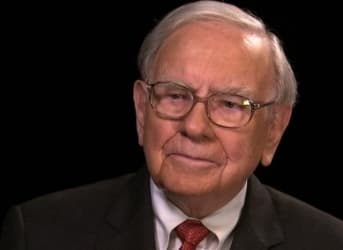

Warren Buffett has been consistently wrong on oil, but many experts are calling a bottom on oil prices now that the investor extraordinaire has upped his ante in Phillips 66, betting that he can’t be wrong three times in a row.

Buffett’s Berkshire Hathaway Inc. paid some $390 million for another 5.1 million shares of oil refiner Phillips 66 this month, boosting its investment to 65.68 million shares that today are worth around $5.21 billion. Phillips 66 shares closed up at $4.03 (5.4 percent) at $79.28 on the New York Stock Exchange on the deal.

Experts have been calling the bottom since the price of oil dropped to $80/barrel. Now, it’s below $30/barrel, and of course those calls continue, but when Buffett makes a contrarian move, these calls get more credence. Related: Oil Bust Could End Dollar Domination

Though everyone watches Buffett closely and his moves can set trends, his record in oil investing hasn’t been stellar.

The first time he bought ConocoPhillips—parent of Phillips 66 before the two split in 2012—was from 2007 to 2009, when both its price and oil prices were at their peak.

He sold 44 percent of the stock around the lows of crude oil in 2009, and the rest over a period of time until 2013. What’s more, he has admitted his mistake in picking a very large stake at the wrong time. It ended up costing him millions.

His next oil mistake was Exxon Mobil. After dropping ConocoPhillips, Berkshire built up a large position in Exxon Mobil at a time when crude oil prices were near their highs in 2013. The buy went down in the third quarter of 2013 when the stock quoted between $86 and $95. He sold in the fourth quarter of 2014 when the stock was between $86 and $92. It’s assumed that the Exxon deal was merely a disappointing breakeven trade for Buffett. Related: 27 Billion Barrels Worth Of Oil Projects Now Cancelled

These two major investments failed to return any profit, so it’s fair to say that oil is not Buffett’s forte.

So will he get lucky the third time around? He just might. Indeed, many are convinced that Buffett would not make the same mistake three times in a row.

Compared to his first two shopping sprees, he’s buying at lower prices. Buffett waited patiently for the price to reach a certain level before he started purchasing, clearly banking on oil prices bottoming out-—someday.

Going against the herd is, after all, Buffett’s famous MO. When everyone else is fearful, this is the time to get in. Related: Saudi Arabia: A Weak Kingdom On Its Knees?

But Buffett is a long-term investor, so this third big bet on oil says more about his faith in oil prices a decade from now than it does about his outlook for tomorrow’s prices. If you’re looking to Buffett, then, look to the long-term. He is a patient investor, and his bet on Phillips 66 doesn’t mean he thinks that oil will bottom out anytime soon.

ADVERTISEMENT

For now, don’t expect any short-term returns on this investment, and be prepared to weather gut-wrenching volatility.

By Rakesh Upadhyay for Oilprice.com

More Top Reads From Oilprice.com:

- Cheap Oil Hits Housing In North Dakota, Texas, and Others

- War Between Saudi Arabia And Iran Could Send Oil Prices To $250

- Can ISIS Actually Gain Power Over Libya’s Oil?

He sold 44 percent of the stock around the lows of crude oil in 2009, and the rest over a period of time until 2013. What’s more, he has admitted his mistake in picking a very large stake at the wrong time. It ended up costing him millions."

Apparently he has learned his lesson. This time he's buying near the lows in oil rather than near the high's.