Bloomberg is out with a surprisingly objective article ("surprising" because it goes against the very "green" ideology espoused by both the media company's billionaire owner and the Biden administration) titled "Biden’s Remedy for High Gasoline Prices: Blame Oil Companies" which echoes what we said yesterday, yet which does not address the elephant in the room, namely that while Biden is (of course) scapegoating someone for his own failures, the solution remains just one: some form of SPR release or "volume exchange" (as JPM explained yesterday).

There is just one problem: at this point an SPR release - which has been fully priced in - would send oil prices higher.

As Goldman's commodity strategist Damien Courvalin explains, while such a release would provide a short-term fix to a structural deficit, "it is now fully priced-in" following the $6/bbl move lower in recent weeks, which are pricing in a release of more than 100 mb into OECD stocks, and - worst of all - would not help the slow global supply response that only higher oil prices can overcome. In fact, according to Courvalin, "if such a release is confirmed and manages to keep oil prices depressed in the context of low trading activity into year-end, it would create clear upside risks to our 2022 price forecast."

Below we excerpt from Courvalin's note which we urge all those who write Biden's daily agenda and speeches to read before they commit another inflationary disaster.

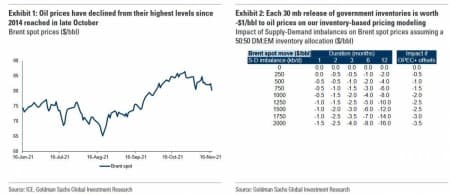

The White House consideration of an SPR release had already pushed Brent down by $4/bbl in recent weeks, with the potential participation of China likely behind the latest additional $2/bbl sell-off that occurred yesterday (November 17). On Goldman's pricing model, the $6/bbl move lower since late October is already pricing a release of well over 100 mb into DM stocks (assuming in fact that rising COVID cases have further exacerbated the recent move lower).

Ironically, this is well beyond what is likely to be announced with reports suggesting a 30 mb US release and a similar aggregate amount from other countries. As a result, "such a potential announcement is already fully priced in" according to Courvalin, with low trading liquidity into year-end the likely only reason for any additional price downside from here.

As Goldman has argued since August 2020, higher oil prices are justified by a strong demand recovery in the face of a slow supply response. This slow supply response has itself three roots, that only higher oil prices can overcome:

- the damage to investors caused by oil producers’ capital destruction over the last seven years, now compounded by ESG allocation inefficiencies, and

- the demand uncertainties of COVID, China and energy transition.

- In the case of OPEC, the slow production increase is the rational response to a steeper global oil cost curve, with oil finally returning to levels that balance their fiscal budgets.

Net, actions to lower oil prices in the short-term would further delay the required global supply response. As Goldman explains, "from a central bank perspective, this would be akin to not raising rates in the face of inflation (Fed in 1965) or, conversely, hiking rates in the face of a recession (Fed in 1928, ECB in 2008)."

As a result, if such a release is confirmed and keeps oil prices below the bank's 4Q 2021 $85/bbl Brent forecast, it would introduce clear upside risks to the bank's 2022 price forecast. This in fact suggests that OPEC could consider halting its production hikes to offset the detrimental SPR impact of lower oil prices on the needed recovery in global oil capex, an unlikely event admittedly given China’s potential participation in a strategic release.

In any case, one thing is clear: the three structural roots of the slow supply response requires higher oil prices, even if it means a rout for the Dems in the miderms. Here's why:

First, an investor payback for poor returns. The oil upstream sector, especially shale, over-invested from 2014 through 2019, destroying significant equity and debt values. This has left investors wary of the sector, requiring producers to focus on returning cash to shareholders through debt buybacks and dividend payouts. Despite these efforts, the recent profitability has been too brief to overcome such damage to investors, leaving the sector trading at a large discount to both the broader market (S&P500) and long-dated oil prices. This is still a long ways away from maximizing shareholder returns, providing little mandate to raise capex, and with the forces of ESG now an additional headwind. Specifically, by cannibalizing investor’s capital away from oil and gas, ESG principles are further raising the cost of capital of producers, increasing the marginal cost of production that needs to be cleared by higher oil prices. This is the main reason why the producer response has been slow, with the return on capital employed of the two largest US producers - pointed out by the White House in a letter to the FTC yesterday - only now back to their cost of capital.

Second, demand uncertainty. In the short-run, this uncertainty is due to the still present COVID risk, with measures to contain successive waves systematically weighing on mobility. The increasingly more important source of uncertainty is, however, that of the path to decarbonization. The focus on shifting away from hydrocarbons, while necessary, creates an uncertain return proposition for long-cycle oil and gas projects, which still represent the bulk of global supplies. The rational response to such uncertainty is to either delay investment or focus on short-cycle solutions. Beyond the volumetric uncertainty of where oil demand will be in ten years time, this uncertainty is increasingly regulatory, with still unclear rules in the US in terms of drilling, emissions and taxation. While action is indeed required in these areas to lower emissions, the lack of clarity is rationally delaying investment. We observed the same outcome in 2014 when a potential lift of the US crude export ban was still unclear, delaying any major investment in US refining capacity.

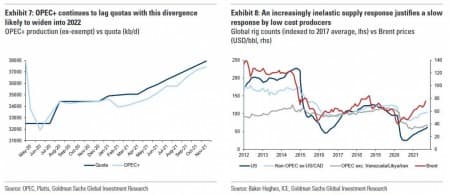

Third, OPEC. The group still has spare capacity and is only ramping up gradually. While it could do more, there are two reasons for such a slow response. First, half of its members can’t meet their quotas given their own under-investment. This complicates changing quotas as such a decision needs to be unanimous. Second, the slow supply response of shale producers has brought the group its pricing power back, leaving a slow ramp-up in output fiscally more beneficial than higher volumes. As we argued in 2014, this is the rational response to a steepening global cost curve, with prices finally back to near core-OPEC’s fiscal breakevens. The nature of the current SPR release - presented in part as targeted at OPEC - raises the question of what the group does next. The rational decision would be to halt production hikes to offset it - since the positive price impact always exceeds the volumetric hit. Conceptually, such a decision could be argued to help support prices to the level needed to stimulate the (slow) recovery in drilling activity globally. A global shortage in coming years is indeed not in OPEC’s interest as it would lead inevitably lead to a global recession - and much lower oil revenues - or accelerate the energy transition away from oil.

Ultimately, Goldman is correct that the decision to release oil from strategic reserves remains mostly political, precipitated by rising inflationary pressures across the economy. Yet, while oil prices are indeed up significantly, they are ultimately not historically elevated, especially when factoring in wealth effects. In the US for example, current spending on gasoline represents 4.3% of total US consumer expenditures, well below the 6% average level of the 2010-14 period, when the last emergency coordinated SPR release occurred. On a global scale, Goldman's estimate of oil consumer spending per GDP (based on retail prices covering 98% of global demand) shows that current prices are only in their 65th percentile since 2000.

ADVERTISEMENT

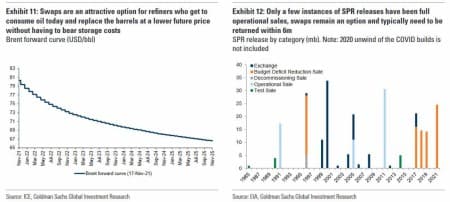

The political nature of this release may lessen the sustainability of its bearish price impact. For example, structured as a loan, barrels would need to be returned at a later date, creating buying demand for deferred contracts as a hedge (an especially appealing strategy given the backwardated forward curves). The EIA’s forecast for lower oil prices next year as well as the historical pattern of US SPR volumes ending up exported would also point to the use of exchanges of barrels rather than a sale, just as JPM predicted yesterday. With India, Korea and China having all already conducted swaps this year to be repaid in 2022, similar government loans would actually become an additional bullish catalyst next year when these barrels will have to be returned from commercial inventories. Meanwhile, the lack of bearish impact of past Chinese SPR releases is ultimately indicative of the scope of the current deficit.

So given Goldman's expectation that an SPR release - which is already more than fully priced in - will not lower oil prices in 2022, with

risks to the bank's forecast skewed to the upside if a deal with Iran does not occur, Courvalin believes the White House will be pushed to consider additional actions to try to lower US gasoline prices. This is consistent with yesterday's news that the White House urged the FTC once again yesterday to investigate US retail gasoline prices, which have indeed outperformed crude oil prices in recent months. Of course, this outperformance reflects refining, regulatory and distribution dynamics, as pump prices need to reflect:

- the historical pattern of a lagged pass through of crude prices into gasoline prices,

- the tight level of gasoline and diesel inventories, leading both to compete and outperform crude in order to defend refiners’ yield incentives,

- regional closures in US refining capacity,

- the impact of government biofuel mandates and elevated RINs values, and

- retail and distribution margins supported by rising input and labor costs

Of these, the Biden admin can only directly impact RIN values - pointing to weaker RFS blending requirements in 2021-22. Marketing margins have also remained elevated, making up 20% of current retail prices (at the high end of the historical range), with the FTC asked for a second time to investigate this sector. This may however still reflect the inflationary effects of the COVID shock, with costs per gallon sold increasing due to a still above-average number of employees as well as wage inflation.

By Zerohedge.com

More Top Reads From Oilprice.com:

- Demand Uncertainty Could Keep Oil From Breaking $100

- U.S. Natural Gas Prices Could Soon Hit $6

- Is Lithium The Best Bet On A Overheated EV Market?

Anyhow somewhere in the middle of all that *YET AGAIN* is President of the United States Joe Biden.

Definitely don't call myself an expert in this regard in the least but absolutely do follow TheHill.com YouTube and BreakingPoints YouTube as well. "Nothing there about this" a hardly prosaic matter going into the Holidays.

While a release of 100 million barrels could only initially lead to a price reduction of up to $2.0 a barrel while the global economy assesses the impact of the release, prices will certainly rebound much higher than the pre-release levels. The reason is the robustness of global oil demand which is underpinned by a global economy growing this year at 6.3%, its fastest growth rate in 15 years, a steep decline in international oil inventories and a firm stand by OPEC+ on oil production.

There is an immediate need for at least $1 trillion in global investments in oil and gas exploration and production expansion but such investments aren’t forthcoming soon or possibly ever because of the pressure on oil and gas companies to divest of their oil and gas assets. Even if investments of that size were made available, it takes at least five years before they reach fruition. Therefore, we could expect surging oil prices for the next five years at least.

OPEC+ has rightly refused to heed President Biden’ calls to increase production beyond what it has already agreed upon for fear of tipping the oil market towards glut.

Therefore, those who are calling for a release of crude from both the United States’ and China’s SPRs and other international sources shouldn’t waste their breath and should let the market decide on price levels. One shouldn’t swim against the tide.

Dr Mamdouh G Salameh

International Oil Economist

Visiting Professor of Energy Economics at ESCP Europe Business School, London