U.S. oil prices are treading water above $US 60/B (WTI) again, the first time since 2015.

Crude oil has a northerly wind in its sails, though everybody on board this fickle ship is cautious about its compass bearing. Since 2013 we’ve seen the price of a barrel peak to $110, capsize to $26, and roll back to $60.

The gyrations make sense.

Here is what we’ve learned over the past decade:

Above $80 is too high. Cash flow is ample. Investors gladly fund more drilling rigs. Pump jacks work hard. Too much productive capacity is added. But costs inflate quickly too—competitiveness diminishes within the oil industry, and also encourages alternative energy systems. Consumers become more miserly and demand growth decelerates.

Under $40 is too low. Cash flows dry up and investors jump ship. Rigs head back to their yards with drooping masts. Costs deflate, rapidly decimating employees and equipment in the service industry. Production begins to decline in marginal regions. State-owned enterprises are unable to pay their ‘social dividends’. On the consumption side, conservation and efficiency lose meaning; consumers revert to guzzling oil like free refills of coffee.

So, simplistically a mid-range price of $US 60/B should represent what oil pundits call “market balance.” It’s the elusive price point where daily consumption is equal to production; inventory levels are neither too low nor too high; and economists’ cost curves intersect with demand. Related: 5 Energy Sector Predictions For 2018

Yet, if there is one thing 160 years of the oil age teaches us, there is no such thing as a mid-range balancing point in oil markets. Everyone either rushes to one side of the ship or the other, almost always at the wrong time.

As in any marketplace, oil producers and consumers respond to price signals. Those on the using end of petroleum products respond to the changing winds of price fairly quickly. On the other hand, much of the world’s big producers are not like nimble sailboats, rather they act like big supertankers that take time to change direction. In other words, the time between investing capital (or not) to realizing changes in production is slower.

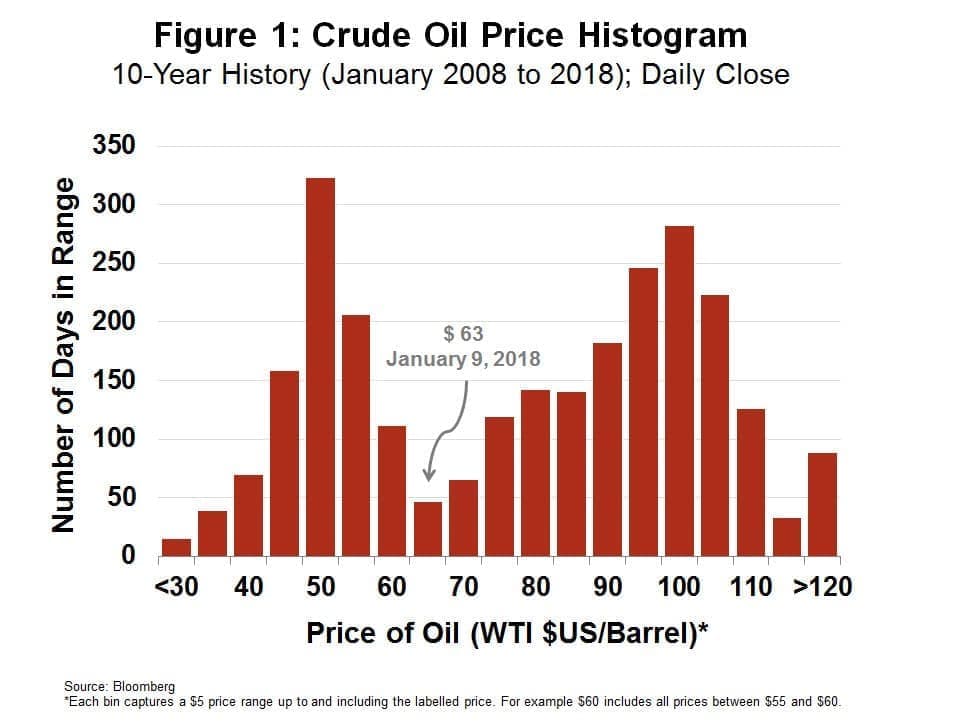

Even in the last 10 years, the frequency of price data (WTI) shows clustering around either the $45 to $50/B grouping or the $95 to $100/B range (see Figure 1). Of course, costs have come down significantly, and the shale revolution has not only lowered the cost curve, but also shortened the cycle time of responding to price signals. So, in theory it’s easy to believe that the low end of the price spectrum may be the new norm.

(Click to enlarge)

But that’s theory. In the oilfields of the world, much of the changes in cost have been a result of taking margin out of the service industry, something that goes up and down with the same waves that bob price. Further, productivity gains seen in US and Canadian shale plays are not the norm in the world—most oil producing nations are rocking the boat by shutting off oil valves rather than innovating on their processes. Related: The World’s Most Expensive Oil

Today’s choppy world of lower extraction costs, process innovation, investor apathy, disruptive alternatives and environmental pressures, have made us skeptical in believing in the possibility of higher prices. And when prices are high our minds become landlocked into thinking about endless demand growth, geopolitics, cartel collusion, steep decline rates and the necessity of high levels of capital investment.

ADVERTISEMENT

I’m only skeptical of one thing: That world oil markets will balance around $US 60/B. Historically, oil prices have not anchored in the calm of mid-ranges for long. So, today’s price is only a way point to either $US 45/B or much higher.

By Peter Tertzakian

More Top Reads From Oilprice.com:

- The Biggest Loser Of The OPEC Deal

- 3 Million Barrels Per Day Could Go Offline In 2018

- Expect A New Wave Of Oilfield Service IPOs In 2018

While many analysts attribute the oil price surge to geopolitical developments, the truth is that oil market fundamentals are positive enough to support an oil price ranging from $70-$80/barrel on their own. That is why the oil price is heading towards $70 and beyond in 2018 and $100 or higher by 2020.

A fair price is $100-$130/barrel. Such a price enables oil producers to invest in oil exploration and capacity expansion so as to be able to meet rising global oil demand in coming years, enhances global investments and gives incentives to the global oil industry to invest in new projects. In so doing, they stimulate growth in the global economy.

Dr Mamdouh G Salameh

International Oil Economist

Visiting Professor of Energy Economics at ESCP Europe Business School, London

1. In the future people will look at our generation and call us crazy for burning fossil fuels for transportation as hydrocarbons real and truly unsurpassed value is in manufacturing advanced materials

2. There is likely secret battery tech out there that hasn't been released to the masses that will make the internal combustion engine obsolete. But the powers that be are just sitting on it

Your crazy predictions have nothing to do with the topic at hand and they base themselves on simply wrong assumptions. Are your crazy predictions perhaps some camouflaged form of wishful thinking?

Anybody Who predicts $100 Oil prices, that shows they do not know anything about the community. We should always remember that Middle East can produce oil and make money under $10 a barrel.

Just a helpful quick reminder please forget about oil going over $100 ever again in our lifetime.