Oil prices tanked early on Black Friday on rumors that OPEC’s leading members aren’t willing to deepen output cuts. At 12:40 PM ET, WTI was down 4.59% at $55.54 and Brent was trading 4.27% lower at $60.57.

Oil prices have held firm in recent weeks on the understanding that Saudi Arabia was willing to at least extend the current production quota through June 2020.

In light of the ongoing Aramco IPO process, Saudi Arabia’s highest priority has been to keep oil prices steady around $60 per barrel. The Kingdom, however, is facing some resistance from other members of the oil cartel ahead of its next meeting.

Riyadh’s largest partner in the OPEC+ production cut deal, Russia, has been far less compliant and less vocal about rolling over the current production cuts. Russian oil majors have thus far been slow to respond to Moscow’s mandate to cut oil production and, as a result, the country continues to overproduce. Russian oil CEOs Igor Sechin and Vagit Alekperov even expect OPEC to delay a decision about extending oil production to March 2020.

According to data from the Russian Energy Ministry, its drillers pumped 11.244 million bpd between November 1 and 26, exceeding their quota by 54,000 bpd. Bloomberg estimates that Russia hasn’t fully complied with the deal for 8 months in a row.

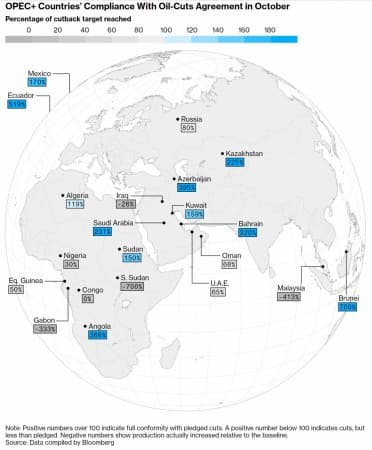

And Russia isn’t the only country that hasn’t been fully compliant. The below chart from Bloomberg shows that several OPEC and Non-OPEC nations have failed to adhere to the production agreement.

(Click to enlarge) Related: Scientific Breakthrough: MIT Solves Two Huge Energy Problems

Saudi Arabia, as usual, continues to overdeliver and is growing increasingly impatient with its fellow OPEC and non-OPEC partners. Saudi Arabia’s new oil minister, Prince Abdulaziz bin Salman, is expected to crack down on rogue producers within the cartel. Oil markets should expect a shift in Saudi attitude in the upcoming OPEC meeting as Prince Abdulaziz seems willing to break with his predecessor's policies.

If OPEC fails to comfort the markets at its upcoming meeting, a deja-vu of Christmas 2018 could be in the making, and today’s price plunge could just be the prelude to a significant correction in crude.

ADVERTISEMENT

By Tom Kool of Oilprice.com

More Top Reads From Oilprice.com:

- Reuters Confirms That Iran Was Behind The Saudi Oil Attacks

- IEA Warns Of A Looming Oil Glut Ahead Of OPEC Meeting

- OPEC Optimism Lifts Oil Prices

The war has widened an already existing glut in the market from a relatively manageable 1.0-1.5 million barrels a day (mbd) before the war to an estimated 4.0-5.0 mbd. As long as the trade war continues, the glut will be with us with even the possibility of increasing.

The recent US legislation relating to Hong Kong is considered by China not only a blatant interference in its internal affairs but also a crude attempt by President Trump to shift the global media focus away from his impeachment proceedings . This will harden China’s attitude towards ending the trade war. Having already won the war, China will be very disinclined to help end it because it has lost all confidence in President Trump’s word and his mercurial behaviour. China’s calculations are that the adverse impact of the war on the US economy coupled with the impeachment proceedings could cost President Trump the 2020 presidential elections.

Saudi Arabia finds itself between a rock and a hard place. It has no alternative but to continue shouldering the biggest production cuts at least to keep oil prices above $60 a barrel. Saudi-led OPEC may also extend the cuts by a few more months beyond their expiration date. A deepening of cuts will be resisted by the majority of OPEC members and also Russia. If, however, Saudi Arabia refuses to extend the current cuts, oil prices may decline to lower $50s inflicting the biggest damage on the Saudi economy. Such an eventuality could lead to a further depreciation of Saudi Aramco’s valuation and more headwinds for its domestic IPO.

Still, all is not lost. With President Trump’s mercurial behaviour, he might still swallow his pride and end the trade war against China if only to improve his chances of getting 4 more years in the White House.

Dr Mamdouh G Salameh

International Oil Economist

Visiting Professor of Energy Economics at ESCP Europe Business School, London