The Security – Energy - SPDR ETF (XLE)

Energy - SPDR ETF is a Standard & Poor’s Exchange-Traded Fund that offers much profit potential with a Low-Risk quotient. I suggest that it be used as an investment only when you are not comfortable with specific Company within the Energy Sector. In my practice, I maintain Sector and Industry Group – Lists (constantly updated) of the best 3% of Companies to take Long Positions in Bullish Cycles and Short Positions in Bearish Cycles. I hope I have pricked your interest in my work / analytics.

Forecasts - - F + C = R

Accurate Forecasts (plus) Patience waiting for Conformations (equals) Results. Results are Consistent Annual Profits for Over 50 Years. This simple formula F + C = R is how I go about making money for myself and my Clients. The below Table of Fundamental - Valuation of a great deal of raw data plus many comparative calculations. They have been both reliable and profitable for many years. Consistent Annual Profits also requires sophisticated and unique Technical Analysis. (The Convention - Technical Analysis - Doesn't Work!) Long hours of hard work and experience to know – the What, the When and the Why I “tweak” the data, to be sure. This is, so I can consistently and accurately identify Market and Company Bullish and Bearish Inflection Points. This is just part of My Methodology for profitable “Investing Wisely.”

In writing for OilPrice.com I will rotate my ETF Energy Forecasts for several Energy and Mining ETFs at one to three per month. Your monitoring the Accuracy of my ETF Forecasts will help you gain a better understanding about - how I go about consistently making money in the Stock Market. Over 200, ETFs are in my "Universe of ETFs" that I am constantly doing Fundamental – Valuation and Technical Analysis on. This work provides a perspective of – Where the Top 3% and Bottom 3% – Sectors and Industry Groups are in the ever-changing Cycles of the General Stock Market. This unique methodology is very important to your maximizing (with the lowest possible risk) consistent annual profits in your portfolios.

For example: I am writing my articles for OilPrice.com and am limited by what I share with you to both Energy and Mining. Clearly, it is very possible, within the General Market Cycles, that Energy and or Mining is NOT where you should be investing your money. Perhaps it should be in Health Care, or Technology, or other Sectors and Industry Groups – or – Perhaps not! I hope you are getting a picture and understanding how I go about making money for myself and my Clients. I invite you to contact me for further information about my work / analytics.

To learn more about my Work / Analytics, you might consider reading my article on “Special Notes Supporting My Articles.” (just click). You will have to be a serious Investor because this article with its many URLs will require much of your time to absorb and understand. I can assure you that your time will be well spent.

Table I: Professor’s – Current Valuation for: Energy - SPDR ETF Corporation (XLE)

Table II: Professor’s - Report Cards for Energy - SPDR ETF

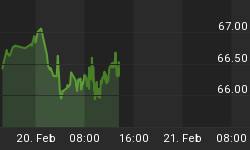

Charts

Two Year Chart for (XLE) with S&P (SPY) as a Reference

How come DIG (Red) is the only one to track with divergence from the S&P ($DJUSEN – green) and (XLE) (Black)? Answer: It is a 2x ETF. If you are not familiar with leveraged ETFs, or Inverse ETFs you might want to check with me.

Fifteen Year Chart for $DJUSEN, DIG, with (XLE).

I suggest that you take a long look at this 15-year chart. Having a longer-term perspective of a possible future investment will always give you a more consistent annual bottom line. The Red Line is (XLE) and it tracks very well all those Inflection Points that I have identified over many years.

General Market Status

The General Market is currently and remains “Fundamentally'” overvalued and “Technically" overbought, and its “Consensus Opinion” is much too bullish. “Insiders” are selling and “Interest Rates / Dividends” are on the rise.

This does not make for “Investing Wisely.” This means that you must consider holding Cash or perhaps taking bearish positions in the coming time-frame. (Taking Bearish positions are for Pro-Active Investors Only!) Owning or Holding - Growth Mutual Funds in periods such as now is also Not “Investing Wisely.”

My analytic focus and logo are “Investing Wisely,” e.g. taking advantage of the Bullish / Bearish Cycles as they occur within the overall Marketplace. Integrating conservative fundamental analytics within these technical cycles means maintaining a process of the thorough and on-going analytics of many companies, sectors, industry groups and ETFs. I have maintained such a Profitable Discipline for over 50 years, and it has been very good to both, me and my Clients.

Professor's Opinion (Currently – Bearish) of Energy - SPDR ETF Corporation (XLE)

(XLE) has simply tracked the Energy Sector (price-wise) over all of these many months and years. It is on a high, however it is coming lower soon. May I suggest that Holding through this period is not “Investing Wisely.” I continue forecasting that (XLE) will be under moderate to severe pressure in the coming weeks/months and perhaps longer.

This is a Warning about Buying or Holding Energy - SPDR ETF.

I am also Bearish on the World Economies and the General Markets. I suggest that holding Cash during questionable time frames is a prudent and wise choice. ( Folks - This is definitely a "questionable" time frame)!

ADVERTISEMENT

Here is my list of 20 or so Component Companies for: SPDR - Energy - (XLE):

XOM,CHV,SLB,OXY,COP,APC,HAL,EOG,NOV,APA,PSX,WMB,PXD,VLO,MRO,BHI,NBL,SE,COG,

DVN,KMI,CAM,MPC,HES,FTI

Few, if any of these Companies are exhibiting longer-term Fundamental – Valuations that are compelling. That means, if you read my Report Card that these Companies are currently Neutral. I hope you understand that there are a number of other Companies on my Buy List that do have both excellent low risk and high profit potential. You might like to read my article on the importance of - Securities Selection in this current Market environment.

http://www.safehaven.com/article/27218/being-selective-is-critical-for-consistent-profitability

For my Near to Short-Term Forecast on any of the above just send me an Email. Serious Investors Only -- Please.

You may want to “bookmark” this Hyperlink for quick access of my published articles here in OilPrice.com. Just Click and scroll down past my Biography. Thanks!

To contact me and begin a personal Email Dialog – just click: senorstevedrmx@yahoo.com

Smile, Have Fun – “Investing Wisely,”

Dr. Steve