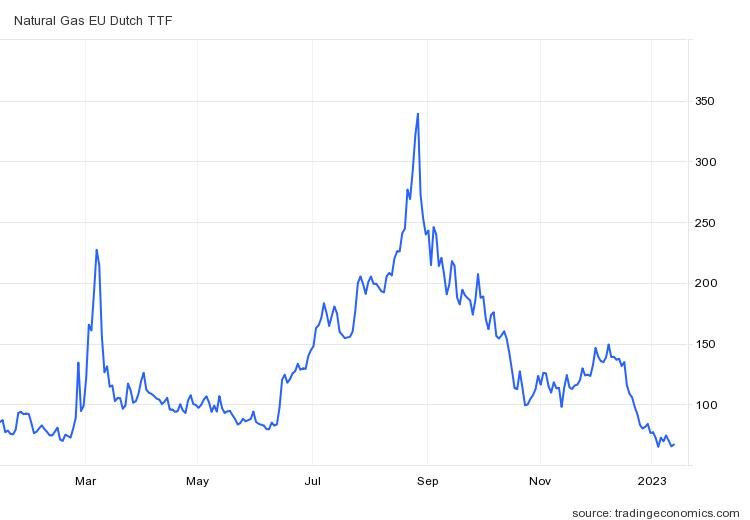

Over the last week, European natural gas prices have been trading at levels not seen since prior to Russia’s invasion of Ukraine in February 2022. TTF prices, the European benchmark, have been trading below €75/MWh since the 2nd of January. Given the record price highs of over €330/MWh in late August 2022, the decline in prices has been welcomed across Europe, particularly by consumers who hope for a reduction in their domestic energy costs. At this stage, it is worth examining the key reasons for the fall in natural gas prices and to look ahead at what may be next for a commodity which has dominated European news over the past 12 months.

Natural Gas TTF Prices over past 12 months (Source: Trading Economics)

High Temperatures and High Storage

Fundamental to the decline in gas prices has been an historically warm winter across Europe. Towns and cities across the continent experienced record high temperatures for Christmas and New Year’s day, continuing a warm trend that began late last summer. Indeed, the one period in Q4 2022 when the TTF price slide was interrupted was during ‘arctic blast’ that occurred throughout late October and November and forced many households to finally reach for the thermostat.

Europe’s warm winter has been key to lowering natural gas prices because it reduced the demand for the gas that had been stored up in anticipation of the colder months. The successful drive to maximise gas storage across the continent last year has been bolstered by the lack of demand, resulting in almost record stocks entering the new year and 36% above the previous ten-year average. These record inventory levels have allayed last year’s fears of blackouts throughout Europe. While there are further cold spells forecast for northwest Europe in late January which may raise prices, concerns have decreased that energy supplies might be exhausted this winter.

Production still Missing, Coal has Returned

The combination of mild weather and high storage has been crucial to lowering natural gas prices, but it is also important to recall the impact that last summer’s unprecedented price surge had on industrial demand. Many energy-intensive industrial production sites across Europe closed in 2022 due to unsustainable costs and still have no prospect of reopening. Fertiliser production and metal processing plants were particularly affected by natural gas prices, with around 70% of the former group and 50% of the latter closing last year. Without the consistent demand resulting from such industries, downward pressure on natural gas prices was predictable.

Less predictable, particularly in an era of climate change pledges, was the return of coal to the forefront of European industrial production. A quick look at Germany, often taken as a paradigm for the state of European industry, reveals insights into the revival of the most decried fossil fuel. Prior to the invasion of Ukraine, Germany relied on Russian gas for approximately 15% of its total energy supply. Compounding this loss, three of the final six active nuclear power plants in Germany were switched offline at the end of 2021 in line with an anti-nuclear policy that began following the Fukushima disaster in 2011. Despite these losses, German industrial production figures bounced back in late summer to record positive YoY growth in August and September and only mild reductions in October and September. Although LNG imports from Norway, Qatar and the US were crucial to this, Reuters reported that there was an almost 5% increase in coal-powered electricity in Germany in Q3 2022 compared to the previous year. This switch is important to note when assessing the decline in European natural prices, and the ongoing coal revival shows no signs of slowing as exemplified by recent protests against a new mining operation in Germany which recently made international news.

Looking Ahead

The European energy crisis has necessitated a long overdue assessment of the continent’s energy security which will initiate fundamental changes to national policies. The shortfall of Russian gas will need to be recouped elsewhere and the wheels are already in motion; in November, Germany announced a fifteen year supply deal with Qatar for natural gas which will begin in 2026. This agreement was reached in spite of vehement criticism from Germany over the Gulf nation’s record on rights for migrant workers and the LGBTQ community ahead of the 2022 World Cup which demonstrates the necessity of a more nuanced, or blurred, moral compass when securing energy as opposed to hosting major tournaments. Increased LNG exports from the US will also be vital to Europe’s transition away from Russian gas but building the required infrastructure will take time. These structural changes to continent-wide energy policies mean that natural gas prices in Europe, while now considerably lower than in summer 2022, are likely to stay much higher than the historical average in the short to medium term.

Finally, there are two key unknown variables ahead in 2023 which could cause price shocks in the European gas market. The first is the weather which, as discussed, has been crucial to preventing power blackouts so far. While Europe looks set to make it through this winter with relative ease, a summer of heatwaves followed by a cold 2023/24 winter could challenge countries’ ability to rebuild and then maintain their gas storage through the next 18 months. As noted by John Kemp, Europe’s gas infrastructure is built for seasonal, rather than strategic, storage and therefore there is a limit to the capacity for gas stockpiling.

The second variable is one which will affect all commodity markets this year; the post-Covid Chinese economic revival. The lack of Asian buyers in the gas spot markets over the past year due to the Zero-Covid policy dampening the need for natural gas imports created a less competitive market for gas which contributed to the decline in prices. With the policy now abandoned, a surge of natural gas imports to China could lead to cargoes being redirected to Asia and consequently cause a price spike in Europe.

The low natural gas prices in Europe at present are certainly cause for optimism, but it is important to remember the combination of luck and losses that have enabled this, and with several unknowns on the horizon, commentators should be wary of declaring the energy crisis over.

By ChAIpredict

More Top Reads From Oilprice.com: