Shale drilling activity in the US likely dropped to 44 jobs per day in November 2018, Rystad Energy’s analysis of preliminary data suggests.

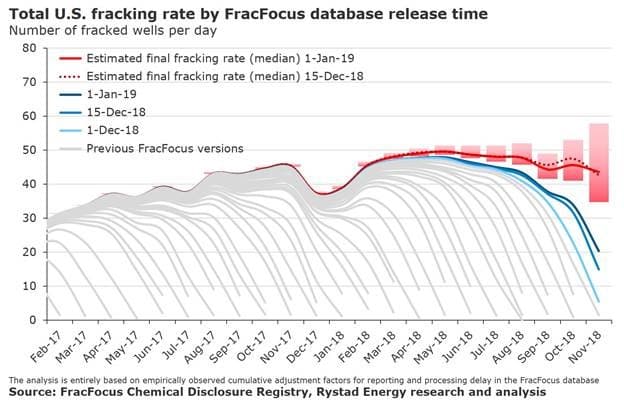

We conclude that nationwide fracking activity was mostly stable from April 2018 to August 2018 at an average daily level of 48 to 50 fracked wells. However, the fracking rate has slipped some since and remains between 44 and 46 in the period of September to November 2018.

“After reaching a peak in May/June 18, fracking activity in the Permian has gradually decelerated throughout the second half of 2018,” says senior analyst Lai Lou.

(Click to enlarge)

“A key observation is that as we move into November, there is evidence that seasonal activity deceleration might have started in all major plays except Eagle Ford”, Lou adds. “There has been a considerable slowdown in Bakken and Niobrara in November based on our estimation.”

The latest FracFocus update, a national US database, was released on January 1. It provides sufficient visibility on fracking operations across the US in November 2018, yet the uncertainty range for November remains significant, as indicated by the figure above.

Some major operators are bucking the general slowdown. The largest operator, ExxonMobil, experienced a strong uptick in October, making it one of the months with the highest number of fracked wells in this period. Energen Corporation is also unaffected by the slowdown.

(Click to enlarge)

“In general, many of the key operators have exhibited a largely flat trend from June to October 2018, which implies that the market-wide deceleration in fracking activity has a more significant implication for smaller operators in contrast to the major players in the Permian”, Lai said. “In terms of absolute numbers, the reduction in the number of jobs for top 10 operators collectively is around 10% from June to October while the corresponding percentage for the remaining operators is as high as 48% in the same timeframe.”

Rystad Energy’s analysis is based on currently available data. Underreporting implies that the reduction in percentage will be smaller then what we see as of today.

ADVERTISEMENT

More Top Reads From Oilprice.com:

- Why Goldman Just Drastically Slashed Its Oil Price Prediction

- Flurry Of Bullish News Sends Oil Higher

- OPEC Oil Exports To The U.S. Fall To Five-Year Low

But always consider "drilled but not fracked" wells in your thinking. Without those numbers the author is simply just jerking readers' chains. The world is multidimensional, and some writers are simply not up to the task of comprehending what is going on.