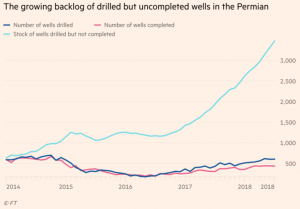

To be fair, not all shale gas drilling is slowing, but in the Permian Basin, which has seen the most incandescent growth in recent years, according to the Financial Times, growth is slowing markedly, according to Schlumberger, Halliburton and the U.K.’s Weir Group – all majors suppliers to, or active players in, the fracking industry.

Source: Financial Times

The article cites logistical challenges, including labor costs and a lack of adequate pipeline capacity constraining growth. The article states the following factors have undermined the economics of oil production in the region:

- Rising costs for labor and equipment

- Difficulties in disposing of the unwanted water and natural gas produced alongside the oil

- And, above all, a shortage of pipeline capacity for taking crude from the wilds of west Texas to refineries and export terminals along the Gulf of Mexico coast.

The Financial Times quotes Bill Thomas, chief executive of EOG Resources, who said: “When you’re focused on one basin, one play, it gets very difficult to continue high rates of growth.”

Source: Financial Times

From a low two years ago, the tight oil industry’s rebound has been impressive. Much of it is coming from the Permian Basin, with national production up by 1.5 million barrels a day in the 12 months to July. Related: Russia Looks To Boost Gas Sales In Tighter European Markets

But questions are being asked as to whether or not the Permian may be reaching a plateau. New wells drilled alongside older wells are relatively less productive than the original when assessed on the basis of their length and the weight of sand used in the fracking process — so-called “parent” and “child” wells, as the Financial Times calls them.

That would suggest the long-term potential for the region to continue impressive growth at ever-lower cost is called into question.

Whether that proves to be the case remains to be seen. Of course, the Permian is not the only tight oil resource in the country. While others haven’t seen the level of investment the Permian has enjoyed in the last two years, subject to oil prices, the other regions still have huge potential.

ADVERTISEMENT

What it probably does say is the stellar growth of recent years is unlikely to continue and may be slower from the middle of this year onwards. With the dramatic rise in steel prices following the U.S.’s imposition of a 25 percent import tariff on steel products, it was to be expected drillers would find both exploratory work and infrastructure investment slowing. However, the Financial Times suggests the slowdown has caught many in the industry by surprise and suppliers’ share prices have taken a hit as a result.

By Stuart Burns via AG Metal Miner

More Top Reads From Oilprice.com:

- Goldman: Don’t Expect A Major Oil Price Spike From IMO Regulations

- The Start Of Saudi Arabia’s Power Play

- Is A New Crisis Brewing In The Saudi Royal Family?

Other than the EIA, peak production in the Permian has been given as between 2018-2020. Seems about right. US aggression against Iran better happen soon, before the world starts needing Iran's oil.