Oil prices closed the week on a positive note, as professional buyers are more convinced that oil is trending higher in the short term.

(Click to enlarge)

(Click to enlarge)

(Click to enlarge)

(Click to enlarge)

(Click to enlarge)

(Click to enlarge)

Friday, March 29th, 2019

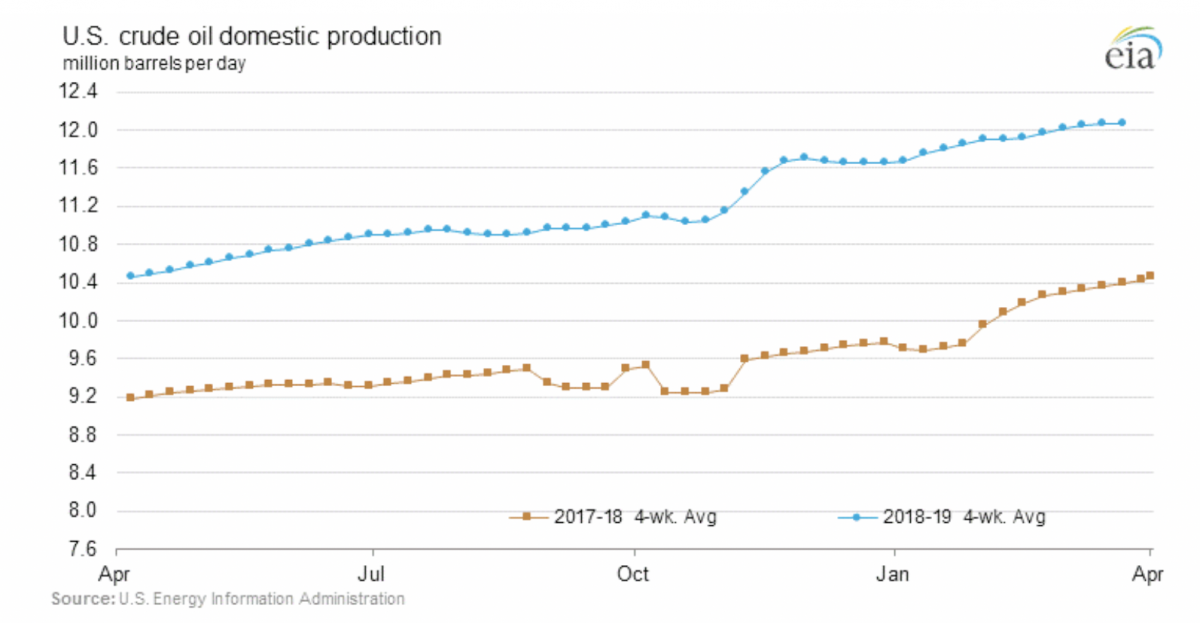

While the breakneck growth of U.S. oil output has slowed considerably since January, domestic production continues to expand (albeit slowly) and will likely continue to grow thanks to tight oil production, according to projections from the U.S. Energy Information Administration (EIA). Meanwhile, overseas, Venezuela continues to face rolling blackouts and plunging oil production, Trump took to Twitter to take on OPEC, and international oil prices have remained weak in the wake last week’s “flurry of bearish news.”

Mega-merger joins the world’s largest oil company and petrochemical company. In a long-anticipated move, Saudi Aramco acquired a whopping 70 percent stake Saudi Basic Industries Corporation (SABIC) for $69.1 billion in what the New York Times reports to be an alternative strategy to “finance an ambitious campaign to modernize the kingdom” in lieu of any movement on the company’s extremely delayed initial public offering.

Trump takes to Twitter to decry OPEC. The tweet, which urged the organization to “increase the flow of Oil”, sent oil prices falling. The results saw WTI trading down $0.46 (-0.77%), and Brent down $0.52 (-0.77%) at 11:25am EST on Thursday.

Continued blackouts in Venezuela threaten oil production. With its second bout of nationwide blackouts in less than a month, completely halting operations at the nation’s main oil export terminal as well as its heavy crude processing complex. While Maduro continues to blame U.S. sanctions for the power outages, the White House maintains that the matters are entirely unrelated. OPEC will likely chalk up the blow to Venezuela’s oil production to a success, with every dip in the global oil inventory driving up prices.

Related: China’s Mad Scramble To Boost Domestic Oil Production

China’s Sinopec reports catastrophic profit drop. In a story broken by Reuters, the world’s second-largest oil company Sinopec reported a jaw-dropping 76-percent drop in its latest quarterly profit for October-December 2018. China’s top refiner suffered even worse losses, with Bloomberg reporting that the company’s profits fell by as much as 90 percent in the fourth quarter. The nosedive is not due to normal operation, but derivatives trading losses brought by the Unipec, the company’s trading arm, which, thanks to bad oil hedging bets, saw net losses of US$690 million (4.65 billion yuan) in the fourth quarter of 2018.

Mexico desperately tries to save its rapidly sinking oil company. Mexico is looking at potentially dipping into a stabilization fund to pay off as much as USD$7 billion to pay off some of the national oil company’s crushing debt. Finance Minister Carlos Urzua told Bloomberg, "Pemex must show that it really has a very robust business plan in the mid- and long-term[...]At this point, the risk perception that global investors have about Pemex isn’t the best." That’s putting it mildly. The criticism of Pemex’s direction isn’t just international, however. Just today three of the troubled company’s board members announced their departure from Pemex due to irreconcilable political differences with Mexico’s new leftist president Andrés Manuel López Obrador.

ADVERTISEMENT

Signs point to recession...but are oil markets taking heed? With the U.S. Federal Reserve, joining the IMF, the World Bank, and the OECD in making public statements about an impending economic slowdown, what are oil markets doing to prepare? Not much, apparently. The U.S. continues to push for higher oil production as U.S. stock and oil markets remain robust and bullish, but reality bites, and according to experts both “can be expected to correct.”

Saudi Arabia angles for $70 oil despite Trump’s outcry. Sources speaking to Reuters say that not only are the Saudis and OPEC aiming to lower crude inventories and rebalance the market, but they are also working toward the specific goal of a $70 dollar barrel. This number is reportedly the minimum oil price needed by the Saudis in order to meet the kingdom’s budget. The initiative directly flies in the face of Trump’s pleas for lower oil prices in order to support heavier sanctions on both Iran and Venezuela. Speaking of which…

Related: Cuba Faces Oil Crisis As Venezuela Crumbles

Washington D.C. appeals to traders to stop buying Venezuelan oil. Foreign commodity traders and refiners are not covered by the latest round of sanctions, leading the U.S. to contact buyers directly and implore them to unilaterally support the Trump administration’s financial blockade against contested Venezuelan president Nicolas Maduro. One anonymous source speaking to Reuters sheds light on the situation: “This is how the United States operates these days. They have written rules and then they call you to explain that there are also unwritten rules that they want you to follow.”

The U.S. continues to defy China in the Indo-Pacific. Last week, Trump provoked angry remarks from the Chinese government when he bolstered U.S. military presence in the heavily-contested, resource-rich South China Sea. This week he doubled down on his flagrant disregard of China’s warnings by cozying up to Taiwan (in direct defiance of the One-China Policy) and sending two American ships through the ever-more controversial Taiwan Strait in a politically fraught move that a Navy spokesman described as a demonstration of “U.S. commitment to a free and open Indo-Pacific."

Oil Rig Count Drops, WTI Hits $60. The U.S. active oil and gas rig count fell for the second consecutive week as U.S. crude production plateaus. In a repeat of last week, the U.S. total rig count fell by 10 rigs. The total amount of oil rigs fell by 8 to reach 816, and the gas rig count fell by 2 to reach 190. That being said, the total rig count is still slightly higher--13 rigs to be exact--than this time last year. The slowdown was felt even more exaggeratedly in Canada, where the total rig count fell to 88, a loss of 17 this week and a loss of 46 as compared to this time last year.

By Tom Kool for Oilprice.com

More Top Reads From Oilprice.com:

- Sources: Saudis Admit They Want $70 Oil

- Trump’s Last Chance To Subdue Gasoline Prices

- Oil Rig Count Falls As WTI Hits $60

Moreover, Saudi Arabia will not come this time to the aid of President Trump as it did in June last year when it agreed to raise its oil production to offset an expected decline in Iran’s oil exports and ended up with a collapse of oil prices by 43% from $87 a barrel to $50 and with the Trump administration issuing sanction waivers to eight of Iran’s biggest buyers of its crude.

This time Saudi Arabia is steeply cutting its production and exports beyond its share of the OPEC+ production cuts aiming to bring the global oil market to balance and pushing oil prices beyond $80 which is the level it needs to balance its budget.

As for Venezuela, it seems that US sanctions are already failing to adversely affect Venezuelan oil production and exports to the extent that the United States is now resorting to pressure foreign commodity traders and refiners to suspend their trades with Venezuelan oil.

Having failed to stop Venezuela’s crude oil production and exports, the US-backed coup and its accomplices plunged Venezuela two times so far in a massive power outage in order to stop oil production and exports. Still, Venezuela managed every time to resume oil production and exports.

The Trump administration suspended sales of diluents to Venezuela to stop the country’s oil production and exports but Russia and India came to the rescue by providing the needed diluents.

The push against oil traders and refiners comes amid a loss of momentum in the US-backed coup. Moreover, Venezuela has managed to redirect the 500,000 barrels a day (b/d) it used to export to the United States to China, India and the European Union without any loss to the global oil supply. China has been buying big volumes of Venezuelan oil estimated at 531,000 b/d. China of course wants to secure as much of cheap supplies as possible, especially from those who are friends with it such as Venezuela and Iran.

There are no signs of recession in the global oil market as manifested by the robust global oil demand and China insatiable thirst for oil. However, there is some uncertainty hanging over the global economy as a result of the delay of an agreement between the United States and China to end their trade war.

If President Trump, emboldened by his recent clearance of alleged collusion with Russia, thinks he can drag his feet in order to extract concessions from China, he will definitely be disappointed as China will never put its name to any agreement enabling President Trump to claim victory. Meanwhile, the US economy continues to suffer far more than the Chinese economy as a result of the conflict.

And rather than responding to President Trump’s reckless provocations of sending two American ships through the controversial Taiwan Strait and also two B-52 bombers to fly over the South China Sea’s contested waters, China is quietly building airstrips and naval harbours on the disputed islands and reefs and biding its time until it has the upper military hand in the South China Sea. Still, China made it clear to President Trump that the “One China Policy” is a red line that shouldn’t be crossed.

This confirms what I have always maintained that the US imposition of tariffs on billions of dollars of Chinese exports to the United States had far less to do with the huge trade surplus between the two countries and China’s trade practices and far more to do with the launching of the petro-yuan and the challenge that China poses to the US.

Dr Mamdouh G Salameh

International Oil Economist

Visiting Professor of Energy Economics at ESCP Europe Business School, London