Breakthrough Paper-Based Battery Design Draws Inspiration from Plants

Researchers at Tohoku University have…

Europe Moves Forward with Major Hydrogen Projects

Large-scale hydrogen production schemes are…

Oil Prices Continue To Shed Gains On Small Inventory Build

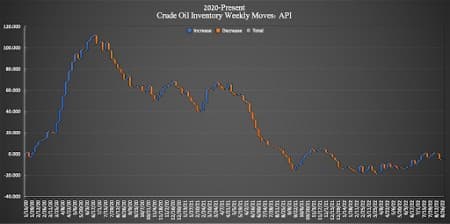

The American Petroleum Institute (API) reported a slight build this week for crude oil of 593,000 barrels, while analysts predicted a draw of 633,000 barrels.

The build comes as the Department of Energy released a massive 8.1 million barrels from the Strategic Petroleum Reserves in the week ending August 26, leaving the SPR with just 450 million barrels.

In the week prior, the API reported a draw in crude oil inventories of 5.632 million barrels after analysts had predicted a draw of 448,000 barrels.

WTI was trading down on Tuesday on inflation concerns and fears of a slowdown in economic growth. WTI was trading down 5.08% on the day at 4:50 p.m. ET at $92.08 per barrel—more than $7 per barrel up on the week. Brent crude was trading down 5.19% on the day at $99.64 after rallying significantly the week prior over Saudi comments that OPEC+ could cut output, citing a “disconnect” between prices and fundamentals.

U.S. crude oil production data for the week ending August 19 fell again by 100,000 bpd to 12.0 million bpd, according to the latest weekly EIA data.

The API reported a draw in gasoline inventories this week of 3.414 million barrels for the week ending Aug 26, compared to the previous week's 268,000-barrel build.

Distillate stocks saw a draw of 1.726 million barrels for the week, compared to last week's 1.051-million-barrel increase.

ADVERTISEMENT

Cushing inventories were down by 599,000 barrels this week. Last week, the API saw a Cushing build of 679,000 barrels. Official EIA Cushing inventories for the week ending August 19 was 25.807 million barrels, up from 25.381 million barrels in the prior week.

By Julianne Geiger for Oilprice.com

More Top Reads From Oilprice.com:

- Belgian Energy Minister: Europe Faces Tough Winter Without Gas Price Cuts

- The Global Gas Crisis Is Spilling Into The United States

- Gazprom Slashes Natural Gas Deliveries To French Utility Giant

Julianne Geiger

Julianne Geiger is a veteran editor, writer and researcher for Oilprice.com, and a member of the Creative Professionals Networking Group.

Open57.81

Trading Vol.6.96M

Previous Vol.241.7B