Elon Musk’s reliance on shock-and-awe tactics and unjustifiably lofty performance projections is creating serious problems for the so-called visionary as a growing number of experts have come forward to explain that many of his claims would defy the laws of physics.

The latest group to call bulls--- is Aurora Energy Research, a European consultancy which estimated that Tesla’s electric haulage truck will require the same energy as up to 4,000 homes to recharge – a stunning claim that would seem to raise serious questions about the projects viability, according to the Financial Times.

According to these scientists, modern battery technology is incapable of supporting anything close to the 30-minute charging time Musk has promised for the new Tesla semi-truck.

The U.S. electric carmaker unveiled a battery-powered truck earlier this month, promising haulage drivers they could add 400 miles of charge in as little as 30 minutes using a new “megacharger” to be made by the company.

John Feddersen, chief executive of Aurora Energy Research, a consultancy set up in 2013 by a group of Oxford university professors, said the power required for the megacharger to fill a battery in that amount of time would be 1,600 kilowatts.

That is the equivalent of providing 3,000-4,000 “average” houses, he told a London conference last week, 10 times as powerful as Tesla’s current network of “superchargers” for its electric cars. Tesla declined to comment on the calculations.

Elon Musk, Tesla’s chief executive, has previously said the megachargers would be solar-powered but the company has not confirmed whether they will also have a grid connection for when it is not sunny.

Many of Tesla’s current superchargers are powered in part by renewable energy. The company is also experimenting with storage batteries to ease demands on the grid. Related: Russia Ups Oil Price Forecast For 2018

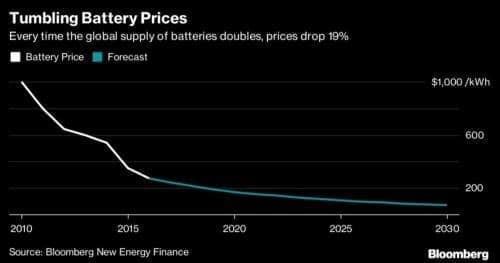

Tesla has promised to begin delivering its trucks in late 2019. Electric battery capacity has been improving at a rate of roughly 8 percent per year – and some have posited that Musk’s lofty claims are merely just him trying to anticipate what will be possible as the first batch of trucks are being assembled. However, if Aurora’s assessment is accurate, then the technological advancements needed to enable a 30-minute charging time for a semi-truck are still years, if not decades, off.

Furthermore, Musk has said little about the enhancements to the power grid that would be needed to power fleets of Tesla’s semi-trucks.

(Click to enlarge)

“There are smart and dumb ways to incorporate this level of capacity requirement into the system, but either way, fully electrified road transport will need a large amount of new infrastructure,” Feddersen told the Financial Times.

National Grid, which oversees Britain’s electricity system, has suggested that in the most extreme scenario, electric vehicles could create as much as 18 gigawatts of additional demand for power at peak times in the UK by 2050.

This is the equivalent capacity of nearly six nuclear power stations on the scale of the Hinkley Point project under construction in the south-west of England. Related: Iran’s Elaborate Sanction-Skirting Scheme

ADVERTISEMENT

Aurora posits that Tesla could try an engineering solution called segmenting – but that approach would come with technological hurdles of its own.

“The fastest chargers today can support up to around 450kW charging, so it’s not clear yet how Tesla will achieve their desired charging speeds,” said Colin McKerracher, head of advanced transport at Bloomberg New Energy Finance, a consultancy.

“One option may be to segment the battery somehow and actually charge different segments simultaneously. This adds additional costs and we haven't seen anything like that done at anywhere near this power output.”

By Zerohedge

More Top Reads From Oilprice.com:

- Venezuela Is Losing Its Best Oil Buyer

- Venezuela To Launch ‘Petro’ Cryptocurrency

- Saudi Oil Minister Hints At Post OPEC Deal Strategy

Also, please stop using phrases like ‘when the sun doesn’t shine’. This is simply not an intelligent way of describing the situation since there are other options like batteries, which Tesla assembles themselves, that may let them avoid/minimize or smooth out grid connections so that so much power is not pulled from the grid in sudden spikes. At the very least this should have been mentioned as a possibility.

There’s no doubt though that electrified transportation will increase the amount of energy the grid will be required to handle in the future. That seems obvious.

http://www.mestmotor.se/recharge/artiklar/nyheter/20170124/farja-helsingborg-helsingor-oresund-scandlines-eldrift-elfarja-elbat/

Fast summation, its about carferries between Denmark and Sweden that shall be converted to battry power. Battery 4.160 kWh (thats 41 Tesla Model S) and the charing time shall be 10 min... its all about how many amps you want to use... a robot will conect the cabel to minimise the risk..... so "30-minute charging time for a semi-truck are still years, if not decades" are totaly wrong.... a better question how long time will it take to build out a net for "super charging"

Well, yeah. But it's not nearly the area you think. Certainly won't seem that way as it will be distributed throughout each grid in various sizes... From a few KW to many MW.

But until then, it's still far cheaper and far if you run them off the current idled generation particularly at night.

But still the trucks will ship 2019 or so, in small numbers deployed scattered throughout and mostly charged at night when they ground out way too much power they'd rather sell.

So yeah, not the moon shot, not even the challenges of building the Iowa class battleships.

Besides, they're deploying storage batteries at many current supercharger sites now. Imagine what they could make in selling some fraction of that as grid services... firming up weak spots in a particular grid points.

There are always thoose who will use arguments instead of facts when they want to "market" an opinion. And an opinion is al that zerohedge presents in this case. They are just scared of change.

Battery weight, originally it was 160 Watts/Kg, then up to 240 and currently Tesla is doing 300. Other companies are developing 450 with even higher density on the way.

The weight of batteries and motors and drive train compares more than favourably with a Diesel Motor, transmission, Cooling, drive train and tank full of fuel

1,600,000 W / 4,000 Houses = 400 Watts / House.

I have news for you, an average house consumes more than 400 Watts of power. An average fridge consumes more than 400 Watts on its own. Sounds like the so called scientists have a special interest sugar daddy, or they are the same so called scientists with bogus degrees that constitute the 3% of scientists that reject climate change.

Personally, I would rather have the world follow Elons' vision than the vision of the Koch brothers.

Keep buying buggy-whips. There isn't any infrastructure for petroleum-burning motor carriages. Draft animals have pulled humanity for 2,000 years, these newfangled inventions are just plain silly.

________________

Electric cars have been around longer than gas cars actually.

They will not be practical for most people until the can charge up much faster than they do now. The range is close to where it needs to be though.

Segmenting large battery packs are childs play. Each pack is composed of modules. It appears there are 4 supercharger like connections bundled together, and there are 4 motors. Likely more then coincidence.

2points, if the "years away" statement had Merritt,, we'd still be gutting whale's for lubrication and lamps.

As far as analyst go, 2points, those so called pro's called for $100 buck oil this year two years ago and were spreading negatives about Musk,, hoping he fail and predicting a fall of his EV car production,, GM, a giant,, is shuttering it's plant's and moving towards the future of EV's.

No where but in the heavens is none the quantity of energy,, its everywhere. And there are no limits to; "CAN DO" except self sabotage.