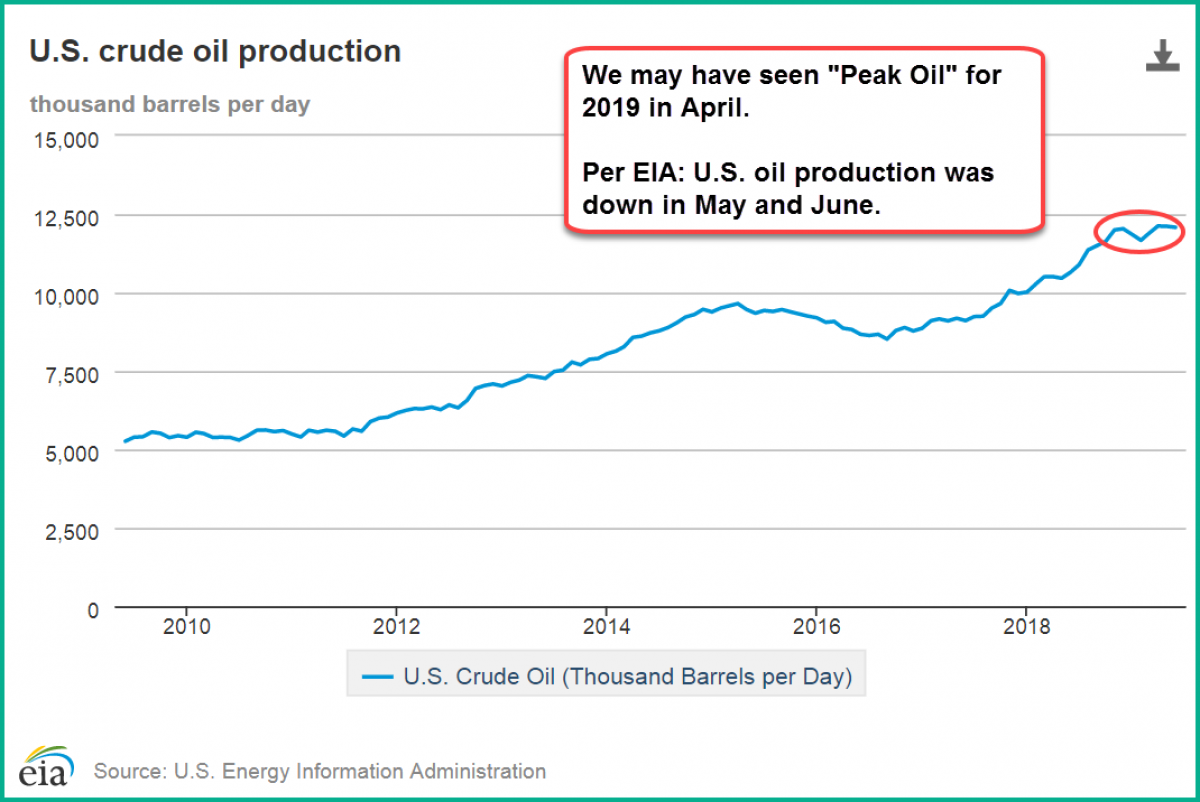

Two weeks ago, Oilprice.com published my notes which supported my belief that U.S. oil production has “hit a wall”. Last week, EIA confirmed my conclusion. The EIA’s 941 report shows that after U.S. crude oil production peaked in April at 12,123,000 barrels of oil per day (“BOPD”) production declined 8,000 BOPD in May and another 33,000 BOPD in June. Preliminary estimates say that when actuals are available for July, they will show an even larger decline.

These are not big declines, but with the active drilling rig count continuing to fall, I feel confident in telling you that U.S. oil production over the second half of this year is not going higher. When EIA reports actual production figures for July at the end of this month, they are surely going to be lower because of the well shut-ins due to Hurricane Berry in the Gulf of Mexico. Barring another GoM hurricane, oil production should rebound a bit in August and September. However, I don’t see anything that will return U.S. oil production to the peak set in April.

Note that EIA’s weekly U.S. oil production “guestimates” have been around 12.3 to 12.5 million barrels per day recently, but most of you should know by now that EIA’s weekly numbers are based on flawed formulas. The Department of Energy has a long history of missing the change in trends of supply and demand.

We need much higher oil prices soon or the global market will soon be undersupplied.

On September 3rd Raymond James published an Energy Industry Brief that contained a statement that all of you should read carefully: “We believe the single most important longer-term driver of oil prices and the energy market over the next five years will be the change in U.S. well productivity.” I agree with this statement 100%.

EIA, the International Energy Agency (“IEA”), the OPEC cartel, Russia and just about everyone that covers the energy industry knows that the surge in U.S. oil production this decade has been the primary source of new supply. The widely held paradigm is that the U.S. can continue to meet the world’s increasing oil demand through the next decade.

The BIG QUESTION then becomes What if U.S. oil production doesn’t keep growing?

The shale revolution has been great for U.S. consumers. We all love lower fuel prices. Abundant low- cost energy is directly related to our booming economy and our high standard of living. So, what has happened to dash the “expert opinions”?

The simple answer is that lower oil prices as a result of the shale production surge has caused upstream oil & gas companies to slash drilling & completion budgets. That’s true, but it is only half of the reason for lower U.S. oil productivity. Related: Oil Majors Go Bargain Hunting In The Permian

Since 2010, when the shale oil revolution really got started, the average horizontal well productivity has increased by an average of 30% through 2018, BUT oil well productivity gains have almost stopped in 2019. Just a few months ago our friends at Raymond James were forecasting a 10% productivity gain this year and 5% in 2020. Other analysts had even higher estimates. I received several emails after my last article that told me that increased productivity gains would more than offset the decline in the active rig count.

We are completing a lot fewer wells and the newer wells are declining faster. Part of the reason for the faster decline rate (60% to 70% during the first year for the average horizonal well) is because upstream companies drill their best leasehold first. All oilfields go on decline after the Tier One drilling locations are fully developed. The Tier Two wells cannot offset the declines of the Tier One wells.

Fact: The Permian Basin is not one big Tier One area

Per Raymond James Energy Stat, “In terms of IP-90s (a well’s initial production in the first 90 days after completions), productivity growth has not only slowed, it actually declined for the wells completed in 1Q19. While U.S. IP-90s declined 2%, Permian IP-90s declined 10% relative to 2018.” I know this sounds bad, but it is very bullish for oil prices.

The more important reason that well productivity has declined this year, is that upstream companies have gone into full “development mode”. Most of the upstream companies were drilling “parent wells” to HBP (“Hold by Production”) as much of their extremely expensive Permian Basin leasehold as they could and to “prove up” lots of oil & gas reserves. HBP leasehold and proved reserves are what supports their bank credit facilities. Now that they have gone back in to drill & complete “child wells” from the same pads they are reporting some disappointing results.

It is early, but it appears that close horizontal well spacing is leading to wellbore production interference and thus lower expected recoverable reserves per acre. Think of it as the wells “cannibalizing” from each other. Related: Big Oil’s Very Risky $50 Billion Bet

Another reason could be that the massive frac jobs on the parent wells combined with all the gas and fluids extracted to date have created a low-pressure zone. When the child wells are frac’d the frac fluid and proppants migrate to the “pressure sink” and the new wells end up with less effective completions.

ADVERTISEMENT

The longer a parent well has been on-line the more likely it is for pressure sink issue to be a problem. So, it is best for all the wells in an area to be drilled and completed at the same time to get more uniform frac placement. The problem then becomes economic. To drill and complete up to a dozen horizontal wells from one pad and the massive production facilities to handle the initial production surge is around $100 million. That is a lot of capital to tie up.

Conclusion: My take is that the U.S. putting the brakes on oil production growth, for whatever reason, is bullish for oil prices. Contrary to the belief of most Democratic Presidential Candidates, this world will continue to run on oil. Thanks to a lack of global exploration expenditures, there has been a lack of new oil reserves found. We are going to need much higher oil prices to get the world’s exploration & development engine going again. I believe the “Right Price” for Brent oil is $80/bbl. That is also the oil price that Saudi Arabia would like to see when they take Aramco public next year.

Let me add that without the U.S. lifting sanctions on Iran & Venezuela, there is no way the OPEC cartel can increase production back to the level they produced in Q4 2018.

By Dan Steffens for Oilprice.com

More Top Reads From Oilprice.com:

- The Coming M&A Wave In U.S. Shale

- Saudi Aramco Boosts Oil Investment In China’s Downstream

- Energy Industry Stumbles As Recession Looms