And the last two days we got a flurry of news confirming this trend in motion.

First from the world's largest producing nation, South Africa. Where another mine looks about to shutter -- perhaps permanently.

Glencore Plc will close its Eland platinum mine, according to reports from Bloomberg yesterday. With officials from local labor unions saying the operation could be "lost forever."

Eland is one of two platinum operations owned by Glencore in South Africa. Which together produce about 157,000 ounces per year -- suggesting that the production losses from Eland's closure will be significant. Related: A Key Tool For Energy Investors

At the same time, things are looking more challenging at one of the world's other major platinum mines -- the Stillwater operation in Montana.

The mine's operator Stillwater Mining said Monday that it will lay off 119 workers at the operation -- comprising about 7% of the total workforce.

The move comes after Stillwater had already trimmed its workforce by 9% over the past year. A direct consequence of falling profitability at the mine under current, lower platinum prices. Related: Low Oil Prices And China Pull The Rug From Under Latin America

The future for the mine is all the more uncertain given that remaining employees are deadlocked with management over a new labor contract. With workers demanding better pay, while management insists the funds just aren't available.

The loss of Stillwater would be significant for the platinum market -- with the mine producing about 120,000 ounces of platinum (plus 390,000 ounces of palladium) yearly.

All of these developments are bringing investors back to the platinum market. With Bloomberg reporting this week that holdings of physical platinum by exchange-traded funds (ETFs) have recently risen to 2.85 million ounces -- very near to all-time highs. Related: Is This The Best Play In U.S. Oil?

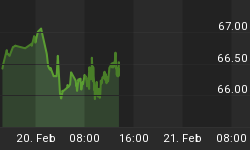

With platinum prices hitting fresh multi-year lows this week, this trend is going to continue. Which could mean major opportunities shaping up in this unique corner of the resource world.

Here's to backing up the truck,

ADVERTISEMENT

Dave Forest

More Top Reads From Oilprice.com:

- Low Oil Prices Could Break The “Fragile Five” Producing Nations

- Oil Prices Must Rebound. Here’s Why

- Could This Innovation Pave The Way For An EV Revolution?