The recent slide in oil prices may finally start impacting U.S. oil production forecasts.

The plunge in oil prices in November and December spread gloom around the industry. Comments from anonymous oil executives in a survey from the Federal Reserve Bank of Dallas from earlier this month clearly depicted the creeping pessimism from oil country. “I expect the dramatic, unexpected and significant drop in oil prices will significantly decrease revenue for the first half of 2019. I intend to mitigate this by stopping all drilling and deferring any new projects,” one oil executive told the Dallas Fed.

Another worried about lack of financing for drilling. “It feels like the capital markets (equity and debt) are backing up fairly hard, which will have a noted impact on capital spending if sustained. Coupled with the fall in oil prices in the past six weeks, this could cause 2019 plans to get pared back,” the executive said.

But the downturn in oil prices, and even the gloomier outlook from oil executives themselves, hadn’t really fed through to oil production forecasts. The projections for U.S. shale still included heady growth figures, despite the plunge in prices.

That is, until now.

“As a result of the slide in oil prices over the past three months, operators have already started to guide down activity for 2019 compared to their initial plans to ramp up activity,” Rystad Energy wrote in a new commentary. “Consequentially, we have lowered our expectations for oil production growth by about 500,000 bpd for 2020 and 2021, implying less need for takeaway capacity.”

Rystad says slower production growth might put a lot less urgency on the closely watched midstream bottlenecks. “This raises the question as to which (if any) of the pipelines projects in the Permian slated for development will move forward if there is less oil to fill them,” Rystad stated. Related: Trump Takes Aim At Maduro, Threatens Oil Embargo

The pricing discounts for oil based in Midland have sharply narrowed. At times in 2018, Midland WTI traded at a discount approaching $20 per barrel relative to WTI in Houston. But Midland prices have converged towards WTI, with a discount of only around $6 per barrel more recently. Much of that has to do with some of the pipeline capacity additions in recent months.

Slower production growth going forward could scramble the case for new pipelines. “Given our current production outlook, we see marginal need for the pipelines that have not been approved yet before 2022,” Rystad concluded. “This equates to about 2.7 million bpd capacity over six pipelines.”

The oil consultancy singled out Phillips 66’s proposed Gray Oak pipeline expansion as one example. Rystad said that “there’s a likelihood that sufficient commitments won’t be reached,” meaning there won’t be demand for the 200,000-bpd proposed expansion because upstream production will slow.

The U.S. added 1.6 million barrels per day of new supply in 2018, the largest annual increase in history. But growth will slow to a still-enormous 1.1 mb/d this year, and 0.8 mb/d in 2020, according to the EIA’s latest Short-Term Energy Outlook. Curiously, however, the EIA’s estimate that U.S. output will average 12.1 mb/d in 2019 is unchanged since its November estimate, even though it has revised down its price forecast significantly. Forthcoming revisions in the months ahead wouldn’t be surprising.

The EIA did suggest, however, that U.S. oil production won’t return to the explosive growth rates of 2018. The agency attributes a more modest growth rate this year and next to pipeline constraints. The agency notes that lower oil prices could curtail drilling, but it says that once new pipelines come online later this year, production growth will rebound into 2020. It’s not clear what to make of this, in light of the recent price meltdown. Related: Offshore Spending To Overtake Shale In 2019

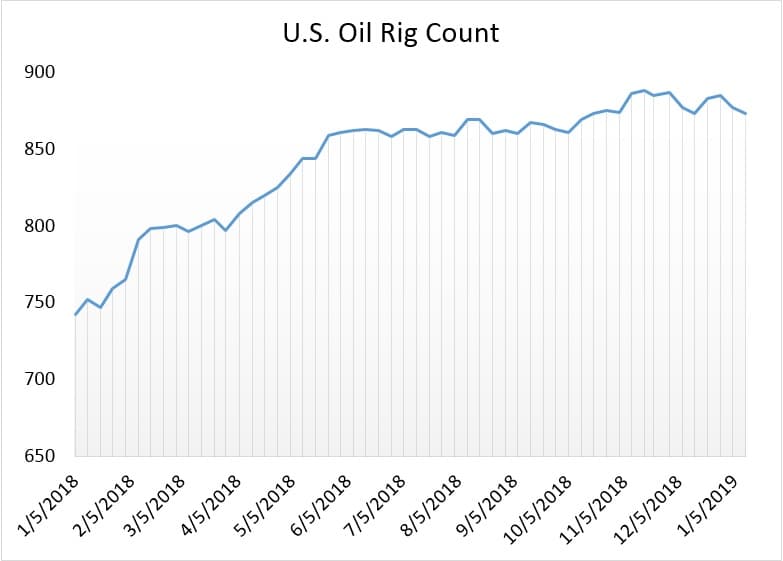

In the short run, there is some evidence to support the notion that lower prices are impacting output. The oil rig count fell by 4 last week, according to Baker Hughes, and is at a roughly three-month low at 873.

ADVERTISEMENT

Also, the EIA weekly production data, which offers a preliminary look into U.S. oil output, has been roughly unchanged at 11.7 mb/d since November. These numbers are a little rough, and are at times out of synch with the more accurate monthly surveys that come out on a several-month lag, but they offer a near real-time glimpse into production. The data suggests that output began to plateau in November.

By Nick Cunningham of Oilprice.com

More Top Reads From Oilprice.com:

- Global Automakers To Spend $300 Billion On EVs In 10 Years

- Can The U.S. Keep Its Nuclear Industry Afloat?

- Oil Markets Could See Deficit In 2019

Things appear to be slowing down, but if the effect of that is a substantial rise in prices, it won't last, not unless OPEC can jump in and soak up whatever deficit exists. But apparently the Saudis want higher prices, which would just open up the taps on all those Permian DUCs. Sounds like a recipe for subdued prices going forward.

The US shale oil industry will remain an indebted industry no matter what the level of oil prices is.

Still, US shale oil producers will never stop production for two reasons. The first is that the US shale oil industry is not judged by standard criteria of economics and profit that govern conventional oil companies otherwise it would have been declared bankrupt years ago given the hundreds of billions of dollars it owes Wall Street. They have to keep producing otherwise they will not be able to borrow to remain afloat.

The second reason is that despite being very deeply in debt, the US shale oil industry will continue operating because it gives the United States a say in the global oil prices and markets along with Russia and Saudi Arabia. Without that, the US Energy Information Administration (EIA) will not be able to hype about the US becoming the world’s top oil producer or the US is now a net oil exporter.

The second question mark relates to US oil production figures. Reports about a slowdown in US shale oil production are coming fast and thick from different reliable sources. These reports from the Wall Street Journal (WSJ), International oil service companies such as Schlumberger and Haliburton and other authoritative organizations including MIT are talking about productivity, depletion and drilling issues and therefore can’t be ignored. Moreover, all of them have been accusing the EIA of inflating production figures.

Yet, claims about explosive growth of US shale production are abound. The EIA is projecting a US oil production of 12.1 million barrels a day (mbd) in 2019. It also claims that US oil production added 1.6 mbd in 2018 over 2017 when US production in 2017 was 9.36 mbd according to the authoritative 2018 OPEC Annual Statistical Bulletin. If that is the case, then the EIA figure is overstated by 740,000 b/d to start with.

Moreover, the whole figure of 11.7 mbd is overstated by at least 3 mbd made up of 2 mbd of NGLs and 1 mbd of ethanol all of which don’t qualify as crude oil. In fact International Exchanges around the world don’t consider them as substitutes for crude oil. And if the International Exchanges don’t accept them as substitutes, then they are not crude. Therefore, US oil production could have been no more than 8.7 mbd in 2018.

Furthermore, there is an estimated difference of 700,000 b/d to 1 mbd between the EIA’s weekly production data and the monthly surveys.

The third question mark about US shale oil production is its breakeven prices. Shale producers are claiming that they managed to reduce their breakeven prices to a range of $50-$60 a barrel. If this is the case then how do they manage to continue producing when oil prices are hovering currently around $60 and how do they explain the slowdown. Moreover, their breakeven prices must be much higher given the steep depletion rates of shale wells estimated at 70%-90% at the initial stages of production necessitating the drilling of more than 10,000 new wells every year at an estimated cost of $50 bn just to maintain production.

The demise of the US shale oil is neigh. It could happen within the next 5-10 years.

Dr Mamdouh G Salameh

International Oil Economist

Visiting Professor of Energy Economics at ESCP Europe Business School, London