Breaking News:

China's Capital Flight Could Fuel Bitcoin’s Next Rally

Chinese FX outflows, often underreported…

Global Climate Goals Still Unreachable Despite Record Renewable Growth

Renewable energy installations reached record…

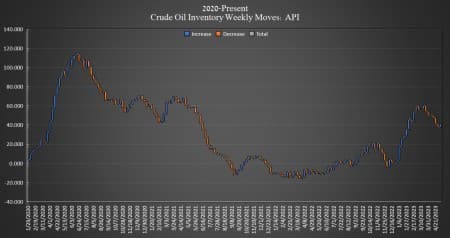

Surprise Inventory Build Starts To Eat Into Oil Price Rally

Crude oil inventories in the United rose this week by 3.618 million barrels, the American Petroleum Institute (API) data showed on Tuesday, with analysts expecting a 1.600 million barrel draw.

The total number of barrels of crude oil gained so far this year is still more than 38 million barrels.

This week, SPR inventory dropped for the sixth week in a row, shedding 2.9 million barrels for the week to reach 362 million barrels—the lowest amount of crude oil in the SPR since October 1983.

U.S. crude oil production rose by 100,000 bpd during the week ending April 28, to 12.3 million bpd. U.S. production is now 800,000 bpd lower than the peak production seen in March 2020, but 400,000 bpd higher than this time last year.

The price of WTI and Brent were both trading up on Tuesday in the run-up to the data release.

By 4:10 p.m. EST, WTI was trading up $0.36 (+0.49%) on the day at $73.52 per barrel, a nearly $2 per barrel gain week over week. Brent crude was trading up $0.26 (+0.34%) on the day at $77.27—up roughly $2 per barrel from this time last week.

WTI was trading at $73.50 shortly after the data release.

Gasoline inventories rose by 399,000 barrels after rising in the week prior by 400,000 barrels. Distillate inventories fell by 3.945 million barrels after decreasing by 1 million barrels in the week prior.

Inventories at Cushing, Oklahoma, fell by 1.316 million barrels—after rising by 700,000 barrels last week.

ADVERTISEMENT

By Julianne Geiger for Oilprice.com

More Top Reads From Oilprice.com:

- The 10 Countries With The Largest Natural Gas Reserves

- The Brent Oil Benchmark Is About To Change Forever

- The 10 Most Incredible Oil And Gas Discoveries Of All Time

Julianne Geiger

Julianne Geiger is a veteran editor, writer and researcher for Oilprice.com, and a member of the Creative Professionals Networking Group.

-

I thought the surprise was anyone on this Planet even allowed to have any oil at this low a price?

Open57.81

Trading Vol.6.96M

Previous Vol.241.7B