One by one they are starting to fall. The long predicted consolidation wave in U.S. shale players, particularly those with assets in the Permian stacked play, is in high gear. Just in the last month or so, Chevron, (NYSE:CVX) has taken out Noble Energy, (NYSE:NBL); Devon (NYSE:DVN) swallowed WPX Energy, (NYSE: WPX); ConocoPhillips, (NYSE: COP) snapped up Concho Resources, (NYSE: CXO), and just last night, Pioneer Exploration, (NYSE: PXD), announced it would merge with Parsley Energy, (NYSE:PE). Earlier this year in an OilPrice article, I wrote a detailed thesis for the future of shale that forecast the current wave of consolidation taking place. One key tenet that I postulated would come into play was “Economy of scale,” meaning that larger, well-established companies would snap up smaller ones with assets that would easily “bolt-on” to their acreage inventory. That seems to be the dynamic currently in play.

Which brings us to the question as to…who is next?

We think the management at Diamondback Energy, (NASDAQ: FANG) might be feeling the heat, right about now. As a combination of debt, liquidity, and assets someone could have them in their sights now.

The case for Diamondback

The three-month chart for Diamondback Energy, (NASDAQ: FANG) tells a pretty grim tale of capital destruction. One thing that intrigues us at this moment in time is the dividend, currently yielding ~near 5%. A tempting target, but does it a sense of security with reliable income, or is it a warning signal that the yield could go higher?

A quick snapshot of the second quarter. Revenues were down by over half from Q-1, at $425 mm. Not surprising given the oil price action over that time. A write down of $2,539 for impairment of oil gas assets killed the quarter for FANG. This is a non-cash item. Cash flows from operations fell dramatically from Q-1 to $324 mm, and did not cover the capex of ~$562 mm they report. They also paid a nice dividend of ~$60 mm, which they also had to borrow money to cover. Not impressive when they are already ~$5.5 bn in debt. Something that could put off a potential acquirer.

Related: Tech Breakthrough Promises Hydrogen Gas From Plastic Waste

While assets are no guarantee that FANG will go on the chopping block in the near future, hence our interest in the dividend.

Asset quality and Logistics

Without pouring over isopach maps, it's pretty easy to tell that FANG's Permian acreage is not of the same quality as that of some of its peers. The Delaware acreage is clustered to the far south near Pecos. The best acreage in the Delaware is in Loving, Winkler, Reeves, and Ward counties in Texas. The rest is widely distributed across the Midland basin. It seems like they got here late and took what was left. I am not as impressed with their asset quality as I have been with some other players, but logistics also play a role here. One thing Diamondback has done successfully is cut production costs. So a potential acquirer with complementary assets might look to add this efficiency to their operations.

Diamondback filing

Liquidity

With $54 mm in cash and $1.9 bn in credit lines available they are certainly not in any "going concern" jeopardy. But, things need to get better and quickly, they're burning cash to the tune of ~$1.2 bn a year on a run-rate basis, so if you're long this stock...keep your eye on it. And, as they note their 10-Q, that revolver expires in November of '22 and will have to be renegotiated, if undrawn. I'll bet it gets whacked down a little. Box ticked...barely.

This could tweak FANG’s management’s interest in a ‘parley’ with a suitor. Debt is always a driver when someone with cash or better investment quality comes calling.

Debt

It's impossible to put a positive debt spin on a company with a capitalization of ~$5 bn and ~$5.5 bn in debt that is losing money to the tune of $1.2 bn a year. That fact they have some running room in terms of debt maturities, means little here if oil prices don't turn up. The ratio isn't terrible right now, there are worse. But with their cash burn at present, it's going to get worse.

Diamondback filing

Hedging

In an unusual bit of clarity they show that if nothing changes their hedges will drop by ~45% in a few months. Putting them squarely at the mercy of the market. This could be good or bad depending on what the oil price does. By comparison many the the Permian players we've looked at recently have been hedged with elegant "costless collars" for as much as 80% of next year's production.

Diamondback filing

Midstream

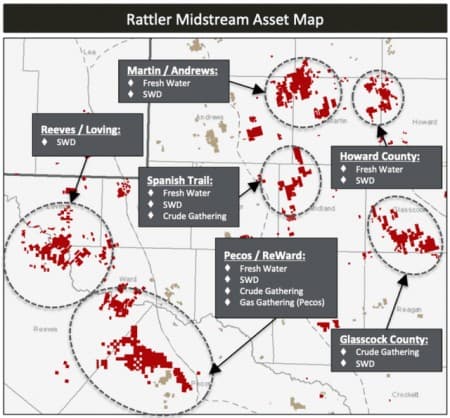

FANG is the general partner of Rattler, (RTLR) midstream, a gather and distribution system built to accommodate their key development areas in the Permian. This is a blessing in that it provides takeaway capacity in a tight supply market. It's a curse as these assets have depreciated about 80% in the last couple of years- think Occidental Petroleum, (OXY) and their desire to deleverage with Western Midstream Partners, (WES). Originally on the market for ~$8-10 bn, OXY withdrew it when bids fell far short of either of those figures. A number of companies have chosen to divest ownership of their midstream assets while retaining the capacity.

Related: Goldman Expects A Structural Bull Market For Commodities In 2021

Worth mentioning in the case of their Viper, (OTCPK:VIPR) and RTLR subsidiaries are the distributions from each that accrue to the benefit of the general partner, FANG. This was worth about $25 mm in the first half of the year.

Guidance

ADVERTISEMENT

With WTI at $40, and all in cost of production of around $30/bbl FANG is making decent money (low $20's net) with the hedged portion (about half with 60% of that tied to Brent), and probably making a few dollars ($8-10) even with realizations on unhedged production.

Their focus will be split 60/40 between the Midland and Delaware basins with 6-rigs and 3-completion crews staying active, and keeping net liquids production of around 198/BOPD, and total BOEPD of about 330 K BOEPD.

Your takeaway

A pretty good case can be made that FANG will come under the consolidation gun. But, you can’t count on that. What you can count on is the dividend while you wait.

Travis Stice, CEO of Diamondback comments in regard to the dividend-

“We've raised our dividend every year since putting it in place three years ago and I think that being the primary return of capital, we're going to look at that very closely at the end of the year and see what 2021 holds on that front. The one consistent theme we received from our largest shareholders over the past few months is to protect the dividend and in exchange for protecting that dividend, cut capital.”

Company filing

On a Price per Flowing barrel they come in at $31 K, not crazy high, but certainly higher than some we've looked over recently. An example would be Devon, (DVN) at $18 K per flowing barrel.

In summary while this company has survivability for at least a year or two if oil prices don't improve, it has challenges. A White Knight is probably their best option. Hopefully one will come along.

By David Messler for Oilprice.com

More Top Reads From Oilprice.com:

- The End Of Venezuela’s Oil Era

- IMF Sees Oil Prices At $40-50 Next Year

- Oil Majors Stuck Between A Rock And A Hard Place