Oil prices have had the strongest start to the year in recorded history, but economic data looks set to put an end to that rally.

(Click to enlarge)

(Click to enlarge)

(Click to enlarge)

(Click to enlarge)

(Click to enlarge)

(Click to enlarge)

(Click to enlarge)

(Click to enlarge)

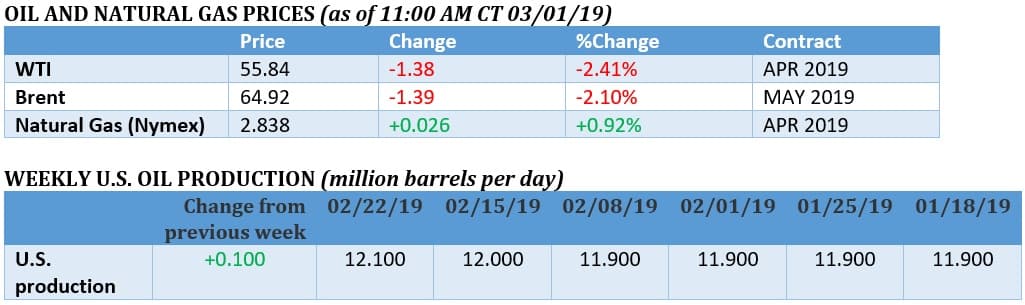

Oil was down a few days ago, but is set to close out the week with another gain, pushing WTI and Brent close to their highest level in three months.

Citgo severs ties with PDVSA. Citgo completed its breakup with PDVSA, cutting off a crucial stream of revenue for the Venezuelan government. The opposition, led by self-proclaimed president Juan Guaidó, hopes to obtain control of Citgo and its resources, which would provide the new government with a revenue base. Recent data from Kpler and the WSJ suggests that Venezuela’s oil exports have only declined to about 1.1 mb/d, evidence that the Maduro government is still finding buyers for its oil.

ExxonMobil reports largest reserve increase in a decade. ExxonMobil (NYSE: XOM) replaced three times its annual production in 2018, the largest reserve-replacement ratio in over a decade. The increase largely came from a re-booking of reserves in Canada’s oil sands that had been written off in 2016 due to low oil prices. In total, Exxon added 4.5 billion barrels of oil equivalent last year, bringing its total to 24.3 billion boe.

ExxonMobil makes gas discovery in Cyprus. ExxonMobil (NYSE: XOM) made a substantial natural gas discovery off the coast of Cyprus, adding to the bounty in the Eastern Mediterranean. According to Wood Mackenzie, Exxon’s Glaucus field could be one of the largest this year. “Glaucus is a giant,” said Robert Morris, senior research analyst at Wood Mackenzie, according to the FT. “The discovery maintains the east Mediterranean’s position as one of the world’s premier exploration hotspots.” Related: Will Trump Take Action Against OPEC?

Wall Street unsatisfied with oil majors. Investors are souring on the oil majors, according to the FT. The majors face both short- and long-term headwinds, including low oil prices stemming from abundant U.S. shale supply combined with the long-term fears of peak oil demand. “There’s just this hate for this commodity right now,” Bernstein analyst Bob Bracket told the FT. That could affect how the industry proceeds going forward. “The structural challenges the industry faces aren’t going to go away, so energy companies of all sizes need to clearly articulate how they will allocate investors’ capital and prioritise shareholder returns in a manner that rebuilds confidence,” Nick Stansbury of Legal & General Investment Management told the FT.

EVs to reach parity with ICE in 3-4 years. Electric vehicles will reach cost parity with the internal combustion engine (ICE) in three to four years, according to Bernstein. Not only will they compete on upfront cost, but EVs will still boast $950/year fuel and maintenance savings compared to gasoline-powered cars. Thereafter, EVs begin to dominate. “By 2029 we believe pure EVs will be cheaper than ICEs for the entire global market, and thus game-over for ICEs,” Bernstein analysts said.

Colombia sees premium for its oil due to Venezuela. The loss of heavy oil shipments from Venezuela to the U.S. Gulf Coast has put a premium on heavier oil from Colombia.

Deepwater drilling costs to rise. Diamond Offshore Drilling Inc. (NYSE: DO) announced a near doubling of its rates for deepwater drillships this year, a sign that renewed drilling activity could lead to cost inflation offshore. Also, the offshore sector hollowed out during the 2014-2016 oil bust, and the contraction in capacity has tightened up the service market.

Oil prices up 25 percent so far this year. The oil market has seen its strongest start to a year in recorded history, with prices gaining more than 25 percent in two months. The increases, analysts say, are due to the Fed backing off interest rate hikes, combined with the OPEC+ cuts and turmoil in Venezuela and Iran.

ADVERTISEMENT

Permian pipelines hit regulatory delay. Two Permian pipelines seen as critical to relieving the midstream bottleneck have seen some regulatory delays from the U.S. Federal Energy Regulatory Commission (FERC). The Cactus II pipeline (585,000 bpd of capacity) and the EPIC pipeline (550,000 bpd) are among two of at least 15 projects that are held up at FERC. Their operators still expect to put them into service on time later this year.

LNG market could be oversupplied beginning this year. The wave of new LNG supply hitting the global market in 2019 – an expansion years in the making – could result in oversupply. Developers are set to bring more than 30 million tonnes (mtpa) of capacity online this year, while China, the fastest growing market, is only set to add around 8 mtpa in additional demand. WoodMac says over 2019 and 2020, an estimated 70 mtpa is expected to come online, a tidal wave that could leave a surplus until the early 2020s.

Canada’s crude-by-rail shipments collapse. Alberta’s mandatory supply curbs have rescued prices for Western Canada Select (WCS), which has converged towards WTI, but the narrower discount has killed the economics of running crude via rail to the U.S., according to Scotiabank.

Related: Goldman: Brent Oil To Reach $70-$75 Soon

China and India slash Iran imports. Iran’s oil exports to Asia fell in January as China and India slowed purchases, and Japan cut off imports from Iran entirely. Reuters reports that the combined import total for China, India, Japan and South Korea (the largest buyers of Iranian oil) fell to 710,699 barrels per day in January, about half of the total in the same month a year earlier.

Fracking activity contracted in December. According to Rystad Energy, the average number of daily fracking jobs in the U.S. fell to 36 in December, a decline of 25 percent compared to the period between May and August. “There is no doubt that significant part of this decline was driven by seasonal weather and capital constraint factors. Yet we keep hearing about somewhat disappointing pace of post-winter recovery,” Rystad said in its report.

Glencore and Shell under investigation. The U.S. Justice Department is investigating Glencore (LON: GLEN) for several potentially corrupt oil and mining deals in Nigeria, the Democratic Republic of Congo, and Venezuela. The probes have weighed on the company’s share price. Meanwhile, Royal Dutch Shell (NYSE: RDS.A) said on Friday that prosecutors in the Netherlands are preparing to issue criminal charges on the company for a shady 2011 oil deal in Nigeria. The same deal has bogged down Eni (NYSE: E) in Italy.

Angola exports decline. Angola’s aging oil fields are in decline, and lack of investment has resulted in a steep drop in output. The country’s oil exports are down 200,000 bpd since October, and the country is over-complying with the OPEC+ deal. Without investment, the declines could continue.

By Tom Kool for Oilprice.com

More Top Reads From Oilprice.com:

- The Permian Is A Double-Edged Sword For Oil Majors

- OPEC Oil Production Drops To Four-Year Low

- Saudi Arabia Oil Exports To U.S. Nosedive

thanks for posting great information