If America doesn't need Saudi oil anymore, why is it still wooing crown princes, especially when American public opinion isn’t really on board?

A Business Insider poll from September 2019 showed that, on the best of days, only one in five Americans viewed Saudi Arabia as a U.S. ally--even fresh off an attack on Saudi Aramco oil facilities, and even when that attack was widely believed to have been orchestrated by Iran.

Outside of the White House, there was little sympathy coming out of the United States. The most recent Gallup Poll on the subject, conducted in February 2019, showed only 4% of Americans with a “very favorable” view of Saudi Arabia. In fact, most view Saudi Arabia in a worse light than Venezuela.

At the same time, America is not reliant on Saudi oil.

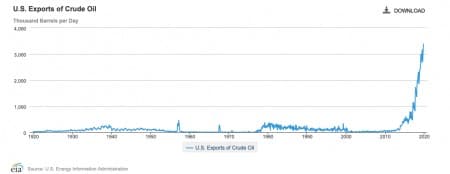

Over the past decade, U.S. oil production has doubled. In terms of extraction, dramatic media reports have emerged at various times over the past couple of years to the effect that the U.S. has surpassed Saudi Arabia as a crude oil exporter.

In June 2019, the U.S. did indeed surpass Saudi Arabia--briefly.

Download our free ''A New War In The Middle East'' report and read about the top risks for oil markets in 2020

For a better understanding, data shows that Saudi Arabia exported 7.38 million barrels per day in 2018. The U.S. exported 2 million barrels per day in 2018.

In 2019, the U.S. was averaging about 2.9 million bpd in exports.

In October 2019, U.S. imports of Saudi crude oil reached their lowest point since early 1974, at 419,000 barrels per day.

Globalization Changes Things

Today, however, dependence isn’t just about physical oil. It’s about markets.

In the era of entrenched globalization, it doesn’t matter if you’re an importer or an exporter, you’re still beholden to the global market and its volatility. Independence, in other words, doesn’t mean what it used to mean backed when Western powers started drawing lines in the Middle Eastern sands over oil. Related: Hydrogen Costs Could Be Set To Plunge By 50%

Whether independent or not, the U.S. will still import oil because sometimes it’s more convenient and because not all oil is the same and imports arise from a need to efficiently supply various refining capabilities that process different types of crude.

So, what does America (or, rather, Washington) need Saudi Arabia for, exactly, if not for oil?

The answer is simple: oil is one thing, but oil money is quite another. One form of ‘dependence’ is traded for another--and that’s global.

Not only has Saudi Arabia just hit its highest level of foreign investment in the Kingdom (up 54% in 2019 from the previous year), but Saudi money is pumping into every major global sector, with Fintech increasingly driving investment. The Public Investment Fund (PIF), Saudi Arabia’s sovereign wealth fund, partnered with Japanese Softbank Group with a $100-billion investment in the tech sector that began in 2016 and is eyeing $2 trillion in investments.

This is also a highly lucrative venue for the defense industry, with “successive U.S. governments” having received “billions of dollars from selling American weapons to Saudi Arabia”.

Foreign Policy Based on Oil, Any Way You Look at It

Without the need for Saudi oil, U.S. foreign policy on the Middle East is confused, at best. Trump has varyingly said he would like to get out of the Middle East entirely and deployed additional forces at the same time.

There was no American military response to the attack on Saudi Aramco oil facilities last September. That was a Saudi problem, even though the intention of the attack was likely to provoke the United States. Instead, the U.S. deployed 14,000 additional troops to Saudi Arabia, which Trump claims are being funded “in cash” by the Saudis to the tune of $1 million (a notion being debunked). No one is sure what this means, exactly, other than that the U.S. military is providing a lucrative private mercenary service even in venues it claims it no longer has a foreign policy interest.

Likewise, in Syria, we saw a dramatic announcement of a withdrawal and a stepping aside to allow a Turkish invasion in the north. Immediately afterwards, we saw a reversal, with U.S. troops redeployed to “protect” Syrian oil.

Then, most spectacularly, we have the U.S. assassination of an Iranian general on Iraqi soil--again in a region in which the latest version of American foreign policy claims to have no skin in the game.

Download our free ''A New War In The Middle East'' report and read about the top risks for oil markets in 2020

The only true form of oil independence is being completely disconnected from global markets, and that means a continued “interest” in the Middle East.

The fact remains, that oil independence doesn’t account for the fact that one-third of the world’s oil still travels through the Strait of Hormuz, and the U.S. still imports plenty of oil from plenty of countries.

ADVERTISEMENT

Everyone is connected to global supply, and if that global supply is disrupted, the American consumer will feel it. The market knows this, but it’s the only “entity” that truly understands globalization. Related: Has Natural Gas Hit Rock Bottom?

American public opinion is bound to continue to disagree, and that will likely get worse in the wake of the December 6th mass shooting by a Saudi serviceman at a Pensacola, Florida, air base. While it’s not getting a lot of attention, the U.S. has expelled 21 members of the Saudi military following this incident, though none were said to be connected to the accused or of aiding the Saudi Air Force lieutenant who committed the terrorist act that killed three sailors and wounded eight others.

What the public should be up in arms about is not only that this was a “terrorist” attack, but that 17 of the 21 cadets expelled in the aftermath were found to have possessed online terrorist material, while some also possessed child porn.

That US-Saudi relations are still as strong as ever should be clear by the lack of any of the usual Twitter vitriol coming from Trump over the incident. While the FBI has called this a “terrorist” incident, Trump has refrained from being too critical of the Saudis.

At the same time, indications are that the Saudis, for instance, were not warned of the assassination of Iran’s General Soleimani in Iraq, which means they are being left out of key Iran-related policy decisions in Washington to some extent.

Really what it all means is that washing Washington’s hands clean of the Middle East isn’t feasible after close to a century of entrenchment.

Trump may think he’s going to get out of the Middle East, but there is no escape without removing sanctions on Iran. As long as sanctions persist, the Iranian regime will provoke.

And even then, in the era of globalization, it’s all about global investment funds. Saudi Arabia has one of the biggest. At this point, there is no way to remove the Middle East from the global equation.

By Editorial Department

More Top Reads From Oilprice.com:

- 800,000 Bpd Offline After Haftar Affiliates Halt Exports

- Is This The End For Big Oil Dividends?

- China Finds Oil In Asia’s Deepest Onshore Well

The simple answer is the huge oil reserves of the Gulf region amounting to 644 billion barrels or 39% of the world’s reserves. The United States works on the premise that he who controls the oil reserves of the Gulf region and their maritime routes and key chokepoints controls the global economy.

The claim by President Trump that the US protects oil-producing countries of the Arab Gulf is a brazen and crude attempt of blackmailing these countries and getting US hand on their money. The only threat facing these countries is Israel which is provided with money and the most sophisticated weaponry by the US to maintain its threat and military supremacy in the Middle East. America and Israel are one and the same and they pose the most serious threat to countries of the Middle East.

Furthermore, the United States uses the threat of Iran to blackmail Saudi Arabia and other Gulf countries to buy American weapons. Saudi Arabia in particular has been for years the most lucrative market for the US Defence industry enabling it to earn hundreds of billions of dollars of Saudi oil money annually.

.

Now President Trump is using ISIS as the excuse to continue occupying Syrian territory illegally for the purpose of stealing Syria’s oil, depriving the legitimate government of Syria of its own oil and continuing to stir trouble to prevent an end to the civil war there. When a retired American General accuses President Trump of turning American troops in Syria into oil pirates, it speaks volumes about the immorality of US foreign policy.

The United States military presence in Iraq aims at limiting Iran’s growing influence in the country. That is why Iran’s strategy in coming days and months will aim to force the eviction of American forces from Iraq. Losing Iraq will be a significant strategic victory for Iran. This will be eventually followed by the withdrawal of all American forces from the Middle East leaving it to China and Russia, Iran and Turkey to fill the political vacuum that will ensue.

President Trump has threatened Iraq with sanctions including blocking access to its US-based account where all the oil revenues are kept if it evicts American forces from its territory.

Still, the global balance of power in the Middle East is shifting away from the United States towards the strategic Russian-Chinese alliance. Part of the shift is the emergence of Iran as the major power in the Gulf region and the strategic decline of Israel.

With a changing global geopolitical landscape, Saudi Arabia and other Gulf states may feel the need to ally themselves with the new rising order in the world.

However, with the disenchantment with the United States in the Middle East, the country’s days in the region are numbered.

Dr Mamdouh G Salameh

International Oil Economist

Visiting Professor of Energy Economics at ESCP Europe Business School, London

I'm not saying we can simply disconnect. I'm suggesting that we need to make a conscious decision about how quickly we should transition away from oil dependency. The more each country can produce it's own energy, the better, in today's world.

President Trump has threatened Iraq with sanctions including blocking access to its US-based account where all the oil revenues are kept if it evicts American forces from its territory.