With Europe and North America falling ever deeper into the quagmire of second-wave coronavirus lockdowns and curfews, caution has become the universal buzzword. In Asia, however, the anticipation of worse things to come has given way to a cautious optimism that has prevented Middle Eastern differentials from falling. Amidst Libya coming back to the global markets and OPEC+ discipline weakening, that is a remarkable feat attesting to the robustness of the Asian market. Buttressed by the market contango, refiners in India and China are ramping up imports to meet increasing demands for gasoline and diesel, nudging Middle Eastern differentials higher.

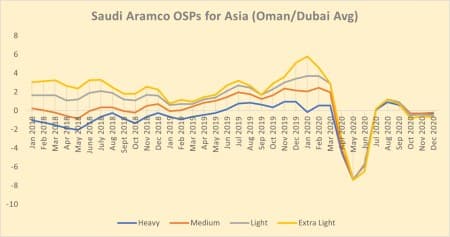

Saudi Aramco’s front-month official selling price routinely set the mood for other Middle Eastern producers, too, providing the general direction prices will be heading in the upcoming weeks. The Saudi national oil company has adopted a policy of minimal month-on-month twitching with its Asia-bound December 2020 official selling prices to Asia (the biggest move was a 20 cent per barrel m-o-m cut to Arab Super Light, brought about by light distillates margins weakening lately). At the same time, Asian demand has become much more oriented towards Middle Eastern supplies on the back of Urals arbitrage closing down and US grades becoming a tad less competitive than previously. Europe-bound Saudi OSPs have been hiked to match Urals’ appreciation, US-bound prices were dropped 20 cents per barrel across the board.

Graph 1. Saudi Aramco OSPs for Asia in 2018-2020.

Source: Saudi Aramco.

By the time the Saudi OSPs reached the market, a change of mood was already present within the trading community, reflected in the cash-Dubai futures spread moving into positive territory on November 06, the day after Saudi Aramco’s issuance of its December 2020 OSPs. Given that other Middle Eastern producers are overwhelmingly lacking the lighter end of grades, their December 2020 differentials have largely gone up. ADNOC has raised its Asia-Pacific prices of flagship grades Murban and Upper Zakum by 10 cents per barrel from November 2020. The Iraqi SOMO went even further and seeing the positive developments around increased the December OSP for Basrah Light by 15 cents per barrel month-on-month, to a $0.45 discount against Platts Dubai/Oman (Basrah Heavy rose by 10 cents per barrel). Related: Adapt Or Die: Refiners Face An Impossible Decision

There are several reasons why it is only now that Chinese demand is bouncing back. Chinese crude imports in October 2020 reached a 6-month low at 10.4mbpd, however this was to a large extent due to China digesting the massive crude stocks it kept floating next to its terminals. Roughly 4 million tons of crude were cleared off the port congestion list, tangibly easing the pressure on the relevant ports in the Northeast. Cognizant of the risks refiners were running if they were to store the crude offshore for a period longer than financially expedient, Chinese authorities have also facilitated the discharge of crudes – from now on, cargoes can be discharged before the quality inspection is finalized by the customs staff. November, largely free from the constraints of past month, will witness a solid rebound in imported volumes to China, to the extent of 11.2-11.3mbpd.

Crude demand from India and South Korea has also been instrumental in turning the tide of the Asian market. One of the star performers of the COVID pandemic, South Korea has managed to pull off the unthinkable and return to pre-COVID levels of crude imports – in August 2020 it was importing some 2.5mbpd crude, by October 2020 the rate rose to 2.93mbpd. Although India has managed to increase its crude imports by 20% from the July low-point of 3.26mbpd, the world’s biggest democracy still has untapped capacity to work with. Before COVID, India’s average monthly refinery runs used to hover in the 5-5.2mbpd interval yet currently they are somewhere around 4.3mbpd, meaning some 0.7-0.9mbpd refining capacity remains unused. This gap might be narrowed in November 2020 as the 360kbpd Vadinar refinery will come back from a month-long maintenance.

Graph 2. Iraqi OSPs for Europe in 2018-2020.

Source: SOMO.

There are two ways to assess crude exports – either from the seller’s point of view (i.e. taking the vessel’s departure date as the basis of reference) or from the buyer’s one (in such a case it is the date of arrival that matters). Now if we look at China’s crude imports from the perspective of their arrival, November 2020 will mark the highest-ever volumes arriving from Saudi Arabia. From the seller’s perspective, October was alright but by no means ground-breaking. Considering the 20+ days voyage from Ras Tanura, the outstanding result is due to the buying spree of Chinese refiners in the second half of October – from October 13 onwards, 25 vessels have loaded and sailed to China (roughly equivalent to the total number of vessels moving to China in the good old pre-COVID times). Ras Tanura departures in November are already weaker, therefore the October peak of Saudi imports is highly unlikely to be maintained for long. Related: Growing Crude Inventories Put A Cap On Oil Prices

Graph 3. United Arab Emirates OSPs in 2017-2020.

Source: ADNOC.

Simultaneously to the above-mentioned Saudi developments, October 2020 seems to have attained an all-time record in volumes sailing from the United States towards Asian refiners. In general terms American exports have been sagging a bit globally in the past 3-4 months, having lost 20-25 million barrels in monthly aggregate terms from levels seen in H1 2020 (to some 130 MMbbls), however Asia is one of the few destinations that have witnessed a tangible ramp-up for US exporters. Provided there is no major disruption on the receiving side, imports from the United States to Asia will amount to 2.15mbpd in November 2020, more than half a million barrels per day higher than the previous peak marked this September. Similarly to Saudi volumes, a part of the US export momentum will peter out in the upcoming weeks, although not to the extent that exports from Europe did (dropping to a mere 8 MMbbls in the whole of November as the arb ran out).

Graph 4. US Crude Exports to China and India in 2017-2020 (‘000 barrels per day).

ADVERTISEMENT

Source: Thomson Reuters.

In a concurrent development, Abu Dhabi’s national oil company ADNOC and the newly formed ICE Futures Abu Dhabi (IFAD) have been making headway in using the emirate’s Murban futures contract, assumed to be launched in late March 2021, as a market benchmark for US crude exports to Asia. Having only signed memoranda of understanding with leading US oil firms, ADNOC and IFAD still cannot be sure of Murban’s success despite promising early signs. The Murban futures would be traded two months ahead as generally is the case with spot cargoes and it would automatically set the monthly Murban OSP which was heretofore set by the ADNOC itself. The Murban futures will also entail a physical delivery FOB Fujairah, with the option for a financial settlement.

By Viktor Katona for Oilprice.com

More Top Reads From Oilprice.com:

- Growing Crude Inventories Put A Cap On Oil Prices

- EIA Sees WTI Crude Averaging $44 In 2021

- OPEC+ Getting Closer To Hatching January Plan