Who would have thought wind’s transformation from subsidy-supported to self-financing power source would happen so quickly – not this publication, that’s for sure.

Apart from diehard environmentalists, most consumers have been opposed to renewables on the basis they cost significantly more, and turbines are an eyesore on the landscape.

But in the span of less than 10 years, public opposition has declined. Opposition has not gone way entirely, but it has softened as we have become more familiar with the sight of slowly rotating turbine blades on the horizon and with the realization that its costs are falling dramatically.

A recent article in The Telegraph reports on how the cost of power production from onshore wind farms has dropped so far it undercuts conventional coal, natural gas and nuclear options.

The below graph from 2015 shows onshore wind as the cheapest option; costs have come down further since then.

(Click to enlarge)

Source Wikipedia

Calling it the “subsidy-free revolution,” the Telegraph article reflects our own surprise at how quickly the change has taken place.

To be fair, offshore power still requires some subsidy because of the greater cost of installation and maintenance. Even here, costs continue to fall, and subsidy is a route the authorities prefer to entertain because of public opposition to what was seen as the blight of onshore turbines dotting the landscape.

Related: Wood Mackenzie: Global Peak Oil Demand Expected In 2036

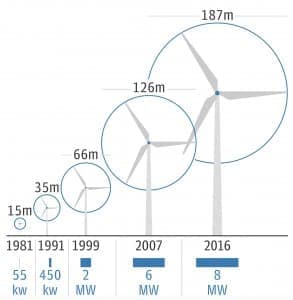

In large part, this is because turbine sizes have increased and, as a result, efficiencies have increased.

(Click to enlarge)

Source: The Telegraph

The industry is seeing it as a major investment opportunity, generating jobs while at the same time reducing the country’s overall carbon emissions.

A figure of £20 billion covering both onshore wind and solar over the next 10 years is mooted, all of which would be subsidy-free.

The latest figures are sounding the death knell for nuclear power in the U.K., but as usual the government hasn’t caught up with the numbers. Related: Oil Slides As Saudis Gear Up To Pump Record Volume

ADVERTISEMENT

Nuclear power is costing a massive £92.50 per megawatt hour and is partly justified on the basis that a base load of power is always required to fill in renewables variability. However, battery parks like Glassenbury in Kent are springing up that can meet gaps in demand, but nothing like a 2 GW nuclear power plant; still, a few MW here and there is slowly adding up.

But, like renewables, costs will need to come down for investment to flow into battery parks. That is, they’ll need to come down to the extent required to negate the need for quick fireup of conventional power sources to fill in gaps during cold snaps or, as renewables rise, as a percentage of the whole to fill in for periods of low wind or at night for solar.

Still, a low-carbon future, at lower power costs and with the benefit of economic growth from investments – what’s not to like?

By Stuart Burns via AG Metal Miner

More Top Reads From Oilprice.com:

- Chinese Oil Demand Growth Could Slow Down Soon

- Is The Oil Industry Repeating A Critical Error

- The Last Oil & Gas Frontier Is Facing Major Challenges

Furthermore the cost of carbon is not just the cost or building and maintaining infrastructure of extraction, transportation, and combustion. It includes the medical costs from pollution.

What we pay doctors, hospitals, and pharmacies for asthma (ozone pollution), bronchitis (SO2 & NOx pollution), Cancer (Volatile Organic Compounds), heart disease (particulates), and retardation (mercury pollution from coal), lost work and premature deaths are part of the TRUE cost of fossil fuels. And we have not included the cost of global climate change.

Ending the fossil fuel economy is long overdue. Clean, renewable, local, endless energy is not a technological or economic question but a political problem. It is the reason Donald Trump says Europe is a foe (they are working hard and with great success to make fossil fuels valueless goo to be left undisturbed deep underground.

Putin is not a foe, said Trump, he is a strong competitor in the race for supplying the world with fossil fuels (and lining his pockets). Trump and Putin are like two fossil fuel peas in a pod.

I suggest that we keep subsidies in place. In addition to the usual reasons of people's health and safety, reducing the need for gas and oil is helpful for world peace. Unfortunately, a lot of the world fights over petroleum, and those that have petroleum sell it in a big way to fund weapons and foreign intervention.

Not only are we moving too slowly to protect the health of our planet, but also we are not reducing world conflict. Oil makes the world go round, yes. But it also makes bullets fly. I haven't seen much evidence that wind power does the same.