Europe’s relationship with Russia has soured over the years due to diverging political views and crises such as Ukraine’s reorientation towards the West. Also, energy dependency has become a politically contentious issue. Natural gas demand in the EU was approximately 564 bcm in 2019 of which Russia provided 35 percent. The Southern Gas Corridor, which is almost completed after 4,5 years, is seen as an essential piece of infrastructure for diversification purposes. However, this article will argue that the costs, both political and financial, far outweigh the benefits.

Gas demand and the shale revolution The Southern Gas Corridor is a chain of pipelines that span 3,200 kilometers from the Caspian Sea to consumers in Turkey and Europe. The infrastructure includes the South Caucasus Pipeline (SCP) through Georgia, Trans Anatolian Pipeline (TANAP) through Turkey, and the Trans Adriatic Pipeline (TAP) that will be finished this year.

The Corridor has received Europe’s unwavering support over the years due to political reasons and high dependency on Russian energy. However, the pipeline will fail in delivering gas to those countries that need it the most such as Eastern Europe. Instead, the pipeline will deliver 5 bcm to Turkey and an additional 10 bcm to Greece and Italy through TAP.

Furthermore, gas demand is unlikely to rise significantly. Therefore, additional gas will add to the oversupplied market where Russian producers and LNG are already competing for consumers leading to lower energy prices.

Related: Global Oil Production Costs Continue To Fall

Also, the shale revolution in the U.S. and growing LNG gasification capacity in the rest of the world is increasing the availability and flexibility of natural gas. The current market is highly oversupplied due to the Covid-19 pandemic. Greece has doubled its imports as cheap LNG is flooding the market. The gloomy economic outlook in southern Europe does not bode well for the owners of the pipeline and producers of gas. According to Gazprom, the glut could continue well into 2021 and the Azeri gas will add more pressure on the market.

Financial burden

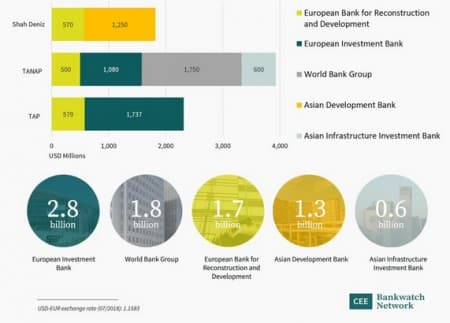

The SGC has cost a whopping $40 billion. A significant amount of public money, $8.1 billion, will be provided as loans by European and international organizations. The majority of the funds will be provided by SOCAR, Azerbaijan’s state oil company.

The final investment decision for the development of the Shah Deniz gas field in Azerbaijan was made in 2013. Although climate issues were already on the agenda back then, they weren’t as important as they are now. Climate change awareness and the Green Deal are putting a strain on new fossil fuel projects. Last year the European Investment Bank announced that it won’t put money in fossil fuel projects anymore.

Therefore, the risk of the Southern Gas Corridor becoming a stranded asset has increased significantly due to structural oversupply of the market, decreasing consumption, and climate change awareness.

Political considerations

The political landscape in which the pipeline was developed, has changed dramatically. Energy diversification over the years has become an important topic due to Europe's difficult relationship with Moscow. Therefore, the gradual transition of Turkey’s political system from 2016 towards authoritarianism and the militarization of the country’s foreign policy, has become a serious reason for concern as one dependency is replaced by another.

ADVERTISEMENT

Already a long list of contentious subjects makes cooperation with Ankara increasingly difficult such as its unilateral actions in Greece’s territorial waters and its recent support for Azerbaijan in the ongoing conflict with Armenia.

The SGC was promised as a game-changer for Europe's energy market that would provide affordable gas and reduce dependence on Russia. However, the high costs compared to the amount of energy transported, environmental concerns, and dependency on undemocratic regimes make the pipeline’s completion less attractive than promised.

By Vanand Meliksetian for Oilprice.com

More Top Reads From Oilprice.com:

- Why Natural Gas Is The Most Important Fuel Of the Next Decade

- ISIS Calls For Attacks On Saudi Oil Industry

- Biden's $2 Trillion Energy Plan Could Crush Natural Gas

The SGC was an initiative to reduce the EU’s dependence on Russian gas and diversify gas supplies by tapping into supplies from the Caspian.

The route of the SGC from Azerbaijan to Europe consists of the South Caucasus Pipeline (SCP), the Trans-Anatolian Pipeline (TANAP) and the Trans-Adriatic Pipeline (TAP).

Yet, the SGC which cost $40 bn risks becoming either a huge white elephant or a stranded asset. As it stands, the TANAP has a capacity of 31 bcm/y of gas but has commitments for only half that, about 16 bcm, and in its current phase can only supply up to 6 bcm/y of gas to Turkey. The remaining 10 bcm will be transferred via the TAP pipeline to Greece, Albania and across the Adriatic to Italy.

Without loading surplus Russian gas from the Turk Stream, the SGC won’t be able to operate at capacity.

Furthermore, Turkey the biggest supporter of the SGC is in a very fractious relations with the EU currently over gas resources and marine boundaries in the Eastern Mediterranean.

The escalating war between Armenia and Azerbaijan over the disputed region of Nagorno-Karabakh could threaten Azerbaijan’s oil and gas infrastructure and two major oil and gas pipelines that traverse the border region of: one is the Baku–Tbilisi–Ceyhan (BTC) oil pipeline which delivers some 640,000 b/d of Azerbaijani crude oil to the EU and the second is the South Caucasus gas pipeline (SCP) which along with the TANAP and TAP pipelines will eventually deliver 16 bcm annually to Turkey and the EU.

Dr Mamdouh G Salameh

International Oil Economist

Visiting Professor of Energy Economics at ESCP Europe Business School, London