Breaking News:

Javier Blas: 10 Things Oil Traders Need to Know About Iran's Attack on Israel

Javier Blas analyzes the impact…

Manufacturing Boom Fuels Demand for Industrial Metals

The manufacturing boom in the…

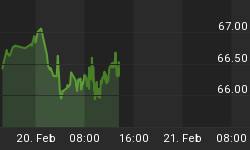

Oil At $51 After API Reports 3.56M Barrel Crude Draw

As trade opened Wednesday, WTI crude started the day on an up note, with oil reaching the $51 handle, the highest it’s hit since July 2015.

Tuesday saw the commodity dip to $49.42 but WTI crude resumed its upward momentum and breached the $50.00 rate, topping out at $50.34, ending the day at $50.15.

Brent crude also ended Tuesday higher at $51.44, following a spike of $51.53.

The slight spike came in the wake of news that Nigerian militants had launched another attack on that country’s oil infrastructure.

Also noteworthy is the fact that Saudi Arabia’s promise not to flood the market has given some support to oil prices.

Related: India Putting Floor Beneath Oil Prices As Demand Continues To Soar

Another factor contributing to some volatility is the uncertainty over the Federal Reserves’ decision to hike interest rates, which has weakened the U.S. dollar and bolstered oil prices.

According to the API weekly data, there has been a recorded draw of 3.56 million barrels, which was close to the anticipated draw of 3.5 million.

Cushing stocks dropped by 1.30 million barrels, but gasoline stocks saw a bump of 0.76 million. The Energy Information Administration (EIA) expects demand to hit 9.5 million barrels per day.

Related: Aviation Giants To Ramp Up Biofuels Usage

The bump was driven in part by the news of the attack in Nigeria, and by continued low output from Canada, which has yet to rebound to its production levels before the wildfire. Also driving prices is employment data, which showed a weaker rise than anticipated by markets.

Traders will keep an eye on the EIA’s official crude oil inventory data, due later on Wednesday, while confirmation of a draw.

ADVERTISEMENT

By Lincoln Brown for Oilprice.com

More Top Reads From Oilprice.com:

- An Oil Price Rebound Is Not Enough For The Bakken

- Why Did Natural Gas Prices Just Rise 25% In Two Weeks?

- Rebound In Oil Prices Changes Drillers’ Mindset

Lincoln Brown

Lincoln Brown is the former News and Program Director for KVEL radio in Vernal, Utah. He hosted “The Lincoln Brown Show” and was penned a…

Open57.81

Trading Vol.6.96M

Previous Vol.241.7B