Crude oil prices went up again this week as Saudi Arabia found itself at the forefront of sabotage attacks, carried out against oil infrastructure – the Fujairah port in the UAE and the East-West pipeline bringing oil from the oil-rich regions to the safer Red Sea coast. Concurrently, the US-China trade war began to spiral out of control, with both sides slapping tariffs on each other worth hundreds of billions of dollars. Add to this that backwardation is even steeper than previously foreseen (front-month to second-month Brent contracts edging beyond $1 per barrel for the first time since 2013), unexpected shutdowns and maintenances in the Norwegian part of the North Sea and you will get a cocktail fraught with problems.

With Iran now struggling to find a market niche from which it could sell at least part of its erstwhile exports, physical security of oil-carrying vessels or other infrastructure in the Persian Gulf is far from guaranteed. We will see whether the sides can be reasonable enough in this era of unreasonableness. As of today, the global benchmark Brent has been trading in the $70.5-70.8 per barrel interval, whilst WTI was hovering around $61 per barrel.

1. Guyanese Politics Start to Mess Things Up Badly

- As the Caribbean Court of Justice (CCJ) is reviewing the case whether the December 2018 vote of no-confidence against the ruling Guyanese parties (APNU-AFC) was legal, the nation’s cherished hopes of an oil bonanza…

Crude oil prices went up again this week as Saudi Arabia found itself at the forefront of sabotage attacks, carried out against oil infrastructure – the Fujairah port in the UAE and the East-West pipeline bringing oil from the oil-rich regions to the safer Red Sea coast. Concurrently, the US-China trade war began to spiral out of control, with both sides slapping tariffs on each other worth hundreds of billions of dollars. Add to this that backwardation is even steeper than previously foreseen (front-month to second-month Brent contracts edging beyond $1 per barrel for the first time since 2013), unexpected shutdowns and maintenances in the Norwegian part of the North Sea and you will get a cocktail fraught with problems.

With Iran now struggling to find a market niche from which it could sell at least part of its erstwhile exports, physical security of oil-carrying vessels or other infrastructure in the Persian Gulf is far from guaranteed. We will see whether the sides can be reasonable enough in this era of unreasonableness. As of today, the global benchmark Brent has been trading in the $70.5-70.8 per barrel interval, whilst WTI was hovering around $61 per barrel.

1. Guyanese Politics Start to Mess Things Up Badly

- As the Caribbean Court of Justice (CCJ) is reviewing the case whether the December 2018 vote of no-confidence against the ruling Guyanese parties (APNU-AFC) was legal, the nation’s cherished hopes of an oil bonanza might be at risk.

- The no-confidence vote was overturned by Guyana’s Court of Appeal and from there the opposition parties took the case to the CCJ, which has been taking its time with adjudicating on the matter.

- If the opposition People’s Progressive Party (PPP) will come out a winner from this, the ambitious plans of ExxonMobil and its partners to reach 0.5-0.6mbpd output by 2025 will be imperiled.

- The PPP considers the production-sharing agreements under which ExxonMobil operates the Stabroek block „too generous” and is openly stating its aim of renegotiating them.

- The Stabroek block has heretofore had 13 discoveries which raised Guyana’s recoverable resource tally from zero to 5.5 Bbbls.

- Under the Stabroek PSA, 75 percent of oil production would go to the shareholders, with the remaining 25 percent to be split evenly on a 50-50 percent basis with the Guyanese government.

- With an additional 2-percent royalty on gross earnings, this would put Guyana’s oil revenues at 14.5 percent (terms which the IMF previously labeled "relatively favorable”).

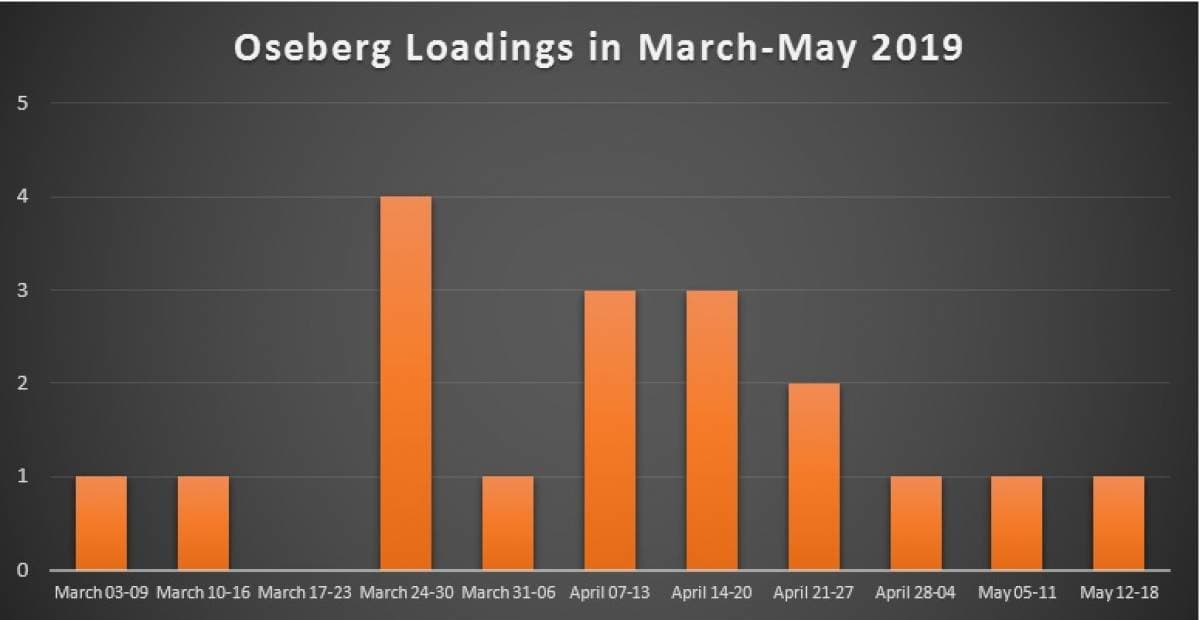

2. Oseberg Off For An Unplanned Shut Down

- One of the North Sea’s flagship fields, the Norwegian Oseberg is to be shut down for at least eight days starting from May 08 due to defects in the fire water pump system.

- The Oseberg platform, comprising the three fields (Oseberg, Veslefrikk and Brage) is pumping around 110kbpd of crude and 9 MMCm per day of natural gas.

- As a consequence, Oseberg premiums to Dated Brent jumped some 60 cents per barrel week-on-week, trading at roughly +1.70 USD per barrel.

- This unexpected hiccup only tightened the North Sea market as fellow Norwegian complexes Ekofisk and Statfjord are heading into planned field maintenance this June.

3. Rosneft Secures Venezuela Waivers

- Rosneft announced that it has secured a waiver from the US Treasury, insulating it from any sanctions-related repercussions.

- Since PDVSA still owes Rosneft a fair share of the 6.5 billion provided by the Russian giant in advance payments (2.4 billion by the end of 2018), Rosneft’s taking of vessels to India does not count as full-fledged transactions.

- After the Rosneft-led consortium bought Nayara Energy in 2017 for $12.9 billion, the Russian NOC has been responsible for supplying the 405kbpd Vadinar Refinery.

- India’s imports of Venezuelan crude dropped palpably in January-February 2019, however, this was largely due to supply constraints after the series of nationwide blackouts in Venezuela.

- Since March, India’s imports are oscillating in the 250-350kbpd interval.

4. SOMO Goes For a New Portion of All-Time Highs

- Following in the footsteps of Saudi Aramco’s across-the-board price hike, the Iraqi state oil marketer SOMO raised its official selling prices for all its Asia and Europe-bound June-loading cargoes.

- Asia-bound Basrah Heavy cargoes will see the biggest month-on-month price increase after SOMO put the June discount at -1.4 USD per barrel against the Oman/Dubai average, 80 cents higher than May’s.

- This marks the second consecutive time that the Basrah Heavy OSP reached an all-time high ever since SOMO started to assess it separately.

- The June OSPs destined both for Europe and Asia were raised by 60 cents per barrel, to a 1.6 USD per barrel premium over Oman/Dubai average and a -1.7 USD per barrel discount against Dated Brent, respectively.

- The European Basrah Heavy OSP reached an all-time high, too (at a -4.25 USD per barrel discount to Brent), whilst Kirkuk also rose to a 7-year maximum at a -1.15 USD per barrel discount to Brent.

- The price increases were much more modest for customers in the Americas with Basrah Light and Kirkuk hiked a mere 10 cents per barrel, whilst Basrah Heavy was rolled over from May.

5. ADNOC Lifts Retroactive April OSPs

- ADNOC has raised all of its retroactive official prices for April-loading cargoes, raising premiums against the Dubai monthly average by 30-50 US cents per barrel month-on-month.

- ADNOC’s latest portfolio addition, the light Umm Lulu grade (39 API, 0.7 percent sulfur), saw the steepest premium increase of 46 cents month-on-month.

- Medium sour Upper Zakum witnessed the least substantial premium hike, increasing 0.26 USD per barrel month-on-month to a 1.17 premium over the Dubai monthly average.

- For the first time since Umm Lulu assessments were launched in October 2018, the new grade’s premium surpassed that of ADNOC’s flagship crude, the light sour Murban.

- In the meantime, as ADNOC is preparing for a massive 2020 refinery turnaround-cum-upgrade at its 400kbpd Ruwais refinery, it is looking into ways on how to expand its retail presence around the Middle East.

- ADNOC would move more assertively into the Dubai emirate as well as to try getting into the Saudi Arabian retail market.

6. ENI Discovers Gas in Offshore Ghana

- The Italian oil and gas major ENI has announced another discovery in Africa, this time hitting 550-650 BCf of gas and 20 Mbbls of condensate with its Akoma-1X well.

- Drilled to a total depth of 3790 meters, the Akoma well encountered a 20-meter net sandstone pay.

- Gas from Akoma will most likely be fed to the Sankofa FPSO a bit more than 12km from the drilled well, to be subsequently transported onshore Ghana.

- Oil started flowing at Sankofa already in May 2017, with gas coming onstream in August 2018, expected to plateau at 180 MSCFd for the next 15 years.

- Sankofa in itself will cover roughly half of Ghana’s power generation needs, with gas from Akoma also intended to be fed into the Ghanaian power grid.

- The Ghanaian deepwater offshore gas discoveries are unique in the sense that they focus primarily on meeting domestic requirements and not exporting the produced hydrocarbons abroad.

7. Uganda Launches 2nd Licensing Round

- The government of Uganda will offer five new oil blocks in its second upstream licensing round, aiming to tap into estimated reserves of 1.4 BBbls of oil and 0.5TCf of gas.

- The exploration blocks, ranging from 400 to 1300km2, are located to the south of first-round finds like Nkassa or Kingfisher, both onshore and offshore Lake Albert in the Albertine rift basin.

- Of international oil and gas majors, Total, UK-based Tullow Oil and the Chinese CNOOC are present in Uganda, even though the blocks they were allotted are still not producing.

- The root causes of the lengthy delay were disagreements over taxation, the financing of a crude export pipeline and a 30kbpd refinery in Uganda.

- IMF now expects Uganda to start crude exports in 2023-2024 (the government itself is aiming for a more ambitious 2022), with further delays down the pipe if the parties do not agree on a FID with the relevant oil majors.

- Oil exports could boost Uganda’s economy by 6-7 percent per year in the long term, however, the high cost of building the pipeline (around $8 billion) and the refinery ($3-4 billion) are making negotiations difficult.