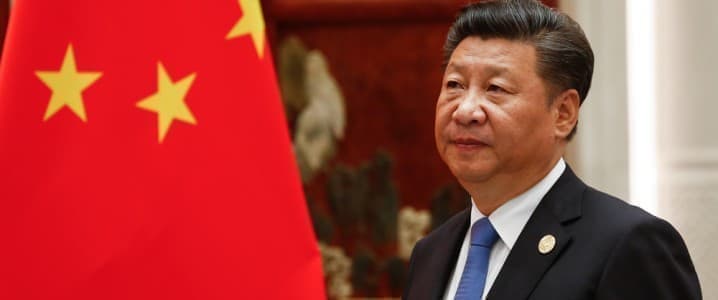

For a long time, China’s energy policy has centered around one primary and pressing goal: to establish energy security. As the biggest importer and second-biggest consumer of oil in the world, China is extremely dependent on international markets to keep the lights on and the gears of industry turning. In 2019, a whopping 72% of all crude oil consumed in China was imported. This is a dynamic that makes Beijing uncomfortable, to say the least, and President Xi Jinping’s administration has been hard at work trying to shore up a greater degree of energy independence.

That’s why it came as such a surprise this week when China made a historic decision to sell off some of the oil it has been stockpiling in a strategic reserve for years now. “The heavy dependence on foreign supply has spurred Beijing to focus on ways it can prevent energy shortages,” CNN Business reported back in April 2020. “In addition to requiring state-owned oil companies to increase production, the country has spent years working to increase the amount of oil it keeps in reserve.” Beijing is secretive about just how much oil they have stockpiled, but the nation had been planning to catch up to the world’s largest backup oil cache -- the United States’ Strategic Petroleum Reserve, which boasts an authorized storage capacity of 714 million barrels.

China’s sudden reversal of its oil-hoarding tendencies comes in response to high energy prices and skyrocketing oil demand. Some provinces are even experiencing the power shortages the country has seen in a decade. And that’s just the beginning of China’s economic woes. “Inflation is soaring, and the country's producer price index hit a 13-year high last month, driven by rising commodity prices,” CNN Business reported this week. “The government has warned that high costs for raw materials such as energy and petrochemical products will exacerbate growth and employment challenges facing manufacturers — especially small and medium-sized businesses.”

It’s not just oil demand that’s soaring. Together, China and India are driving up global coal prices in a worrying turn of events for the climate. “The benchmark coal price was $177.50 per ton on Sept. 10, more than double the level at the beginning of the year and up from about $50 a year ago” reports Nikkei Asia. “The price is the highest in the past 11 years and is nearing the all-time high of the mid-$180s seen in July 2008.” India is even at risk of running out of coal entirely.

While Xi Jinping has been making lofty climate commitments and has publicly pledged that China will achieve net-zero carbon emissions by 2060, China has made little to no progress phasing out coal. The dirtiest fossil fuel still makes up more than half of the nation’s energy mix. Ironically, the reason that China can’t quit its coal addiction and the motivation for developing domestic clean energy production capacity stem from that same base imperative: energy security.

But China’s best efforts have not yet been enough to wean them off of foreign oil and coal - not by a long shot. As the global economy bounces back from the first wave of the novel coronavirus pandemic, countries with fast-growing consumer bases like China are facing some major hurdles. Demand for energy, products, and services is returning to pre-pandemic levels, but global supply chains and markers still have not fully recuperated.

It’s a tricky situation. Many of the standard options for supporting an economy in slowdown, as is the current case with China, are off the table. Fiscal and monetary supports will only make soaring rates of inflation worse. And then there’s the new and pressing issue of the Delta variant, which is making major waves in economies from China to the United States. When China is selling off its precious oil reserves, it’s obvious that Beijing is between a rock and a hard place - and it’s not going to get out any time soon.

By Haley Zaremba for Oilprice.com

ADVERTISEMENT

More Top Reads From Oilprice.com:

- 3 Bearish Catalysts For Oil This Fall

- Why Hedge Funds Are Turning Bullish On Oil Again

- The Major Problem With EVs No One Is Talking About