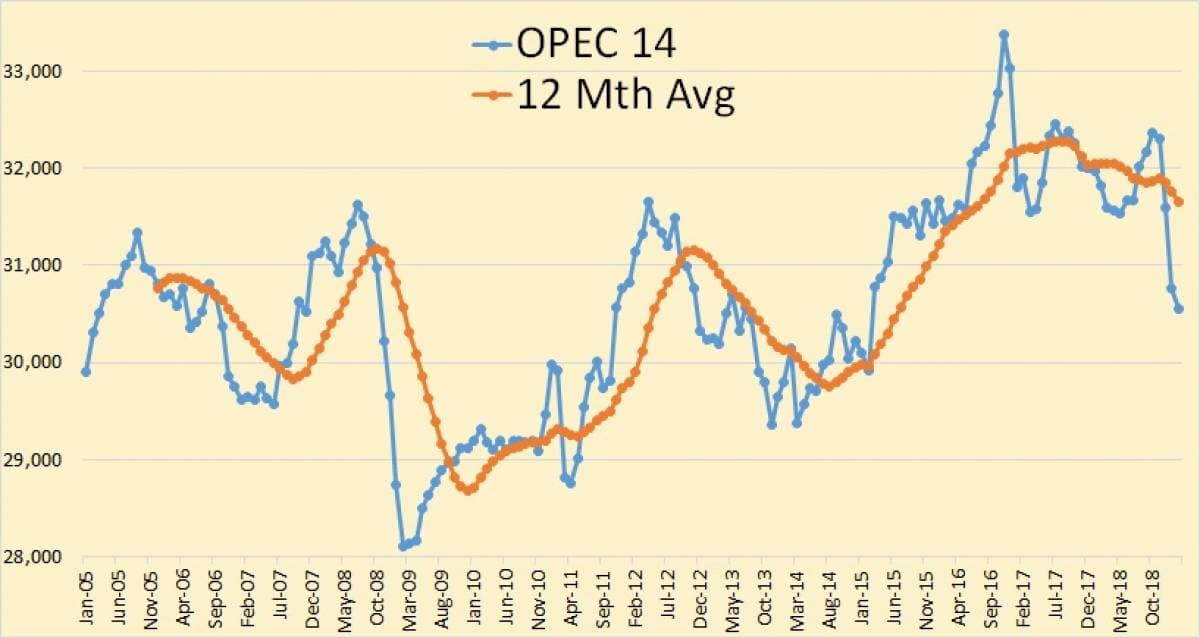

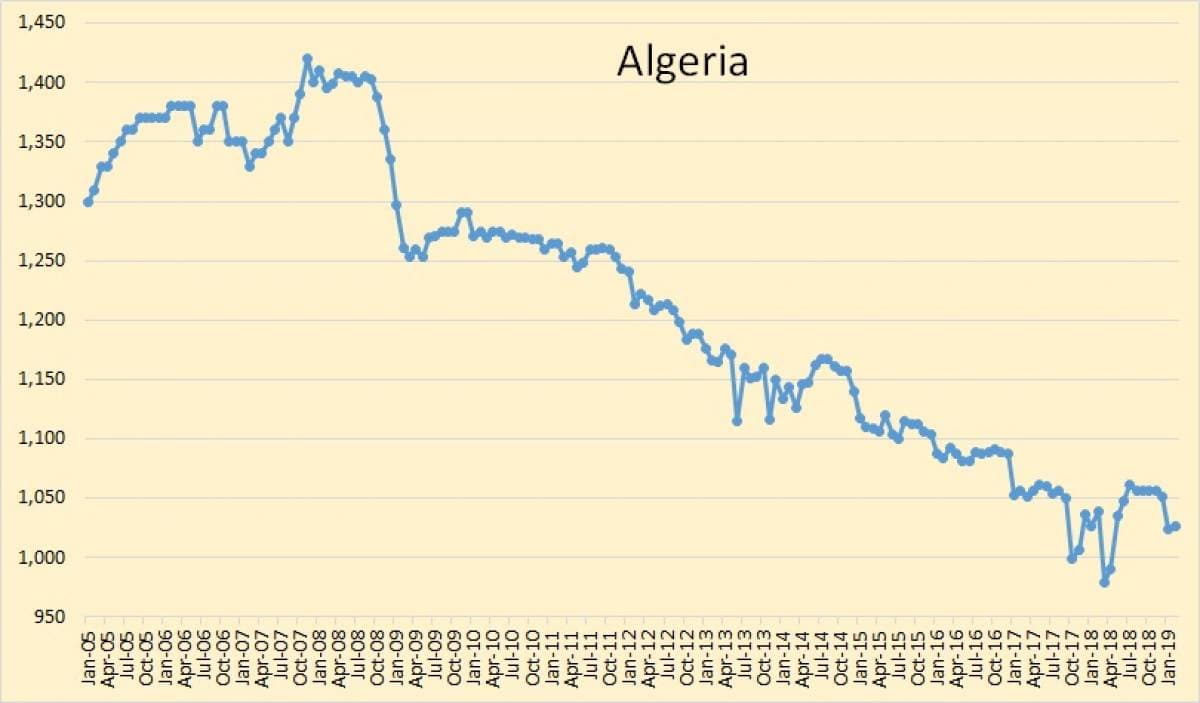

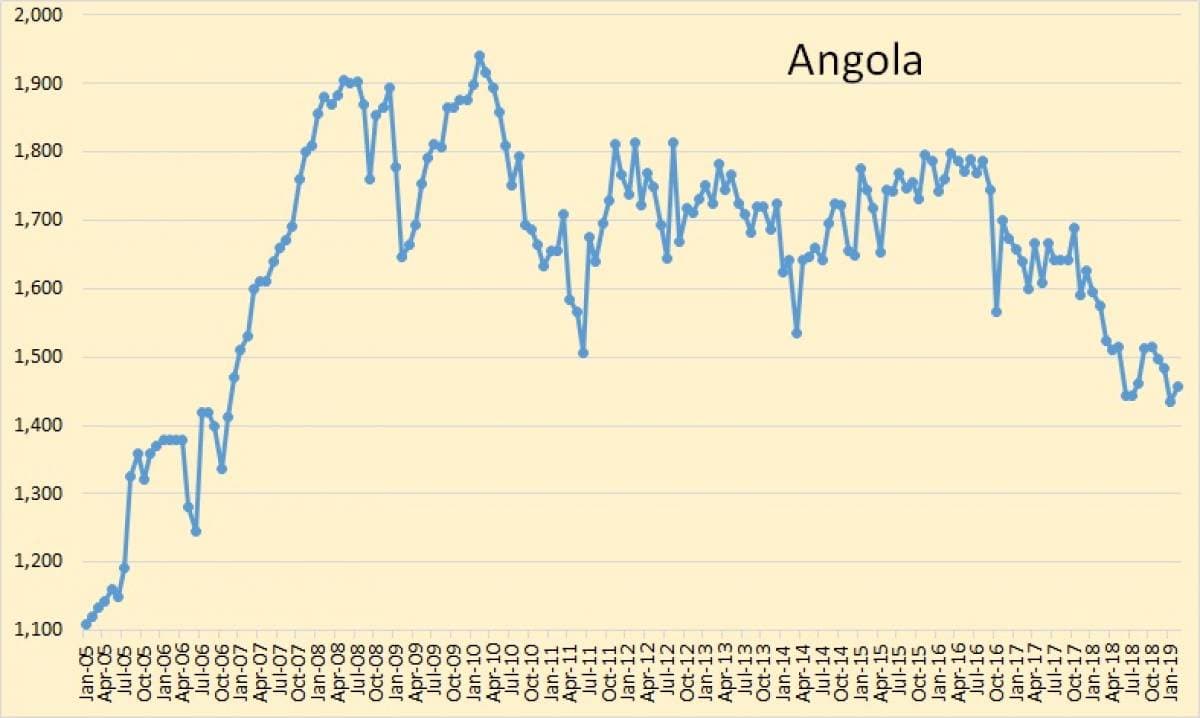

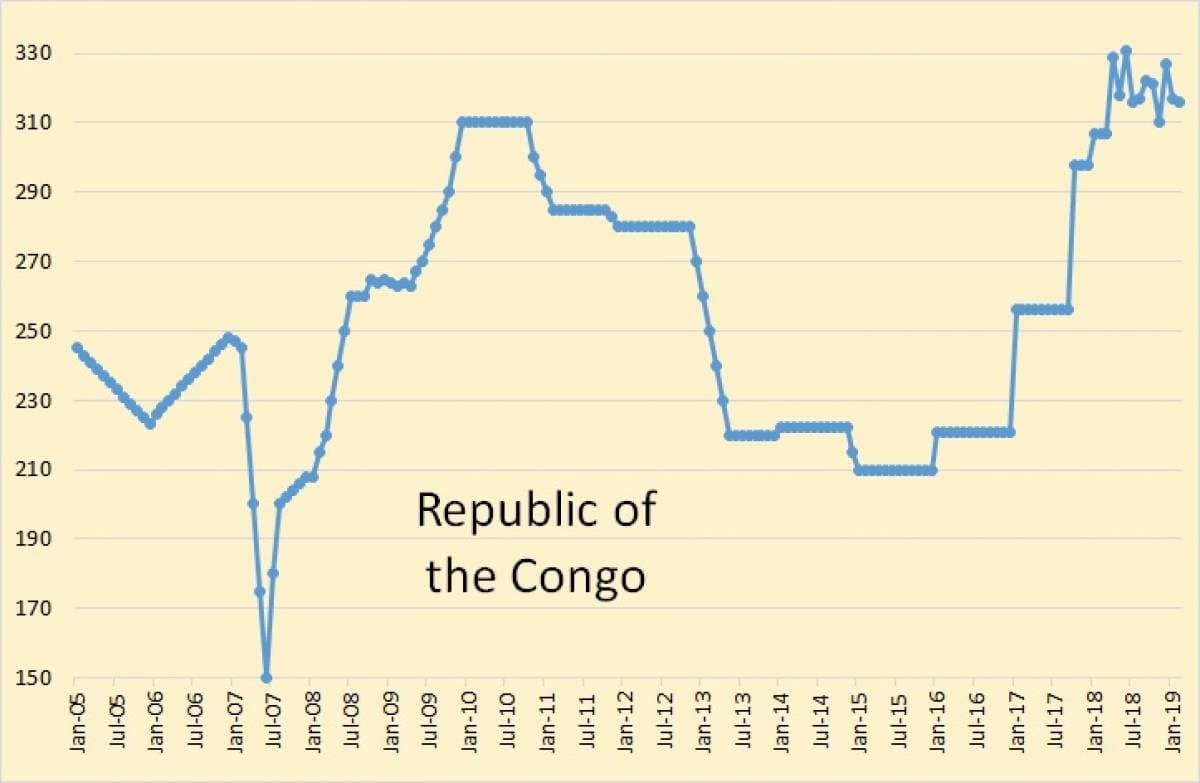

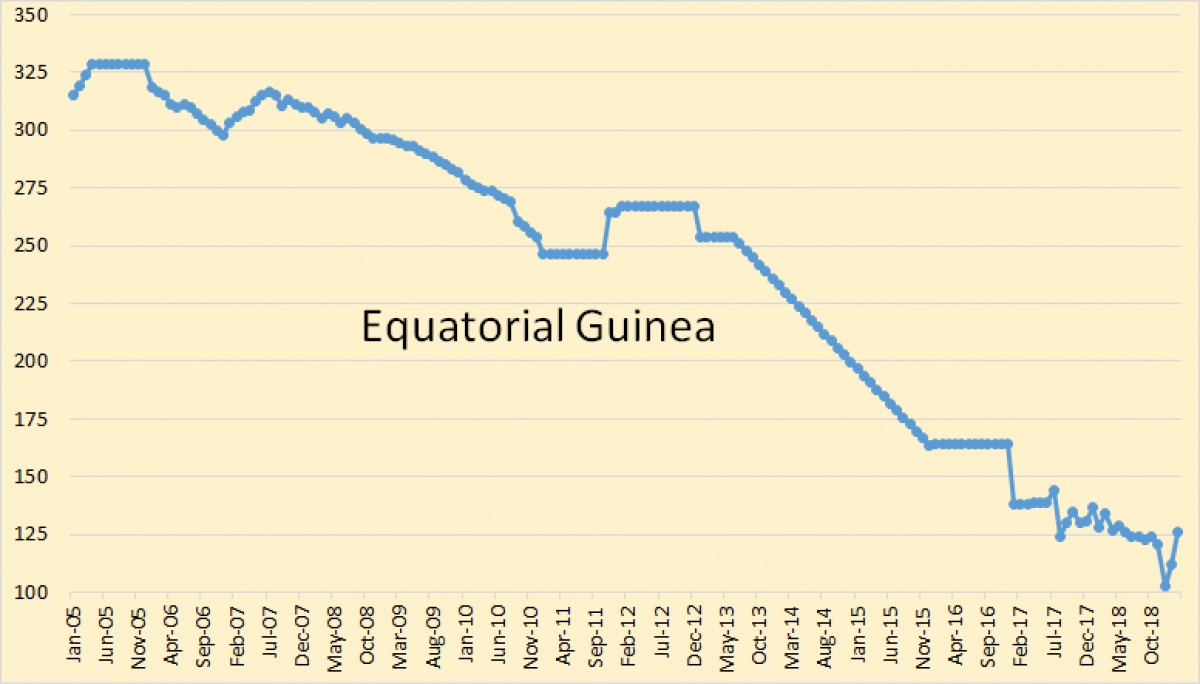

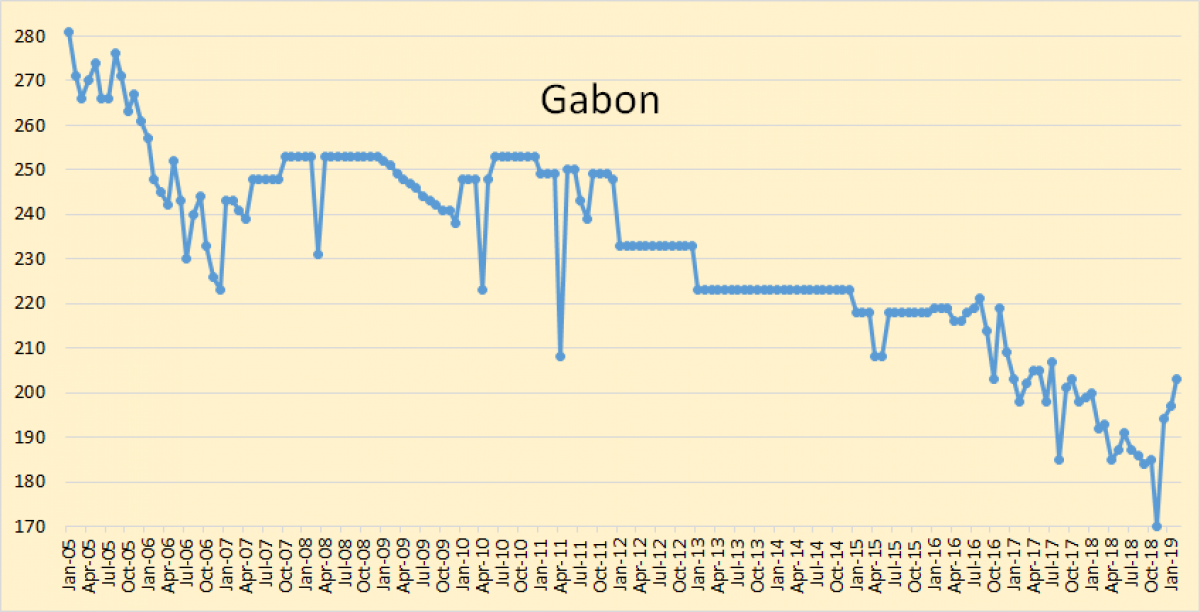

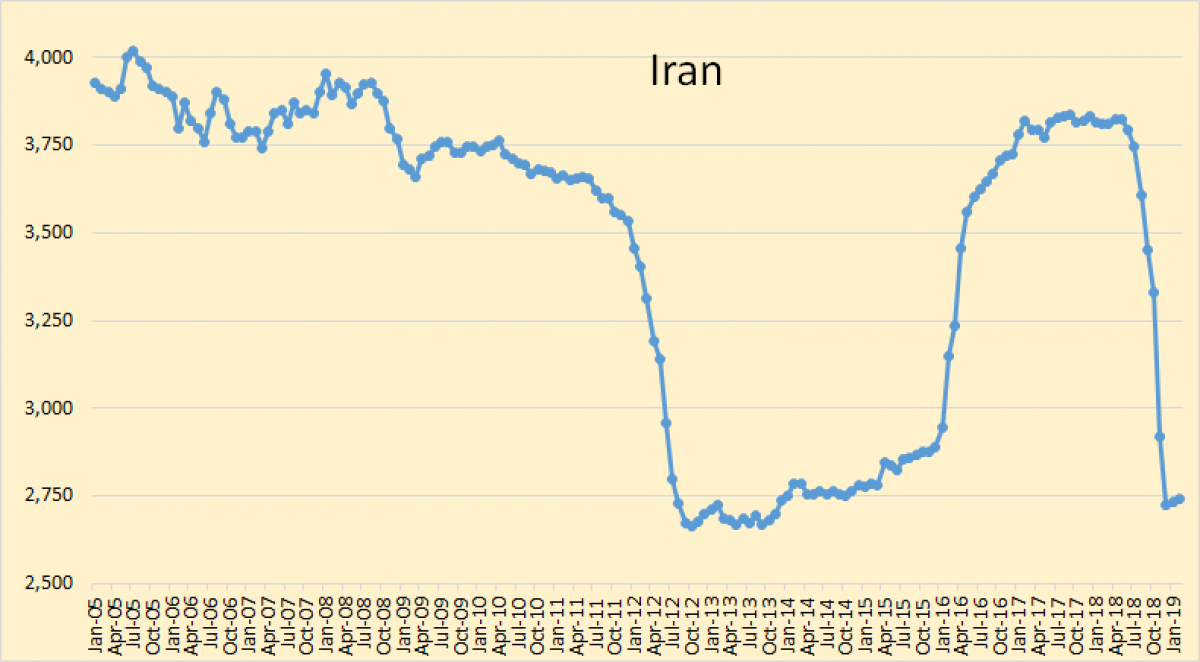

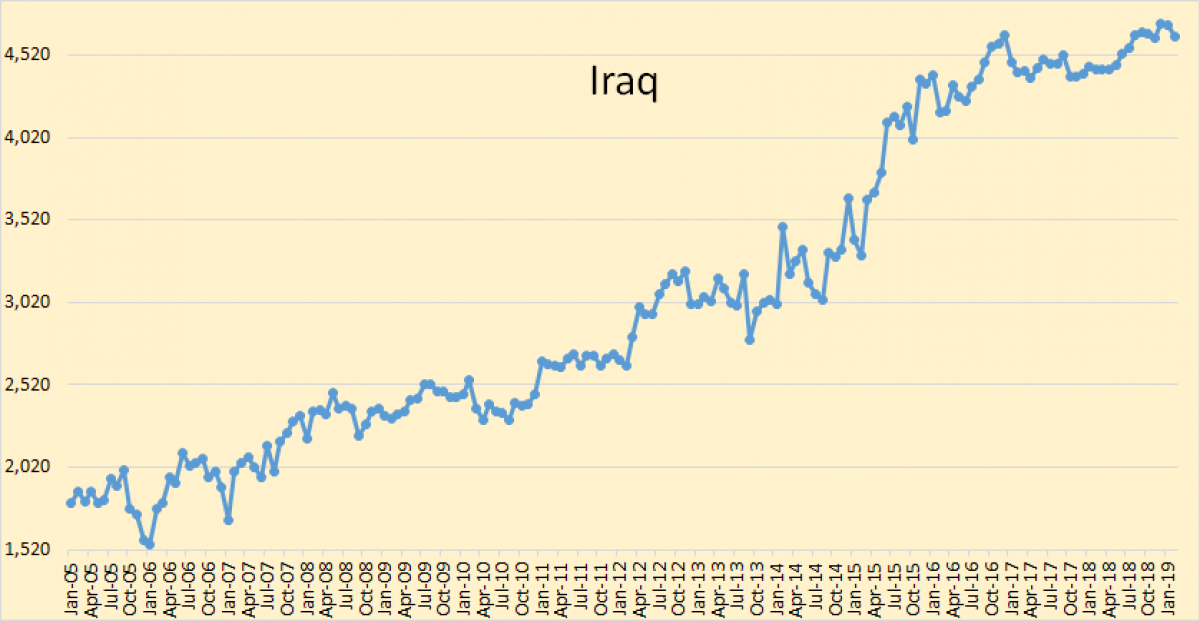

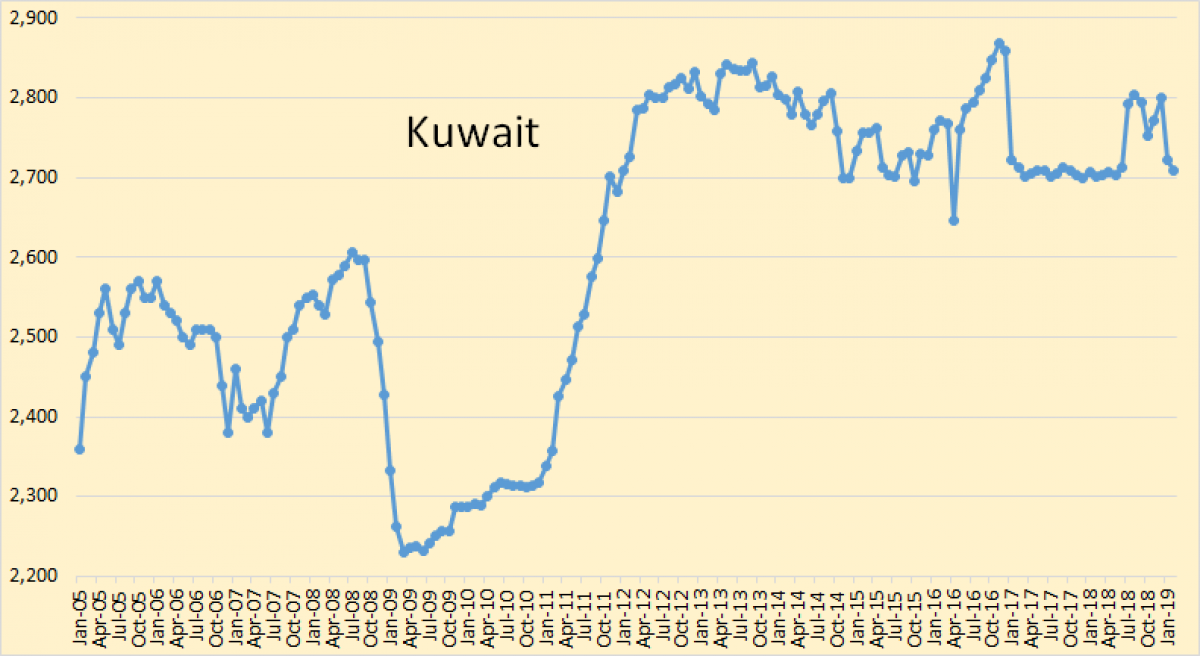

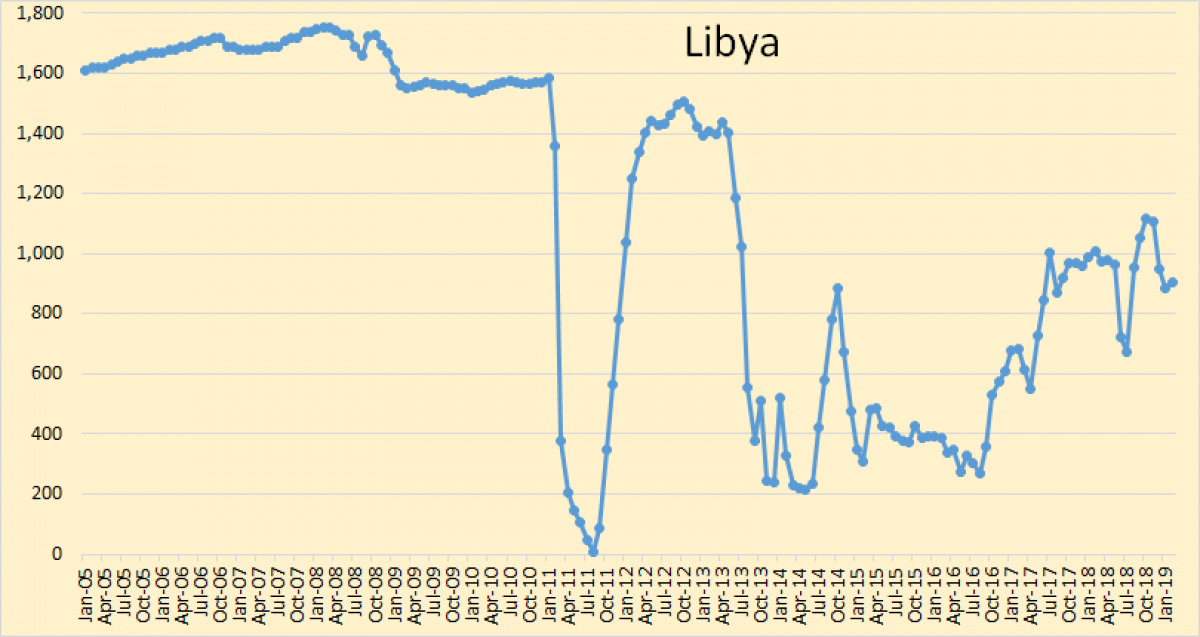

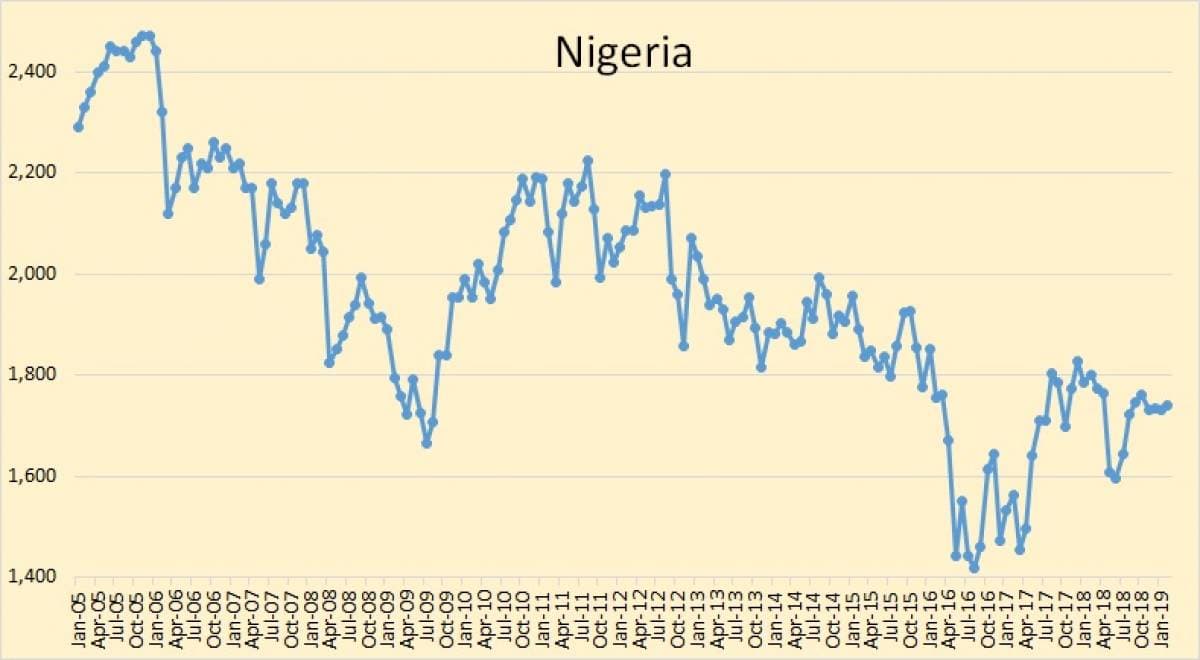

The following OPEC charts were created with data from the OPEC Monthly Oil Market Report. All OPEC charts are through February 2019 and is in thousand barrels per day.

(Click to enlarge)

OPEC crude oil production was down 221,000 barrels per day in February. That was after December production had been revised downward by 13,000 bpd and January production revised down by 40,000 bpd.

OPEC 14 crude oil production now stands at 30,549,000 barrels per day. That is the lowest since February 2015. The peak was November 2016 at 33,347,000 bpd. So OPEC production is down 2,798,000 bpd from that point.

There is little doubt that if Libya, Iran and Venezuela had no political problems then OPEC production would exceed that 2016 peak. Iran’s problems will likely be settled in the next couple of years. They will likely recover quite quickly. Libya will take a bit longer to recover to full production if and when their problems are settled. However it will likely take Venezuela a decade or more when and if their problems are ever settled. But it is likely they will collapse even further, closer to zero production, before their situation even starts to turn around.

(Click to enlarge)

Major decliners in February were Iraq, Kuwait, Saudi Arabia and Venezuela. Everyone else was either relatively flat or up slightly.

![]()

(Click to enlarge)

Above are the quota numbers for the 11 OPEC members who are subject to quotas. Saudi Arabia is undershooting its quota number by quite a bit. Iraq and Nigeria seem uninterested in any compliance to their quota.

(Click to enlarge)

(Click to enlarge)

(Click to enlarge)

(Click to enlarge)

(Click to enlarge)

(Click to enlarge)

(Click to enlarge)

Sanctions on Iran have apparently taken their toll. Iranian production will likely continue to drift upward from here, until sanctions are lifted.

Related: Is A Crisis Looming For Canadian Oil?

(Click to enlarge)

It appears that Iraq has no interest in cutting production. They appear to still be producing flat out.

(Click to enlarge)

Kuwait is down about 80,000 barrels per day from their average the last six months of 2018. However they are down over 100,000 bpd from their average during their peak year of 2013.

(Click to enlarge)

Libya, exempt from quotas, seem to be holding steady.

(Click to enlarge)

Nigeria seems to be totally uninterested in cutting production.

(Click to enlarge)

Saudi Arabia is down 934,000 bpd from their peak in December. They are 221,000 barrels per day below their quota.

(Click to enlarge)

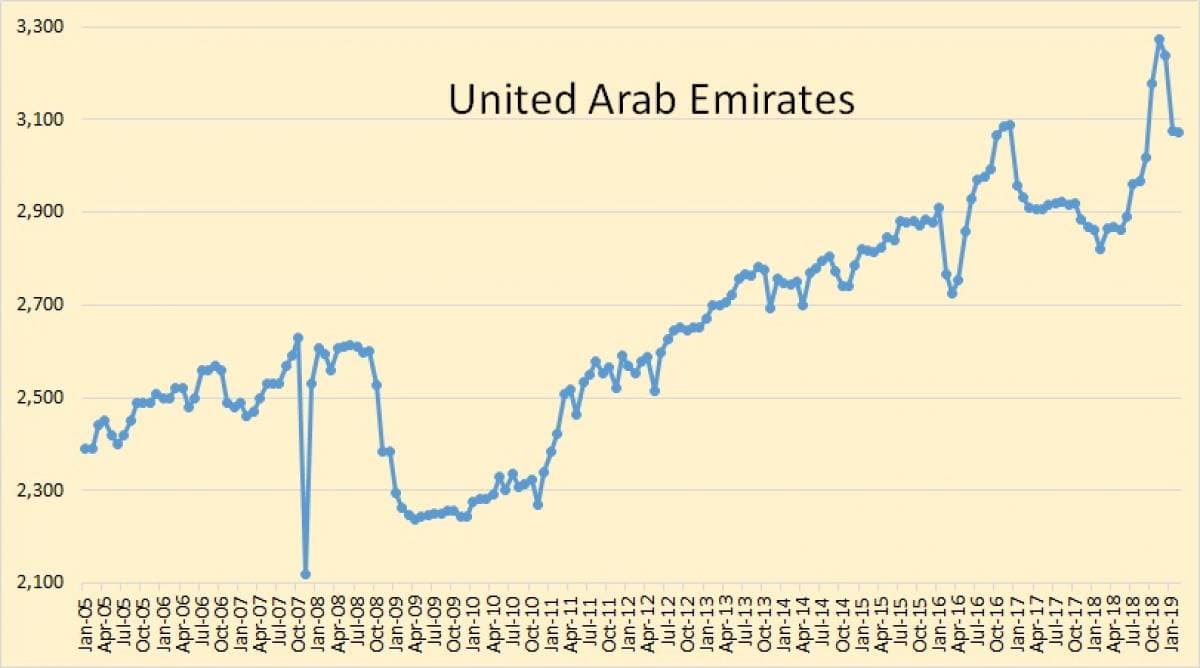

The UAE dramatically increased production during the last three months of 2018 in order to increase their quota numbers. They are now exactly at their quota.

(Click to enlarge)

Venezuela took a huge hit in February, down 142,000 barrels per day. They will likely be down even more in March due to the blackout.

(Click to enlarge)

The data for the four charts below is from the EIA and is in thousand barrels per day through December 2018.

(Click to enlarge)

USA production was down 56,000 barrels per day in December to 11,849,000 bpd.

(Click to enlarge)

Texas oil production, the USA’s largest producer, was up 35,000 barrels per day in December, to 4,877,000 bpd.

(Click to enlarge)

ADVERTISEMENT

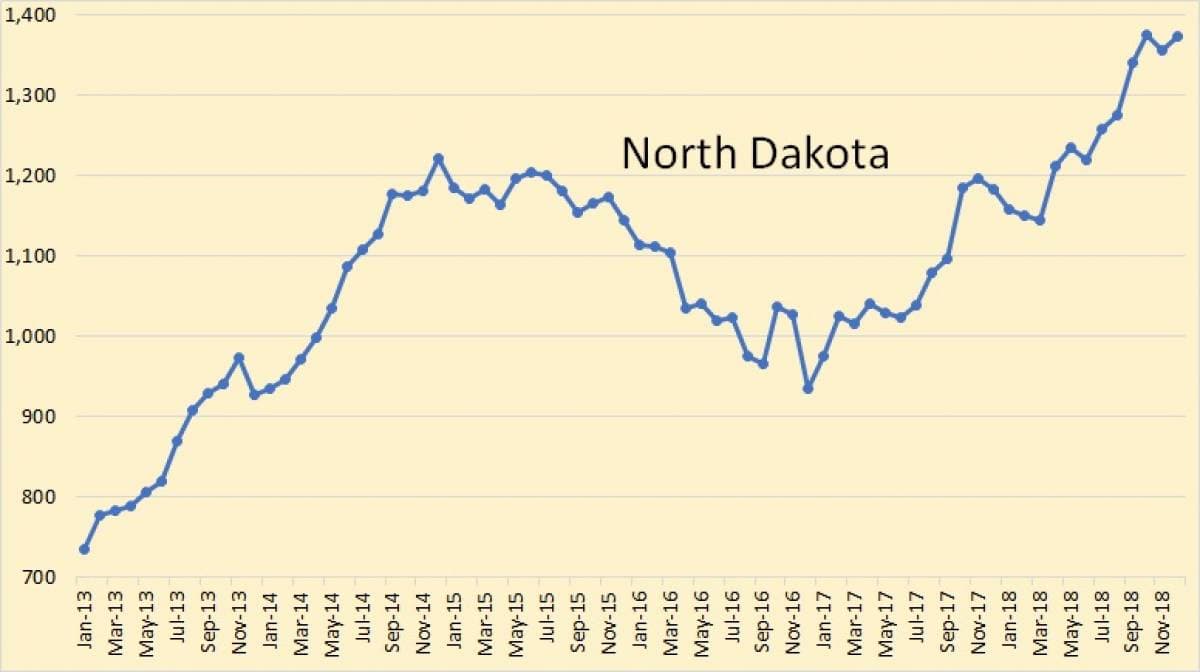

North Dakota crude oil production was down 18,000 barrels per day in December to 1,373,000 bpd.

(Click to enlarge)

Gulf of Mexico crude oil production was down 125,000 barrels per day in December to 1,802,000 bpd.

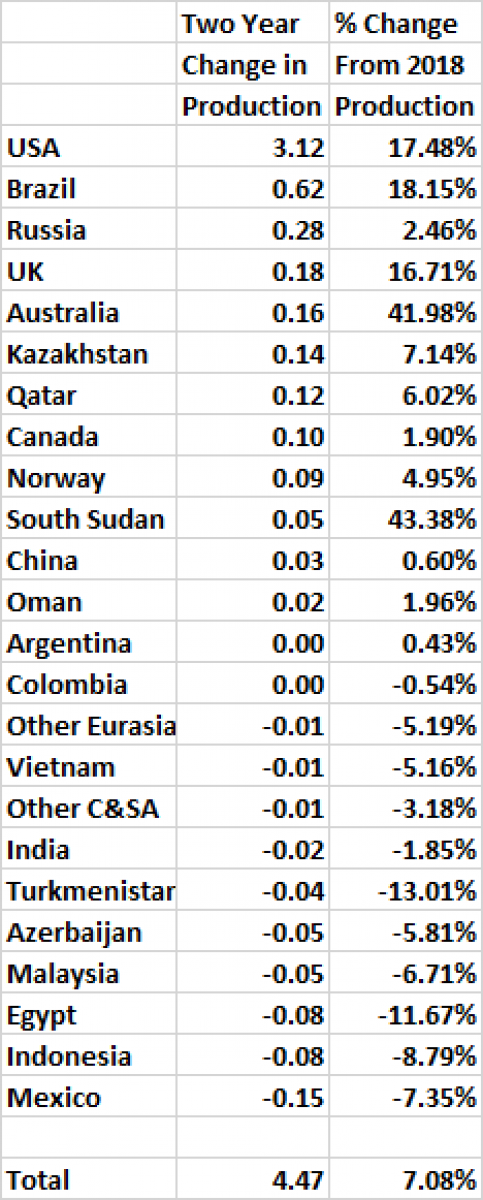

The EIA’s latest Short-Term Energy Outlook has some very optimistic figures. The below chart gives their Non-OPEC total liquids production estimates for the next two years. That is December 2020 production estimate as compared to their December 2018 production data. The data is in million barrels per day.

(Click to enlarge)

The EIA expects total liquids production to increase by 4,470,000 barrels per day over the next two years. The lion’s share of that will come from the USA. The rest, 1,350,000 bpd will come from the rest of Non-OPEC.

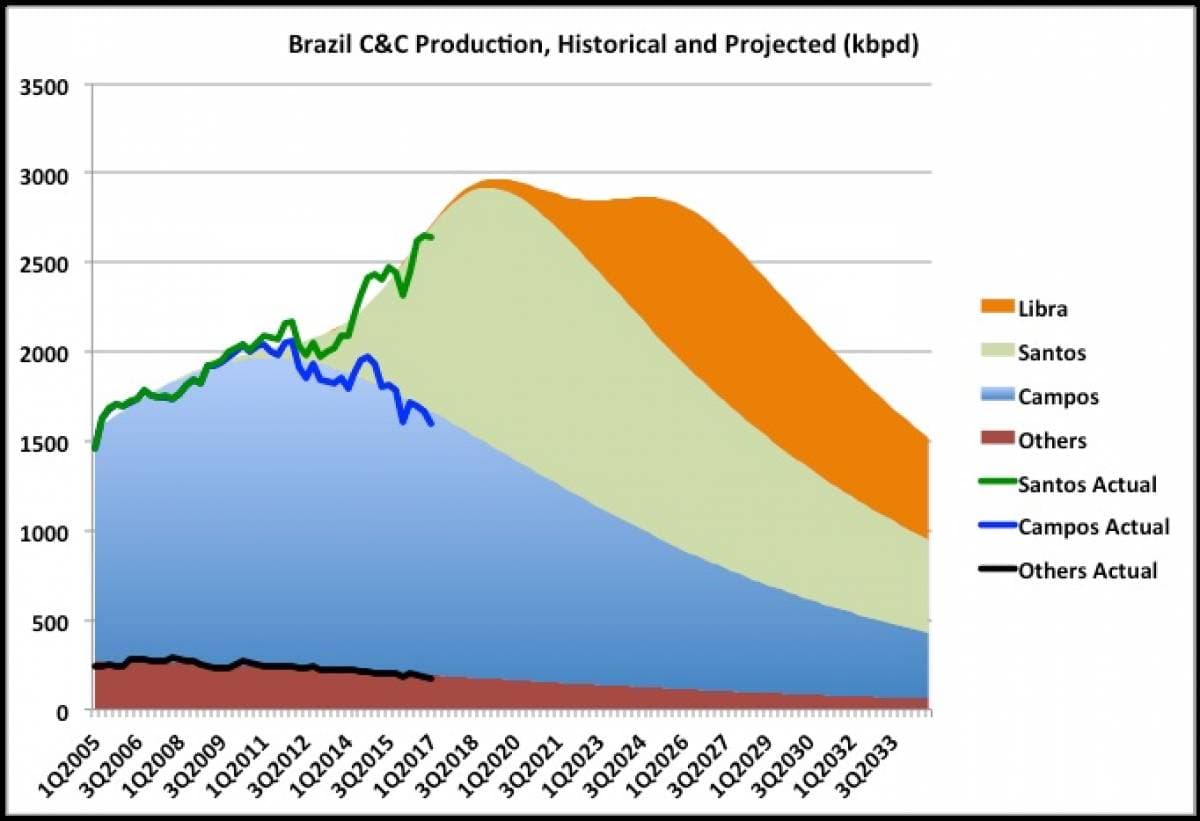

Notice that they are expecting Russian and Canadian production to taper off but expecting Brazilian production to continue booming. In a July 2017 post, George Kaplan had a different opinion. Brazil: Reserves and Production

(Click to enlarge)

George has Brazil peaking in 2018 at just over 2,900,000 barrels per day.

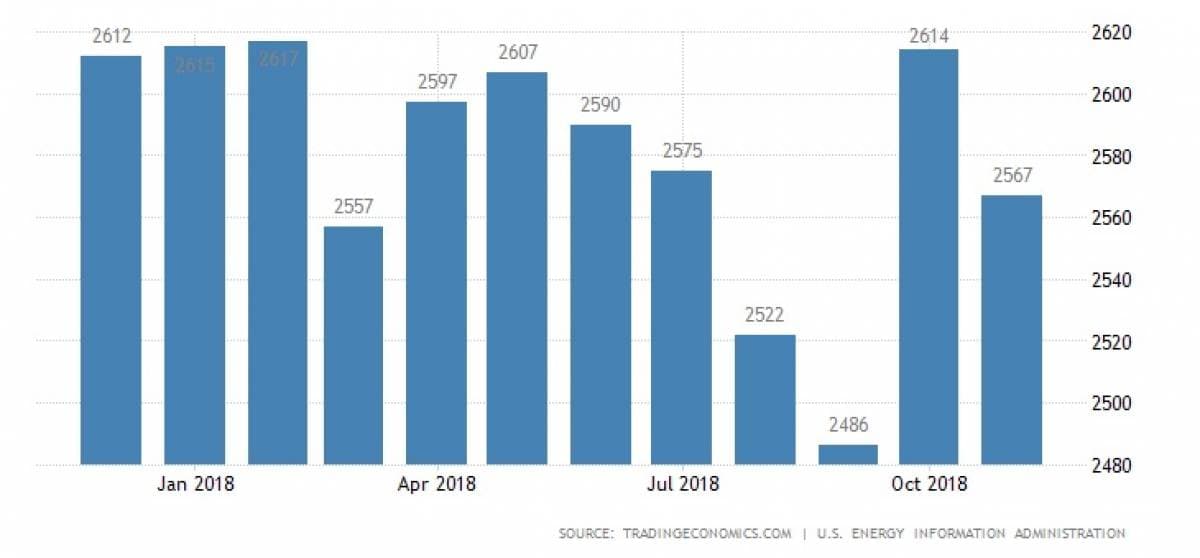

Brazil Crude Oil Production (November 2018)

Related: The Billionaires Battling It Out Over Biofuel

Crude Oil Production in Brazil decreased to 2567 BBL/D/1K in November from 2614 BBL/D/1K in October of 2018. Crude Oil Production in Brazil averaged 1661.38 BBL/D/1K from 1994 until 2018, reaching an all time high of 2730 BBL/D/1K in December of 2016 and a record low of 330 BBL/D/1K in May of 1995.

(Click to enlarge)

It appears that perhaps Brazil may not be the bonanza the EIA hopes it to be.

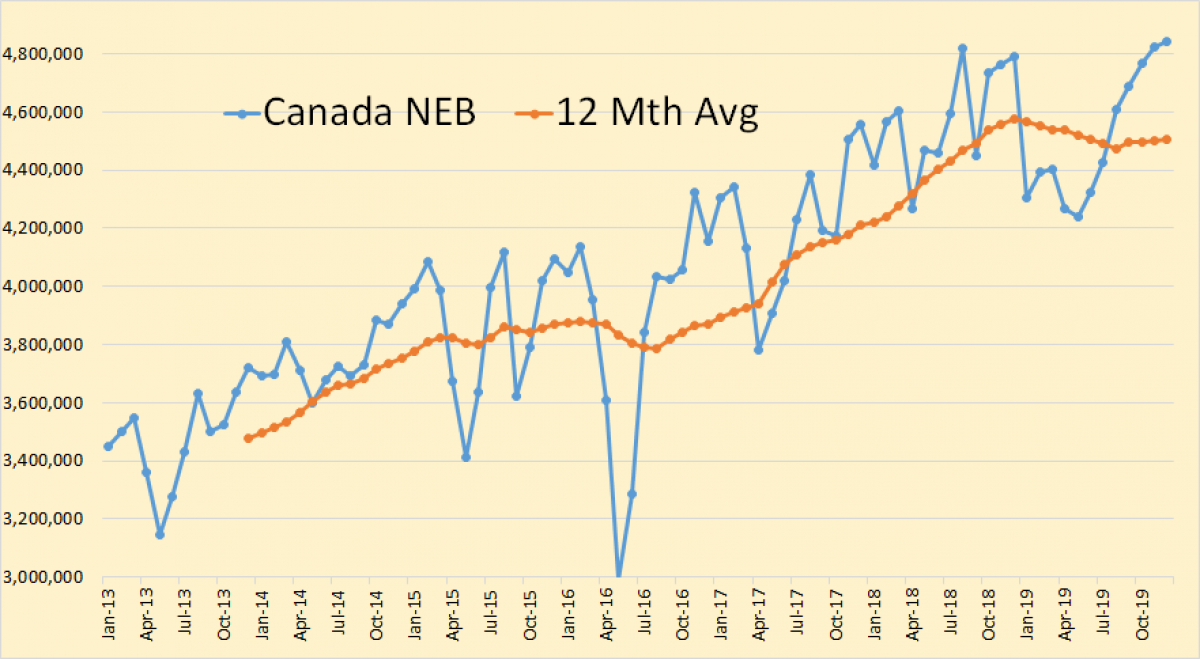

(Click to enlarge)

The Canadian National Energy Board is out with their latest Crude oil production data with projection through December 2019. They are expecting a huge hit in production starting in January, down by 0ver 550,000 bpd by May 2019 and not recovering until late summer.

I am now of the opinion that 2018 will be the peak in crude oil production, not 2019 as I earlier predicted. Russia is slowing down and may have peaked. Canada is slowing down and Brazil is slowing down. OPEC likely peaked in 2016. It is all up to the USA. Can shale oil save us from peak oil?

(Click to enlarge)

OPEC + Russia + Canada, about 57% of world oil production.

By Ron Patterson via Peak Oil Barrel

More Top Reads From Oilprice.com:

- The Small Asian Nation With Big LNG Plans

- Pakistan Aims To Become A Natural Gas Hotspot

- Venezuela’s Latest Nightmare: Crude Oil In The Tap Water

If OPEC production stands now at 30.549 mbd compared to 33.347 mbd in 2016, it is because Saudi Arabia flooded the global oil market then against the wishes of OPEC until it was forced to abandon its discredited strategy and agree to OPEC production cuts.

And while production in Libya and Venezuela will take quite a while to rebound, Iraq is already working on raising its production capacity from almost 5 mbd currently to between 6-7 mbd by 2022/2023.

Russia is also hoping to add more than 1.5 mbd to its current oil production of 11.4 mbd in the next few years from the Arctic region where ExxonMobil and Rosneft were operating together before US sanctions forced ExxonMobil to withdraw its operations.

Global production will continue to grow year after year to meet a projected demand for oil amounting to 120 mbd by 2040. However, for global production to meet global demand, two major things will be needed: vast investments and high oil prices.

According to the International Energy Agency (IEA), the world needs $44 trillion in investment in global energy supply between now and 2040 to meet the coming global energy needs with 60% or $26 trillion allocated for oil production.

To attract the huge investments needed, an oil price ranging from $100-$110 a barrel would be essential. Such a price would be good for the global economy as it will invigorate the three biggest chunks of the global economy, namely global investments, the global oil industry and the economies of the oil-producing countries.

Investments and high oil prices will be underpinned by three pivotal premises. The first is that there will never be a post-oil era throughout the 21st century and far beyond. The reason is that it is very doubtful that an alternative as versatile and practicable as oil, particularly in transport, could totally replace oil in the next 100 years and beyond. Oil will continue to reign supreme throughout the 21st century and far beyond.

The second premise is that there will never be a peak oil demand either. Global oil demand will never peak throughout the 21st century and far beyond because electric vehicles (EVs) will never be able to replace oil in global transport. They will only decelerate the growth of global demand for oil.

The third premise is that it is a valid economic principle that oil producers and investors should always aim to maximize the return on their assets and investments respectively by looking for opportunities in the most profitable outlets in the world. The global oil industry is and will continue to be the most profitable industry for the foreseeable future. It also follows that OPEC will continue to be in a position not only to play a major role in determining the oil price but also to stabilize the global oil market and prices as well.

Dr Mamdouh G Salameh

International Oil Economist

Visiting Professor of Energy Economics at ESCP Europe Business School, London