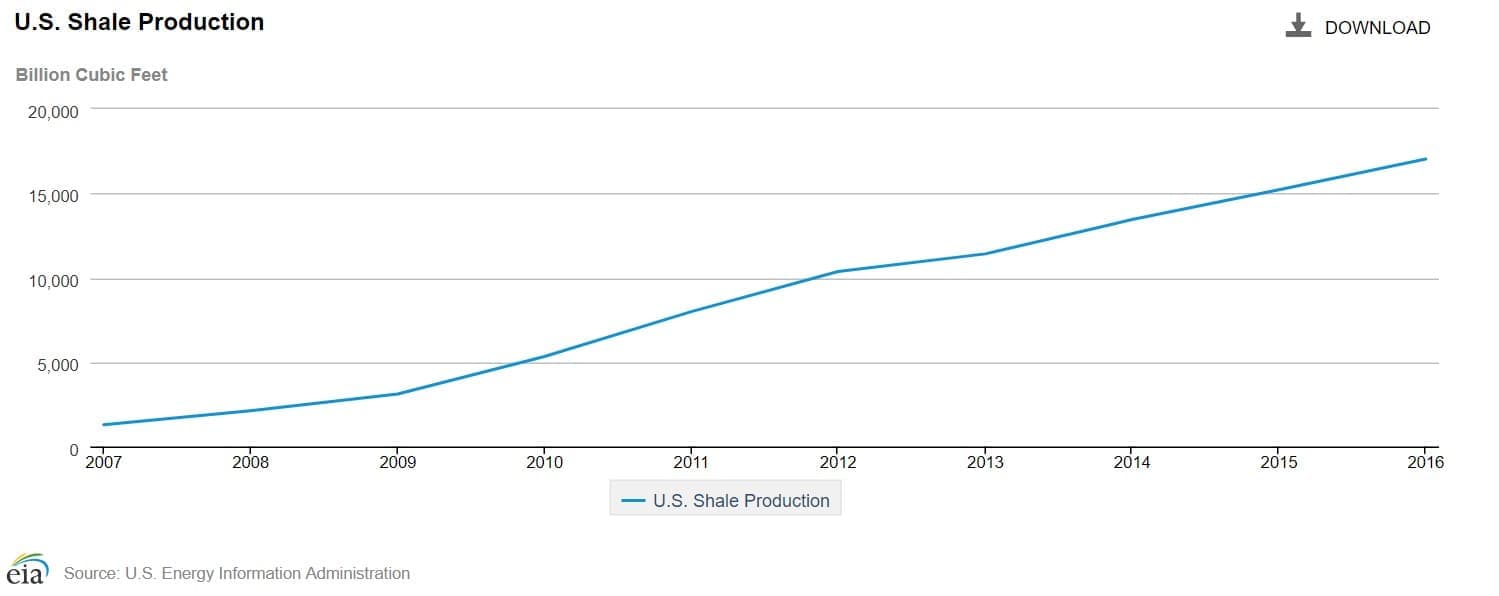

One of the often-unsung aspects of the shale revolution that has taken place in the U.S.A. over the last few years, is the amount of natural gas that’s been produced. Natural gas, or ‘Natty’ as it is sometimes affectionately referred to, has turned into a bumper crop that America is not quite ready to fully absorb into its economy.

Shale, as we are learning, can be gassy due to the way the source rock often accumulates in laucaustrine-like settings, i.e. lake and shallow sea beds. Fine grained sediments filter down through the depths, combining as they do with mostly planktonic marine life, and pack tightly as they are compressed by further sedimentation. Wait a couple of hundred million years, for the Types II, and III kerogen that this usually accompanies sediment of this type to fully mature, and ‘Bob’s your Uncle,’ you have Natty. This source rock is often associated with wet-gas as well, depending on the burial depth and thermal maturity. Add in a nice fifteen or twenty-million-pound sand-frac, and you have lots of them both. Perhaps more than you are ready to deal with.

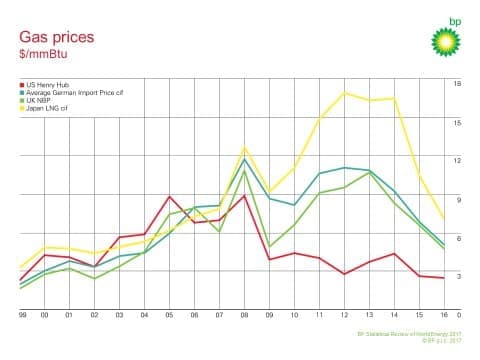

What this has done is turn America into the global low-cost producer of natural gas and the heavy ends associated with wet-gas. The BP review of World Energy slide pack below illustrates this point. It can be clearly seen that one off-shoot of the American frac miracle, has been a massive decrease in the cost of this fuel. A situation driven largely by the bounty of shale gas now being produced.

This has turned into an embarrassment of riches in a way, as the infrastructure; pipelines to take dry gas to markets, and the cryogenic plants needed to extract the heavy ends for LPG, Ethylene, and LNG production just aren’t in existence yet. Due to perennially low prices, and a political mindset that made construction of new pipelines difficult, the ability to monetize this new-found bounty has been impeded. This lack of transport and compression capacity has impacted the stock of producers in recent times, as without an obvious way to sell production, investors have come to view Natty as a potentially stranded asset. Related: Shale Boom Creates New Petrochemical Hub

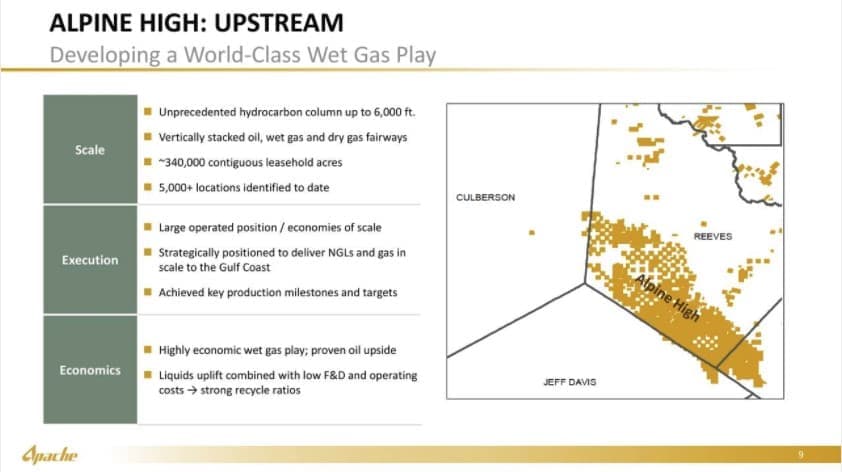

John Christman, CEO of Apache Corp, whose stock has been punished in the first three months of this year, said in their most recent conference call, in relation to the monetization of their Alpine High asset,

“I cannot overstate the strategic importance of the midstream solution at Alpine High. The optimal outcome requires a deliberate and thoughtful approach, highly integrated with the upstream development plan, and we are investing the necessary time and resources to get it right.”

Alpine High is a largely wet-gas play that Apache is developing in the Delaware sub-basin of the Permian basin. This is a potential 3-billion BOE discovery that was initially viewed by the investment community as a stranded asset, leading to a massive 30 percent sell-off in Apache’s stock the first three months of 2018. Apache’s response has been to invest nearly a billion dollars in cryogenic plants, and trunk lines to connect Alpine High to the WAHA dry gas HUB. The last piece of the marketing puzzle for this asset has been Apache’s commitment to Kinder Morgan’s new 42” bulk transport line, The Gulf Coast Express, or GCX line. This is slated for completion in 2019.

(Click to enlarge)

Source

Located in Southern Reeves County, Apache’s Alpine High is a huge structure containing vertically stacked pays. The nearest sales point is the WAHA Dry gas HUB, located in the Northern quadrant of Reeves County, on the Pecos County borderline.

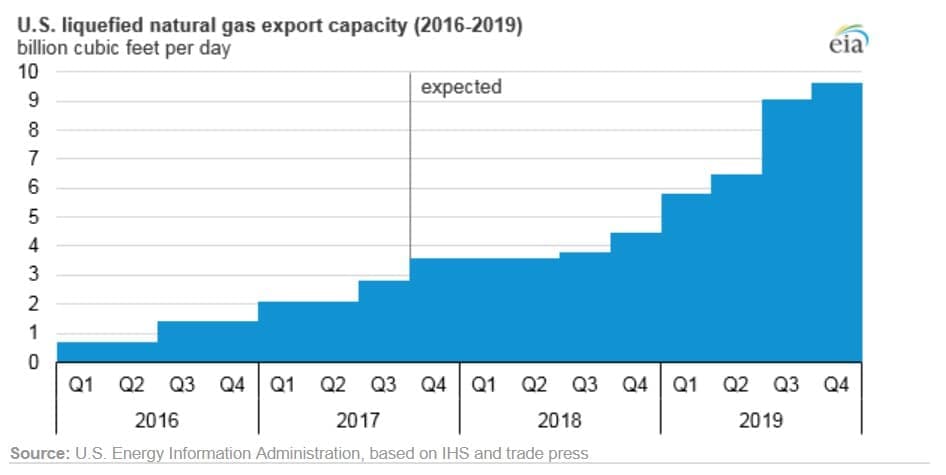

Fortunately for all, this situation is changing rapidly however, and by 2019 America should have its network of pipelines and cryogenic plants ready to handle the export natural gas export volumes coming from shale. Just in time as gas volumes are projected to continue exploding higher. The graphic below highlights the EIA’s view that America’s ability to export this fuel will nearly triple from present capacity of about 3.3 BCFD, to almost 10 BCFD in 2019.

(Click to enlarge)

Source

Nature’s perfect fuel

Why is the demand so high for this fuel? The answer is really two-fold. First, very little compares to it in terms of energy density- the ability of a fuel to do work expressed in MJ/KG (Megajoules per Kilogram) and coming in right next to hydrogen at 55.2 MJ/KG.

Second, it is much cleaner than other commonly considered forms of alternate energy. The carbon dioxide content of natural gas is about 117 pounds per million BTU. Much lower than solid forms of fuel, like coal, which tips the carbon scale at 220.

Together these form the key drivers that will propel natural gas to the forefront of fuels used to provide electricity, and transport as this century unfolds. It is cleaner, and more transportable with the proper infrastructure, than other fuels, and there is loads, and loads of it to supply energy security. Related: Canada’s Oil Patch To Turn Profitable In 2018

Where will it go?

ADVERTISEMENT

The U.S. in a very short period of time has achieved a broad geographic distribution for its LNG exports. The graphic below compiled from the U.S. Energy Information Agency (EIA) data, shows in descending order of Billions of Cubic Feet/day (BCFD) the import requirements of key LNG customers. This trade has exploded as with the advent of cheap shale gas over the last few years. Moving the U.S. from being a net importer of LNG in 2011, to its present dominance in the supply of this fuel to global markets.

(Click to enlarge)

Source: EIA, Chart by Author

Summary

The U.S. was relatively unprepared in terms of infrastructure for the natural gas bounty the shale revolution provided. Fortunately, the demand in global markets for a clean fuel source to replace coal for electricity generation, and mass transport, provided a clear rationale for the rapid development of this infrastructure.

The U.S. from 2019 and onward will be well positioned to compete with other international players, (Australia, Russia, Middle East) in these markets, on a low-cost and dependable supply basis.

By David Messler for Oilprice.com

More Top Reads From Oilprice.com:

- $100 Oil Is Back On The Table

- Venezuelan Oil Enters The Disaster Zone

- IMF: Expect Oil To Fall Below $60