If one follows the media coverage of Elon Musk, the overwhelming impression would be of a man in a huge rush. The last couple of weeks have been particularly crowded. It looks like wherever you look, there’s news about Musk and his businesses, whether it’s the fifth successful landing of its Falcon 9 rocket after a supply mission to the International Space Station or the much-awaited release of the second part of Musk’s master plan, or a fresh price cut for its Model X crossover to stimulate demand.

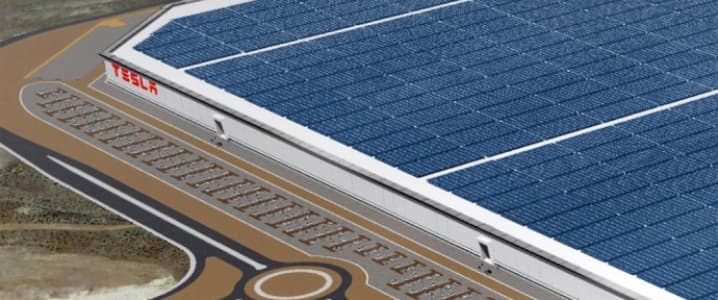

Elon Musk has been having a busy year and now, a week before the release of Tesla’s second-quarter results, he plans to officially cut the ribbon on Tesla’s gigafactory in Nevada. The facility is perhaps one of the best demonstrations of Musk’s vision for Tesla as a world leader in not just electric vehicles but also power storage systems. The grand opening comes ahead of schedule, with production slated to begin later this year versus initial plans for the start of 2017.

According to Tesla officials, the purpose of the rush is to have the factory up and going before the launch of the low-cost Model S, which will carry a price tag of just 35,000, basically half of what Model S buyers pay to date. Demand is expected to be through the roof for the cheap sedan. But then again, demand was expected to be through the roof for the Model S and the Model X, and the expectations failed to meet reality. Not even after it lowered the price for the Model X by introducing a cheaper version earlier this month. Related: Libya’s Oil Deal Turns Sour As Army Chief Threatens To Bomb Tankers

For two consecutive quarters Tesla has been missing its own sales targets, although the company remains upbeat about full-year figures. Tesla cited component shortages as the main reason for the discrepancy between planned and realized sales for the first quarter. In the second quarter, apparently, it still dealt with the consequences of supplier part shortages, ramping up production in June.

These are the cars that will need the batteries to be produced at the gigafactory. Musk expects annual production of the Model S alone to reach half a million vehicles in a few years. He also plans to go into electric trucks and buses as per Master Plan Part 2. Power storage systems that use lithium-ion batteries are also a priority. The future from his perspective looks bright but is it?

Along with announcing quarterly sales results, Tesla somewhat quietly added that it is scrapping its buyback program that offered buyers of Model S and Model X vehicles the option to re-sell the vehicle to Tesla at no less than 50 percent of the original price. The reason: it just doesn’t have enough cash to afford to provide the cover.

Then, of course, there have been the investigations into its Autopilot program that have turned into a major headache for Musk and company, despite assurances that accidents are statistically rare. Statistics take a break when a fatal accident is involved. Related: Why Are Oil Producers Rushing To The STACK?

In August, Tesla is expected to report a loss per share of $1.15 for April-June 2016, up from a loss of $0.82 for the second quarter of 2015. It is also expected to get the go-ahead for its acquisition of SolarCity soon. It looks like Musk has a lot on his plate and, besides great visions, much of this lot is problems, practical problems.

The early launch of the gigafactory may look impressive and ambitious but it might turn out to be more about form than substance. Even if large-scale production of batteries starts before the year’s end, it remains to be seen whether demand for the Model S will live up to expectations and the same goes for power storage systems.

Elon Musk’s vision of a green-power, energy-independent future certainly makes a lot of sense. It’s just that it makes long-term sense and the path to this future is uneven. Besides, success is not guaranteed, as the mismatch between expected and actual demand for Tesla’s cars shows clearly. If this mismatch persists, the gigafactory may turn out to be just another bubble. At least over the short-term.

ADVERTISEMENT

By Irina Slav for Oilprice.com

More Top Reads From Oilprice.com:

- Bizarre Lawsuit Could Derail Elon Musk’s Hyperloop

- ‘’The Worst Is Behind Us’’ Schlumberger CEO Sees Reason For Optimism

- Forget The Glut – This Is Why Oil Prices Will Rise

EV's will not kill the OGI, but the future for OGI is already behind them. Simple as that.