Oil markets have found themselves torn once again between supply fears and an economic slowdown, with oil prices now having stabilized at a lower level.

Investor Alert: A new breakthrough – known by only a handful of scientists, researchers and insiders – is about to turn the energy world upside down. And one small company is at the center of it all. Get the full report here.

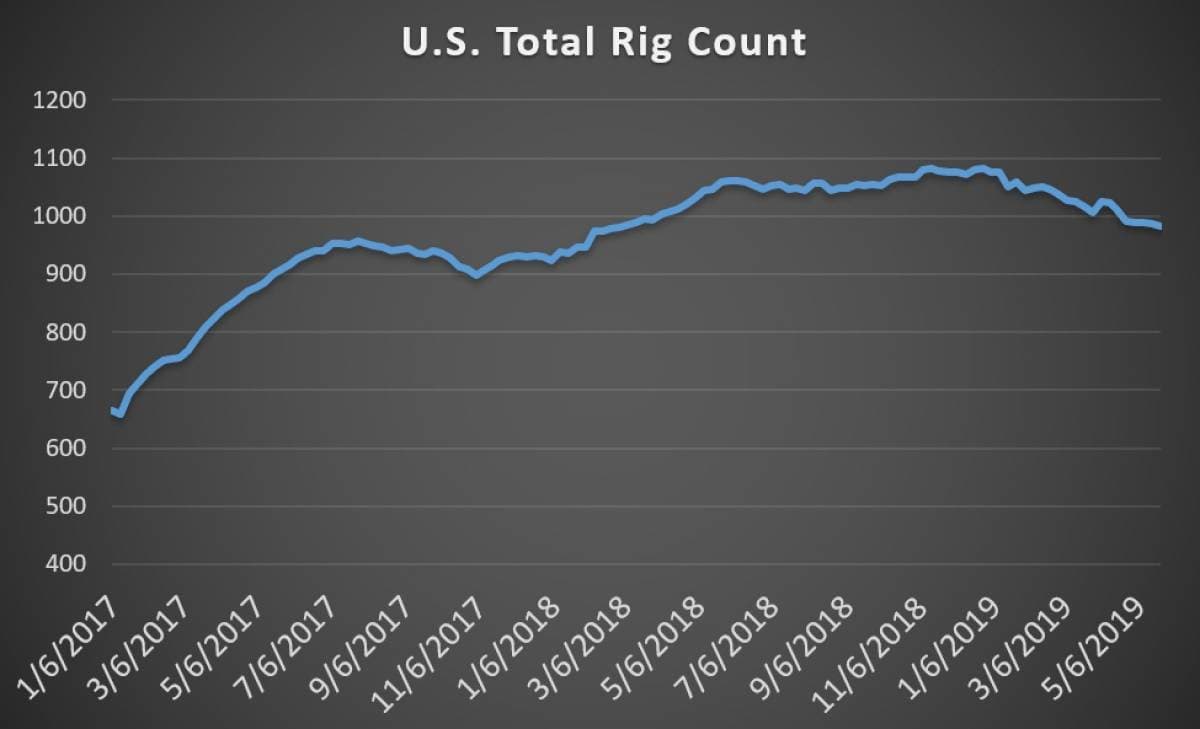

(Click to enlarge)

Chart of the Week

- U.S. motorists saw average regular gasoline prices at $2.85 per gallon over the Memorial Day weekend, slightly lower than last year’s $2.92/gallon.

- “EIA expects U.S. regular retail gasoline prices will increase in the coming months and average $2.92/gal during the 2019 summer season,” the agency said, which would be 7 cents higher than last summer.

- Lower inventories and an uptick in consumption should keep prices elevated. Although, as always, the price of gasoline is at the mercy of global crude oil prices.

Market Movers

- S&P downgraded Schlumberger (NYSE: SLB) by one notch to A+. It also gave Halliburton (NYSE: HAL) a Negative outlook, down from Stable. Both oilfield service companies are being negatively impacted by the slowdown in drilling activity in North America.

- Algeria will block Total SA (NYSE: TOT) from buying Anadarko Petroleum’s (NYSE: APC) assets in the country until its concerns are answered. Total has agreed to acquire Anadarko’s assets in Algeria, Ghana, Mozambique and South Africa for $8.8 billion.

- Seadrill (NYSE: SDRL) plunged by nearly 15 percent in pre-market after Carnegie Investment Bank recommended selling shares. The offshore rig market recovery is “not happening fast enough” for Seadrill, Carnegie said.

Tuesday May 28, 2019

Oil started the day mixed, with WTI up but Brent flat. The market seems to be once again stuck between supply outages on the one hand, and fears of a softening economy on the other. That was the same dynamic for much of May, although prices have now stabilized at a lower level, with WTI right around $60 and Brent under $70. “Oil prices lack direction because the oil market currently finds itself caught between supply risks and concerns about demand,” Commerzbank said.

Fragmented European elections; Greens surprise. Record turnout for European Parliamentary elections produced mixed results, but also lots of drama. The far-right parties in Italy and France did well, but the Greens also did well in a number of countries. The traditional parties closer to the center were hit hard in some places. Eurosceptic parties increased their total, but there was no continent-wide sweep. The addition of Greens and Liberals could move up climate change as a major issue at the European level.

North Dakota flaring continues. The shale boom in North Dakota has led to a spike in flaring, despite the state setting out flaring rules intended to cut down on the practice. In 2014, the state adopted targets, aiming for no more than 15 percent of production flared by 2016, a level that would lower to 10 percent by 2020. In March of this year, the industry flared 20 percent. “We need to find an excess flared gas solution immediately,” said Republican Rep. Vicky Steiner. “It's a shame. I'd like to see us find a use for this.” Related: Norwegian Oil Patch Ramps Up Spending To Counter Decline

Trump signals softer line on Iran. President Trump said that he is not seeking regime change in Iran, and only wants to contain their nuclear weapons, a comment that seems to contradict the rising drumbeat for war. “We are not looking for regime change. I just want to make that clear,” Trump said during a visit to Japan. “I’m not looking to hurt Iran at all. I’m looking to have Iran say no nuclear weapons,” Trump said. “No nuclear weapons for Iran and I think we will make a deal.”

Morgan Stanley: Shale is deflationary force. The increasingly important role of U.S. shale in the global energy mix is a deflationary force in the medium-term, Morgan Stanley argues. Unlike conventional production, shale resources are abundant and the real cost determinant is the industrial process following extraction, which means that costs can be driven down over time.

Iran oil exports drying up. Traders say that buyers of Iranian oil have disappeared following U.S. sanctions. In March, the countries that had exemptions on U.S. sanctions purchased 1.6 million barrels per day from Iran, and evidence suggests that they are all mostly abiding by U.S. demands to cease purchasing. “China has enough problems with the U.S. They don’t want to give them a pretext,” an Iranian oil executive told the WSJ.

Kuwait: Oil balance later this year. Kuwait’s oil minister argued that the oil market will reach balance later this year with steady demand and declining inventories. But uncertainties, including the trade war, mean that OPEC+ has more work to do.

Refiners face shifting markets. A shortage of heavy oil due to the outages in Venezuela and Iran are cutting into the profits of refiners who rely on such oils. Gulf Coast fuel oil, a byproduct of heavy crude, saw prices surge to a six-month high. As refiners ramp up production of gasoline, their margins are narrowing. Meanwhile, for refiners who have made expensive upgrades to produce cleaner fuels, the forthcoming IMO rules on sulfur concentration could provide a windfall, the Wall Street Journal reports.

Renewables spending surpasses oil and gas in Asia. As soon as 2020, total investment in renewable energy in Asia and the Pacific (excluding China) will overtake spending in oil and gas, according to Rystad Energy. “These countries each have strong pipelines for renewable energy developments of all types, including offshore wind,” says Gero Farruggio, Head of Renewables at Rystad Energy. “And, importantly, most have large targets outlining the inclusion of renewable power sources within their respective energy mixes, with corresponding support policies.”

IEA: World hits another grim milestone. The IEA said that energy consumption in 2018 grew at its fastest pace in a decade. And 70 percent of the additional supply came from fossil fuels. Many of the technologies needed to slash carbon emissions are not on track, the IEA said. CO2 concentration in the global atmosphere continues to rise, and recently hit 415 parts per million.

ADVERTISEMENT

Hedge funds sell more oil. Hedge funds and other money managers continue to liquidate their net-long positions on crude futures. However, in the most recent week, the selloff was a bit lighter, which suggests the correction may have gone far enough. Related: The Single Biggest Challenge For The Oil & Gas Industry

Fiat-Renault merger. Fiat Chrysler has proposed a merger with Renault, and the tie-up could accelerate both companies shift towards electric vehicles. The combination could save $5.6 billion annually, Fiat says. The merger would create the world’s third largest automaker, but because Renault is already tied to Nissan and Mitsubishi, the deal is complex and complicated.

Bank of Canada: Climate change a financial risk. The Bank of Canada listed climate change as one of six major risks to financial stability. Climate change carries physical risks – extreme weather – but also disruption during transition, including sudden policy moves. At the same time, the lack of transparency around carbon exposure at the company level could lead to mispricing of assets.

Fed: Small shale companies face pressure. The Federal Reserve Bank of Dallas said that smaller U.S. shale companies are under pressure to either expand or be acquired. Smaller drillers are losing access to capital and are under scrutiny from shareholders, the head of the Dallas Fed told the FT. “People have said to me in this industry, you’re either a buyer or a seller today,” Robert Kaplan said. “But if you stand pat, where you are, you’re going to be in a dangerous place…Even shale is not immune from disruption and capital discipline, and they’re feeling it right now. And this is why you’re seeing more merger activity.”

Harvard economist: China slowdown is nightmare scenario. The largest threat to the global economy is that China’s economy slows down at a much faster rate than expected, Harvard economist Carmen Reinhart told Bloomberg.

From The Editor's Desk: An urgent piece of research has just come across our desk highlighting what might just be the most significant development in the energy industry since fracking. A group of scientists has discovered a “super-crystal” that is poised to completely transform everything we know about electricity. It’s up to 273% more efficient than silicon solar cells, and it can’t be painting onto almost any surface. I’m sure you can imagine the implications of such a breakthrough! Learn more about the “super-crystal” and the small-cap stock that has surrounded it in patents here.

By Tom Kool of Oilprice.com

More Top Reads From Oilprice.com:

- The Single Biggest Challenge For The Oil & Gas Industry

- Why Bears Will Win The Oil Price War

- Falling Russian Crude Output Lifts Brent Oil Prices