When I first recommended the rare earths miners four months ago, I thought of them as stocks that you put on the back book and forget about, hoping that they would appreciate someday.

Last night I reviewed my positions in this space, and I was stunned by their performance, having exploded into my best trades of the year.

Canadian Avalon Rare Metals (AVARF) is up 114% since then, Australia's Lynas Corp. (LYSCF) has rocketed 282%, and Great Western Minerals Group (GWMGF) has gone ballistic, with a 191% rise. The new IPO for Molycorp (MCP), which I have been touting since well before its launch, has raced up 68% from its July launch price of $14.

Readers who had the guts to buy the out of the money calls are deluging me with emails reporting gains of several hundred percent.

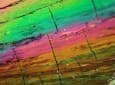

The smart money is pouring into companies with greater production of the more valuable heavy rare earths, like dysprosium, Dy, terbium, Tb, and europium, Eu. The Chinese, which control 97% of world production, dominate in the lighter end of the spectrum, such as in cerium, Ce, lanthanum, La, and neodymium, Nd.

This is why Great Western has secured the rights to South Africa's Steenkampslraal Mine, and Avalon is attempting to raise $844 million to develop the Nechalacho Mine in the far north of Canada, which is also rich in the heavies (click here for the link).

Some traders may blanche at the meteoric moves that have already occurred in this sector. In three years the most common rare earth, cerium, has soared 930% to $35/kg. But this is still a tiny industry, and it is in the early days.

What price is your teenage daughter willing to pay for enough rare earths to keep an endless supply of cell phones coming? The potential answers boggle the mind.

ADVERTISEMENT

By. Mad Hedge Fund Trader