For decades, the nuclear energy sector has been regarded as the black sheep of the alternative energy market family thanks to massive cost-overruns, poor public perception as well as a series of high-profile disasters such as Chernobyl, Fukushima and Three Miles Island. However, last year, the sector received a much needed shot in the arm after the Trump administration sought a $1.5B bailout in a bid to create sufficient federal uranium stockpiles for national security purposes.

But now the out-of-favor industry has managed to snag its biggest ally yet: China.

Lately, Beijing has revealed ambitious plans to build 150 nuclear reactors at a staggering cost of $440B over the next 15 years as the country looks to become carbon neutral by 2060.

China's nuclear intentions resonate well with a cross-section of leaders and the investment community considering the global energy crisis and the calls for action coming out of the COP26 Climate Summit. That many reactors is more than what the entire planet has built in the past 35 years, representing a third of the current global fleet of 440 reactors.

Where investors should be looking now is uranium, which is basking in the limelight.

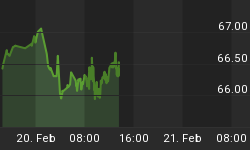

Shares of Canadian uranium producer, Cameco Corp. (NYSE:CCJ), have surged nearly 10% after Bank of America on Wednesday touted the growing acceptance of nuclear as an alternative power source in a decarbonizing economy.

BofA upgraded its rating on CCJ to Buy from Neutral, setting a $32 price target. The firm pointed to strength in uranium prices and a changing cultural attitude toward the space, highlighting the advantages of nuclear power as part of a push towards decarbonization, compared to options like renewables, hydro and natural gas.

CCJ shares are now up 109.7% in the year-to-date, but its peers have done even better: Energy Fuels Inc. (NYSE:UUUU) is up 154.9% YTD, Uranium Energy Corp. (NYSE:UEC) has vaulted 188.6% while NexGen Energy (NYSE:NXE) has jumped 132.5%, with many names in the space hitting 52-week highs.

Source: Bloomberg Green

China is the biggest emitter of greenhouse gases but says its nuclear program will play a critical role in replacing its 2,990-coal-fired generators alongside wind and solar energy. Indeed, Beijing says its plans could prevent about 1.5 billion tons of annual carbon emissions, more than the annual emissions of the U.K., Germany, France, and Spain combined.

Another key reason why nuclear energy in China makes sense: Low costs.

About 70% of the cost of Chinese reactors is covered by loans from state-backed banks, leading to dramatically lower costs. In fact, Francois Morin, China director at the World Nuclear Association, says China can generate nuclear power at just $42 per megawatt-hour, thanks to the low 1.4% interest rate on loans for infrastructure projects, making it far cheaper than coal and natural gas in many places. At the high end of the spectrum, in developed economies, a 10% interest rate means the cost of nuclear power shoots up to $97 per megawatt-hour, making it more expensive than everything else. The World Nuclear Association estimates that China can build nuclear plants for about $2,500 to $3,000 per kilowatt, about one-third the cost of the latest nuclear projects in the U.S. and France.

New uranium funds

But that's just part of the reason why uranium stocks are flying; the other being the launch of the world's first and largest physical uranium funds.

In July, Canadian investment fund Sprott Asset Management LP launched Sprott Physical Uranium Trust (OTC:SRUUF) after acquiring uranium holding company, Uranium Participation Corp. Since then, Sprott has gone on a uranium buying spree and currently holds ~33 million pounds of uranium, roughly equal to 76% of JSC National Atomic Co. Kazatomprom's sales last year. Republic of Kazakhstan state-owned miner Kazatomprom is the world's largest yellow cake producer.

ADVERTISEMENT

The new fund says it has "no endgame," will not sell uranium to other entities, and will operate as a passive entity "in perpetuity" until investors lose interest in the fund. Investors are particularly enthusiastic about Sprott's modus operandi because it's effectively taking material off the market that will never come back.

Further, the uranium market has become so hot that Kazatomprom itself has announced plans to finance a separate fund for physical uranium purchases.

These new uranium-buying funds have been creating plenty of competition in the spot market and helped drive uranium prices up 46% in the year-to-date to trade at $48.35 per ounce.

By Alex Kimani for Oilprice.com

More Top Reads From Oilprice.com:

- Chinese Crude Oil Imports Drop To Three-Year Low In October

- Natural Gas Prices Soar As Putin Punks Europe

- Why Oil Prices Fell After The OPEC+ Meeting

USA at all oil, gas & coal not solar & wind power country also not california importing 32% electricity for e-cars and about 45% gas 10% hydro 10% nuclear.

Also.B. Obama did not builf up wind parks at coasts as wrong reaction to hurricanes destroying also solar panels

Penetrant primitive repeated criminal stupid global fraud COP 26 Prof. dorks activism with enforced payments and used for left communist terror decisions in energy politics etc. showing all time sane fraud charts as work.

From CO2 only +0,5°C every +100ppm minus sulfates cooling sef also free burning fissil fuel at 380ppm -0,25°C always wrong in charts including arctis area on base of cooling phase before and local there not from CO2.

Always right more human CO2 but not always more than only +2ppm/a since reduced from photosynthesis means 2070 only +100ppm +0.5°C again long after fossil energy peak problem.

E-cars subsidies not justified also not reducing if no green energy surplus like in norway and not enough lirhium for all full electric coal gas elecrtricity cars and to wait for Na & Mg battery.