President Donald Trump’s aversion towards Iran’s rulers has been obvious since his announcement for running for the office of US president. His confrontational policy has culminated in the unilateral withdrawal of the United States from the JCPOA, the Iran Nuclear Deal. In order to increase pressure on the already ailing Iranian economy, it is adamant for Washington to cut off oil exports and thus reduce the financial power of Tehran. However, this policy could backfire as oil prices are already rising and the Middle Eastern country is a major producer and exporter.

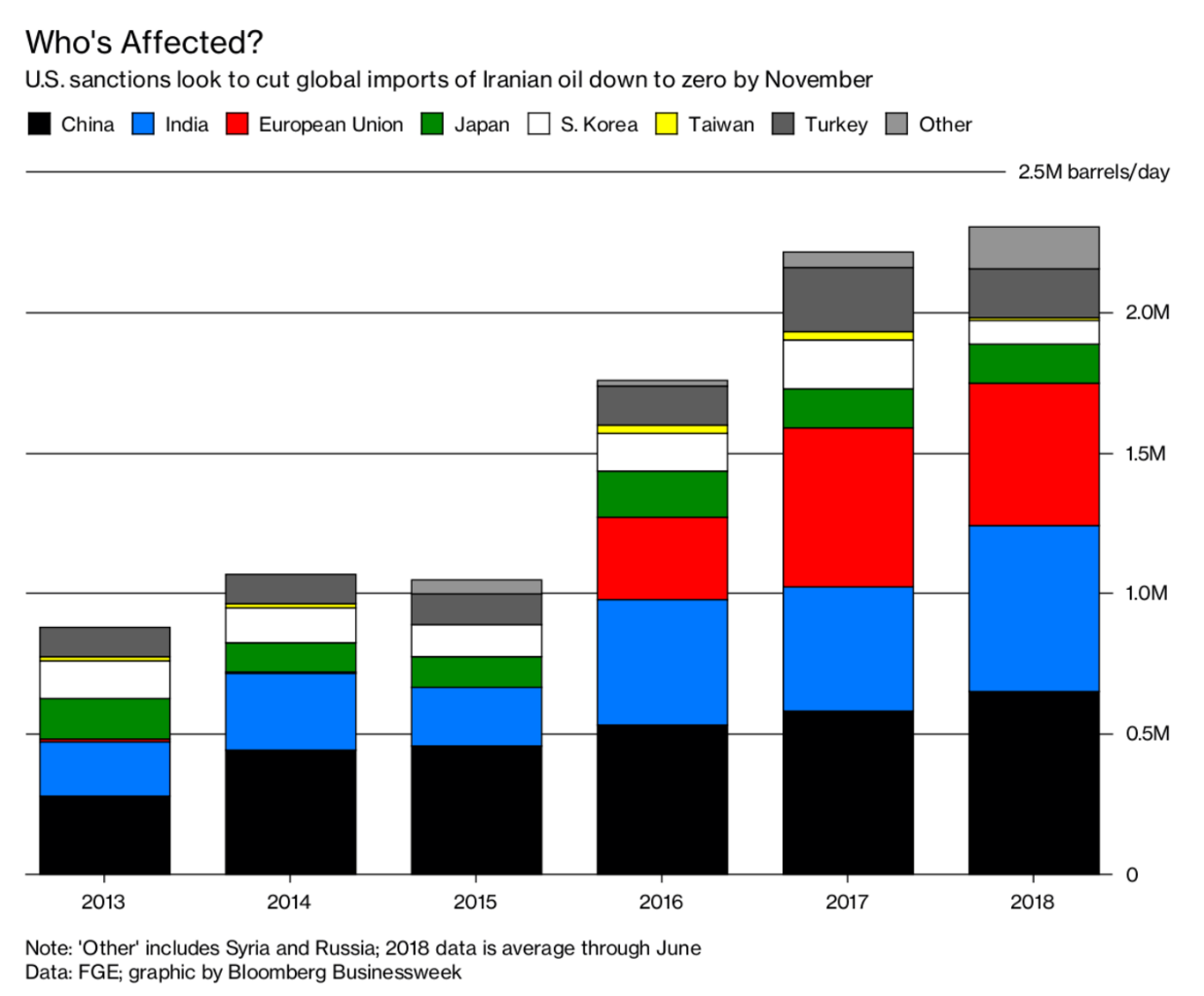

Currently, Iran is the third largest oil producer within OPEC after Saudi Arabia and Iraq with a production of 4 million barrels/day and an export of 2,1 million. Oil revenues have kept the country afloat while confronting a global sanctions regime and hostile U.S. policy across the region. Since the signing of the historical Nuclear Deal and the easing of restrictions on Iran’s energy sector in 2015, exports have risen by 1,4 million barrels/day. The U.S. is pursuing not the elimination of just the extra added barrels since the signing of the Deal, but the entire Iranian export of oil. However, depriving the world’s market this quantity has far-reaching consequences for economic and political reasons.

(Click to enlarge)

The world economy is running on full steam. All major economic regions from North America to Europe and East Asia are seeing significant economic activity and growth. Even the looming trade war of the U.S. with several other countries has fortunately not yet caused any negative effects. Global growth has positively influenced demand for oil and oil products. In 2017 alone consumption rose by 1.5 million barrels per day, growing at 1.6 percent which is double the global annual growth rate in a decade.

Rising oil prices have been a welcome development for producers. Bullish sentiment in oil markets is a direct consequence of the deal between OPEC and Russia to limit production by 1.8 million barrels per day in order to reduce the global oil glut. Inventories have been falling and prices have been rising, improving the financial health of petro states. The recent deal struck to partly undo the previous agreement, can be seen in the light of much tighter oil markets and falling Iranian exports. Adding an additional 1 million barrels per day should compensate for falling production elsewhere.

With the midterm elections later this year, President Trump has been afraid that it could negatively affect his constituency and thus Republican support in the House. Trump's efforts on Twitter was aimed at exactly this goal. The U.S. president took to social media to increase pressure on OPEC and production. Related: Big Oil’s Next Major Move

Although OPEC and Russia have agreed to add an extra million barrels/day to world markets, the fear remains that this might not be enough to compensate for both rising demand and production risks across the globe. Trump has acknowledged this risk in a recent tweet where he implies that Saudi Arabia is able and willing to further increase production to 2 million barrels. Analysts, however, strongly doubt whether Riyad is able to raise production by this amount.

Riyadh, however, did not confirm Trump’s request but affirmed the Kingdom’s capacity to prudently use its spare capacity to balance the world’s markets. The White House for its part, backed down on Trump’s assertion in a statement. Saudi Arabia’s vague affirmation of being able to raise production with 2 million barrels per day should be seen as an indirect approval for Washington’s relentless quest to confront Iran. However, this strategy is risky to say at least due to other events not directly related to the U.S.' dissatisfaction with Tehran's rising role in the region. Related: Asian Buyers Look To Replace Iranian Oil Amid U.S. Sanctions

The ongoing conflict and instability in Libya and Venezuela have significantly reduced oil output from these countries. The end is not yet in sight, meaning production can fall even further and increase the price of oil which currently stands at $74. Although prices have decreased slightly due to an unexpected increase in U.S. domestic inventories, the picture for the long term is not as bright.

Assuming the U.S. achieves its political goal of convincing buyers of Iranian oil to stop their activities in the Middle Eastern country, another dangerous economic situation could be created. Assuming Saudi Arabia is able to compensate for the loss in production from Iran, the risk remains to cover other potential developments.

ADVERTISEMENT

One of OPEC’s raison d’être has been the stabilization of the oil markets both in the interest of producers and consumers. With no spare capacity available, rising demand, and political instability across the globe, prices could skyrocket and damage global economic growth. This isn’t in the interest of either producers or consumers. However, this could be another legacy of President Trump as the consequences of his decisions could far outstrip the duration of his administration.

By Vanand Meliksetian for Oilprice.com

More Top Reads From Oilprice.com:

- Chinese Refiner Stops U.S. Oil Imports, Turns To Iranian Crude

- The Critical Chokepoint That Could Send Oil To $250

- How Bad Is Iran’s Oil Situation?

This time US sanctions against Iran will fail. President Trump’s attempts to convince the global oil market that US sanctions could cost Iran 1 million barrels a day (mbd) of its oil exports coupled with western media’s fake news claiming that South Korea, India and Japan have already decided to halt their imports of Iranian crude, are already creating doubts in the global oil market as to whether US sanction will succeed.

The previous sanctions were effective because of two major factors. One is the European Union (EU) threatening sanctions on global insurance and oil shipping companies to prevent them from insuring and shipping Iranian oil exports. The second is US sanctions on banking to prevent Iran from selling its oil and receiving payments in dollar.

The EU confirmed that it will neither walk away from the Iran nuclear deal nor comply with US sanctions and that it will continue to buy Iranian crude. If, however, the EU countries succumb to US pressure, then China will come to the aid of Iran. Given the current tense political and trade relations between the US and China, the Chinese will be only happy to oblige. Moreover, Iran now may rely on a fleet of Chinese supertankers, properly insured, to export its own oil.

The introduction of the petro-yuan has virtually nullified US sanctions on banking and has been gaining weight and momentum at the expense of the petrodollar. Iran will be paid in petro-yuan for its oil exports to China, euro for its exports to EU and yen for its exports to Japan thus totally bypassing the petrodollar. Moreover, Iran already has barter trade agreement with Russia, India and Turkey. Under these agreements, it will exchange oil for food stuffs and other goods.

The oil market has not re-balanced yet completely. There is still a bit of glut in the global oil market capable of taking care of outages in Venezuela, Libya, Angola and Nigeria. Moreover, these outages are not new. They have been factored long time ago by the global oil market so they will hardly have any impact on oil prices.

President Trump’s legacy will not be rising oil prices as a result of US sanctions on Iran but a global economy damaged by his discredited “America first” policy and also his policy on the environment and an America looked upon as a bully and hated by the overwhelming nations of the world.

Dr Mamdouh G Salameh

International Oil Economist

Visiting Professor of Energy Economics at ESCP Europe Business School, London

The District of Columbia's military has failed to get the dirty job done, The City of London has failed to get the financial job done, Israel, is working on it, so far no success, how to is yet to be found, but, make no mistake, even if it takes total destruction of all life on Earth the Rothschild's will have their way. The embargo, is on all of us, an embargo of freedom, an embargo paid for by the Rothschild's, paid too the Leadership in all the world. The Leadership, for personal gain, so their family and themselves can have all the good stuff life has to offer, Iran, is under the Rothschild's heel again.

Support Kevin Annett in every way you can, there may be a way to get these buggers our of our lives, for good.