The moderating global growth story from trade tantrums, primarily between the U.S. and China, have kept a lid on the fortunes many of the Super Major oil companies through the second quarter. BP, (NYSE:BP) is no exception here, having declined about 7% from its early April peak of $45.23/sh to $42ish.

There was a time in late May where it looked like it might crack $40 on the downside, but that never happened. I imagine due to yield hungry investors looking for income, swooping in and gathering up its shares for a 6%+ yield on cost. Shares have rebounded above $42.00 since as a result. As we move into the latter part of the second quarter, I think we may see that magical 6% yield return, and think investors should take a close look at this company.

In this article we will review BP's first quarter review the pipeline of new legacy oil and gas projects and highlight some of their growth areas.

Q-1 Results

The current weakness in shares is due (ex-trade fears) to moderating results from lower crude realizations in Q-1 versus Q-4; currently $63/bbl, down from $69/bbl. This put a knock on what BP refers to as it "replacement cost profit," landing at $2.4 bn, a decline of $0.2 bn YoY, and a big drop from the $3.5 bn for Q-4, 2018. GoM turnaround activity,…

The moderating global growth story from trade tantrums, primarily between the U.S. and China, have kept a lid on the fortunes many of the Super Major oil companies through the second quarter. BP, (NYSE:BP) is no exception here, having declined about 7% from its early April peak of $45.23/sh to $42ish.

There was a time in late May where it looked like it might crack $40 on the downside, but that never happened. I imagine due to yield hungry investors looking for income, swooping in and gathering up its shares for a 6%+ yield on cost. Shares have rebounded above $42.00 since as a result. As we move into the latter part of the second quarter, I think we may see that magical 6% yield return, and think investors should take a close look at this company.

The oil market is being driven by two things primarily at this point, trade and oil inventory growth. I expect these will continue to dominate the water cooler discussions, with only the increasingly remote chance of a shooting war with Iran, to change that dynamic. Shares of BP will fluctuate in the range set over the last six months as a result.

BP is looking past the day-to-day changes in the oil markets and investing for the long term. Both in legacy oil development, and the energy market that is developing for the next decade.

In this article we will review BP's first quarter review the pipeline of new legacy oil and gas projects and highlight some of their growth areas.

Q-1 Results

The current weakness in shares is due (ex-trade fears) to moderating results from lower crude realizations in Q-1 versus Q-4; currently $63/bbl, down from $69/bbl. This put a knock on what BP refers to as it "replacement cost profit," landing at $2.4 bn, a decline of $0.2 bn YoY, and a big drop from the $3.5 bn for Q-4, 2018. GoM turnaround activity, lower refining margins and heavy crude differentials all worked against the company in Q-1.

Operating cash flow was $5.9 bn in the quarter. Subtract capex and some incidental payments of $4.2 bn and they still had plenty of free cash to cover their $1.6 bn in dividend payments and buyback $50 mm in shares. BP still offers scrip in lieu of cash for dividends and controls the dilution through share buybacks.

Gearing is running near 30% at present, near the top end of its targeted range. This is due to final payments made in the quarter to Broken Hill Proprietary, (NYSE: BHP) for its shale acreage purchased last year. BP anticipates that assets sales over the next couple of years, and no planned major acquisitions at present will drop that back down toward its lower range of 20%.

New Projects for 2018/19

Anadarko operated, the Constellation SPAR, located in 5,000+ feet of water, will deliver 10 mm BOEPA net to BP over the next 25-30 years. Production is from Pliocene era formations and the oil ranges around 30-35 API gravity. This is badly needed production that will be well received in U.S. GoM refineries, to blend with light oils coming from shale.

Trinidad is a legacy operating area for BP, carried over from Amoco days. They have been active in Trinidad-Tobago since World War II. Angelin will deliver 200 mmsfd to BP's onshore compression unit, for transmission to the Fortin LNG cooperative. BP has other LNG targeted gas projects slated for BPTT over the next couple of years.

Now drilling with first production slated for late this year, Raven which is phase 3 of this multi-year deepwater project in the Middle East. Raven, when all 8 wells are online will deliver about 500 mmscfd to support Egypt's growing economy.

New FID's for "Advantaged Oil" in 2019

Atlantis Phase 3 is located in the deepwater Gulf of Mexico, approximately 130 mi (208 km) off the coast of Louisiana. The project is a subsea tie back of eight new production wells that will take advantage of existing infrastructure. First production is expected in the 2020 calendar year and is estimated to increase production by ~38,000 BOEPD- gross at its peak.

Along with its partners, Neptune Energy, and Japex, BP approved the Seagull HPHT project in the North Sea. Like other advantaged oil projects, it will be tied back to existing infrastructure, in this case located in the North Sea. Seagull will deliver 50K BOPD when all four subsea wells are brought on line.

Azeri Central East in Azerbaijan

The $6 billion development includes a new offshore platform and facilities designed to process up to 100,000 barrels of oil per day. The project is expected to achieve first production in 2023 and produce up to 300 million barrels over its lifetime.

Culzean, offshore Aberdeen Culzean is a 1.2 Tcf High Pressure High Temperature (HPHT) lean gas condensate field located approximately 140 miles east of Aberdeen in Block 22/25a of the Central North Sea in water depths of 300 feet. The project scope includes a stand-alone three bridge-linked platform development with dry gas export via the Central Area Transmission System and liquids export via a new-build Floating Storage and Offloading tanker (FSO). A new Heavy-Duty Jack Up (HDJU) rig, the Maersk Highlander, will drill six production wells and one produced water re-injection well. Culzean will deliver 30 mm BOPD annually to BP.

BP is one of a few companies positioned to develop stranded deepwater assets. With its global infrastructure it can reduce development costs dramatically for marginal fields. Having resources like this is what puts BP ahead of many of its cohorts in the Super Major class.

The Permian-Eagle Ford acreage

BP had 14 drilling rigs operating in West Texas at the end of the first quarter; including three on the new Permian-Delaware acreage and five in the Eagle Ford. As they begin developing this new acreage, picked up last year from BHP, they report seeing further upside potential that was not assumed in their base case.

Growth areas for BP

BP is growing in two areas that are now clear will be important to future results in the decades to come. International retail and EV charging.

If you haven't traveled a lot outside the U.S. you don't realize the clean, well-stocked auto service centers with nice well-maintained restrooms that we take for granted, are rare in other countries. In 2019 through a JV with a Chinese operator BP has begun adding to it

One way to sell more gas is to have the bright well-lit stations where other human needs can be safely met. This is a proven model for the USA and Europe that will translate well globally.

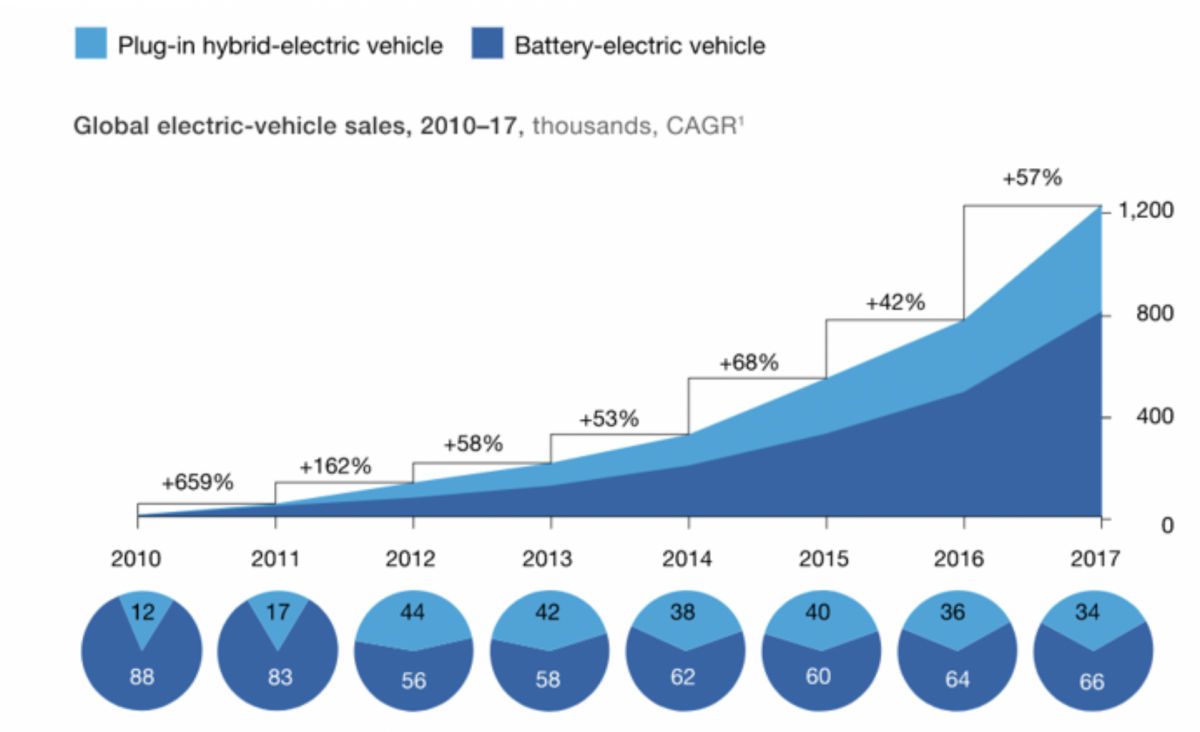

Electric vehicles are growing in popularity globally, and will soon comprise 2% of new vehicle sales, if they aren't already there. Some places in Europe, for example intend to phase out internal combustion-IC's, over the next decade or two. Many countries are now favorably subsidizing this change through tax laws.

(Click to enlarge)

Source

So if EV's are going to gain market share as the linked above McKinsey report suggests they will, one thing is for sure. They are going to need charging stations, a lot of them. Enter BP Chargemaster. In 2018 BP acquired Chargemaster, the largest supplier of rapid re-charge technology for EV's.

BP believes that to accelerate the adoption of EVs, customers will require convenient access to fast and ultra-fast charging. BP’s UK retail network is well positioned to provide this access with over 1,200 service stations across the country. A key priority for BP Chargemaster will be the rollout of ultra-fast charging infrastructure, including 150kW rapid chargers capable of delivering 100 miles of range in just 10 minutes. BP customers in the UK can expect to access BP Chargemaster chargers on forecourts over the next 12 months.

Risks

The main risks for BP center on the environmental goofiness that now pervades the world. They have been the target of lawsuits that seek to follow the U.S. cigarette liability model. So far none of these have gone anywhere-to my knowledge. Several big ones have been dismissed by courts for irrationality, if you can believe that courts ever take logic into account. One thing you can count on though, is that environmental groups and cash hungry cities will be thinking of new ways to try and transfer costs of climate change to legacy energy providers. To be clear, I think this is a remote risk at present, but it is there all the same.

Along the same lines goofy shareholders are now doing stuff like blockading BP's London HQ, and demanding more transparency on BP's implementation of the Paris climate change accords. Nothing makes people feel better than thinking they are doing something for the greater good and posterity, so this type of activism will continue and grow. And, of course protesters will more than likely drive their cars to climate change rallies. "Do Gooder's" rarely apply any logic to their passions.

You have to factor this type of lunacy into any calculation for investing in BP. The chance of it impacting results are remote now, but there's nothing to say it will continue to be the case.

You can see in spite of everything they do, carbon reduction strategy, Paris Climate Accord goals now a part of their mission statement, BP still falls victim to these enviro-thugs. It's a risk.

The oil price factors strongly in the day to day price fluctuations, and there is a risk that an entry point around $40 could find itself under water for a time. I do not expect that situation to extend for long periods, and I would view declines as a way to enhance the yield of your portfolio and capture some growth when the price rebounds.

Upstream outlook

In 2016 BP made a commitment to deliver 900K BOEPD by 2021. BP's CFO, Brian Gilvray addressed the progress they have made since toward that goal, in the Q-1 conference call.

“In terms of ramp up of major projects, it's up over 500,000 barrels a day from the two start-ups that we've had, up to the end of 1Q '19. And the track looks pretty good now in terms of that ramp toward a full 900 K in 2021. Of course. Growth from BPX (BP’s U.S. onshore operating unit)sits on top of that 900,000 barrels that we have described in other materials.”

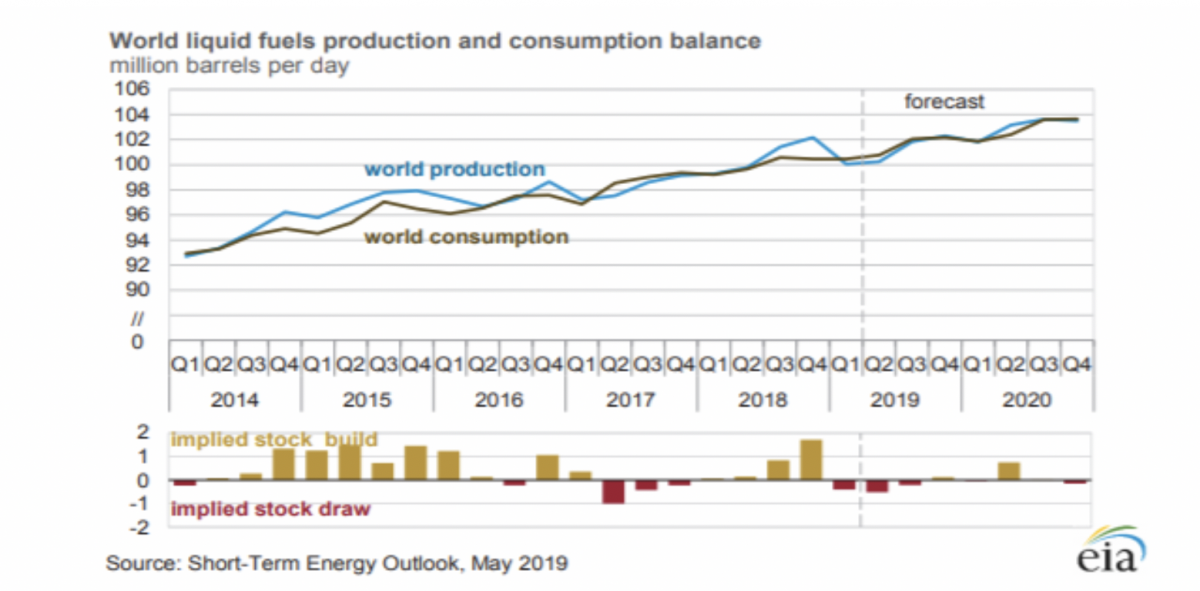

BP expects continued growth in world oil demand in spite of the slower rate of increase forecast by the EIA for 2019.

(Click to enlarge)

Source

BP CFO, Brian Gilvray comments on BP's outlook for energy demand.

“Looking ahead, we expect oil demand growth to remain relatively robust, and supply growth to be modest, with disruptions in Venezuela and Iran continuing and ongoing compliance from the OPEC alliance in the first half of the year. These factors are expected to partly offset the increase in US production, which is currently around 12 million barrels a day.”

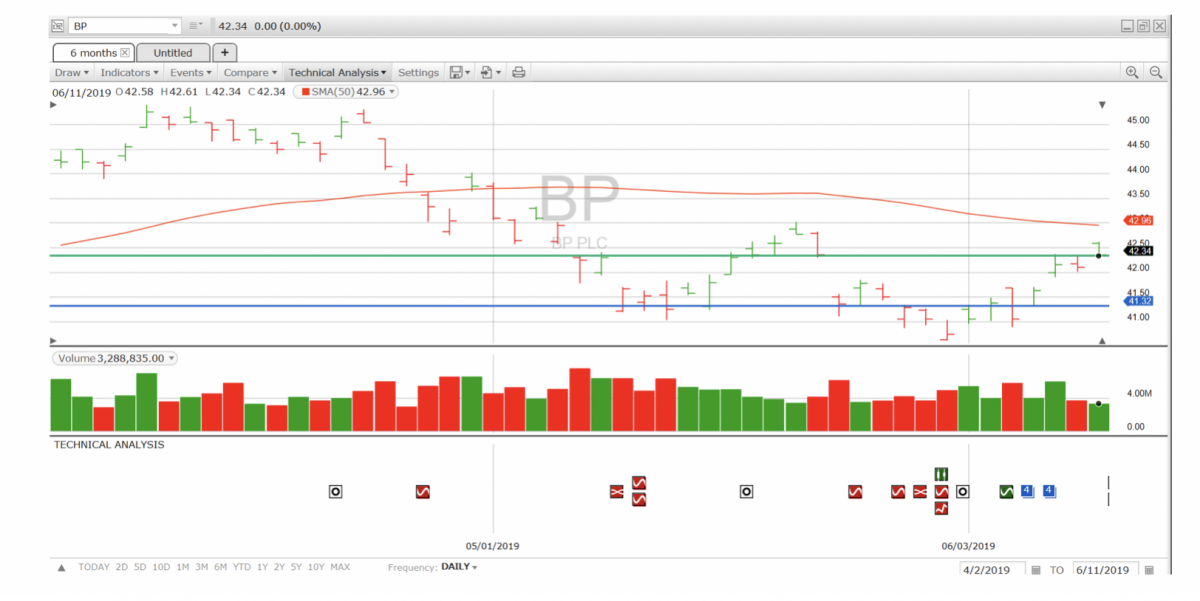

Technicals

(Click to enlarge)

BP recently bounced off upper resistance and could retest recent lows of ~$40.30/share in the days to come. If the lower support line were to be breached, the next support would come in the upper $30’s last seen in January of this year. BP should be strongly accumulated there.

BP has an analyst rating of 2.4, with a forecast range of $39-50.00/share.

Your takeaway

BP is currently yielding 5.84% and shares look to be off slightly in the pre-market. Investors looking for a possible incremental share purchase, or to initiate a new position should monitor the increasing yield as it approaches six percent. That implies a price of around $41.00 share, down about a buck or so from its current price. With the builds we have been seeing recently in oil supplies, we might just see that target price.

BP is an energy stalwart with a robust pipeline of projects to deliver revenue growth and free cash from legacy sources. Additionally, it is preparing to adapt to changes in the energy distribution market it sees developing over the next decade. I see BP as a diversified company with a solid long term plan that includes multiple revenue sources that should secure its role as an energy provider.

Entry points are important as we have seen the price of this stock fluctuate from about $30 in the depths of the 2016 oil bottom, to as high as $47 in the pre-Iran sanctions-fail euphoria in 2018. Absent, a positive sea-change for energy I don't see a lot of growth beyond the upper $40s. BP has bumped off this upper-level several times in the past couple of years, and in the last several months has maintained a range between $40-$43-ish a share.

In summary, I can't recommend BP as a likely growth play, the market conditions at present simply will not allow it, in spite of increasing distributable cash flows for the foreseeable future with $55 Brent. But, at around a 6% yield combined with its diverse portfolio, and the relative safety of its balance sheet, I can recommend it as an income play to collect its sizable dividend. All the while, sleeping fairly well at night.

By David Messler for Oilprice.com