The death of coal has run hand-in-hand with the rise of renewable energy, though the real credit for killing king coal might just go to U.S. shale. Even if the renewable revolution is growing too big to ignore.

There are plenty of environmental and ideological reasons that many academics and pundits are pushing for placing renewable energy at the heart of COVID-19 economic recovery plans. But it turns out that there are plenty of economically compelling reasons for a renewables-forward strategy as well. Last month the World Economic Forum published a report pleading with the energy industry to use the novel coronavirus’ unprecedented disruption of the economic and societal status quo to begin building a “new energy order.” Although COVID-19 has severely battered (in some cases irreparably) huge portions of the global energy industry, this is a unique opportunity to redirect resources, investment, and research and development into renewable energy ventures that we may never see again in our lifetimes--and then it will be too late.

“Though this is the worst possible way to begin a decade, the coronavirus pandemic and the collapse of oil prices also offer an opportunity to consider unorthodox intervention in the energy markets and global collaboration to support the recovery phase once the acute crisis subsides,” stated the World Economic Forum. “This giant reset grants us the option to launch aggressive, forward-thinking and long-term strategies leading to a diversified, secure and reliable energy system that will ultimately support the future growth of the world economy in a sustainable and equitable way.”

Writers at the Verge also argued that renewable energy should be the way forward and is the clear answer to employing the tens of thousands of oil patch workers that have been fired or furloughed thanks to the oil price crash of recent months. As business as usual has ceased to become an option, “transforming America into a country that runs on clean energy is one-way experts hope to alleviate the devastating economic downturn caused by the COVID-19 pandemic,” the Verge reported.

Related: Lithium-Ion Battery Demand To Increase By More Than 1000% This Decade

And now, just this week, PV Tech reports that “a raft of new studies has come to underscore the business case of pushing renewables to the heart of the COVID-19 recovery, amid claims green energy plays offer a low-cost, high-return opportunity for investors.” Now that the research is being done to investigate claims that renewable energy will be an economic boon for the United States going forward, the numbers certainly seem to support this idea. “Solar and wind levelized costs of electricity (LCOEs) have dropped to such an extent that the world would save US$23 billion per year by tapping these technologies to replace the priciest 500GW of existing coal, according to a new study by the International Renewable Energy Agency (IRENA).”

IRENA director-general Francesco La Camera, as quoted by PV Tech, underscores the magnitude of these findings by saying that renewables are clearly becoming the “default choice” for new energy projects worldwide. “Now, crucially, their continued cost decline means the world can afford to be ambitious amid the crisis,” he continued.

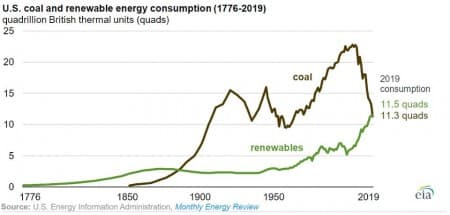

And there has already been some major progress. Just this month, for the first time in 135 years, the news broke that the United States’ consumption of renewables overtook consumption of coal in the last year’s energy mix. “There are two interrelated reasons for this,” reports Forbes. “The collapse of coal consumption over the past decade, which was fueled by the rise of cheaper alternatives.”

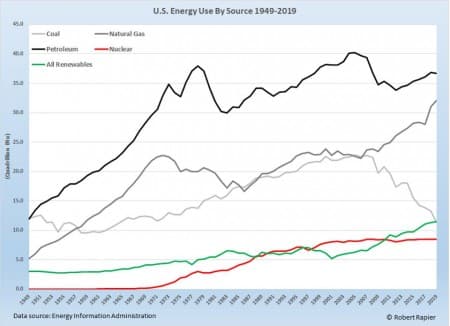

While the unseating of coal is truly extraordinary and bodes well for the overall clean energy transition, however, renewables still lag far behind oil and natural gas in the United States energy mix. And, in fact, it wasn’t really renewables that single-handedly took down coal, but the increased use of natural gas that took away from coal’s market share. “So,” writes Forbes, “renewables did play an important part in coal’s demise, but they often get most of the credit. In fact, without cheap natural gas from the shale gas boom, U.S. coal consumption would still be substantially higher than U.S. renewable energy consumption.”

There are a few different takeaways from this snapshot of the U.S. energy mix. The first is that numbers can be deceiving, and readers and speculators alike should be discerning about narrow interpretations of quantitative data. The second is that the United States is still, far and away, powered by non-renewable fossil fuels and is not making significant progress toward meeting goals set by the Paris climate accord. The third is that if reports by IRENA and the World Economic Forum are to be heeded, renewable energy investment has to expand exponentially and do so in a hurry.

ADVERTISEMENT

By Haley Zaremba for Oilprice.com

More Top Reads From Oilprice.com:

- Offshore Oil Is On The Brink Of Collapse

- U.S. Oil Drillers Restart Production As Prices Recover

- Petrobras Oil Stockpiles Are “Paradoxically” Low

The first reality is that a post-oil era is a myth. Oil will continue to reign supreme throughout the 21st century and far beyond particularly in the global transport system and the petrochemical industry both of which account for an estimated 89% of global consumption of oil.

The second factor is that there will be no peak oil demand either. Electric vehicles (EVs) will never prevail over internal combustion engines (ICEs). EVs may get a small share to slightly decelerate global oil demand. But ICEs will continue to be the backbone of the global transport system well into the future.

The third reality is that an imminent global energy transition is a mirage. Natural gas will be the pivot for the transition. And while renewables get most of the credit for the demise of coal, it is natural gas which is the real reason behind the death of coal. Despite a hefty expenditure of $10 trillion on renewables during the last decade, all they have to show for it is a 1% decline in the use of coal, something that would have happened anyway.

The fourth reality is that oil and natural gas will continue to be the core business of the global oil industry well into the future. There was no ambiguity whatsoever about this when the CEOs of ExxonMobil and Shell the world’s two biggest supermajors recently made their positions on peak oil demand very clear. Darren Woods the chief executive of ExxonMobil declared that “the long-term fundamentals that drive our business have not changed." This was echoed by Shell’s CEO Ben Van Beurden who said that it is entirely legitimate to invest in oil and gas because the world demands it". "We have no choice." Even the International Energy Agency (IEA) is now saying that peak oil demand is years away, a change of sentiment for the IEA.

The World Economic Forum is simply deluding itself by pleading with the energy industry to use the coronavirus unprecedented disruption of the economic and societal status quo to begin building a “new energy order”. Why not instead let energy diversification take its course with alternative sources to fossil fuels, notably renewables, growing alongside, not at the expense of the incumbents.

Dr Mamdouh G Salameh

International Oil Economist

Visiting Professor of Energy Economics at ESCP Europe Business School, London

Technology of fracking killed coal.

Oil and gas have the coming technology of cheap solar with falling prices and increased power.. Battery technology falling prices and rising output. Million mile EVs with lower cost solar energy.

Big grid scale batteries. On site solar.

Oil and gas can not compete. Last month's price drop was just a warning of what to come. We did not expect that to be permanent, YET. Electric semis. Electric delivery vehicles. Tesla cybertruck with power for tools.

Oil and gas have not had the heavy ammunition hit yet. Yet.