A lower buying appetite among LNG importers in Asia may cast a shadow over the survival chances of planned LNG projects as fewer buyers are now willing to commit to the long-term deals LNG companies need to get the financing they need, S&P Global Platts writes.

Lower prices for the commodity resulting from the slew of new supply that came on stream in the last couple of years is making buyers less worried about the possibility of a shortage in the future. Also, the U.S.-China trade war has further dampened appetite for long-term contracts in the world’s fastest-growing LNG import market.

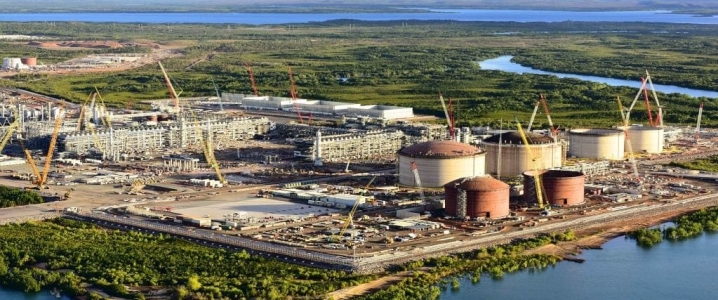

LNG projects cost billions of dollars to build and are often accompanied by cost overruns and delays. Companies with activities in the area need debt financing to go ahead with their plans, and lenders are a lot more willing to dispense the cash when they see long-term commitments from buyers.

Still, "We expect several further FIDs to be taken in 2019. But this is a race with clear frontrunners, and the finish line is well in sight," S&P Global Platts Analytics said in a recent report, adding that "LNG buyers remain reluctant to sign long-term contracts, and hence project developers that are able to finance a project without firm offtake agreements seem to be in the driving seat.”

Even with this lower willingness among Asian buyers to commit to long-term contract terms, demand for LNG is set to continue growing at a solid rate. In its latest LNG Outlook, Shell forecast this to rise by 27 million tons this year, to 319 million tons and further to 384 million tons in 2020. Over the medium to long term, the supermajor even warned of the possibility of a shortage unless a sufficient amount of new production capacity comes on stream.

By Irina Slav for Oilprice.com

More Top Reads From Oilprice.com:

- Activist Investors Force Change In The Oil Industry

- The Latest News From Tesla Is A Game Changer

- Global Oil & Gas Drilling Set To Surge In 2019