One of the most important questions in the global oil markets revolves around U.S. oil production. There is probably nothing OPEC would like to know more than when U.S. oil production will begin to decline.

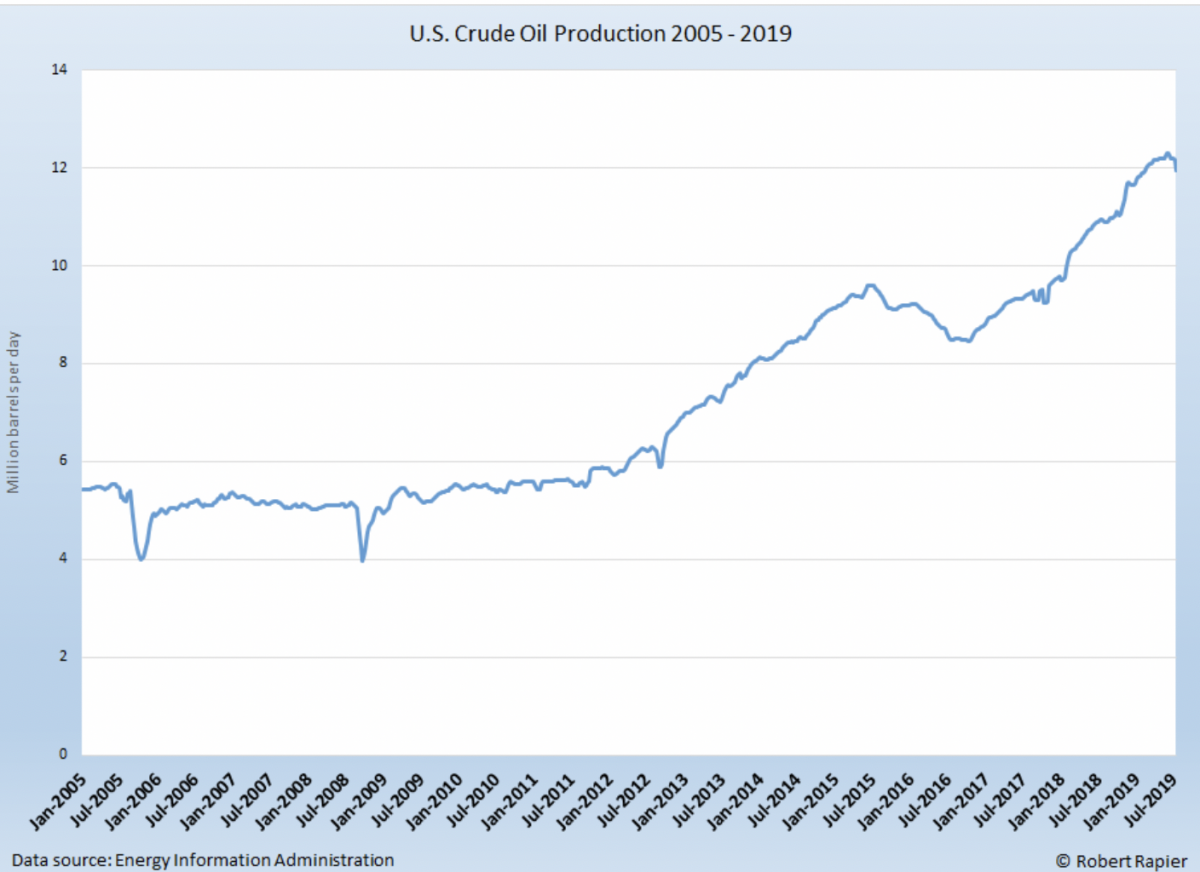

The resurgence of U.S. oil production over the past decade diminished OPEC’s control of the global oil markets. In less than eight years, U.S. oil production climbed from under 6 million barrels per day (BPD) to more than 12 million BPD. This surge is arguably the only reason oil prices today aren’t above $100/barrel (bbl).

(Click to enlarge)

U.S. oil production growth 2005 to 2019.

OPEC’s current strategy seems to be to wait for U.S. production to begin declining so they can begin to regain control of the oil markets.

They may not have to wait all that long.

In last week’s article, I covered the slowdown in oil production growth in the Permian Basin. This is the most important oil-producing region in the U.S., but of course it isn’t the only one. And while most of the coverage of the resurgence of U.S. oil production has been primarily focused on shale oil and tight oil, U.S. offshore oil production has also made a big jump. Over the past decade, Gulf Coast oil production in the U.S. rose from about 1.2 million BPD to about 2.0 million BPD.

Thus, I thought today it might be instructive to look at the trends in total U.S. oil production. Note that in the previous graphic, it looks like production may be starting to turn down right at the end of the time frame. In fact, the Energy Information Administration (EIA) has reported a slight downward trend in U.S. oil production since May. The key question is whether this is an anomaly, or the beginning of a sustained trend.

Applying the same analysis that I did last week to Permian Basin production — which looked at year-over-year production changes — it becomes clear that overall U.S. production growth is declining even faster than Permian Basin production growth.

(Click to enlarge)

Year-over-year change in U.S. oil production.

From this graphic, production growth has been slowing since January, and the slowdown has accelerated in recent months. Production growth is falling so fast that at the current pace, it would fall below zero before the end of the year. The steep decline from the most recent EIA report was influenced by offshore production shutting in ahead of Hurricane Barry. But, even if we assume the slower rate of decline from earlier in the year, it looks like growth will fall below zero within a year. Once growth falls below zero, that represents a year-over-year decline in U.S. production.

It’s hard to say whether the current decline will be permanent. Note that there was a similar decline that began in 2015, but that reversed direction in 2017 as oil prices recovered from the $30/bbl level back up to over $50/bbl.

It’s doubtful that the current decline will see the same sort of sharp reversal, as the previous decline was a result of sharp cuts in capital spending as oil prices fell from the $100/bbl level to below $30/bbl. The current production decline is taking place during a period of a smaller decline in oil prices.

ADVERTISEMENT

Regardless, probably the only thing that can arrest the current slowdown is a spike in oil prices from current levels. And unless that slowdown is arrested, total U.S. oil production will likely once again be in decline within one year — and possibly by year-end.

This is the outcome OPEC is hoping for. It is clear that their strategy is to keep oil prices propped up until U.S. oil production begins its decline, at which point they can reassert control over the global oil markets.

By Robert Rapier

More Top Reads From Oilprice.com:

- Did Trump’s ‘Plan B’ For Iran Just Fail?

- Growing Fear Of Global Economic Slowdown Caps Oil Price Gains

- A Serious Contender To Lithium-Ion Batteries

Even at its climax, US oil production has had a limited impact on the global oil supplies as US crude oil exports never exceeded 2 million barrels a day (mbd) in 2018 while net US oil imports hit 7.76 mbd in the same year according to the authoritative 2019 OPEC Annual Statistical Bulletin.

Furthermore, US oil production consists of shale oil production and conventional oil. The slowdown in US shale oil production particularly from the Permian which has been contributing 65%-70% to US shale oil production is so well documented by so many authoritative reports that it has virtually become an established fact. Total US oil production is projected to average 11 mbd this year and decline in 2020 to between 10 and 11 mbd and go below 10 mbd in 2021.

As for US conventional oil production contribution, it is beyond the pale. It has virtually dried up with never a hope for recovery even with the most advanced production technology. A daily average oil production from a conventional well in the United States amounts to 17 barrels or less. Compare this with 13,700 barrels in Iraq and 10,200 barrels in Saudi Arabia. It would take more than 800 US wells to pump as much oil as a typical Iraqi well. Iraq’s oil wealth was the ultimate factor behind the invasion of Iraq in 2003. This will always be a stigma on the face of the United States.

Dr Mamdouh G Salameh

International Oil Economist

Visiting Professor of Energy Economics at ESCP Europe Business School, London

The US growth in production since 2010 is unprecedented - even the discovery of Ghawar in Saudi in 1948 cannot match it. It will continue and US importance as the dominant global producer will only increase. Think about it - in the next ten years global oil demand will be 12-15 mmbo/d higher than today. That is more than all of Saudi's current production. Since we are unlikely to add another Saudi over this time frame, the US will have to fill most of this void. My guess is US production will exceed 20 mmbo/d in 10 years, which is only possible by commercially producing source rock as opposed to low hanging fruit of conventional.