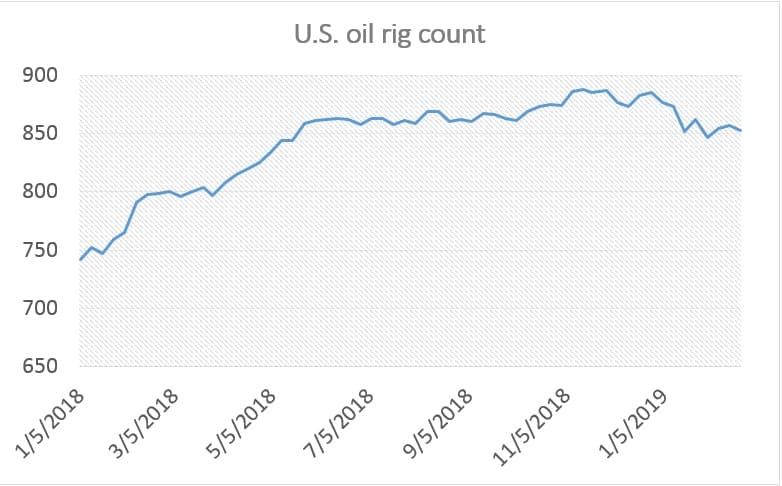

Drilling activity has plateaued in much of the U.S., with the rig count zig-zagging well below the peak from last November.

The rig count often rises and falls in response to oil prices, but on a several-month lag. It takes some time before oil companies make drilling decisions in response to major price movements. As such, the price meltdown in the fourth quarter of 2018 is still working its way through the system.

But the U.S. shale industry has already begun to tap the brakes. Total U.S. oil rigs are stood at 853 for the week ending on February 22, down from a peak of 888 in November. In particular, the Permian – often held up as the most profitable and prolific shale basin – has seen the rig count decline to a nine-month low.

Production continues to rise, to be sure, but the growth rate could soon flatten out. “We estimate that the y/y change in US oil drilling will, for the first time since 2016, turn negative by late May, should the current trend of gentle declines continue,” Standard Chartered analysts led by Paul Horsnell wrote in a note.

(Click to enlarge)

At the same time, oil prices are rising again, and are up roughly 25 percent since the start of the year. If WTI tops $60, many shale drillers could find themselves feeling confident all over again, and could pour money and rigs back into the field.

That said, multiple drillers have laid out more conservative and restrained drilling programs, facing pressure from shareholders not to overspend. According to Bloomberg and RS Energy Group, U.S. E&Ps have trimmed their spending plans by 4 percent on average, while at the same time they still expect production to grow by 7 percent.

Noble Energy, for instance, posted a $824 million loss for the fourth quarter, and slashed 2019 spending plans in response. The company expects to spend between $2.4 billion and $2.6 billion this year, sharply down from the $3 billion spent in 2018. The loss was magnified because the company was forced to take an impairment charge due to lower oil prices, which pushed some of its assets out of reach. “Recent market dynamics, including increased commodity price volatility, further highlight the need for our industry to prioritize capital discipline and corporate returns over top-line production growth,” said Noble Chief Executive David Stover, according to the Houston Chronicle. Related: Wall Street Loses Faith In Shale

Still, Noble’s President and CEO Brent Smolik told analysts and investors that the company’s productivity in the Permian continues to improve. “Through drilling completion and facility design changes and lower service cost, we’ve already identified $1 million to $1.5 million of well cost reductions versus the second half of 2018,” Smolik said on an earnings call.

Pioneer Natural Resources, considered one of the stronger drillers in Texas, also pared back its spending and growth plans for this year. After seeing production rise by 20 percent in each of the past two years, Pioneer will see growth slow to 15 percent. Spending will fall by 11 percent. Meanwhile, drilling and completion costs will rise by between 4 and 5 percent by the end of the year, Pioneer said. The company’s share price fell sharply when it reported fourth quarter earnings that missed analyst expectations in mid-February, although it has made up ground since then.

Pioneer’s CEO Tim Dove abruptly retired, handing the reins back over to Scot Sheffield, the former CEO. A handful of other chief executives from shale companies also resigned recently, in a sign that shareholders are getting antsy about financial results. “It’s a what-have-you-done-for-me-lately scenario,” Jason Wangler, analyst with Imperial Capital in Houston, told Reuters. “Not only are investors holding people accountable, they’re watching every move.”

It’s hard to reconcile the disappointing financial results and the promises to do better on the one hand, and the forecasts from the likes of the EIA for ongoing explosive production growth on the other. There are signs that the U.S. shale industry is slowing down – modest spending cuts and a flat or declining rig count – but also plenty of evidence to suggest production growth will remain on track.

ADVERTISEMENT

The industry is entering a new era of heightened scrutiny from shareholders. The financials seem to be improving, with some (only some) companies cash flow positive or on the verge of it. But they still expect to spend large amounts to grow production. This year will be an important marker for the health of the industry, after lofty promises of lower breakevens, efficiency gains and a cash flow-centric strategy. Time will tell.

By Nick Cunningham of Oilprice.com

More Top Reads From Oilprice.com:

- Middle East Oil Kingdoms Grapple With New Crisis

- Saudis Leaning Toward OPEC Cut Extension

- UAE To Build World’s Largest Underground Oil Storage Facility