- With the Greek economy showing signs of recovery, there is a high probability that the Troika will not attempt to revive the derailed Hellenic Petroleum privatization in the future.