The 17 rare earth elements have energy supply by the throat. They are used in everything from oil refineries to solar and wind generators.

These rare earths are, as John Kutsch, director of the Thorium Energy Alliance, says, “the great multipliers.” They make metals stronger, generators more efficient, cell phones smaller, television sets sharper, and laptops lighter. They are, in their way, as important to modern manufacturing as energy.

Back in the days, the United States was a major supplier of rare earths -- with supplemental supplies coming from countries around the world, including Australia and Brazil. Today, 90 percent of the rare earths the world uses come from China.

The use of rare earths is as important in lasers and jet engines as it is in aiming cruise missiles, which means the United States, and the rest of the world, has a huge vulnerability: China controls the supply of new war-fighting material. All U.S. defense manufacturers – including giants Boeing, General Electric and Lockheed Martin -- are dependent on China. Now China is demanding that U.S. companies do more of their manufacturing there: China wants to control the whole chain. Related: The $6.8 Billion Great Wall Of Japan: Fukushima Cleanup Takes On Epic Proportion

Yet, as the rare earth elements industry is quick to assert, rare earths are not rare; they are scattered generously throughout the world. So why China’s dominance?

China has three main advantages. The first is that in 1984, leader Deng Xiaoping adopted a major initiative, the so called 863 Program, to move China from being a simple supplier of raw materials and products, enhanced by cheap labor, to being an industrial powerhouse and scientific giant. Rare earths were one of the areas singled out in the program.

The second advantage is that the Chinese ignored – and, to a large extent, still do -- the environmental costs of rare earths' extraction. The environmental damage is described by those who have been to one of two major Chinese sites, which have a combined population of 17 million, as catastrophic, with mountains bathed in acid to remove the sought-after rare earths, resulting in lakes of acid.

China's third advantage is a natural one: It has a lot of ionic clay, which contains rare earths without the associated uranium and thorium.

About the time China was ramping up its plans to dominate the world rare earths market, the United States, in conjunction with the International Atomic Energy Agency in Vienna, began to regulate so called source materials. These are materials which, at least in theory, could be fashioned into weapons. In reality, those associated with rare earths are not in sufficient quantity to interest potential proliferators. Related: The World's Most Uniquely-Positioned Coal Play

But the regulations are there. Many in the rare earths elements industry believe that it was these regulations -- particularly those affecting thorium -- that crippled production around the world and essentially closed down the U.S. industry, just as demand was escalating.

There is a commercial market for uranium. While hardly any thorium is used nowadays, it was once used in some scientific instruments and mantles for lighting. Thorium is akin to uranium in atomic weight, and it is a fertile nuclear material. That means that it can be used in a nuclear reactor, but it has to be ignited by a fissile material, such as enriched uranium or plutonium.

Thorium is radioactive, but mildly so. It is an alpha emitter, which means it can be shielded with tissue paper and will not penetrate the skin. However, it has a half-life of 1.5 billion years. Related: Beyond Iran And Pakistan: 7 Nuclear Wannabes

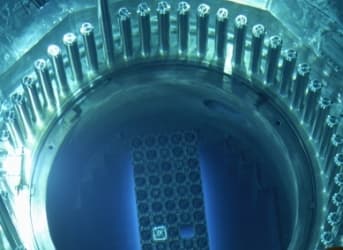

The answer, according to James Kennedy, a science consultant and rare earths expert, is to develop a reactor using thorium instead of uranium. This reactor, called a molten salt reactor, is inherently safe, say its passionate advocates, and would be a better all-around nuclear future. The technology was pioneered by one of the giants of the early nuclear age, Alvin Weinberg, at the Oak Ridge National Laboratory, but abandoned under pressure from enthusiasts for light water reactors, the kind we have today.

ADVERTISEMENT

The Thorium Energy Alliance believes that the United States and other countries should develop a cooperative to source rare earths from the existing mining of phosphates and metals and store the thorium until it becomes a useful fuel. A bill to do this is making its way through Congress, but its chances are slim. Short of putting a value on thorium and isolating it, the chances of a rare earths elements industry reawakening in the United States, or elsewhere, is rare.

By Llewellyn King for Oilprice.com

More Top Reads From Oilprice.com:

- US Energy Storage Market Could Triple This Year

- A Look At The Future Of Nuclear Power

- Wall Street Losing Millions From Bad Energy Loans

http://en.wikipedia.org/wiki/Thorium